Get the free Case 17-33946-CMG

Get, Create, Make and Sign case 17-33946-cmg

Editing case 17-33946-cmg online

Uncompromising security for your PDF editing and eSignature needs

How to fill out case 17-33946-cmg

How to fill out case 17-33946-cmg

Who needs case 17-33946-cmg?

Your Comprehensive Guide to the Case 17-33946-CMG Form

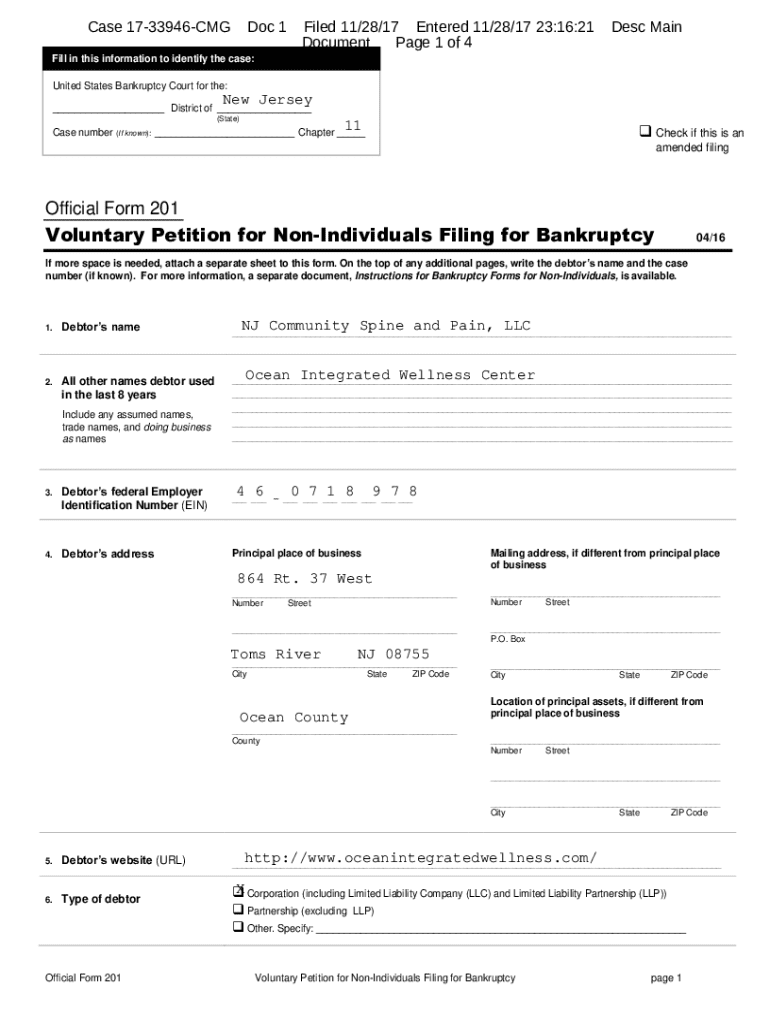

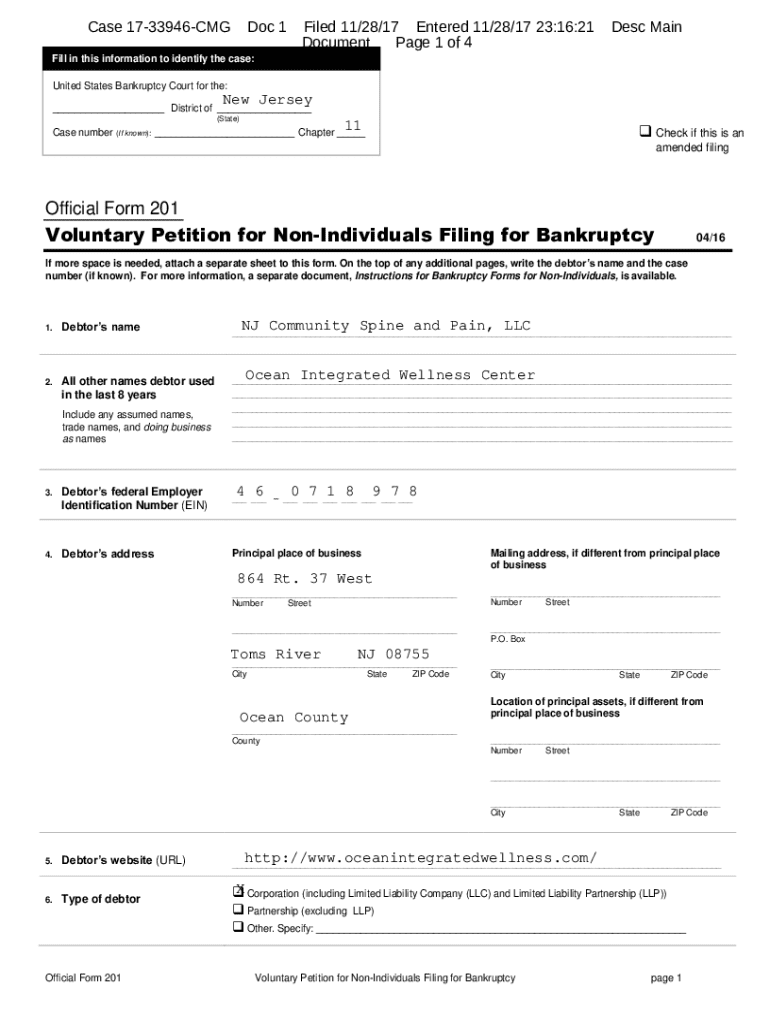

Overview of case 17-33946-CMG form

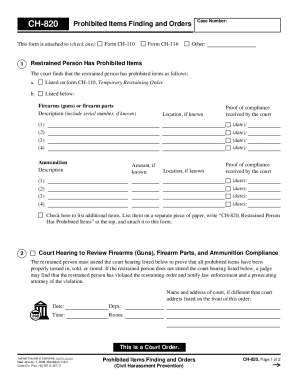

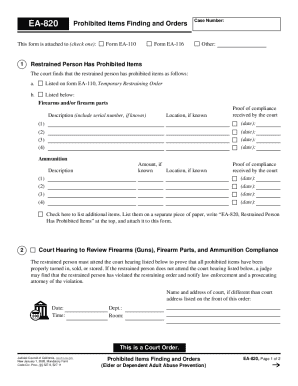

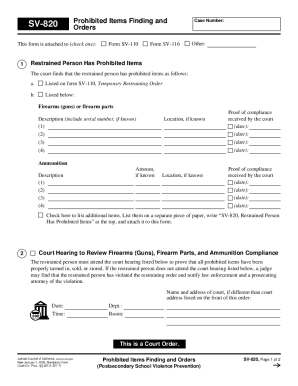

The case 17-33946-CMG form is pivotal in the legal landscape, primarily utilized in bankruptcy proceedings. This document is critical for stakeholders involved in Chapter 11 cases, facilitating the collection and organization of essential information that the court requires. Its purpose extends beyond mere bureaucratic necessity; it aims to ensure transparent handling of financial matters by allowing parties to detail liabilities, assets, and operational structures.

Proper completion of the case 17-33946-CMG form is paramount. Submitting an incomplete or inaccurate form can lead to significant delays in the legal process, potential dismissal of the case, or even adverse legal implications for the parties involved. Each section of the form demands careful attention, ensuring that all information reflects current circumstances accurately.

Contextual background

In the context of the case 17-33946-CMG form, several key entities typically play important roles. These include the debtor, which is the individual or business filing for bankruptcy, the creditors owed money, and legal representatives on both sides. Their interactions shape the submission process and eventual outcomes of proceedings.

