Get the free 1-of-

Get, Create, Make and Sign 1-of

How to edit 1-of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1-of

How to fill out 1-of

Who needs 1-of?

1-of Form: A Comprehensive Guide to Form 1040

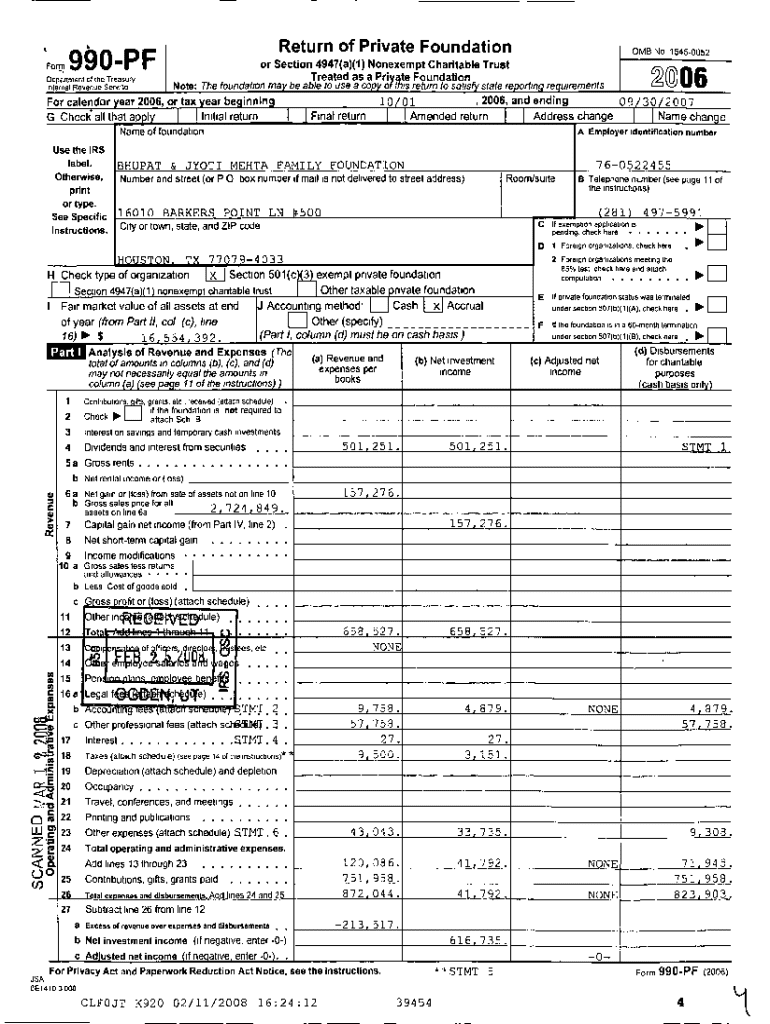

Understanding Form 1040

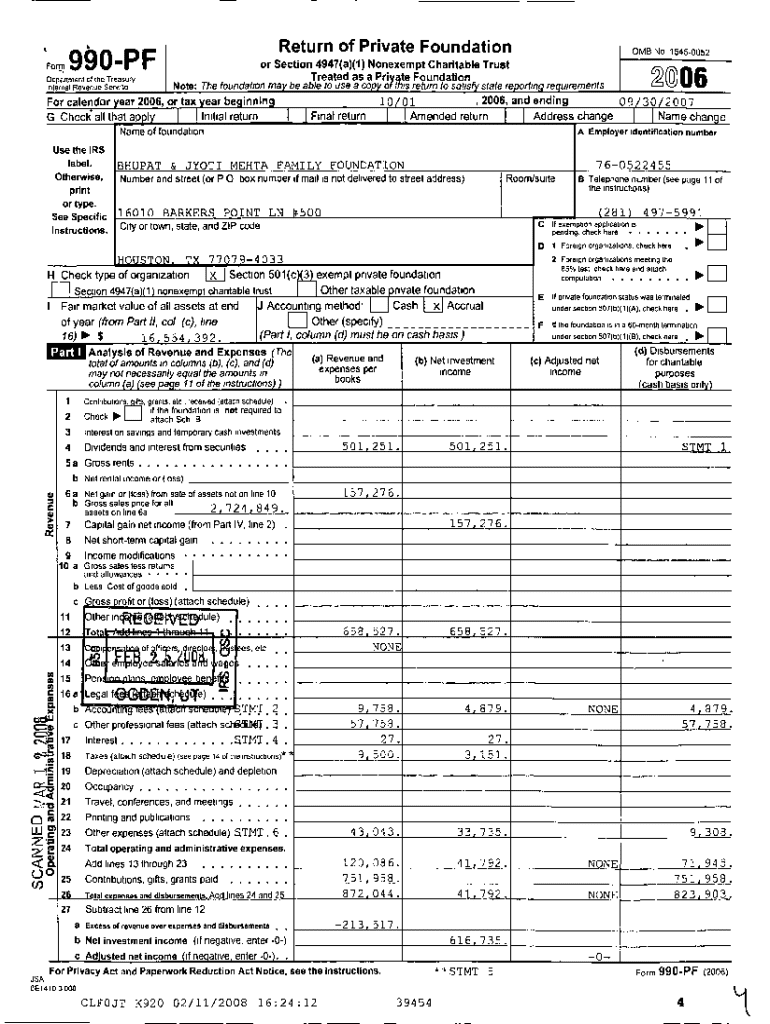

Form 1040 is the standard federal income tax form used by individual taxpayers to report their income. This form is essential for calculating personal income tax obligations to the IRS for U.S. citizens and residents. The importance of Form 1040 lies not just in its function as a tax filing tool, but also in its critical role in informing taxpayers about their earnings, tax liabilities, and potential refunds.

Whether you’re a salaried employee, self-employed, or derive income from investments, understanding whether you need to file Form 1040 is crucial. Most individuals who make above a certain amount must report their income annually. Key features of Form 1040 include various sections for income, deductions, and credits, allowing taxpayers to accurately detail their financial situations.

Preparing to fill out Form 1040

Before tackling Form 1040, it’s essential to gather the necessary documents to ensure a smooth filing process. Required documents typically include W-2 forms from employers, which detail annual wages, and 1099 forms if you've done freelance or contract work. Additionally, you should collect any financial documents that reflect other sources of income, like interest or dividends.

After gathering your documents, decide whether you prefer eFiling or paper filing. eFiling offers benefits like quicker processing times, immediate acknowledgment from the IRS, and fewer chances for errors due to built-in validations. However, if you're more comfortable handling paper forms or have specific tax situations, paper filing might still be a viable option.

Step-by-step guide to completing Form 1040

Completing Form 1040 can be straightforward if you break it down into sections. Begin with Section 1: Personal Information, where you select your filing status, which is vital as it affects your tax rate and eligibility for certain credits. It's important to ensure that your name and address are entered correctly to prevent any processing delays.

As you fill out each section, be meticulous about entering the correct numbers and ensuring proper calculations. If you’re unsure about any deductions, researching IRS guidelines or consulting a tax professional can provide clarity and ensure you're maximizing your potential refund.

Common mistakes to avoid when filing Form 1040

Filing Form 1040 can be daunting, and mistakes can lead to significant delays or even audits. One of the most common mistakes individuals make is skipping or missing crucial information, particularly in income reporting. Another frequent error involves calculating tax owed or refunds incorrectly, which can be problematic during audits. It's also essential to remember to sign and date your return before submission; failing to do this can lead to your form being rejected.

Special circumstances: Additional considerations

