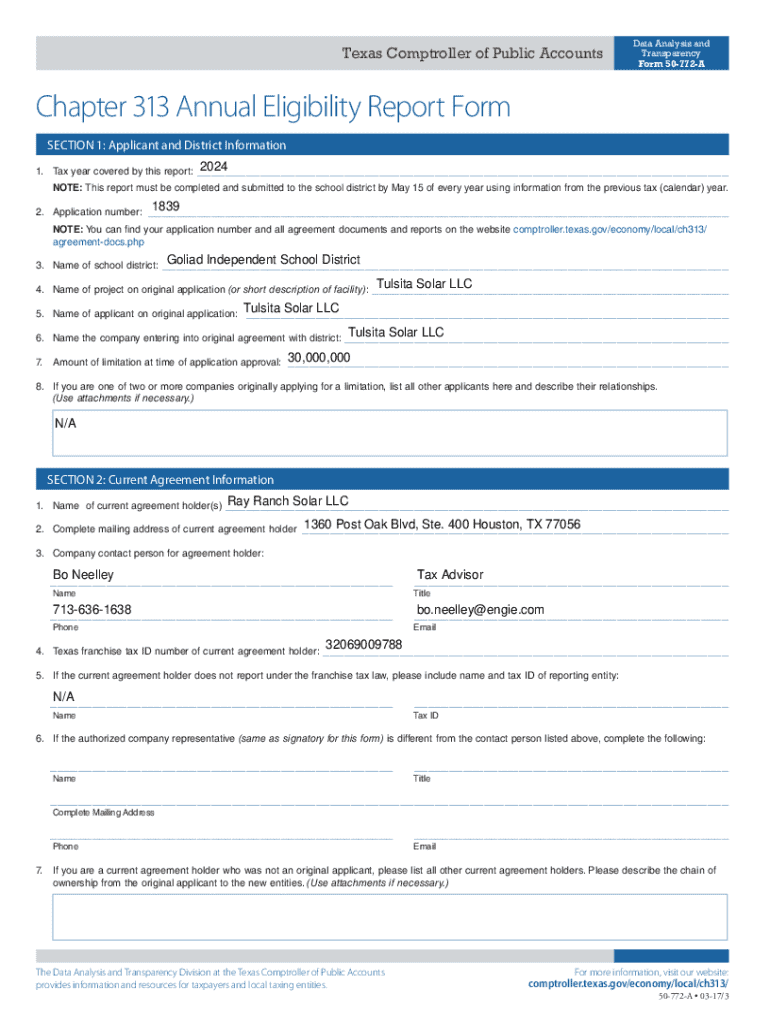

Get the free New tax incentive program succeeds Chapter 313

Get, Create, Make and Sign new tax incentive program

Editing new tax incentive program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new tax incentive program

How to fill out new tax incentive program

Who needs new tax incentive program?