The legal framework surrounding case 17-33946-CMG is rooted in federal bankruptcy laws, particularly those outlined in Title 11 of the United States Code. Understanding this framework equips individuals and teams with the knowledge necessary for successful navigation through the filing system.

Preparing to fill out the form

Before initiating the process of filling out the case 17-33946-CMG form, several key pieces of information are needed. These include existing financial statements, lists of assets and liabilities, and documentation confirming income sources. Compiling this information beforehand streamlines the filling process and reduces the potential for errors.

It's also essential to familiarize oneself with the legal terminology that accompanies the case 17-33946-CMG form. Terms like 'debtor,' 'creditor,' and 'collateral' may appear frequently. Understanding these terms ensures that every section of the form is filled out appropriately and comprehensively.

Step-by-step instructions for completing the case 17-33946-CMG form

Completing the case 17-33946-CMG form requires a systematic approach. Each section is designed to capture detailed information pertinent to the case's specifics.

Personal information section

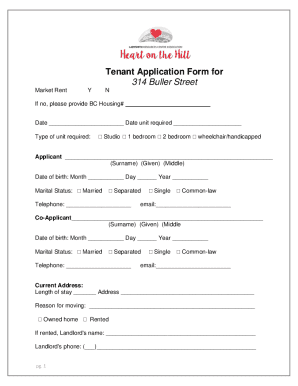

Begin with the Personal Information section, which mandates inputting details regarding the parties involved in the case. Expected inputs include full names, addresses, and contact details of stakeholders.

