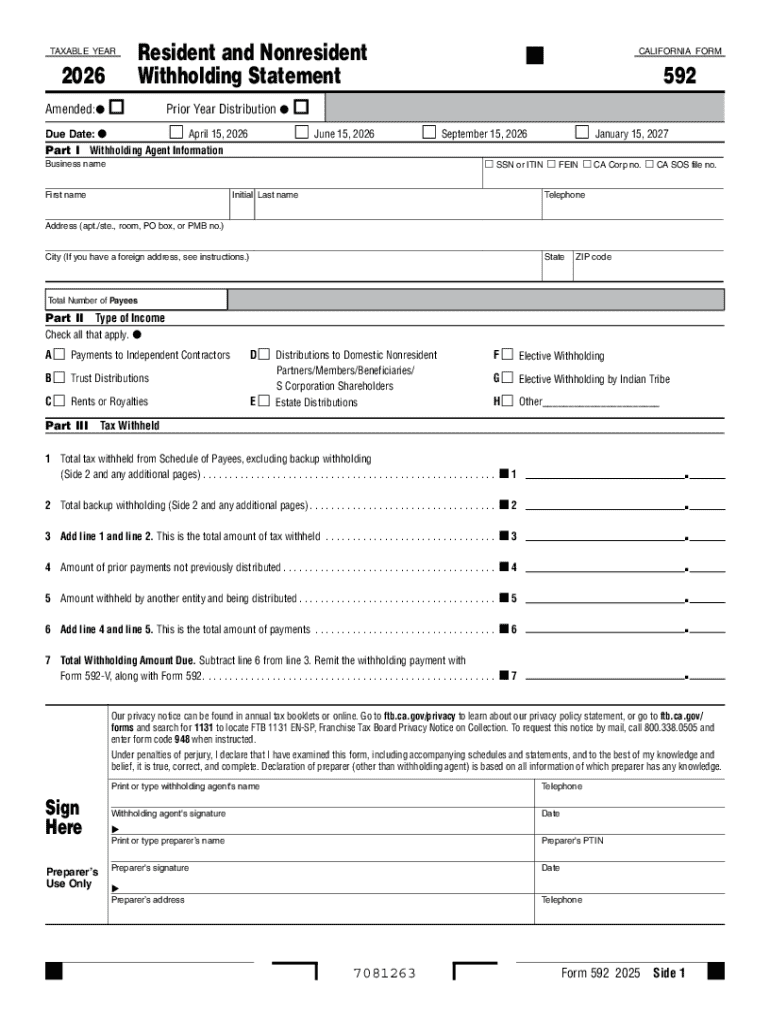

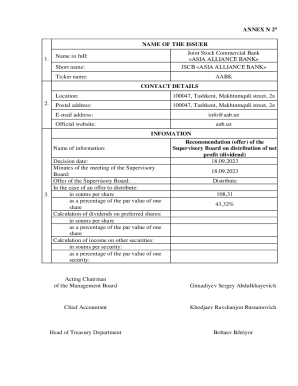

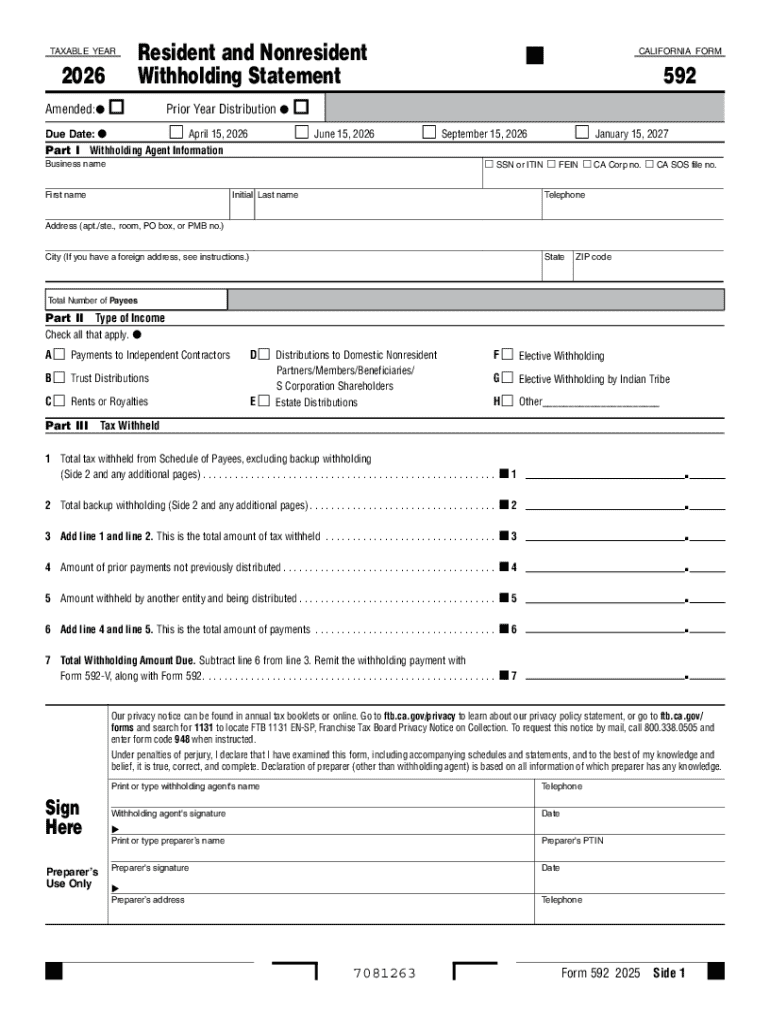

Get the free 2026 Form 592 Resident and Nonresident Withholding Statement. 2026, Form 592, Reside...

Get, Create, Make and Sign 2026 form 592 resident

How to edit 2026 form 592 resident online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 form 592 resident

How to fill out 2026 form 592 resident

Who needs 2026 form 592 resident?

2026 Form 592 Resident Form: A Comprehensive Guide

Overview of Form 592: What You Need to Know

Form 592 is a critical tax document used in California for reporting income and withholding for residents receiving payments in certain situations. It's essential for individuals and entities that make payments to various payees, as it outlines tax withholding obligations. Residents must understand this form's purpose, as it ensures that withholding agents comply with state tax laws efficiently.

The primary function of Form 592 is to track withholding tax on income distributed to California residents, ensuring that the appropriate taxes are withheld and remitted to the state. This form is especially relevant for withholding agents who disburse funds to individuals or entities classified as payees, especially in cases like distributions of income, dividends, or other payments subject to California withholding tax. Ensuring compliance with Form 592 can save residents from potential penalties and issues with the California Department of Tax and Fee Administration (CDTFA).

Understanding the components of Form 592

Form 592 consists of distinct sections, each designed to capture essential information about the withholding process. It is divided into three main sections: A, B, and C, which identify the withholding agent, the payee, and the payment details respectively. A thorough understanding of these sections is vital for accurate filing and compliance.

#### Section A: Withholding Agent Information This section captures details about the entity responsible for withholding and submitting the tax payments. It includes the withholding agent's name, address, and contact number. #### Section B: Payee Information Here, payees, who are the individuals receiving payments subject to withholding, must provide their name, address, and taxpayer identification number (TIN). Special care should be taken when filling out this information to avoid errors. #### Section C: Payment Information and Amounts This section details the nature of payments made to the payee and the corresponding amounts withheld. It includes the total income distributed and any taxes withheld. The accurate reporting of these amounts is crucial to ensure compliance and avoid discrepancies.

Who needs to fill out Form 592?

Not every resident or entity needs to fill out Form 592. This form is specifically required for residents who receive payments subject to withholding from a California withholding agent. The criteria for filing include individuals or entities who have received payments such as salaries, fees, or other compensations from which taxes must be withheld.

Certain situations necessitate submission of Form 592. These include instances where a withholding agent makes payments exceeding a specified threshold during the taxable year. Additionally, if nonresidents are included in a remuneration structure where California tax withholding applies, Form 592 must be filled out accordingly.

However, exemptions exist. For example, not all payments necessitate tax withholding, such as those that fall below the specified threshold set by the state. Understanding these exemptions can prevent unnecessary filing and streamline the process for residents.

