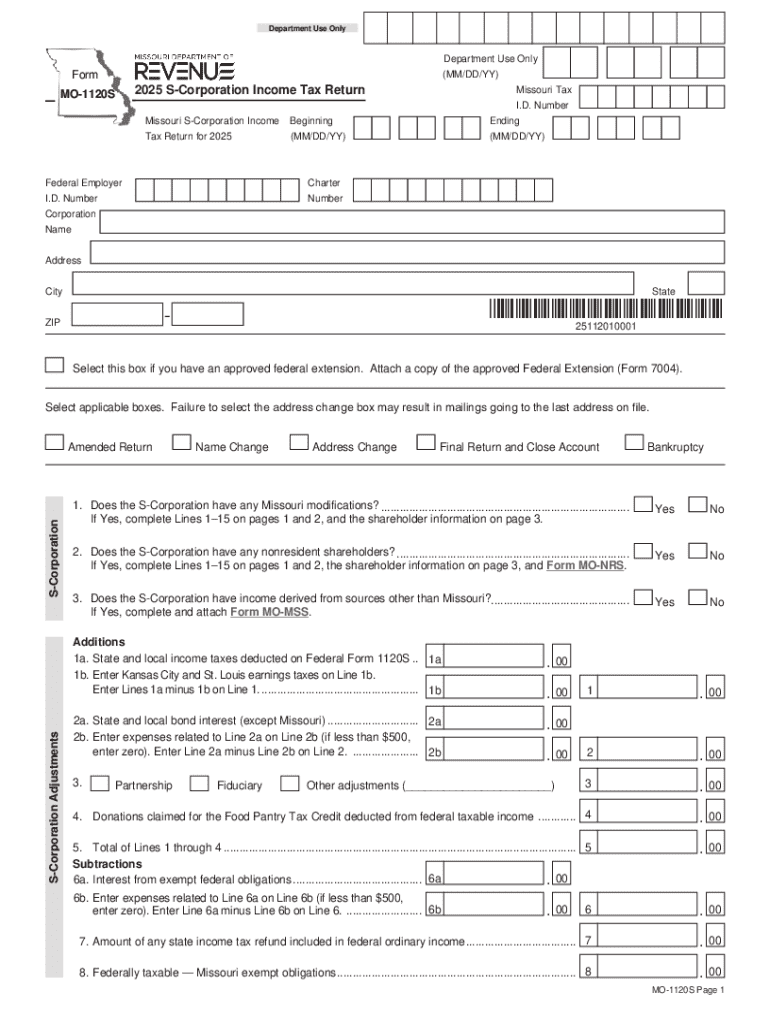

Get the free Corporate Tax Electronic Filing - dor mo

Get, Create, Make and Sign corporate tax electronic filing

How to edit corporate tax electronic filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate tax electronic filing

How to fill out mo-1120s 2021 s-corporation income

Who needs mo-1120s 2021 s-corporation income?

Understanding and Completing the mo-1120s 2021 S-Corporation Income Form

Toolbar navigation

This guide covers everything you need to know about the mo-1120s 2021 S-Corporation Income Form, including how to fill it out, important components, and interactive resources. Use the links below to jump to the sections you need.