Case details section

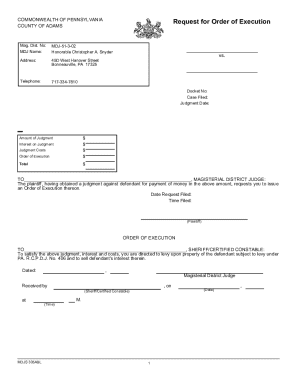

Next, the Case Details section prompts users to provide specific information such as the case number, court jurisdiction, and the nature of action being taken. Accurately listing this information is crucial for maintaining a clear legal record.

Attachments and supporting documents

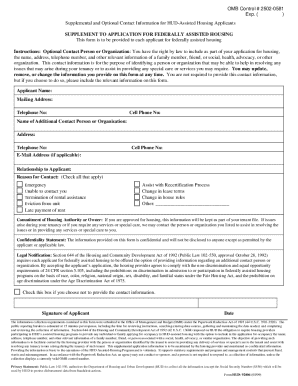

Additionally, the form may require supplementary documents as attachments. This can include prior judgments, creditor agreements, and compliance documents. A comprehensive set of attachments fortifies the submission.

Using interactive tools to enhance completion

With advancing technology, using tools like pdfFiller significantly simplifies the completion process of the case 17-33946-CMG form. pdfFiller's editing features, such as editing existing PDFs, inserting text, and adding images, streamline the experience.

Moreover, pdfFiller provides collaborative tools for team filling, where multiple individuals can review and co-edit in real-time. This feature significantly enhances accuracy and enforces accountability among contributors.

Common mistakes to avoid

Despite careful planning, mistakes during the completion of the case 17-33946-CMG form do occur. Common errors include misplacing decimal points in financial figures, overlooking required fields, and submitting without necessary documentation. Such oversights can lead to an array of complications.

To prevent these pitfalls, double-checking all sections before submission is paramount. Create a checklist that includes all required fields and documents to eliminate the risk of missing essential components during the submission process.

Submitting the case 17-33946-CMG form

Once the case 17-33946-CMG form is accurately completed, the submission process entails several options. Typically, the form can be filed electronically through the court's website or sent in via mail. Understanding the preferred submission methods of your specific jurisdiction is vital.

Tracking submission status is equally crucial. Applicants can often confirm that their form has been received and is being processed through online case management tools provided by the court or by following up with the court clerks directly.

Post-submission steps

What happens after submitting the case 17-33946-CMG form is contingent upon the specifics of the case. Generally, individuals can expect a notice of upcoming hearings, along with any additional documentation requests from the court or opposing counsel clarifying unresolved issues.

Navigating follow-up requests necessitates a proactive approach. Be prepared to respond promptly to any information requests, as delays could complicate proceedings. Properly managing these communications reflects well on your credibility in the eyes of the court.

Case study examples

Illustrative examples of real-life scenarios provide invaluable insight into the practical applications of the case 17-33946-CMG form. For instance, a small business owner who meticulously completed their form, including all necessary supporting documentation, successfully navigated a Chapter 11 filing, leading to the successful restructuring of their debts.

In contrast, a case where the submission was hasty and lacked crucial financial statements resulted in rejection. These case studies highlight the importance of precision and thoroughness in the filing process.

Interactive FAQs

Users often have pressing questions concerning the case 17-33946-CMG form. How should I handle a specific financial disclosure? What are the repercussions of minor errors? These FAQs help elucidate concerns, offering expert answers to help navigate the complexities of the legal system.

Moreover, users are encouraged to seek personalized legal advice tailored to their specific circumstances, ensuring they are equipped to make informed decisions throughout the process.

Notes on usage of pdfFiller

Utilizing pdfFiller’s cloud-based platform provides seamless access to the case 17-33946-CMG form, enabling users to manage document creation from any location. This flexibility accommodates the needs of individuals or teams who require real-time access to their records.

The streamlined editing experience that pdfFiller offers, with its range of features to create, edit, and sign PDFs, simplifies the entire process. Whether working collaboratively or independently, users can utilize pdfFiller to manage their legal documentation effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send case 17-33946-cmg to be eSigned by others?

How do I complete case 17-33946-cmg online?

How do I make changes in case 17-33946-cmg?

What is case 17-33946-cmg?

Who is required to file case 17-33946-cmg?

How to fill out case 17-33946-cmg?

What is the purpose of case 17-33946-cmg?

What information must be reported on case 17-33946-cmg?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.