Get the free Hull-990-(FY2024).pdf - Farmville

Get, Create, Make and Sign hull-990-fy2024pdf - farmville

How to edit hull-990-fy2024pdf - farmville online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hull-990-fy2024pdf - farmville

How to fill out hull-990-fy2024pdf - farmville

Who needs hull-990-fy2024pdf - farmville?

A Comprehensive Guide to the Hull-990-FY2024 PDF Form for Farmville

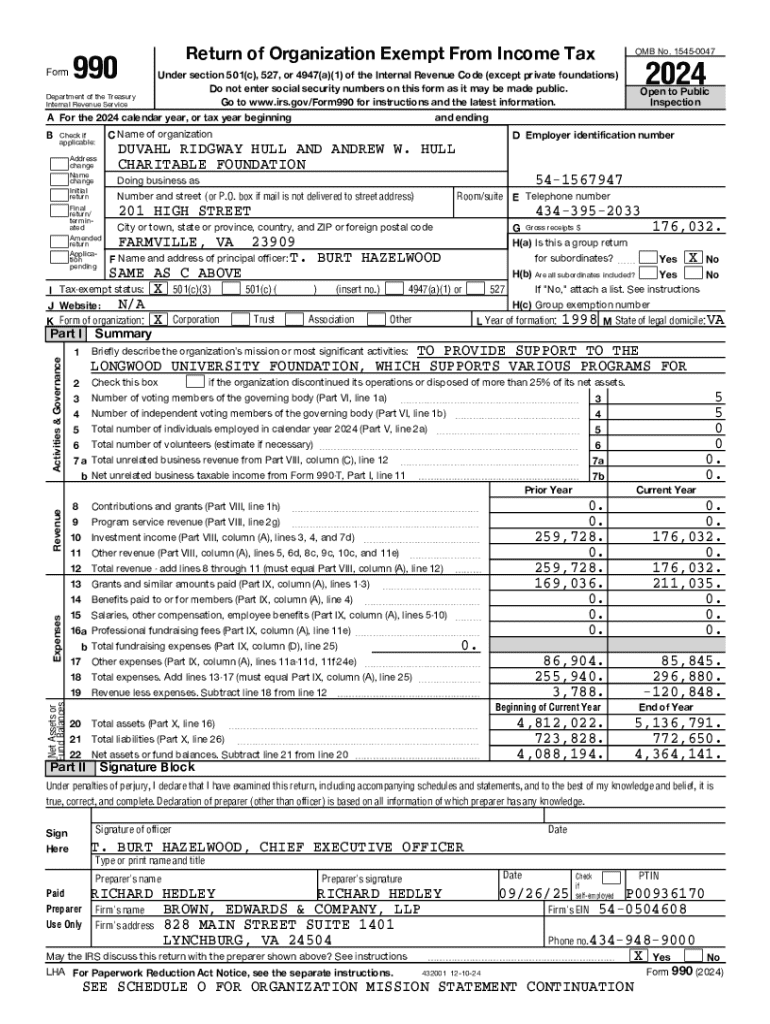

Understanding the Hull-990-FY2024 PDF form

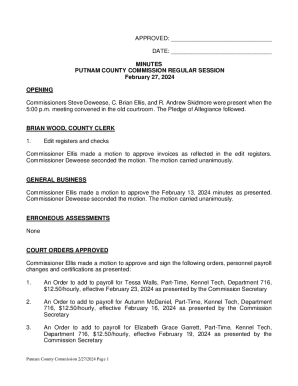

The Hull-990-FY2024 form is a crucial document designed for organizations in Farmville to report their financial activities for the fiscal year. It serves as a detailed account of financial performance, funding sources, and expenditures, making it essential for transparency and accountability. By compiling this information, stakeholders can assess the organization's financial health, program efficacy, and compliance with regulatory standards.

The importance of the Hull-990-FY2024 form cannot be overstated. It is the foundation upon which organizations demonstrate fiscal responsibility to donors, tax authorities, and the community at large. Key stakeholders involved in completing the form include finance teams, board members, and sometimes external auditors, who ensure that the data presented is accurate and reflects the true nature of the organization's activities.

Key features of the Hull-990-FY2024 form

The Hull-990-FY2024 form is structured to provide a comprehensive overview of an organization’s financial performance. It includes several key sections that detail various aspects of financial activity, crucial for any organization’s compliance with regulations.

The comprehensive sections breakdown includes:

Accurate data entry in every section is vital. Not only does it demonstrate compliance with financial regulations, but it also ensures that stakeholders can trust the information being presented.

