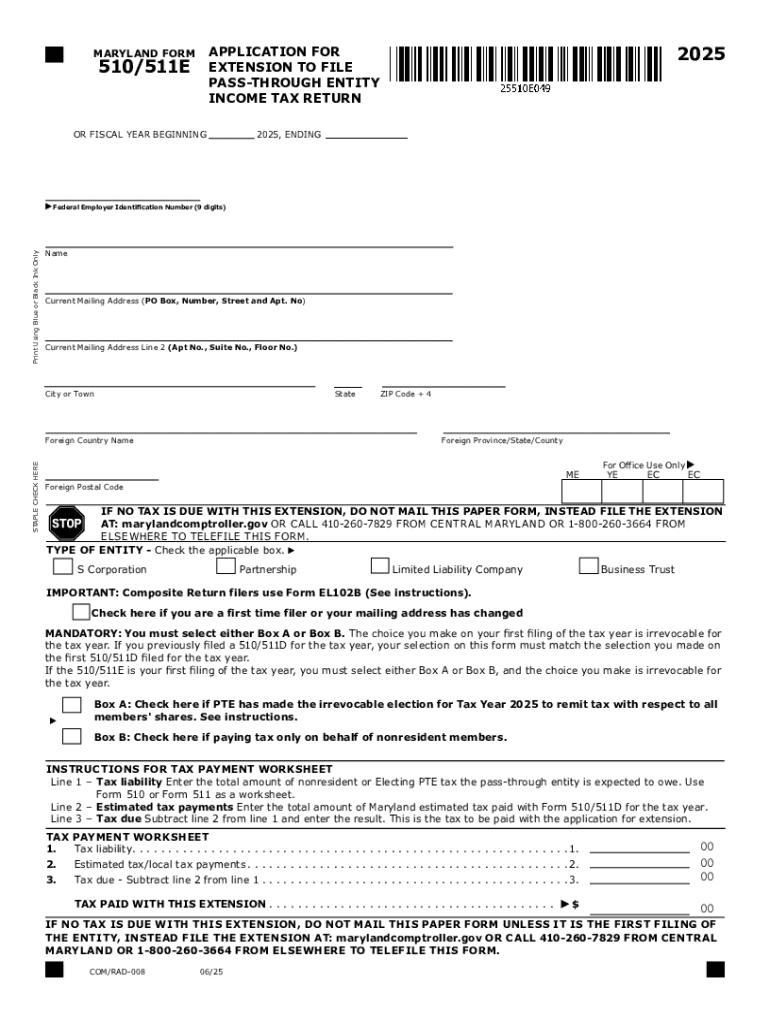

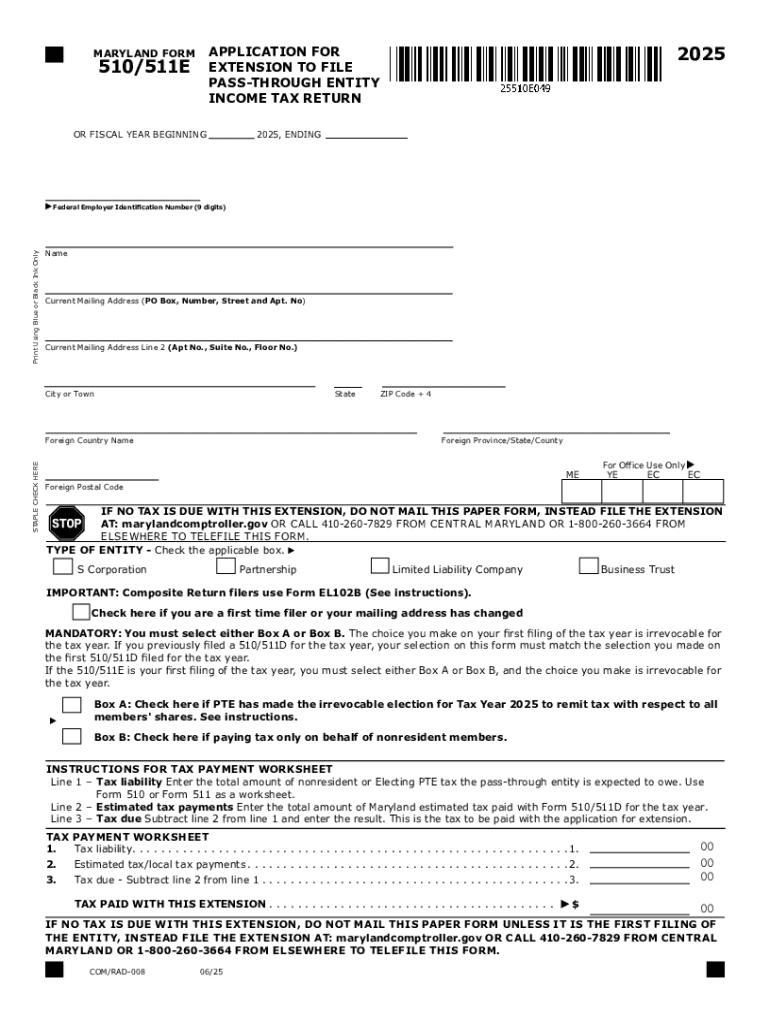

MD Form 510/511E (Formerly 510E) 2025-2026 free printable template

Get, Create, Make and Sign MD Form 510511E Formerly 510E

How to edit MD Form 510511E Formerly 510E online

Uncompromising security for your PDF editing and eSignature needs

MD Form 510/511E (Formerly 510E) Form Versions

How to fill out MD Form 510511E Formerly 510E

How to fill out 2025 maryland form 510511e

Who needs 2025 maryland form 510511e?

2025 Maryland Form 510511E Guide

Overview of Maryland Form 510511E

The 2025 Maryland Form 510511E is a crucial document for individuals and businesses engaged in tax reporting in Maryland. This form serves as the central piece for calculating and reporting state income tax liabilities, specifically tailored for entities operating within the jurisdiction of Maryland. Understanding the nuances of this form is essential for ensuring compliance and avoiding potential pitfalls during tax season.

The importance of Form 510511E lies in its role in accurately conveying pertinent financial information to the Maryland State Comptroller's Office. By filing this form, taxpayers can not only fulfill their legal obligations but also ensure they receive any applicable credits, deductions, or refunds to which they may be entitled.

For the 2025 tax year, there are several key changes to Form 510511E compared to previous years. These updates may affect eligibility criteria, reporting requirements, and tax rates, which highlights the need for taxpayers to stay informed and prepared to accommodate these modifications.

Eligibility for filing Form 510511E