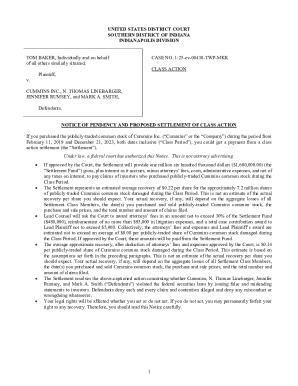

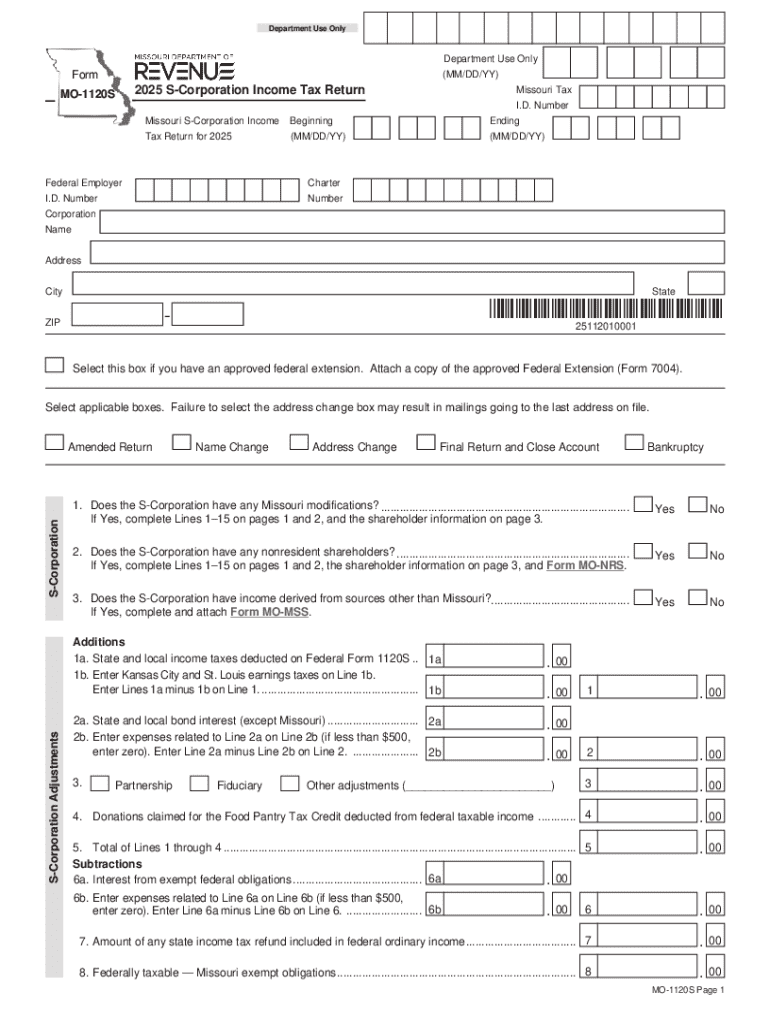

Understanding form mo-1120s

The mo-1120s form is critical for S-corporations, allowing them to report various aspects of their income to the state of Missouri. This form serves as an income return specifically tailored for S-corporations, a type of corporation that meets specific Internal Revenue Code requirements and allows income to pass through to shareholders.

In the 2021 version, crucial changes and updates reflect the evolving tax landscape, primarily impacting income reporting and deductions. From updated categories of income to recent IRS guidance, it's essential to familiarize yourself with these features during the filing process.

Correctly filing the mo-1120s is crucial for maintaining S-corporation status and ensuring shareholders report income accurately on their personal tax returns. This underscores the importance of accurate and timely filing to avoid potential penalties.

Detailed breakdown of form sections

The form is divided into several parts, each focusing on different financial aspects of the S-corporation. Understanding each part is vital for accurate reporting, which ultimately impacts tax liability.

Part : Income and deductions

This section captures the total income and allowable deductions for the year. Accurate reporting here sets the foundation for the subsequent tax computation.

Filing errors or omissions can lead to IRS scrutiny and penalties, making it critical to double-check figures and consult financial records.

Part : Tax computation

Understanding your taxable income is essential, especially since S-corporations are typically not subject to federal tax, with income passing through to shareholders.

Part III covers various other information unique to each S-corporation, such as foreign transactions and any additional requested details by the IRS or state. Gathering all required information allows for smoother filing.

Step-by-step instructions for completing form mo-1120s

Filling out the mo-1120s can seem daunting, but a structured approach simplifies the process. Start by gathering all necessary documentation to ensure that you have everything at your fingertips.

Each of these steps requires attention to detail. Particularly during data entry, ensure figures are accurate to avoid common errors, which could lead to filing complications or audits.

Interactive tools for successful filing

To assist in the filing process, utilize interactive tools designed to enhance your experience. They provide freelancers and teams with straightforward avenues for effective form management.

By taking advantage of these resources, you can enhance collaboration among team members and streamline the filing process.

eSigning and managing your form

Once the mo-1120s is filled out, you'll need to electronically sign the form. This can be done easily through pdfFiller, which simplifies the eSignature process.

Leveraging these collaboration tools ensures all parties are on the same page, leading to quicker completion and enhanced accuracy.

Frequently asked questions (faqs)

Understanding common concerns around the mo-1120s can alleviate confusion during the filing process. Below are some frequently asked queries.

Consulting with tax professionals can also help clarify any specific concerns you may have regarding the mo-1120s.

Final submission process

Once the form is complete, prepare for final submission thoughtfully. Assess whether you plan to file electronically or via paper, each method comes with its own procedures.

Understanding the specifics of each filing method can prevent unnecessary delays and ensure compliance with state regulations.

Best practices for s-corporation income reporting

To ensure successful S-corporation income reporting, adopting best practices is essential. Regular assessments and adjustments can drastically improve compliance and accuracy.

By staying proactive in these areas, you can contribute to significantly smoother filing processes and better financial outcomes for your S-corporation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my corporate tax electronic filing in Gmail?

Where do I find corporate tax electronic filing?

How do I fill out the corporate tax electronic filing form on my smartphone?

What is mo-1120s 2021 s-corporation income?

Who is required to file mo-1120s 2021 s-corporation income?

How to fill out mo-1120s 2021 s-corporation income?

What is the purpose of mo-1120s 2021 s-corporation income?

What information must be reported on mo-1120s 2021 s-corporation income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.