Get the free Tax Court rules cancellation of debt is part of gain realization

Get, Create, Make and Sign tax court rules cancellation

Editing tax court rules cancellation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax court rules cancellation

How to fill out tax court rules cancellation

Who needs tax court rules cancellation?

Tax Court Rules Cancellation Form - How-to Guide

Understanding the Tax Court Rules Cancellation Form

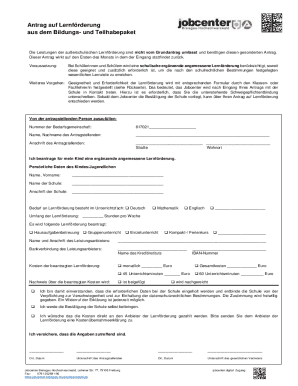

The Tax Court Rules Cancellation Form serves as a crucial document for those wishing to rescind or withdraw their cases from tax court proceedings. By formally submitting this form, individuals assert their intention to cancel their case, which is significant if there are changes in circumstances or if prior resolutions have been reached.

Using the correct form is paramount; an incorrect or improperly completed form can lead to delays or dismissals. The cancellation form must reflect all necessary details to ensure that the court accurately processes the request. Individuals should be aware of common reasons for submitting this form, which can vary from resolving discrepancies with tax authorities to addressing changes in personal financial situations, such as debts or property transfers.

Preparing to complete the cancellation form

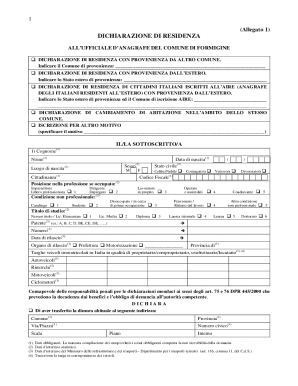

To properly complete the Tax Court Rules Cancellation Form, it's important to gather necessary information before beginning. This includes personal identification details such as your name, address, and Social Security number. Furthermore, information relevant to your tax court case is essential, including the case number and the names of involved parties.

Documentation plays a vital role in substantiating your cancellation request. Collect all pertinent tax documents, previous court orders, and any correspondence with tax authorities. These documents can help clarify the reasons behind your cancellation and provide the necessary context needed to support your case, particularly if you are invoking specific sections such as Sec. 1001 regarding taxable entity transfers.

Step-by-step guide to filling out the cancellation form

Filling out the cancellation form requires careful attention to detail. Start by identifying the party names and the specific case number at the top of the form. This ensures that the request is connected to the appropriate case in the tax court system.

As you specify the type of cancellation requested, make sure to provide clear reasons for the withdrawal. This not only streamlines processing but also helps in mitigating any potential follow-up queries from the court. Avoid common pitfalls by double-checking for errors like misspelled names or incorrect case numbers, as accuracy is vital.

Editing and signatures

Once you've filled out the Tax Court Rules Cancellation Form, utilizing tools like pdfFiller can enhance the editing process. This platform allows you to easily insert or remove information without confusion. Additionally, electronic signatures can be added directly to the form, streamlining the submission process.

Collaboration features available within pdfFiller enable you to share the form with legal advisors or team members for their input. Team reviews can significantly improve the accuracy and comprehensiveness of your submission, reducing the likelihood of errors and ensuring all necessary parties are informed of the cancellation.

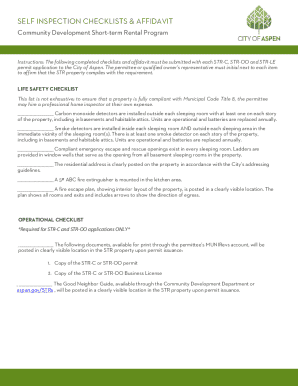

Submitting the tax court rules cancellation form

Before submitting your completed form, it’s vital to conduct a thorough review. Check for completeness and ensure that all required signatures are included. Depending on your jurisdiction, submission guidelines will vary; typically, the form should be sent to the tax court where your case was originally filed.

Pay attention to deadlines associated with your submission, as failing to submit on time can lead to complications. Once you’ve submitted your form, it’s advisable to confirm its receipt. This can often be done through the court’s online system or by following up via telephone.

Managing your cancellation request

After submitting your cancellation request, it's essential to know what to anticipate. Generally, the court may review the cancellation and contact you if further information is needed. Being prepared to respond promptly can prevent unnecessary delays in your case’s resolution.

Utilizing tracking features available via pdfFiller can help you monitor the status of your submission. By keeping an eye on progress, you can effectively manage any follow-up actions required by the court, ensuring that your cancellation request proceeds without unnecessary hindrance.

Frequently asked questions (FAQs)

Individuals often have questions regarding the cancellation process. Common inquiries include the necessary timelines for submission and what happens if a cancellation is not granted. It’s important to understand the implications of cancellation and any follow-up requirements based on your specific situation.

Clarifications around legal terms can also be beneficial. For example, understanding concepts like recourse, debt, and how they relate to property and mortgages can provide greater clarity when navigating tax court issues.

Glossary of terms related to tax court and cancellation forms

Understanding the terminology associated with tax court can simplify the process for individuals navigating their cancellations. Terms like 'entity,' 'transfer,' and 'income' play pivotal roles in defining legal relationships and tax responsibilities.

To make the navigation of tax court processes easier, definitions for key terms are provided below, helping you make informed decisions.

Latest updates related to tax court procedures

Staying updated with the latest trends in tax court rules is essential for effective navigation through the process. Recent changes to procedural regulations or changes in tax law can impact how cancellation submissions are handled.

Being aware of these updates enables individuals to strategically plan their cancellation requests. For instance, adjustments affecting timelines could mean that individuals have a shorter window for cancellations. Monitoring these developments allows you to react promptly and adjust your strategy as needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax court rules cancellation in Chrome?

Can I create an electronic signature for signing my tax court rules cancellation in Gmail?

How do I edit tax court rules cancellation straight from my smartphone?

What is tax court rules cancellation?

Who is required to file tax court rules cancellation?

How to fill out tax court rules cancellation?

What is the purpose of tax court rules cancellation?

What information must be reported on tax court rules cancellation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.