Step-by-step guide to completing Form 592

Before diving into form completion, gather all necessary documents. This includes payment records, TINs for payees, and past withholding information if applicable. A well-prepared pre-filling checklist can significantly streamline the completion process.

When you begin filling out Form 592, ensure that each section is carefully addressed: - **Withholding Agent Information**: Provide the name, address, and agent number. - **Payee Information**: Double-check to ensure payees' names and TINs are accurate to prevent issues. - **Payment Information**: Specify the amounts distributed, including any taxes withheld.

Common mistakes to avoid include failing to update payee information and incorrect reporting of amounts. Double-checking all entries before submission can mitigate most errors. Make sure to follow instructions carefully, as errors can lead to penalties or additional scrutiny from the California tax authorities.

Submission guidelines for Form 592

Understanding where and when to submit Form 592 is essential for compliance and to avoid penalties. Typically, Form 592 can be submitted to the California Department of Tax and Fee Administration through various channels. Ensuring that you submit the form on time aligns with California’s tax deadlines, commonly set for annual income tax filings.

Preferred methods of submission include e-filing and paper filing. E-filing is often faster and allows for quicker processing times. On the other hand, paper submissions must be mailed to the designated address provided by the CDTFA. Be mindful of submission deadlines, as late submissions can incur penalties and interest on any unpaid taxes.

How to track and confirm your Form 592 submission

After submission, it's prudent to verify that your Form 592 has been received. This can typically be done through the CDTFA's online portal, which allows residents to track the status of their filings. If you opted for paper filing, maintaining a record of your submission can help confirm delivery.

Processing times for Form 592 can vary based on the volume of submissions received by the CDTFA. Typically, residents can expect confirmation of receipt within a few weeks. If issues arise, such as missing confirmations or discrepancies, it's advisable to contact the CDTFA directly for assistance.

Consequences of incorrectly filing Form 592

Submitting Form 592 inaccurately can lead to a variety of consequences, ranging from minor clerical errors to more severe penalties. It’s crucial for residents to understand that incorrect withholding calculations or misreported amounts can trigger fines or interest charges from the state.

In the event of an error post-submission, residents can correct mistakes by filing an amended Form 592. Documentation of the correction process is vital, as it provides a trail for the CDTFA. Maintaining thorough records of all payments, withholdings, and correspondence with tax authorities can safeguard against future issues and facilitate smoother rectifications.

Utilizing pdfFiller for Form 592 management

pdfFiller streamlines the process of managing Form 592 with its robust cloud-based features. Users can easily access, edit, and eSign the form, allowing for a seamless fill-out experience. This versatility is especially beneficial during tax season when meeting deadlines becomes increasingly important.

The platform also enables collaboration amongst team members for shared access and management of the form. This makes it easier to ensure that all necessary parties are involved and have input, thus enhancing accuracy and compliance across the board.

Interactive tools and resources for Form 592

pdfFiller offers access to various interactive tools and resources to elevate the experience of working with Form 592. These include template features, FAQs covering common questions, and additional resources, such as calculators to assist in determining withholding amounts.

Using these tools can alleviate some of the complexities associated with filing. For example, the template feature allows users to quickly get started with Form 592, ensuring that essential fields are filled out correctly. Through these resources, individuals can learn more about requirements and stay up-to-date with regulations regarding Form 592.

Additional insights and best practices for Form 592 compliance

As tax year 2026 approaches, it's crucial for residents to stay informed about any changes related to Form 592 and the associated regulations. Keeping abreast of updates issued by the California Department of Tax and Fee Administration can facilitate compliance and optimize the filing process.

For individuals unsure about their specific requirements or obligations, consulting with a tax professional can provide clarity. Professionals can offer insights into new regulations affecting Form 592 and help navigate potential pitfalls, ensuring residents remain compliant and avoid unwanted penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2026 form 592 resident?

How do I execute 2026 form 592 resident online?

How do I fill out 2026 form 592 resident using my mobile device?

What is 2026 form 592 resident?

Who is required to file 2026 form 592 resident?

How to fill out 2026 form 592 resident?

What is the purpose of 2026 form 592 resident?

What information must be reported on 2026 form 592 resident?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.