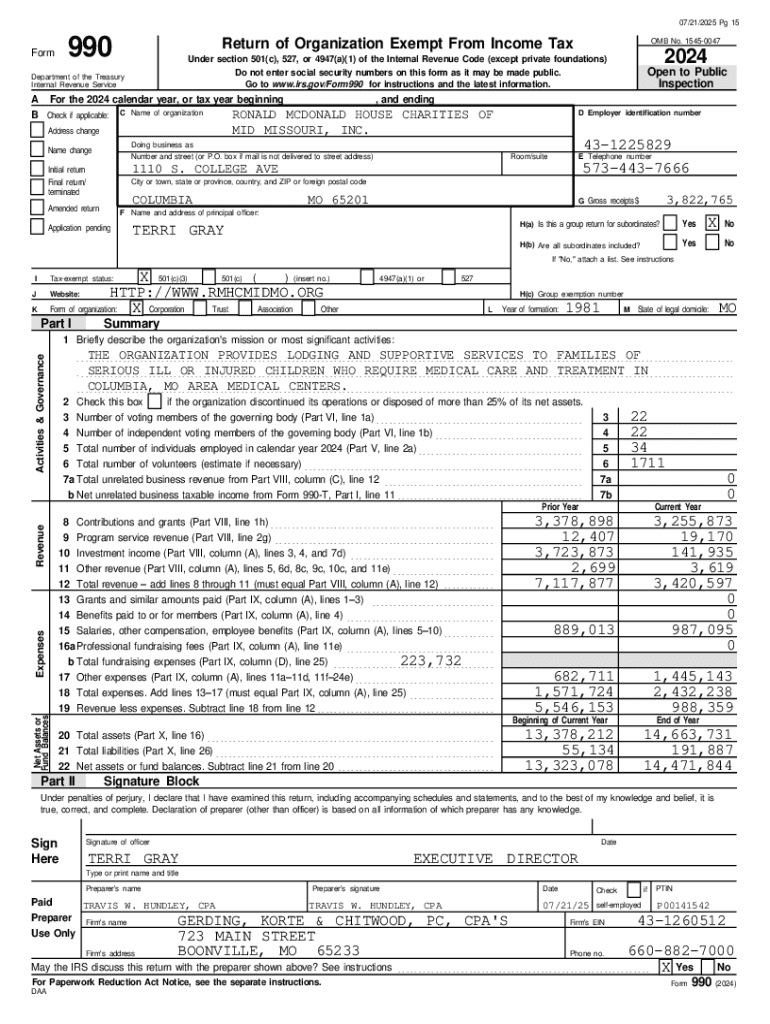

Get the free Form 990, Page 1 - Ronald McDonald House Charities

Get, Create, Make and Sign form 990 page 1

How to edit form 990 page 1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990 page 1

How to fill out form 990 page 1

Who needs form 990 page 1?

