Get the free Financial Archives

Get, Create, Make and Sign financial archives

How to edit financial archives online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial archives

How to fill out financial archives

Who needs financial archives?

Financial Archives Form - How-to Guide

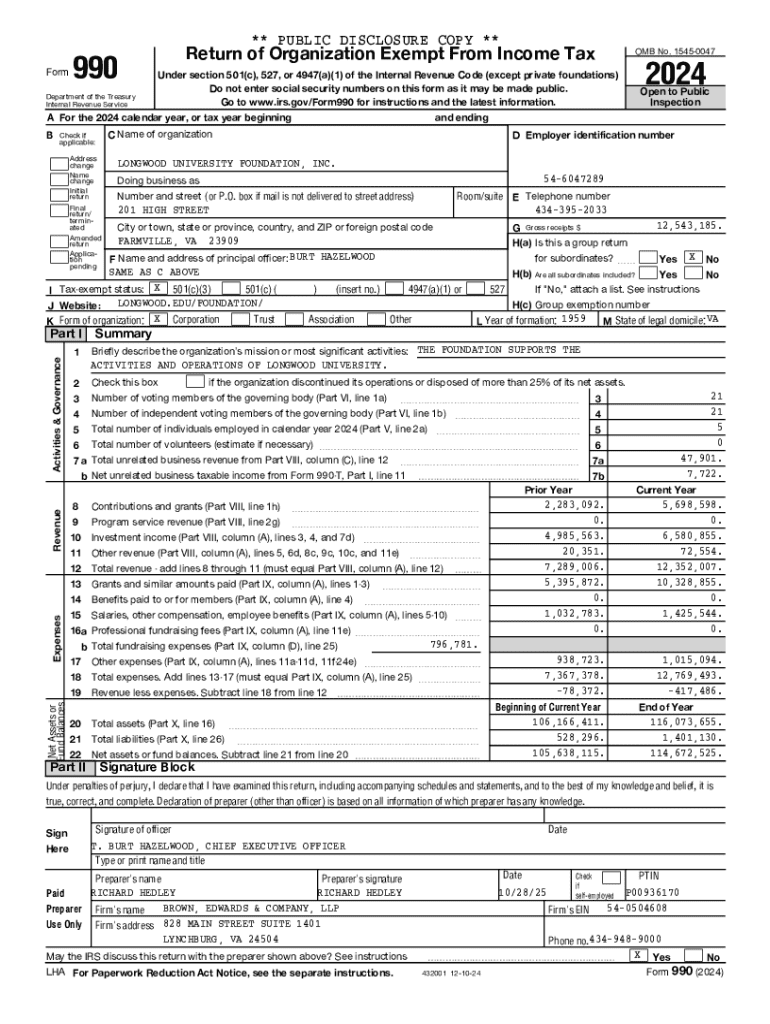

Understanding the financial archives form

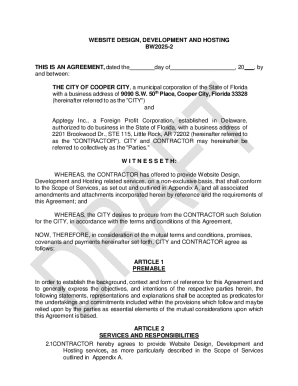

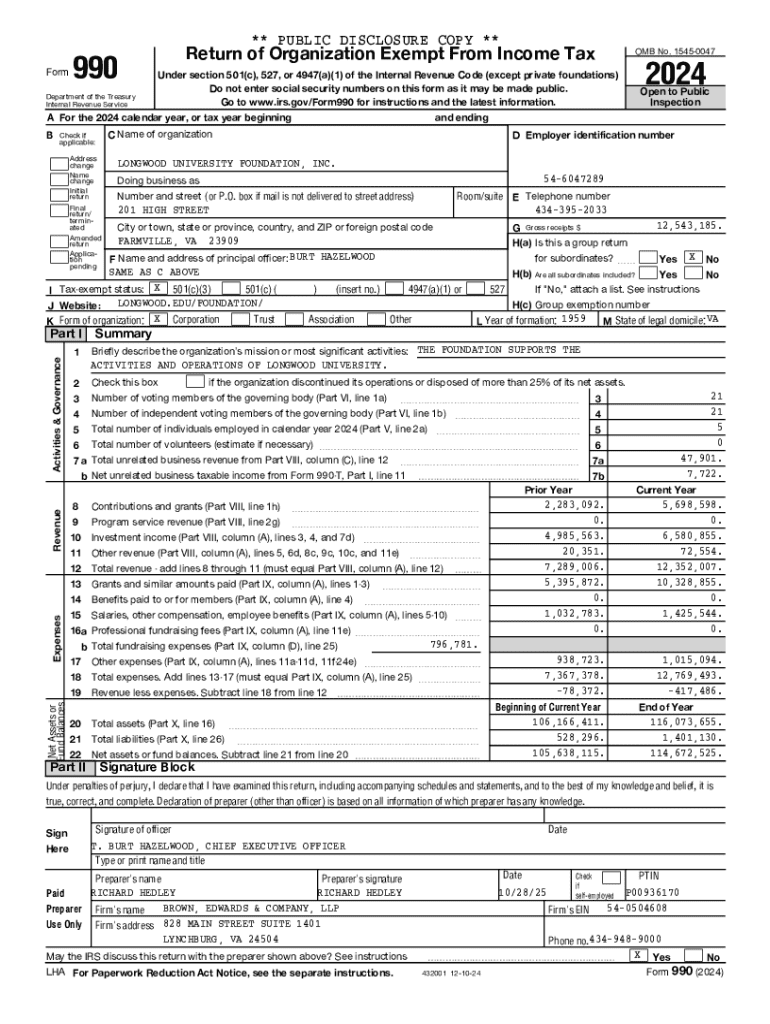

The financial archives form serves as a crucial tool for documenting and organizing financial information. It enables individuals and businesses to track income, expenditures, investments, and tax obligations systematically. This organized record-keeping can be the backbone of effective financial management.

Understanding the importance of such forms cannot be overstated, especially in compliance-heavy sectors. They facilitate accurate preparation of tax filings, ensuring that no financial detail is overlooked, which can be detrimental to both personal and business finances.

Features of pdfFiller's financial archives form

pdfFiller's financial archives form stands out due to its robust features designed to enhance both functionality and user convenience. One of the most appealing aspects is the availability of editable templates which allow users to tailor the form to their specific financial situations, improving both usability and accuracy.

