Get the free Return of Private Foundation As

Get, Create, Make and Sign return of private foundation

Editing return of private foundation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of private foundation

How to fill out return of private foundation

Who needs return of private foundation?

Return of Private Foundation Form: A Comprehensive Guide

Understanding private foundations and their tax obligations

Private foundations are nonprofit organizations established by an individual, a family, or a corporation, primarily to provide funding to other charitable organizations. Unlike public charities, which receive the majority of their funding from the public, private foundations are typically funded by a single source and operate with more discretion over their grants and activities. To maintain their tax-exempt status, private foundations must comply with specific IRS regulations, including the necessity of filing the Return of Private Foundation Form.

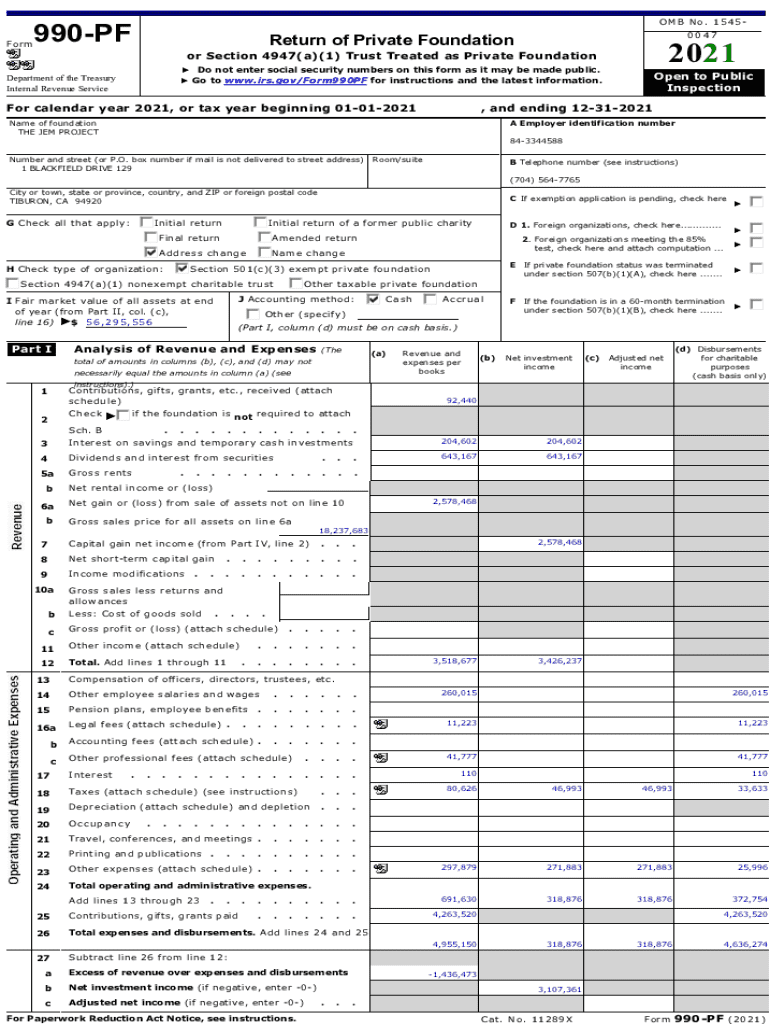

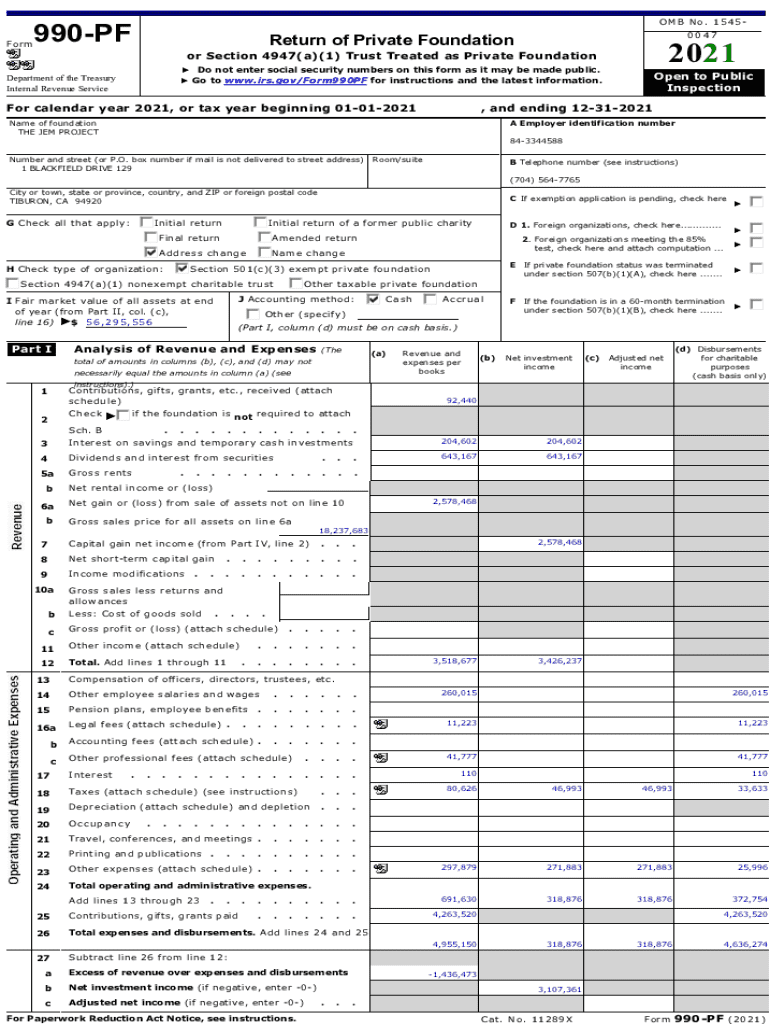

Filing the Return of Private Foundation Form is essential, as it not only details the foundation's financial activities but also ensures accountability and transparency in the philanthropic sector. The primary form used is Form 990-PF, which differs significantly from other tax forms, such as Form 990, used by public charities. While both forms serve to report financial information, Form 990-PF requires additional disclosures specific to foundations, including detailed information on operating foundations and charitable distributions.

Why accurate filing matters