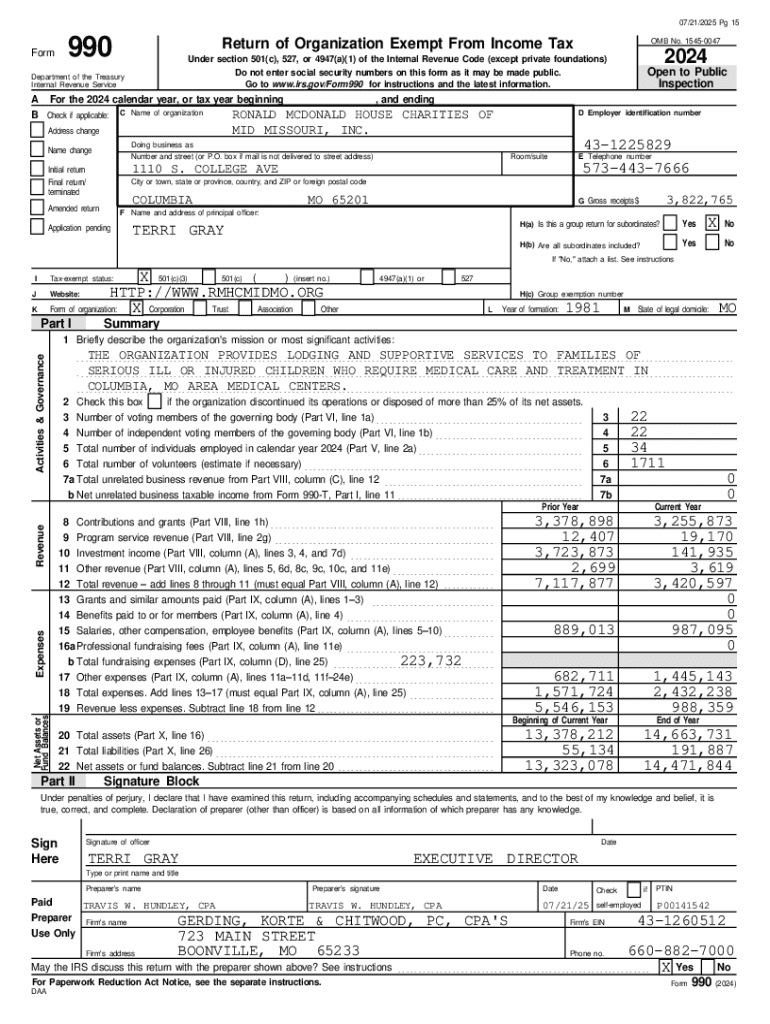

Understanding Form 990 Page 1: A Comprehensive Guide

Overview of Form 990

Form 990 serves as a critical tax compliance tool for nonprofit organizations in the United States. This multifaceted document not only aligns with IRS regulations but also provides transparency about an organization’s financial health and operational activities. Understanding the nuances of Form 990 is essential for nonprofits to maintain their tax-exempt status and ensure accountability to stakeholders.

Filing Form 990 is mandatory for most tax-exempt organizations. Nonprofits that fail to comply with this requirement risk losing their tax-exempt status and facing significant penalties. The IRS expects these organizations to operate transparently, and Form 990 is a primary method through which they disclose essential financial and operational information to the public.

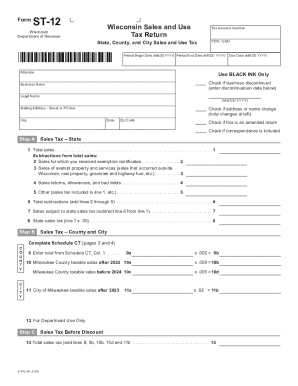

Detailed breakdown of Form 990 Page 1

The first page of Form 990 contains vital summary information about the nonprofit entity. It's divided primarily into two parts: Part I summarizes the organization’s mission, revenue, expenses, and net assets, while Part II features the signature block. Both areas must be completed with attention to detail, as they set the tone for the integrity of the Form 990.

Part : Summary Information

The Summary Information section is pivotal as it offers a snapshot of the organization’s activities and financial standing. Key components to include are a clear mission statement, an overview of revenue and expenses, plus net assets. Ensuring accuracy in this part lays a solid foundation for the entire submission.

When completing this section, consider double-checking figures and confirming that they align with supporting documentation, such as annual financial statements and budgets. This practice not only enhances accuracy but also aids in answering potential questions from the IRS and stakeholders.

Part : Signature Block

The signature block is not merely a formality; it’s an essential section that verifies the legitimacy of the form. Typically, an officer of the organization, such as the president or treasurer, must sign it to affirm that the information provided is accurate and complete. Unauthorized or incorrect signatures can lead to complications with the IRS.

Common mistakes to avoid in this section include neglecting to date the signature, having multiple signatures when not necessary, and allowing an unauthorized person to sign. Therefore, following through with internal protocols for this step is paramount.