Moreover, the cloud storage benefits ensure that all archived financial data is securely stored and easily accessible from any device. This feature not only reduces the risk of losing important documents but also allows users to collaborate effectively in team settings.

Step-by-step guide to accessing the financial archives form

Accessing the financial archives form on pdfFiller is a straightforward process. Users can start by navigating to the pdfFiller platform. Once logged in, users should pay attention to the user-friendly interface that has been designed for easy navigation.

Using the search function can significantly reduce the time spent locating the form. Simply enter 'financial archives form' into the search bar, and relevant templates will appear, allowing users to choose their preferred format efficiently.

Filling out the financial archives form

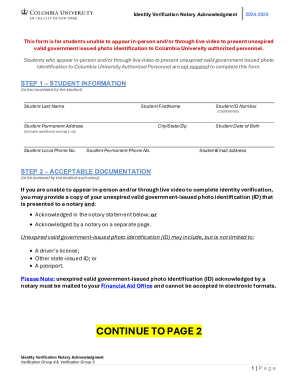

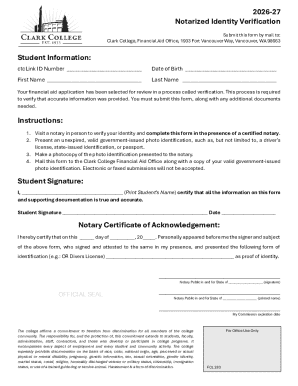

Filling out the financial archives form requires attention to several key sections to ensure completeness and accuracy. The primary sections typically include personal information such as name, address, and contact details, which are critical for identification purposes.

