Get the free ODC Form 990(final)-0624

Get, Create, Make and Sign odc form 990final-0624

How to edit odc form 990final-0624 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out odc form 990final-0624

How to fill out odc form 990final-0624

Who needs odc form 990final-0624?

A comprehensive guide to the ODC Form 990 Final-0624

Understanding the ODC Form 990 Final-0624

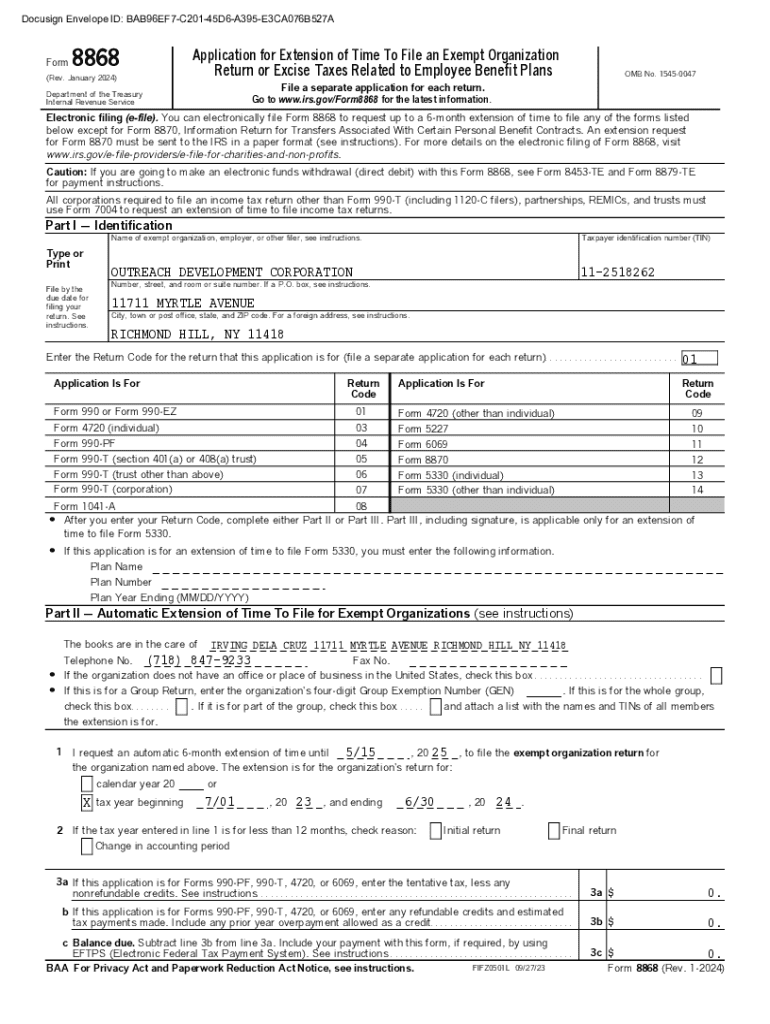

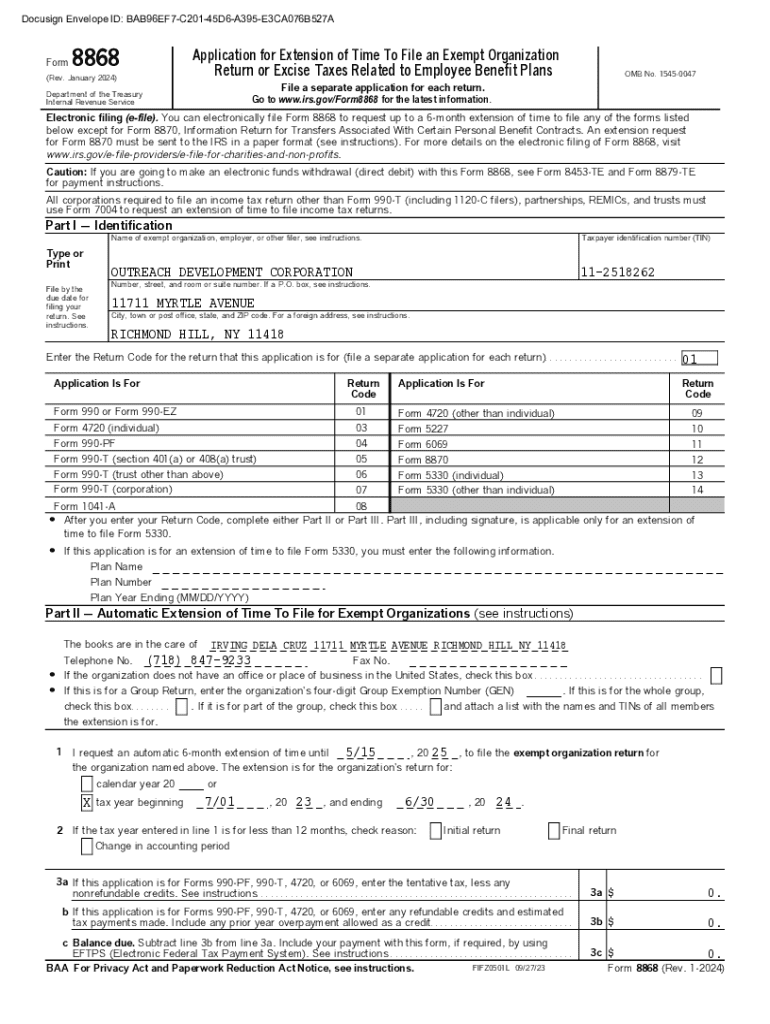

The ODC Form 990 Final-0624 serves an essential purpose within the realm of nonprofit organizations. Specifically, it is a tax form required for certain tax-exempt entities to report their financial activities to the Internal Revenue Service (IRS). This form, often referred to as the annual information return, helps promote transparency about how organizations utilize their financial resources.