Understanding program service accomplishments

Program service accomplishments outline the effectiveness and impact of a nonprofit's primary activities. Towards fostering accountability, the IRS requires nonprofits to detail these accomplishments on Form 990. This section includes reporting on the outcomes of services or programs, helping stakeholders understand the social return on investment.

Effective reporting practices involve being specific and highlighting both qualitative and quantitative data. A well-defined impact statement can powerfully reflect an organization’s contributions and aspirations. Furthermore, including metrics such as the number of beneficiaries helped can elevate the presentation of outcomes.

Checklist of required schedules

Completing Form 990 does not stop at Page 1; several additional schedules may be required depending on the nature of the nonprofit's activities. Each schedule offers a distinct function that provides further context and detailed information tailored to the IRS requirements. It’s crucial for organizations to assess which schedules apply to them.

Commonly required schedules include Schedule A, B, and G, each focusing on different aspects of nonprofit governance and operations. For example, Schedule A is designated for organizations exempt under Section 501(c)(3), which further estimates compliance with specific public support tests.

Organizing supporting documentation is equally essential. This may include donor letters, financial statements, and proof of contributions. Keeping thorough records not only facilitates accurate reporting but also eases any inquiries from the IRS or external stakeholders.

Additional tax compliance information

Beyond Form 990, nonprofits may have other IRS filings to consider, including Form 990-EZ or Form 990-N (e-Postcard) depending on their revenue size and operational structure. Maintaining compliance requires a strategic approach to ensure all necessary forms are filed timely and correctly. Organizations must stay vigilant regarding their tax responsibilities.

Understanding associated tax obligations allows nonprofits to avoid dangerous pitfalls that could threaten their status. From income tax considerations related to unrelated business income to fulfilling state-specific requirements, being informed is essential for sustainable operation.

Governance, management, and disclosure

An essential component of Form 990 is the governance section, where nonprofits disclose the composition and responsibilities of their board of directors. This transparency reassures donors and stakeholders that the organization operates with integrity and accountability.

Key disclosures include board meeting frequency, policies regarding conflicts of interest, and practices surrounding charitable care. Each of these aspects reflects an organization's commitment to good governance and ethical conduct, which can enhance its reputation among funders and the community.

Compensation reporting

Transparency in compensation reporting is crucial for nonprofits to instill trust among donors and stakeholders. Form 990 requires detailed disclosures regarding remuneration for officers, directors, and the highest compensated employees, helping to paint a clear picture of financial stewardship.

Nonprofits should approach this reporting with care, ensuring that all compensation figures are accurate and reflective of the total remuneration package. Common mistakes include failing to disclose fringe benefits or bonuses, inadvertently misleading the review process.

Statement of revenue

In the realm of nonprofit filings, the Statement of Revenue section demands attention as it encapsulates the organization’s income streams. Accurate reporting of revenues assures donors and regulators that the nonprofit operates sustainably and transparently.

Nonprofits are required to report various types of revenue, including contributions, grants, program revenue, and investment income. Distinguishing between these categories is essential for clarity and can enhance the trust placed in the organization. Furthermore, being consistent in reporting practices contributes to credibility.

Interactive tools and resources

By leveraging tools provided by pdfFiller, nonprofit organizations can simplify the process of completing Form 990. Using document management features not only enhances the productivity of teams but also streamlines submission with additional e-signature capabilities.

Collaborative features offered by pdfFiller ensure that various contributors can work on different sections simultaneously, cutting down on turnaround times. Users can also manage documents effectively while enjoying easy access to their ongoing drafts, improving the accuracy of the final submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 page 1 from Google Drive?

How can I send form 990 page 1 to be eSigned by others?

How can I fill out form 990 page 1 on an iOS device?

What is form 990 page 1?

Who is required to file form 990 page 1?

How to fill out form 990 page 1?

What is the purpose of form 990 page 1?

What information must be reported on form 990 page 1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.