Step-by-step instructions for filling out the Hull-990-FY2024 form

Before diving into filling out the Hull-990-FY2024 form, preparation is key. Gather necessary documents such as tax documents, financial statements, and previous Hull-990 forms for reference. This preparatory step will streamline the process and reduce the chances of mistakes.

Here’s a detailed walkthrough of each section of the form:

Tips for accurately completing the Hull-990-FY2024 form

While filling out the Hull-990-FY2024 form, there are several common pitfalls you should be aware of. For instance, failing to include all funding sources can lead to compliance issues, as can inaccuracies in reported figures. Always verify that totals add up correctly to avoid discrepancies that could trigger audits.

Handling discrepancies requires careful attention. If you find a mismatch, re-examine your supporting documents to pinpoint the error. Additionally, the importance of double-checking figures cannot be overlooked; it's advisable to have another team member review the form before final submission.

Utilizing interactive tools for form management

In today's digital age, utilizing interactive tools can significantly enhance the efficiency of filling out the Hull-990-FY2024 form. Tools like pdfFiller offer features specifically designed to simplify the editing and completion of PDFs, ensuring that you can work through the document with ease.

For teams handling this process, collaborative tools are essential. pdfFiller allows multiple users to interact with the document simultaneously, making it easy to manage contributions from finance teams or external auditors. eSigning features enable users to add legal signatures seamlessly, ensuring that the final document is authoritative and recognized without delays.

Managing submissions and follow-up steps

Once the Hull-990-FY2024 form is completed, adhering to best practices for submission is critical. Ensure that all required sections are filled out completely and accurately before submission. Consider submitting electronically, if allowed, as it can facilitate quicker processing.

Tracking your submission status can provide peace of mind. Stay engaged throughout the process, and be prepared to address any requested changes or audits promptly. Establish a contact at the receiving agency who can provide alerts regarding the status of your submission.

FAQs about the Hull-990-FY2024 form

Many individuals and teams often have questions regarding the Hull-990-FY2024 form. Common concerns involve understanding which documents are needed for submission, the deadlines for filing, and how to amend the form once submitted.

For additional queries, resources are available online to support organizations through this process. Engaging with local financial experts or webinars can provide deeper insights and tailored advice.

Integrating pdfFiller for a streamlined document workflow

Choosing pdfFiller as your platform for form management adds tremendous value. The ability to edit PDFs, collect eSignatures, and collaborate with team members all in one cloud-based environment simplifies the entire workflow.

Moreover, testimonials from users highlight how pdfFiller has transformed their document management processes. With seamless access from anywhere, users can easily maintain compliance and stay organized, ensuring that their Hull-990-FY2024 forms are always submitted accurately and on time.

Future considerations and updates for the Hull-990 forms

Organizations should remain vigilant about upcoming changes to the Hull-990 forms, particularly as legislation impacting financial reporting evolves. Staying informed about these updates is crucial to maintaining compliance and ensuring all forms are completed according to new standards.

Engaging with financial advisors and following industry news can also help organizations prepare for any anticipated changes in the next fiscal year, ensuring they are always ahead of the curve.

Navigating the pdfFiller platform

Getting started with pdfFiller is straightforward. Signing up for an account opens up a multitude of features tailored for document management. Once registered, users can navigate through the platform easily to find specific forms, including the Hull-990-FY2024 PDF.

To maximize efficiency, take time to explore the various tools available, such as template customization, document sharing, and data analytics. A well-informed user is ultimately more capable of leveraging these features for outstanding document management.

Other related form templates available on pdfFiller

In addition to the Hull-990-FY2024 form, pdfFiller offers a wide range of additional templates for financial recording and reporting. Forms like the annual foundation report and audited financial report are readily accessible and can be used in conjunction with the Hull-990 forms for comprehensive financial management.

By linking these resources through the pdfFiller platform, organizations can create a cohesive documentation workflow, ensuring that all necessary forms are completed accurately and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify hull-990-fy2024pdf - farmville without leaving Google Drive?

How do I complete hull-990-fy2024pdf - farmville online?

Can I create an eSignature for the hull-990-fy2024pdf - farmville in Gmail?

What is hull-990-fy2024pdf - farmville?

Who is required to file hull-990-fy2024pdf - farmville?

How to fill out hull-990-fy2024pdf - farmville?

What is the purpose of hull-990-fy2024pdf - farmville?

What information must be reported on hull-990-fy2024pdf - farmville?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.