Filing the 2025 Maryland Form 510511E is required for individuals and businesses who meet certain income thresholds set by the state. Generally, anyone who earns taxable income from Maryland sources is required to submit this form. This ensures that the state can accurately assess tax obligations and enforce compliance among its residents.

However, there are exceptions to this rule. For instance, individuals below a specified income level may not be required to file, and certain business entities might be exempt based on their operating status or revenue. Understanding your specific situation is vital for determining the necessity of filing Form 510511E.

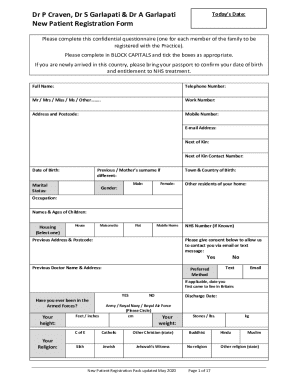

Step-by-step instructions for filling out Form 510511E

Completing the 2025 Maryland Form 510511E accurately is crucial for ensuring compliance and avoiding errors. Here’s a step-by-step guide to help navigate the filing process.

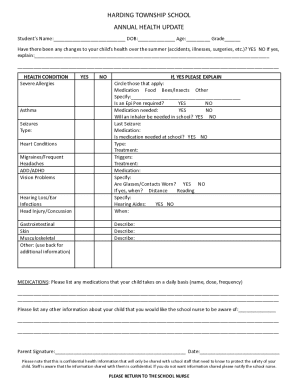

Step 1: Gather necessary documents

Before initiating the filling process, it’s essential to gather the required documents. This might include W-2 forms, 1099 forms, and evidence of any deductions you plan to claim. Having these documents readily available can simplify the process and reduce the likelihood of errors.

Common mistakes to avoid include mixing up different tax years' documents and failing to provide supporting information for deductions.

Step 2: Accessing the form

The next step involves accessing the 2025 Maryland Form 510511E. This can be done easily by downloading the form from pdfFiller's platform, ensuring you have the latest version. Interactive tools available can provide additional guidance during the download and fill-out process.