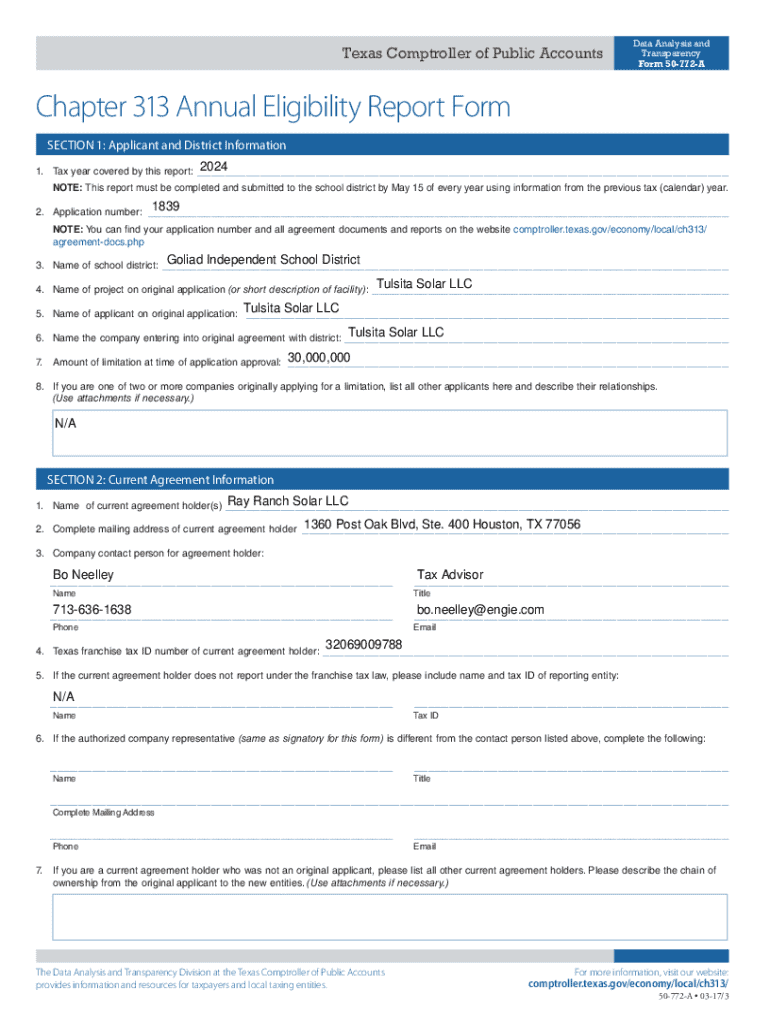

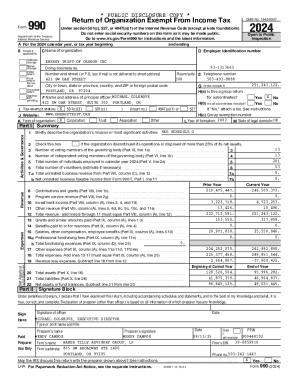

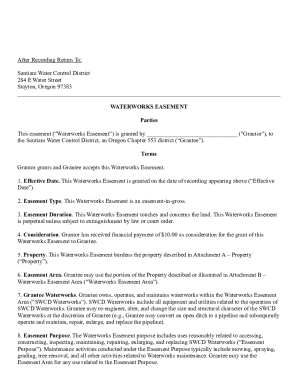

Understanding the New Tax Incentive Program Form

Overview of the new tax incentive program

The New Tax Incentive Program is a government initiative designed to encourage economic growth by providing tax credits and deductions to qualifying individuals and businesses. Its primary goal is to stimulate specific sectors of the economy, such as clean energy or technology, by reducing the tax burden on those who comply with outlined requirements. By doing so, the program aims to foster job creation, support local markets, and promote responsible fiscal practices.

The importance of the new tax incentive program form cannot be overstated; this form serves as the primary vehicle for applicants to access the incentives offered. Properly completing this form ensures that applicants provide all necessary information, which can significantly impact the approval of their applications.

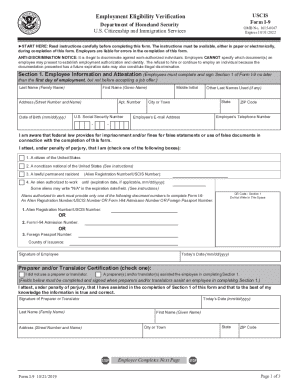

Eligibility criteria for the new tax incentive program

To ensure fairness and target support effectively, the New Tax Incentive Program has specific eligibility criteria for both individuals and businesses. Understanding these requirements is essential for a successful application.

How to claim the new tax incentive

Claiming the new tax incentive requires a series of steps aimed at ensuring you have the correct documentation and form details.

For submission, you have options. You can either submit the form online using tools provided by pdfFiller or opt for traditional paper submission, ensuring that you send it to the designated mailing addresses often listed on the application guidelines.

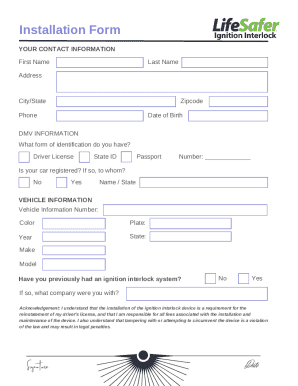

Overview of the new tax incentive program form features

The new tax incentive program form, especially when accessed through pdfFiller, comes equipped with various interactive tools designed to enhance the user experience. These features streamline the process and make collaboration easy for team submissions.

Visual aids accompanied by a guide to the form highlight key sections and offer tips for effective form management, ensuring a smoother completion process.

Managing your application after submission

After your application for the new tax incentive program has been submitted, it's crucial to manage the next steps effectively. Tracking the status of your application can save you from unnecessary delays.

Common queries about the new tax incentive program

Potential applicants often have questions regarding the process and outcomes of the new tax incentive program. Addressing these queries proactively can enhance the applicant's experience.

For any further inquiries, applicants are encouraged to contact the support teams associated with the new tax incentive program for detailed assistance.

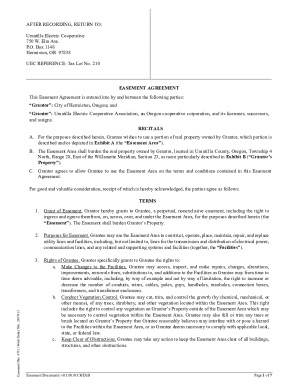

Related tax incentives and programs

The new tax incentive program is part of a broader landscape of financial support mechanisms available to individuals and businesses. By exploring these options, applicants may uncover additional benefits tailored to their specific situations.

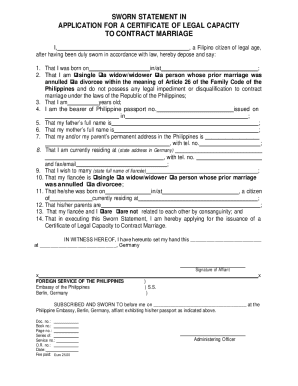

Multilingual support for the new tax incentive program form

Recognizing the diverse population, the new tax incentive program form is available in multiple languages on pdfFiller. This is particularly beneficial for non-native English speakers who may require additional assistance during the application process.

Help & support

Navigating the new tax incentive program form can be challenging, but pdfFiller offers robust help and support channels that can assist users effectively.

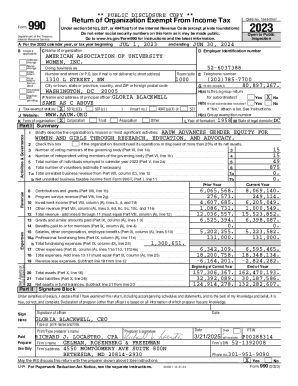

Importance of digital document management

In today's fast-paced world, efficient document management systems like pdfFiller are vital for successful tax incentive applications. Employing digital tools not only makes the form-filling process smoother but also ensures that all documents are safely stored and easily accessible.

Embracing digital document management is a worthwhile investment for both individuals and teams looking to maximize their chances of success in participating in the new tax incentive program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out new tax incentive program using my mobile device?

Can I edit new tax incentive program on an Android device?

How do I fill out new tax incentive program on an Android device?

What is new tax incentive program?

Who is required to file new tax incentive program?

How to fill out new tax incentive program?

What is the purpose of new tax incentive program?

What information must be reported on new tax incentive program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.