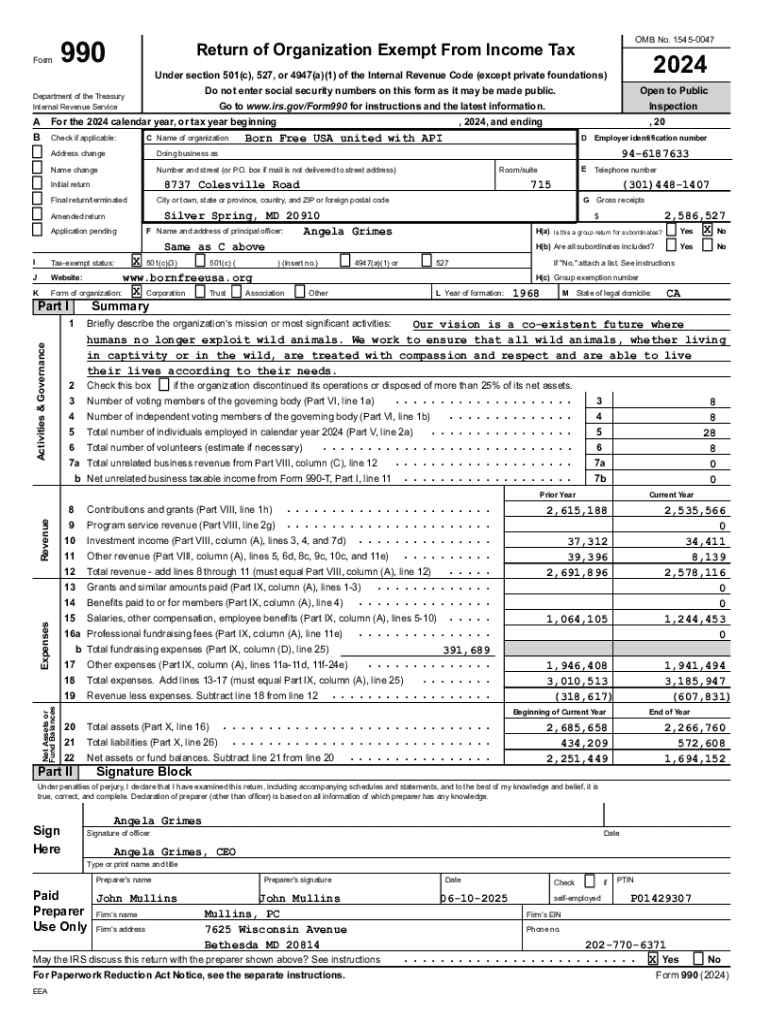

Get the 2024 Tax Return Documents (Born Free USA united with API)

Get, Create, Make and Sign 2024 tax return documents

How to edit 2024 tax return documents online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 tax return documents

How to fill out 2024 tax return documents

Who needs 2024 tax return documents?

2024 Tax Return Documents Form: Your Comprehensive Guide

Understanding your 2024 tax return

Tax return documents are essential paperwork that individuals need to report their earnings and calculate their tax obligations for the year. The accuracy and timeliness of filing these documents play a crucial role in avoiding penalties and ensuring that taxpayers receive any refunds to which they may be entitled.

The 2024 tax regulations introduce key changes that taxpayers must be aware of. Adjustments in tax laws, including new deductions and credits, can significantly affect how individuals and families file their returns, leading to potential savings or increased responsibilities.

Key components of the 2024 tax return documents form

To successfully navigate your 2024 tax return, understanding the required personal information is crucial. This typically includes your name, Social Security Number (SSN), and filing status (single, married, head of household, etc.). Failing to provide accurate data can result in delayed processing or returns.

The income reporting section of the form is where you report all sources of income, including wages from employer-provided W-2s, freelance earnings documented by 1099 forms, and investment income. Each entry must be accompanied by accurate documentation.

Additionally, understanding the deductions and credits available for the 2024 tax year is vital. Taxpayers can choose between standard or itemized deductions, which can significantly affect taxable income. Familiarity with common credits can maximize potential refunds.

Step-by-step instructions for completing your 2024 tax return

Preparation is the first and most crucial stage in completing your 2024 tax return. Start by gathering all necessary documents such as W-2s and 1099s, alongside any receipts that may support your deductions. Creating a checklist of required information can streamline this process.

After preparation, it’s time to fill out your form. The process can be broken down into specific sections:

Once the form is filled out, it is imperative to review all information for accuracy. Common mistakes such as incorrect SSNs or omitted income can delay processing.

Tools for editing and managing your 2024 tax return

pdfFiller offers comprehensive tools for document creation and management, making the handling of your 2024 tax return seamless. By uploading your tax documents directly onto the platform, you can ensure they are securely stored and compliant with necessary regulations.

In addition, pdfFiller enables collaboration among teams. Sharing documents for review and feedback becomes straightforward, which can enhance the accuracy and completeness of your filings.

eSigning and submitting your 2024 tax return

Understanding digital signatures is essential when filing your tax return electronically. eSignatures are legally valid for tax documents, making the submission process quicker and more efficient. pdfFiller simplifies this process with an easy-to-follow guide for eSigning your completed tax forms.

When it comes to submission methods, taxpayers can choose between e-filing and paper filing. E-filing is recommended as it reduces processing time and expedites refunds. The benefits of using electronic filing are numerous, including immediate confirmations upon submission.

Post-filing management

After filing your 2024 tax return, tracking your filing status becomes critical. Tools like the IRS’s 'Where’s My Refund?' can be instrumental in following up on your return and understanding refund timelines.

If you find it necessary to amend your return, knowing the reasons that typically warrant amendments is essential. The pdfFiller platform streamlines this process, allowing for easy edits and re-filing when required.

Interactive tools for your 2024 tax filing experience

Utilizing calculators and estimators can make your tax preparation more efficient. Tax estimate calculators and deduction finders available through pdfFiller assist in identifying savings opportunities tailored to your personal financial situation.

Additionally, pdfFiller offers support features such as live chat for tax-related inquiries and community forums where users can share insights and tips for filing their 2024 tax return.

FAQs on 2024 tax return documents

Questions often arise regarding the filing process, such as what to do if you miss the deadline. It's crucial to file as soon as possible to minimize penalties. Understanding how to handle a tax audit is also essential; preparation and accurate reporting are your best defenses.

Other specific scenarios include the differences between filing as a freelancer or an employed individual. Tax implications vary widely based on your status, including how expenses are reported and what deductions you may claim.

Navigating state-specific 2024 tax forms

State-specific requirements can complicate the tax filing process. Each state has its own regulations and forms, and it’s essential to be aware of these differences. Leveraging tools available on your state tax website can be an effective way to ensure compliance.

Resources such as links to state tax websites and informative articles can also aid in understanding varying obligations, helping you prepare adequately for your 2024 tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 2024 tax return documents without leaving Chrome?

How can I edit 2024 tax return documents on a smartphone?

How do I edit 2024 tax return documents on an Android device?

What is 2024 tax return documents?

Who is required to file 2024 tax return documents?

How to fill out 2024 tax return documents?

What is the purpose of 2024 tax return documents?

What information must be reported on 2024 tax return documents?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.