Step 3: Completing the form

When completing the form, break it down into manageable sections. The first part involves entering your personal information, such as your name, address, and Social Security number. Following this, you'll report your income, including wages and other sources, ensuring accuracy.

Don’t forget to include applicable deductions and credits. For example, if you are eligible for educational credits or health care deductions, enter those amounts accordingly.

Step 4: Review and verify your information

Once you have completed the form, it’s crucial to review and verify all entries. Make use of checklists to ensure no sections are overlooked. Accuracy is vital as incorrect filings can lead to delays in processing or penalties.

Editing and managing Form 510511E with pdfFiller

Editing PDF documents can be cumbersome if not done properly. However, pdfFiller provides streamlined tools for efficiently making changes to your Form 510511E. Users can easily correct errors, add missing information, or alter details without needing to start from scratch.

Collaboration features allow teams to work together on the document, ensuring all necessary input is collected before submission. This is particularly useful for businesses where multiple stakeholders might be involved in the filing process.

Moreover, tracking changes and managing different versions of the form is seamlessly handled within pdfFiller, providing a clear audit trail and ensuring that no vital information is lost during the process.

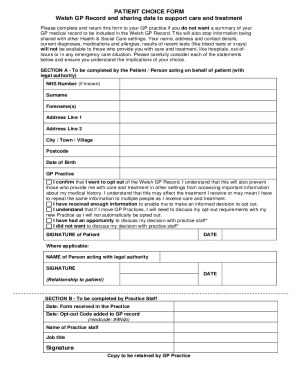

Signing and submitting Form 510511E

Once the form is completed and verified, the next step is signing and submitting it. With pdfFiller, users can utilize eSignature options, allowing for quick and secure signing of documents without the need for printing. This feature ensures a smooth finalization of the filing process.

For submission, form 510511E can be filed online or mailed to the Maryland State Comptroller’s office. Online submission is often faster and allows for immediate confirmation of receipt, while mail-in submissions should be sent via certified mail to ensure tracking and proof of delivery.

Understanding tax implications and responsibilities

Filing 2025 Maryland Form 510511E comes with tax obligations that taxpayers must be aware of. Understanding these responsibilities is essential for informed filing. Those who fail to file on time may incur penalties, which can vary based on the severity of the delay.

Common penalties include late fees as well as potential interest on unpaid taxes. To ensure compliance, consider setting reminders for filing deadlines and consulting tax professionals when necessary.

FAQs about Maryland Form 510511E

Many taxpayers have questions regarding the 2025 Maryland Form 510511E. Here are some common inquiries that may assist you in navigating this form.

Related forms and filing extensions

In addition to Form 510511E, several other Maryland tax forms may be relevant to your filing process, including but not limited to Form 502 for individual income tax and Form 548 for business taxes. Each of these forms serves a specific purpose depending on your financial situation.

Requesting a filing extension is straightforward. Taxpayers can apply for an extension via the Maryland State Comptroller's website or by submitting the appropriate form. Distinguishing between forms for individuals and businesses is vital to ensure compliance.

Learning and resource center

To stay ahead in document management and fulfill your tax obligations, consider utilizing webinars and tutorials that provide further insight into the filing process. These resources typically cover best practices for document creation and filing, ensuring you remain informed about any changes to Maryland tax laws.

Staying updated on Maryland tax changes can't be understated. Frequent visits to the state’s tax website and following trusted news sources can enable you to keep abreast of new developments and avoid potential compliance issues.

Connect with pdfFiller community

Engaging with the pdfFiller community offers numerous benefits. Connecting through social media channels allows you to stay updated on new features, tips, and guidance from fellow users. Additionally, sharing your experiences can foster a supportive network for all users navigating the complexities of form submission.

The community-driven platform encourages dialogue around document management, which can lead to improved practices and enhanced user experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find MD Form 510511E Formerly 510E?

Can I edit MD Form 510511E Formerly 510E on an iOS device?

How do I fill out MD Form 510511E Formerly 510E on an Android device?

What is 2025 maryland form 510511e?

Who is required to file 2025 maryland form 510511e?

How to fill out 2025 maryland form 510511e?

What is the purpose of 2025 maryland form 510511e?

What information must be reported on 2025 maryland form 510511e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.