Get the free Delinquent Taxes - Warren County Clerk

Get, Create, Make and Sign delinquent taxes - warren

How to edit delinquent taxes - warren online

Uncompromising security for your PDF editing and eSignature needs

How to fill out delinquent taxes - warren

How to fill out delinquent taxes - warren

Who needs delinquent taxes - warren?

Delinquent Taxes - Warren Form: A Comprehensive Guide

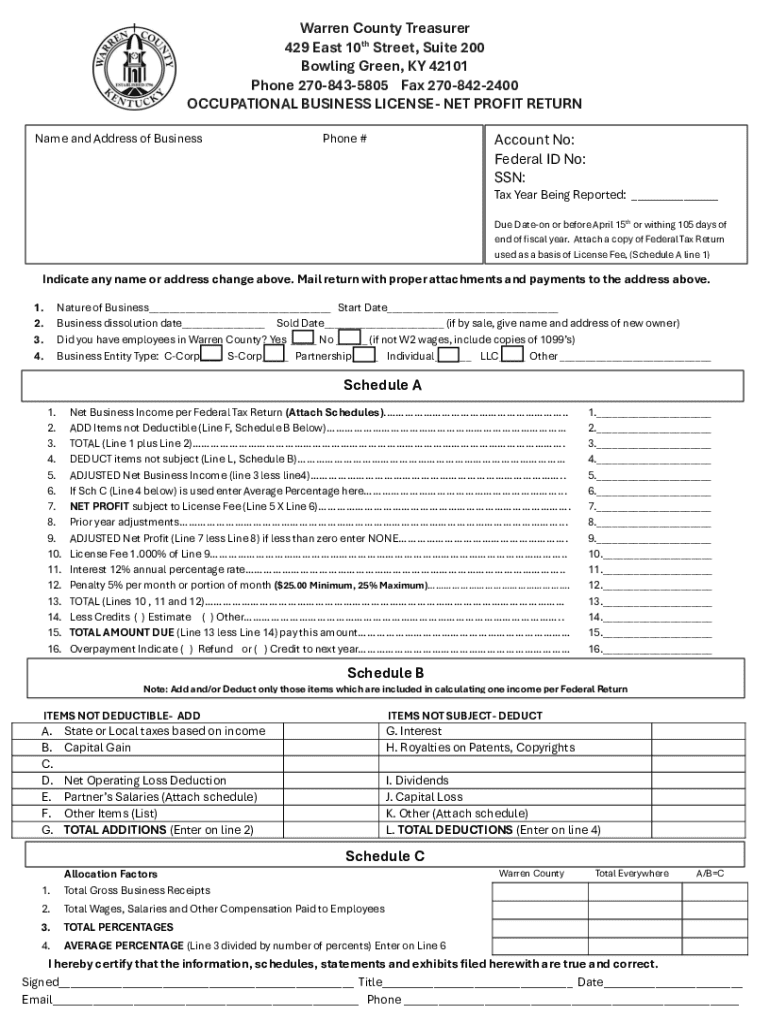

Understanding delinquent taxes in Warren County

Delinquent taxes are overdue property taxes that have not been paid by their due dates. In Warren County, failing to address delinquent taxes can lead to significant penalties, interest accumulation, and potentially the loss of your property through tax sales. These taxes represent a crucial source of funding for local services, such as education, infrastructure, and public safety, making it vital for residents to ensure their tax obligations are met promptly.

Addressing delinquent taxes not only helps maintain community services but also protects your rights as a property owner. Warren County has implemented various tax policies designed to provide support and assistance for those grappling with unpaid taxes. Understanding these policies is essential for all citizens to navigate their responsibilities effectively.

For Warren County residents, staying informed about tax deadlines and obligations guarantees a smoother experience with local tax authorities and minimizes potential financial strain.