Accurate filing of the Return of Private Foundation Form is crucial for various reasons. An inaccurate form can lead to misrepresentation of a foundation's activities, which may result in financial penalties or even the loss of tax-exempt status. The IRS scrutinizes filings closely, and discrepancies can trigger audits, increasing compliance-related risks.

Additionally, late filings have severe consequences, including penalties that can accumulate over time, further jeopardizing the foundation’s finances. Timely compliance is not just about avoiding penalties; it’s also about maintaining trust with stakeholders, including donors and the public. Failure to comply with reporting requirements can tarnish a foundation's reputation and hinder its ability to fulfill its philanthropic goals.

Overview of the Return of Private Foundation Form (Form 990-PF)

The Return of Private Foundation Form, or Form 990-PF, serves as the IRS's primary tool for collecting information on the financial activities of private foundations. This form details the foundation's income, expenses, and grants made, among other requirements. Understanding the purpose of Form 990-PF is key to navigating the nonprofit landscape. It ensures that foundations are transparent about their operations and adhere to legal obligations.

Key components of Form 990-PF include revenue and expenses reports, a list of grants made to charitable entities, and information about the foundation's assets and liabilities. The filing deadlines for Form 990-PF generally fall on the 15th day of the 5th month after the end of the foundation’s fiscal year, with foundations allowed to request extensions. Most private foundations file annually, and maintaining a regular schedule of submissions ensures ongoing compliance with the IRS.