Another vital section involves documenting financial history, where users will enter details regarding income, expenses, and investments. Accurate entries here will not only simplify tax preparation but also facilitate better financial planning.

It's essential for users to cross-reference their entries with financial records to avoid discrepancies. Identifying potential discrepancies at this stage can save time and prevent issues during audits or tax reviews.

Editing tools on pdfFiller

pdfFiller offers several interactive features to make editing your financial archives form seamless. Users can easily modify text, ensuring their entries are both accurate and clear according to their specifications. The platform also allows users to add signatures and initials, ultimately streamlining the signing process.

Highlighting and annotating tools are particularly useful for emphasizing important notes or areas in the form that warrant additional attention. This feature promotes better clarity not just for the user but for anyone else who might review the document in the future.

Managing your form with pdfFiller

Once the financial archives form is filled out, managing it is essential for future reference. pdfFiller allows users to organize completed forms efficiently through custom folders and tagging features, making it easy to retrieve information when needed.

Version control is also a standout feature on pdfFiller that ensures you never lose track of your document's revisions. This is particularly useful when multiple edits are made over time. Sharing options enable users to collaborate with colleagues effectively, by inviting team members to edit the document while observing strict security protocols.

Signing and securing your financial archives form

Signing your financial archives form is a critical step that completes the process and verifies that the information provided is accurate. Electronic signatures (eSignatures) are increasingly being accepted in many jurisdictions, making them convenient and legally binding.

On pdfFiller, signing a form requires just a few clicks. Users can easily eSign their documents while complying with eSignature laws. Securing sensitive information throughout the process is paramount; therefore, users should ensure data protection protocols are in place to prevent unauthorized access.

Common pitfalls and troubleshooting tips

Users may encounter various challenges while working with their financial archives form. One common pitfall includes submission errors, which can occur due to incomplete information or improper formatting. Knowing how to troubleshoot these issues can save users time and frustration.

If a document is lost or cannot be retrieved, pdfFiller offers secure backup options, allowing users to recover documents easily. Regularly saving progress and utilizing the cloud service can prevent significant losses from unexpected issues.

Frequently asked questions (FAQ)

Users often have similar inquiries regarding the financial archives form, particularly about what types of documents can be archived. Typically, this includes receipts, bank statements, invoices, and property documents.

Another common question revolves around how long financial archives must be kept. While regulations can vary, it's generally advisable to retain documents for at least five years. Additionally, many users wonder if the form can cater to both business and personal finances, which it absolutely can, providing flexibility in financial management.

Best practices for maintaining financial archives

Maintaining organized financial archives is critical for effective financial management. Recommended filing practices include categorizing documents by type and date. This systematic approach allows for quick retrieval during tax preparation or audits.

Regular updates and reviews of financial records ensure accuracy and help identify any discrepancies promptly. Furthermore, understanding local regulations for records retention can guide users on how long to keep specific types of documents without risking compliance.

Unlocking advanced features of pdfFiller

For those looking to enhance their document management capabilities, pdfFiller provides access to advanced features. These include sophisticated reporting tools that can help users analyze financial data more effectively. Automated workflows tailored for financial documentation can also reduce the time spent on repetitive tasks, allowing for better productivity.

The pricing structure for pdfFiller varies based on features included; understanding this structure can help users select a plan that best fits their needs. Emphasizing user support, pdfFiller aims to create an efficient and user-friendly experience for managing financial archives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit financial archives in Chrome?

How can I fill out financial archives on an iOS device?

How do I complete financial archives on an Android device?

What is financial archives?

Who is required to file financial archives?

How to fill out financial archives?

What is the purpose of financial archives?

What information must be reported on financial archives?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.