Get the free IRS Form 8868 Instructions for 2025 Tax Year

Get, Create, Make and Sign irs form 8868 instructions

Editing irs form 8868 instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 8868 instructions

How to fill out irs form 8868 instructions

Who needs irs form 8868 instructions?

IRS Form 8868 Instructions Guide

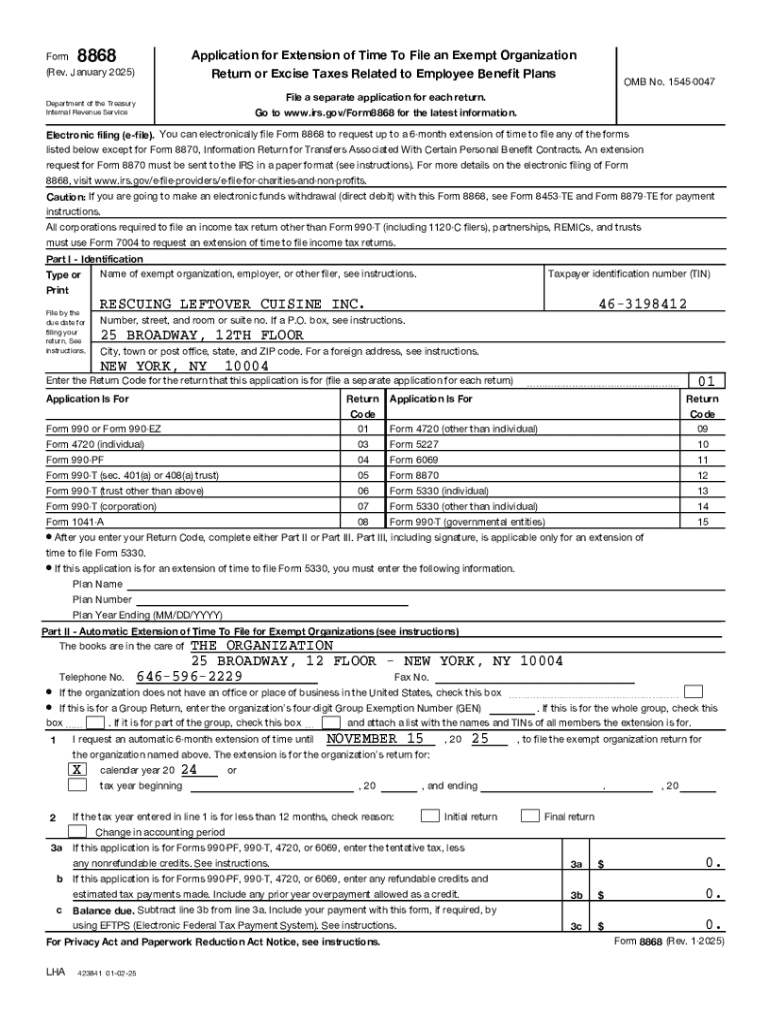

Understanding IRS Form 8868

IRS Form 8868 is a critical document for certain tax-exempt organizations. Its primary purpose is to apply for an automatic extension of time to file various tax returns, including annual information returns. For organizations that need additional time to gather necessary documentation, this form plays a vital role in ensuring that they comply with IRS regulations while avoiding penalties for late submissions.

The importance of IRS Form 8868 cannot be overstated; it enables eligible entities to manage their filing timelines smartly. Organizations that fail to file their required returns on time may face significant penalties—further emphasizing the necessity of this form in the tax landscape for nonprofits and other tax-exempt entities.

Key features of the 2025 IRS Form 8868

For the 2025 tax year, IRS Form 8868 includes some key updates compared to its predecessors. The most notable change includes a revision in the filing criteria that broadens eligibility, allowing more organizations to qualify for extensions. This reflects the IRS’s continuing adjustment of policies to accommodate the needs of organizations managing their complex filing requirements.

Understanding the structure of Form 8868 is essential. The form is divided into sections that logically guide filers through the necessary information, making it clear what is required for an extension request. This organization aids in minimizing delays and errors, which is beneficial for all concerned parties.