Understanding the intricacies of the ODC Form 990 Final-0624 is crucial for ensuring compliance and maintaining the organization’s tax-exempt status. Accurate reporting not only fulfills IRS requirements but also enhances organizational credibility among donors and stakeholders.

Who needs to use the ODC Form 990 Final-0624?

The requirement to submit the ODC Form 990 Final-0624 applies to a variety of eligible entities. Primarily, organizations that are tax-exempt under section 501(c) of the Internal Revenue Code need to file this form annually. This includes charitable nonprofits, foundations, and some social welfare organizations.

Entities must submit this form if they gross more than $200,000 in revenues or have total assets exceeding $500,000. New organizations may also be required to submit the form, depending on their financial activities within the first fiscal year. It’s crucial for such organizations to be aware of their obligations to avoid penalties and ensure continued compliance.

Key components of the ODC Form 990 Final-0624

The ODC Form 990 Final-0624 is divided into several sections that capture essential financial data. By breaking down the content into specific sections, the IRS can assess the organization’s financial health and operational integrity. Major sections include revenue, expenses, and net assets, each requiring precise details.

Detailed insights into specific sections

Revenue reporting

Accurate revenue reporting is the backbone of the ODC Form 990 Final-0624. Organizations need to categorize income sources meticulously, including donations, grants received, and revenue from programs. This detailed breakdown not only aids IRS assessments but also provides valuable insights into an organization's financial landscape.

Expense reporting

Organizations are also required to provide a comprehensive overview of their expenses. This includes operational costs, salaries, and other program-related expenditures. Accurate reporting in this section helps ensure that the funds are being utilized appropriately and assists the organization in budgeting for future activities.

Net assets overview

The net assets section outlines the total net worth of the organization at the reporting period’s end. Organizations should ensure that their net assets reflect the accurate financial situation, as this is critical when being evaluated for potential funding or grants. Clear understanding and reporting of net assets can underscore an organization's financial health.

Step-by-step instructions to complete the ODC Form 990 Final-0624

Completing the ODC Form 990 Final-0624 requires diligent preparation. Start by gathering all necessary documentation such as financial statements, bank records, and any previous returns. Organizing this data can streamline the process and reduce the chances of errors.

Preparing to fill out the form

Once all data is prepared, it’s time to fill out the form. Each section should be completed methodically, with careful attention to detail. The use of interactive platforms like pdfFiller can significantly ease this process, allowing for direct data entry and immediate visibility of changes.

Filling out the ODC Form 990 Final-0624

Reviewing entries is crucial; mistakes can have severe consequences. Use pdfFiller's review features to catch common errors such as mismatches in financial totals or omitted information, which can jeopardize compliance.

Editing and customizing your ODC Form 990 Final-0624

After initially completing the ODC Form 990 Final-0624, you may find the need to make edits. pdfFiller offers extensive editing capabilities that simplify this process, allowing users to easily amend any section as necessary.

Using pdfFiller to edit your form

Collaboration is a key feature of pdfFiller. The platform allows multiple users to access the document simultaneously, enabling real-time cooperation and input from varying stakeholders, which enhances the accuracy of the final submission.

Electronic signature options for ODC Form 990 Final-0624

The completion of the ODC Form 990 Final-0624 isn’t complete without the necessary signatures. Electronic signatures (eSignatures) are legally accepted and can save your organization time and resources while ensuring compliance with legal requirements.

The importance of eSigning your form

When you are ready to eSign the document, pdfFiller facilitates the signing process, making it straightforward. Users can follow guided prompts to add their eSignature easily.

Managing your completed ODC Form 990 Final-0624

Once the ODC Form 990 Final-0624 is filled and signed, the next step involves managing and storing your document securely. pdfFiller provides efficient solutions for safe document storage, allowing organizations to access their documents easily when needed.

Saving and storing your document

Understanding submission guidelines is vital once the documentation is complete. Organizations should familiarize themselves with how and where to submit the form, including any applicable deadlines to avoid penalties.

Troubleshooting common issues with the ODC Form 990 Final-0624

Common errors can occur during the completion of the ODC Form 990 Final-0624, often stemming from miscalculations or incorrect data entries. Understanding how to amend errors is essential to maintain compliance.

Addressing errors in reporting

If any uncertainties arise, seeking additional guidance from professionals or utilizing pdfFiller’s customer support can provide tailored assistance to navigate complex issues.

Conclusion of insights and next steps

In summary, the ODC Form 990 Final-0624 is a pivotal component for nonprofits in maintaining financial transparency and compliance. Understanding its structure and components ensures that organizations can file accurately and avoid penalties.

Continuous learning about updates in IRS regulations and utilizing tools like pdfFiller can help organizations remain efficient in handling their documentation needs. By leveraging the features available, organizations not only simplify the process but also enhance their capacity to manage various forms effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit odc form 990final-0624 online?

Can I create an electronic signature for signing my odc form 990final-0624 in Gmail?

How do I complete odc form 990final-0624 on an iOS device?

What is odc form 990final-0624?

Who is required to file odc form 990final-0624?

How to fill out odc form 990final-0624?

What is the purpose of odc form 990final-0624?

What information must be reported on odc form 990final-0624?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.