Certain taxpayers encounter unique situations that might affect how they file. For instance, if you're filing as a dependent, there are specific income thresholds and rules determining if you must submit a return. Additionally, married couples may need to consider whether to file jointly or separately, as this affects tax benefits. Life changes such as marriage, divorce, or having children can also significantly impact your filing status and required forms.

Frequently asked questions (FAQs) on Form 1040

Individuals often have questions about Form 1040, especially if this is their first time filing. One common query is whether someone can file Form 1040 if they have no income. The answer is yes; an individual can file to claim potential refunds or credits, even with zero income. If a mistake is realized after submission, you have the option to amend your return using Form 1040-X. This allows you to correct inaccuracies or make necessary updates.

Interactive tools and resources for Form 1040

For those looking to simplify their filing experience, a variety of interactive tools available online can assist with Form 1040. Tax calculators can help estimate potential refunds or amounts owed, making tax preparation less daunting. Additionally, checklists and error-checking tools can ensure you confirm all necessary details before submission. pdfFiller provides links to IRS official resources, providing clarity and guidance throughout your filing process.

Tips for efficient management of your tax documents

Managing your tax documents doesn’t have to be overwhelming. Creating a systematic approach throughout the year can help ease the stress during tax season. Organizing your financial records by category—such as income, deductions, and expenses—can streamline the process significantly. Additionally, storing tax documents online and using tools that allow for document comparisons can enhance efficiency and security.

Collaborating on your taxes with others

If you find tax preparation daunting, collaborating with financial advisors or accountants can provide valuable insights and assistance. Securely sharing and collaborating on documents online can enhance transparency and efficiency, ensuring that every detail is accounted for without the risk of sensitive information being compromised. pdfFiller’s cloud-based platform offers such collaborative features, enabling you to work with others seamlessly.

Success stories: How pdfFiller users simplified their tax filing

Countless individuals and teams have transformed their tax filing experiences with pdfFiller. From small business owners managing multiple income streams to families maximizing deductions, users have found that the platform significantly enhances efficiency. Testimonials reveal how features like easy document editing, eSigning, and collaboration capabilities have empowered users to navigate Form 1040 and tax obligations smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 1-of for eSignature?

How do I execute 1-of online?

Can I edit 1-of on an Android device?

What is 1-of?

Who is required to file 1-of?

How to fill out 1-of?

What is the purpose of 1-of?

What information must be reported on 1-of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.