Step-by-step guide to filling out Form 990-PF

Filling Out Form 990-PF can be complex, but a systematic approach can simplify the process. Here’s a step-by-step guide to help foundations navigate the submission:

Handling amendments and errors in filings

Mistakes on Form 990-PF can occur, and understanding the process for handling amendments is crucial. Common errors include incorrect financial reporting, misclassification of grants, and missing signatures. Such mistakes can trigger an IRS audit or lead to penalties, making it vital for foundations to address errors swiftly.

To amend a filed return, foundation leaders must file Form 990-PF again, marking it as an amended submission. Keep in mind that filing an amendment should be done at the earliest opportunity to mitigate potential issues. Additionally, understanding the implications of errors on future filings is critical, as prior inaccuracies can affect the foundation's reputation and further complicate compliance.

Post-filing considerations

After submitting Form 990-PF, it’s essential for foundations to monitor any correspondence from the IRS. This could include notices of acceptance, requests for additional information, or alerts about discrepancies. Staying on top of notifications helps foundations to respond promptly and address any potential concerns raised by the IRS.

Furthermore, understanding the aftermath of submission is critical. Foundations should maintain thorough records of their filings and any follow-up communications. By keeping comprehensive documentation, organizations not only ease the burden of future filings but also enhance their organizational accountability and transparency.

Leveraging technology to simplify form management

In today's digital age, technology can dramatically simplify the return of private foundation form process. Tools such as pdfFiller provide seamless document editing, eSigning, and team collaboration features that make managing Form 990-PF more efficient. Organizations can create, modify, and share documents effortlessly from any location, enhancing accessibility and usability.

Using interactive tools available on platforms like pdfFiller not only streamlines the filing process but also improves accuracy. Editable PDF templates allow organizations to fill out necessary sections smoothly while aiding in collaboration. Furthermore, options for eSigning contribute to a quicker turnaround, ensuring that deadlines are met without unnecessary delays.

Frequently asked questions about the return of private foundation form

Foundations often have pressing concerns and misconceptions surrounding Form 990-PF, ranging from filing deadlines to tax implications of grant distributions. Understanding these questions can demystify the filing process. For instance, many mistakenly believe that all private foundations operate under the same set of financial thresholds for reporting. However, different types of private foundations, such as family foundations or corporate foundations, may have varying requirements.

Moreover, navigating complex scenarios, such as the implications of large grant distributions on tax liabilities, can perplex even seasoned foundation leaders. Clarifying these issues with professional advice from tax specialists can prevent costly missteps and help foundations optimize their operations while adhering to legal standards.

Insights from experts on philanthropy and tax compliance

Expert commentary on philanthropy and tax compliance underscores the importance of meticulous documentation and recordkeeping. Tax professionals emphasize the need for private foundations to create a structured approach to their filings. Best practices include regular audits of financial records and ongoing education on IRS regulations, which can help organizations maintain compliance and instill trust in donors.

Real-life case studies illustrate successful filings that resulted in continued tax-exempt status. Foundations that focus on transparent processes and communicate effectively with stakeholders tend to foster stronger reputations and simplified compliance. By learning from these models, organizations can better navigate the complexities of IRS regulations and support their philanthropic missions.

Additional tips for effective document management

Effective document management is key in ensuring that private foundations meet their filing obligations with ease. Organizing tax documents annually can help foundations maintain clarity and efficiency. Establishing a standardized filing system will make it easier to locate critical documents during the Form 990-PF preparation process.

Collaborating as a team on document management practices dictates the foundation's overall efficiency. Using shared tools for real-time updates and collaboration while ensuring everyone involved understands their roles will enhance productivity. Future-proofing philanthropic efforts with robust document management solutions, such as those offered by pdfFiller, can safeguard against potential issues and streamline the foundation’s mission-driven activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit return of private foundation straight from my smartphone?

How can I fill out return of private foundation on an iOS device?

How do I complete return of private foundation on an Android device?

What is return of private foundation?

Who is required to file return of private foundation?

How to fill out return of private foundation?

What is the purpose of return of private foundation?

What information must be reported on return of private foundation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.