Step-by-step instructions for completing IRS Form 8868

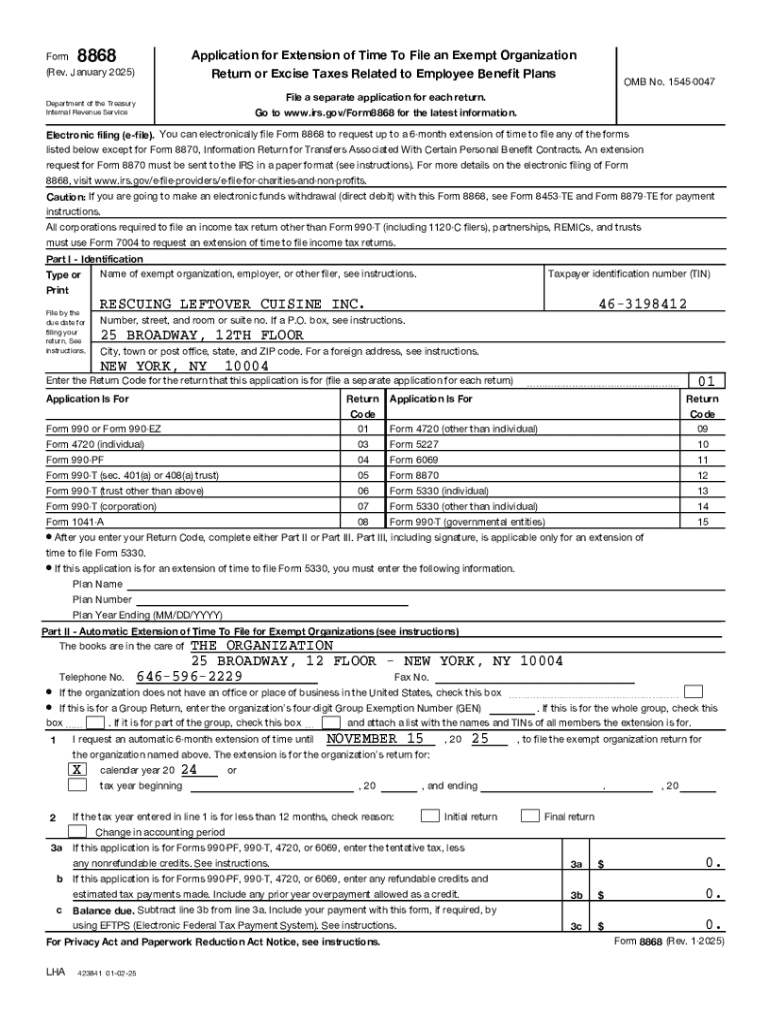

Completing IRS Form 8868 requires careful attention to detail. Start with Section I, which captures basic information such as your organization's name, address, and EIN (Employer Identification Number). Ensure these details are accurate, as errors can lead to processing delays. Section II requires you to specify the exact tax return for which you're seeking an extension, including the type of return and its due date.

Moving on to Section III, you'll find a declaration for eligibility. It's crucial to certify your organization meets the necessary eligibility criteria to avoid penalties. Review all entries thoroughly before submission. Additionally, common mistakes include not providing complete information or failing to sign the form. Utilize checklists and review procedures to enhance accuracy.

Deadlines and filing requirements for Form 8868 in 2025

The deadlines for filing IRS Form 8868 are based on the original due date of the tax return you are applying to extend. Typically, the form must be submitted by the due date of the original return to be granted an extension. For example, if your organization’s return is due on May 15, the form should be submitted by that date to avoid any penalties associated with later submissions.

Understanding the ramifications of filing for an extension is also crucial. An approved extension gives organizations additional time—generally, six months—to file their returns. However, it is important to note that while the extension allows more time for filing, it does not extend the time for payment of any taxes owed. Therefore, organizations should make timely payments to avoid interest and penalties.

Electronic filing options for IRS Form 8868

E-filing IRS Form 8868 offers numerous benefits, including faster processing times and immediate confirmation of submission. This electronic method is particularly useful for organizations managing large volumes of paperwork, as it streamlines the filing procedure. Leveraging e-filing capabilities can significantly reduce the risk of errors and improve efficiency in handling tax documentation.

To e-file Form 8868, organizations can use authorized e-file providers. These services not only comply with IRS standards but typically include helpful features such as error checking, which can identify common mistakes before submission. Resources available through pdfFiller further simplify this process, allowing users to create, eSign, and submit documents directly from the cloud, thereby enhancing collaborative efforts within organizations.

Managing your tax documents with pdfFiller

pdfFiller streamlines the management of tax documents, enabling organizations to edit, sign, and share files seamlessly. With access to IRS forms and templates directly on the platform, users can easily navigate and manage their document workflow. This centralized management system not only saves time but also reduces the potential for errors that could arise from handling multiple versions of documents across different formats.

Moreover, pdfFiller's collaborative features allow team members to work on documents together, enhancing communication and efficiency. With options for eSigning and sharing files instantly, teams can ensure that every necessary signature is captured promptly, making the overall tax filing process smoother and less cumbersome.

Common questions about IRS Form 8868

Filing IRS Form 8868 raises several common questions, particularly among first-time users. Many organizations wonder what happens if the form is filed late or what to do if they realize they've made an error on the form. Understanding the answers to these questions can significantly influence an organization's decision-making regarding their tax filing and extension requests.

In case of late filing, organizations may still submit Form 8868, but penalties for missed deadlines may apply. For errors found after submission, organizations should file an amended return to correct any mistakes promptly. Additional support can be obtained through IRS resources or consultation with tax professionals to navigate these complexities.

Additional considerations

Special cases and exceptions in relation to IRS Form 8868 can complicate matters for some organizations. For example, certain organizations may have unique circumstances that require personalized guidance on filing extensions or specific compliance issues related to their type of business or sector. This necessitates a careful review of IRS regulations and possibly seeking expert advice.

If a mistake is made on Form 8868 after it has been filed, the organization should promptly file an amended form as per IRS guidelines. Managing document flow proactively post-filing can ensure that organizations maintain compliance moving forward, avoiding unnecessary penalties or issues that may arise from delayed corrections.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete irs form 8868 instructions online?

Can I sign the irs form 8868 instructions electronically in Chrome?

Can I create an eSignature for the irs form 8868 instructions in Gmail?

What is IRS Form 8868 instructions?

Who is required to file IRS Form 8868 instructions?

How to fill out IRS Form 8868 instructions?

What is the purpose of IRS Form 8868 instructions?

What information must be reported on IRS Form 8868 instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.