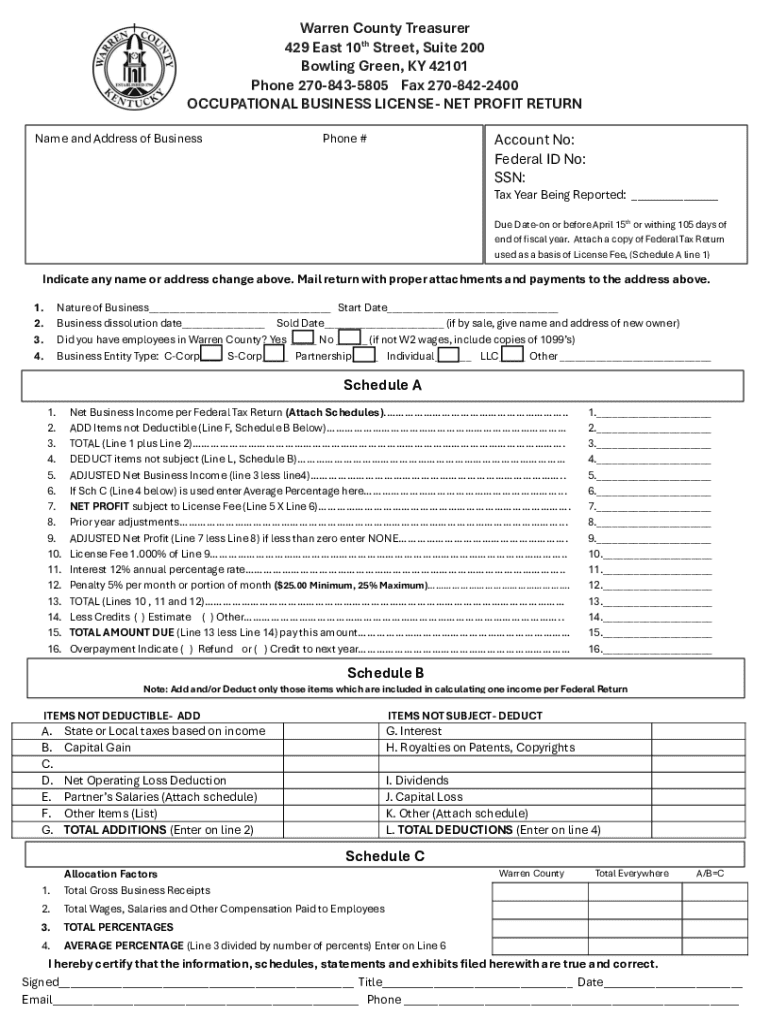

The Warren Form: A comprehensive overview

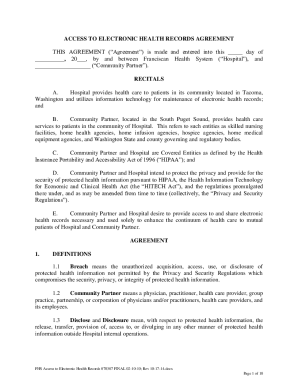

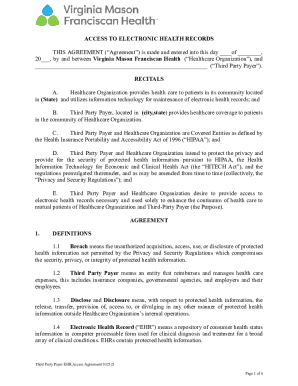

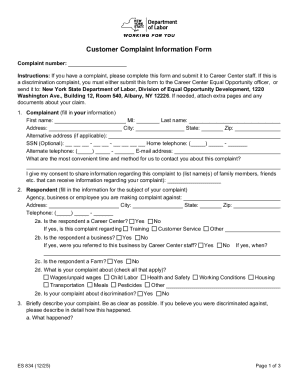

The Warren Form is a specific document used for managing delinquent tax situations within Warren County. This form allows property owners to formally address overdue taxes, including options for repayment or negotiation of their tax obligations. Understanding the Warren Form is critical for any citizen who may find themselves dealing with delinquent taxes, as it outlines the necessary steps to rectify the situation.

The primary purpose of the Warren Form is to provide local tax officials with essential information that aids in assessing each case and determining the appropriate course of action. By filling out this form accurately, taxpayers can facilitate the process of settling their delinquent accounts.

Step-by-step guide to filling out the Warren Form

Completing the Warren Form involves several key sections that must be filled out with accuracy and attention to detail. Each part of the form captures specific information necessary for the treatment of your delinquent taxes.

Section-by-section breakdown of the form

To ensure the form is completed correctly, it’s wise to review all sections thoroughly. Common mistakes include omitting required details or providing incorrect property descriptions, which can delay processing or result in rejections.

Editing the Warren Form

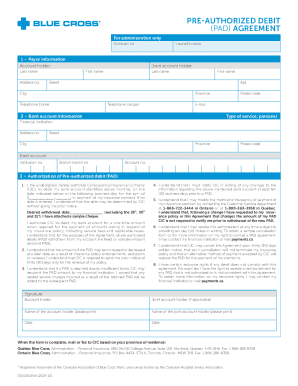

Once the form is filled out, you may need to make edits before final submission. This can be efficiently done using pdfFiller, which allows you to upload your document and use various editing tools.

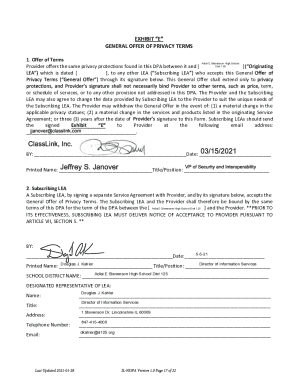

Digital signing options available for the Warren Form

After finalizing your edits, you will need to sign the form. pdfFiller provides simple eSigning options that allow you to sign your document digitally.

Collaborating on your delinquent taxes form

If you are working in a team or need assistance from advisors, collaboration tools offered by pdfFiller make it easy to share the Warren Form for review. This can streamline the process and ensure accuracy before submission.

Managing your delinquent taxes with pdfFiller

Staying on top of your delinquent taxes requires organization and timely management. Using pdfFiller's features enhances your ability to track deadlines and payments efficiently.

Common issues and troubleshooting

Even with thorough preparation, issues can arise when dealing with delinquent taxes. Understanding how to troubleshoot these issues is essential for a smooth resolution.

Next steps after submitting the Warren Form

After submitting the Warren Form, it’s important to monitor the progress of your application and remain proactive about your tax situation. Following up is essential to ensure your case is being processed in a timely manner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit delinquent taxes - warren from Google Drive?

How can I send delinquent taxes - warren for eSignature?

How do I edit delinquent taxes - warren on an Android device?

What is delinquent taxes - warren?

Who is required to file delinquent taxes - warren?

How to fill out delinquent taxes - warren?

What is the purpose of delinquent taxes - warren?

What information must be reported on delinquent taxes - warren?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.