Get the free IRS Form 1098-T walkthrough (Tuition Statement)

Get, Create, Make and Sign irs form 1098-t walkthrough

How to edit irs form 1098-t walkthrough online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 1098-t walkthrough

How to fill out irs form 1098-t walkthrough

Who needs irs form 1098-t walkthrough?

IRS Form 1098-T Walkthrough Form

Understanding IRS Form 1098-T

IRS Form 1098-T, also known as the Tuition Statement, is a crucial tax document for both students and educational institutions. It provides essential information regarding tuition payments and related educational expenses for the tax year. This form is vital as it helps students claim potential education tax credits like the American Opportunity Credit or the Lifetime Learning Credit on their tax return. Without accurate information from this form, individuals may miss out on substantial tax benefits.

Educational institutions also play an important role in this process, as they are required to file IRS Form 1098-T to report tuition payments received, scholarships granted, and other relevant details. Understanding the nuances of this form is essential for both parties to ensure compliance and maximize financial benefits.

Key terms and definitions

To effectively navigate IRS Form 1098-T, familiarity with key terms is essential:

Why you need IRS Form 1098-T

Understanding the importance of IRS Form 1098-T can significantly affect your tax situation. For taxpayers, the form enables access to various tax credits and deductions. The American Opportunity Credit and the Lifetime Learning Credit can reduce taxable income, resulting in potentially lower tax bills. Moreover, taxpayers need this form to accurately complete their tax returns, ensuring they are claiming the right credits based on their educational expenses.

Conversely, educational institutions must file this form to comply with IRS regulations. This compliance not only ensures accurate reporting but also helps maintain eligibility for federal financial aid programs. Accurate reporting is crucial for institutions to help students understand their financial commitments and navigate their education expenses effectively.

Important dates related to IRS Form 1098-T

Knowing the key dates associated with IRS Form 1098-T can help both students and educational institutions remain organized during tax season. Educational institutions are required to issue Form 1098-T to students by January 31 of the following tax year. This deadline ensures that students receive their forms in a timely manner to prepare for tax filing.

Additionally, institutions must file this form with the IRS by the end of February if submitting a paper form or by mid-March if filing electronically. As tax season approaches, it is vital for students to keep these deadlines in mind to ensure they have ample time to gather necessary documents and file their returns promptly.

Detailed breakdown of IRS Form 1098-T

IRS Form 1098-T contains several boxes, each serving a specific purpose that directly impacts education tax credits. Here’s what you need to know about each box:

It's essential to accurately report these amounts to avoid issues with the IRS and ensure you capture the full benefits of available education tax credits.

Additionally, common errors to avoid include misreporting amounts or leaving out essential information, both of which can lead to complications during the tax filing process.

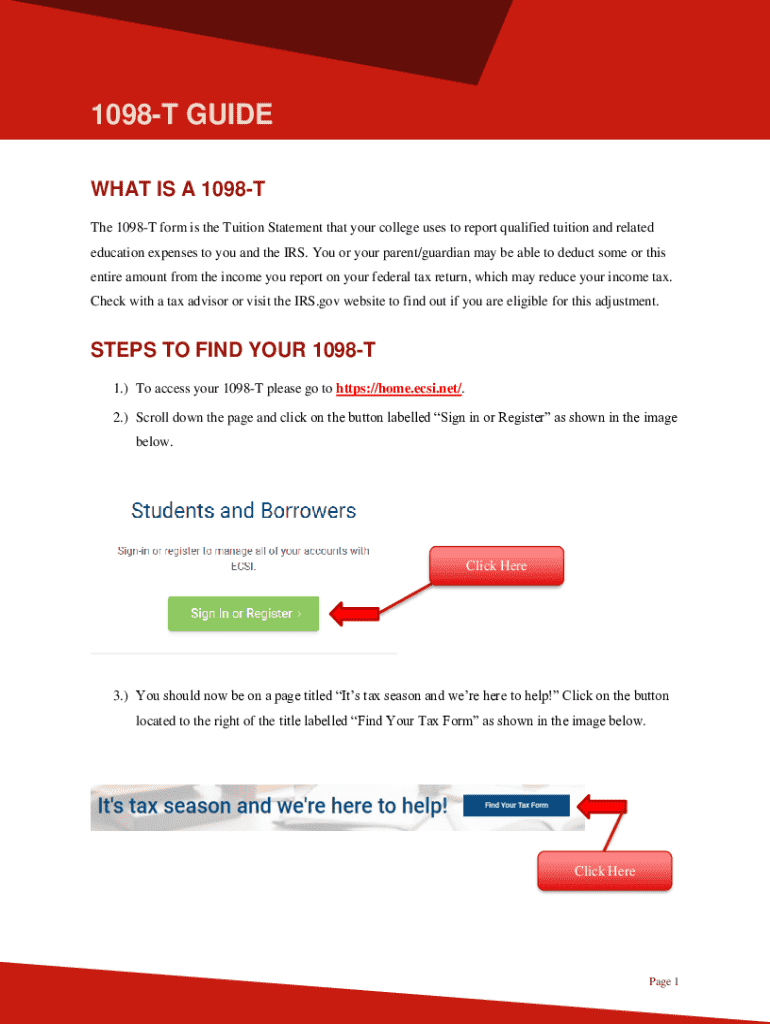

Steps to effectively use IRS Form 1098-T

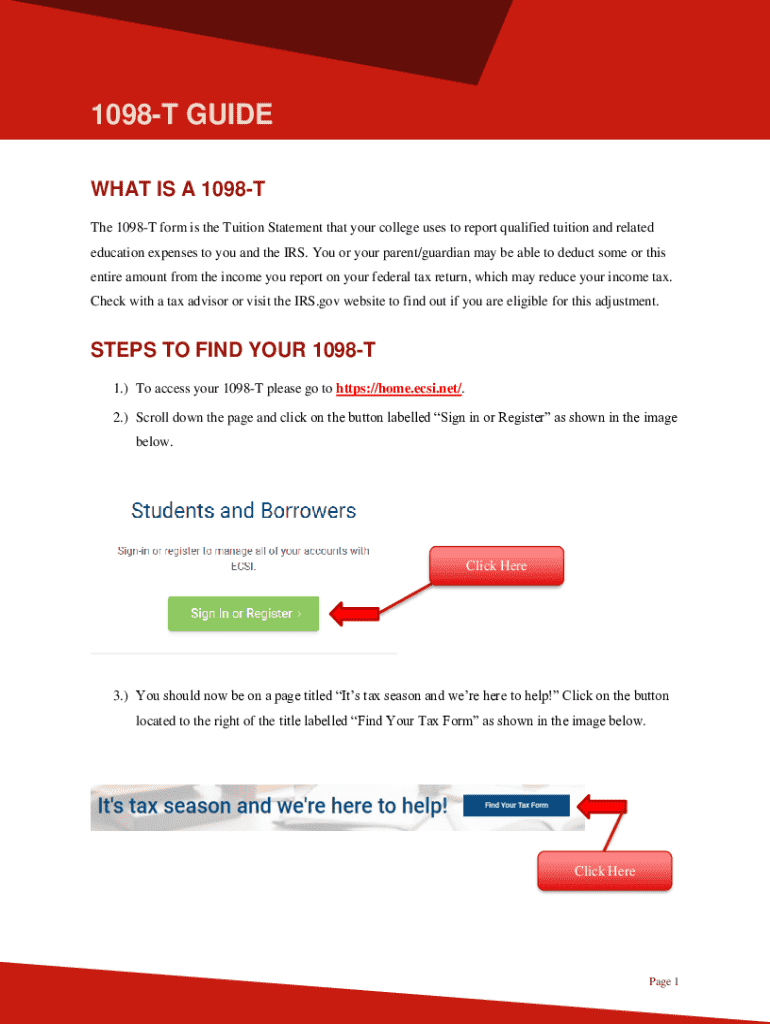

To effectively use IRS Form 1098-T, it's crucial to organize and verify your information before you begin filling it out. Start by gathering all relevant documents, including invoices from educational institutions, scholarship details, and records of tuition payments made during the year. This foundation will help ensure that all amounts reported are accurate.

When completing the form, take a systematic approach. Online platforms make it easy to fill out Form 1098-T by allowing you to input your information in user-friendly formats. After entering your data, meticulously review all entries to confirm accuracy and completeness. Any discrepancies could delay your tax return or lead to incorrect filings.

Finally, you must choose a method for submitting your form. E-filing is often faster and more efficient than paper filing, but ensure you keep a record of your submissions, including confirmation of any electronic filings.

FAQs about IRS Form 1098-T

Frequently asked questions surrounding IRS Form 1098-T can help clarify common uncertainties. For instance, if students do not receive their form, they should contact their educational institution's student accounts office to request a copy. Institutions usually prepare duplicates if forms are lost or misplaced.

If a submission contains errors, it's vital to address them promptly by filing a corrected 1098-T with the IRS. Students should also inquire about how such corrections impact their tax credits. Finally, for individuals attending multiple institutions, all forms must be consolidated to ensure an accurate tax return reflecting all education expenses.

Using pdfFiller for IRS Form 1098-T

pdfFiller provides a robust platform for managing IRS Form 1098-T effectively. One of the key features is the ability to edit and fill out the form quickly and easily. The platform's intuitive interface allows you to input your details without any hassle, ensuring that even those unfamiliar with tax forms can navigate it comfortably.

Additionally, pdfFiller offers eSignature capabilities, allowing for quick and secure submissions. This functionality is a significant advantage for those managing multiple forms or collaborating on tax preparation with others, removing the burden of printing and scanning documents.

Using pdfFiller ensures you can handle all document-related tasks seamlessly. The cloud-based platform means you can access your forms from anywhere, making it incredibly convenient during tax season or when reviewing your education expenses.

Interactive tools and resources

pdfFiller also offers interactive tools designed to enhance your experience when filling out IRS Form 1098-T. With features that guide you step-by-step through the form, you can access tips and recommendations tailored to your specific tax situation. These tools can significantly streamline the process, ensuring that users feel confident in their submission.

Moreover, pdfFiller provides additional document management features, enabling you to organize and store your tax documents in one place. Integration with other financial tools further amplifies the ease of managing educational expenses and tax returns.

Feedback and support for using IRS Form 1098-T

If you need assistance regarding IRS Form 1098-T, there are various support channels available. Students should always start by reaching out to their institution's student accounts office for clarification on form-related queries or reporting discrepancies. Educational institutions provide dedicated support to help you navigate any issues.

For those utilizing pdfFiller, there is robust customer service available to assist with any technical issues or questions related to form management. Engaging with community forums can also be a valuable resource, providing insights from others who have successfully navigated similar tax situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my irs form 1098-t walkthrough in Gmail?

Can I create an eSignature for the irs form 1098-t walkthrough in Gmail?

How do I edit irs form 1098-t walkthrough on an iOS device?

What is irs form 1098-t walkthrough?

Who is required to file irs form 1098-t walkthrough?

How to fill out irs form 1098-t walkthrough?

What is the purpose of irs form 1098-t walkthrough?

What information must be reported on irs form 1098-t walkthrough?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.