Get the free Instructions for Form N-360 Renewable Fuels Production ...

Get, Create, Make and Sign instructions for form n-360

Editing instructions for form n-360 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form n-360

How to fill out instructions for form n-360

Who needs instructions for form n-360?

Instructions for Form N-360: Your Complete Guide to the Renewable Fuels Production Tax Credit

Overview of Form N-360: Purpose and Importance

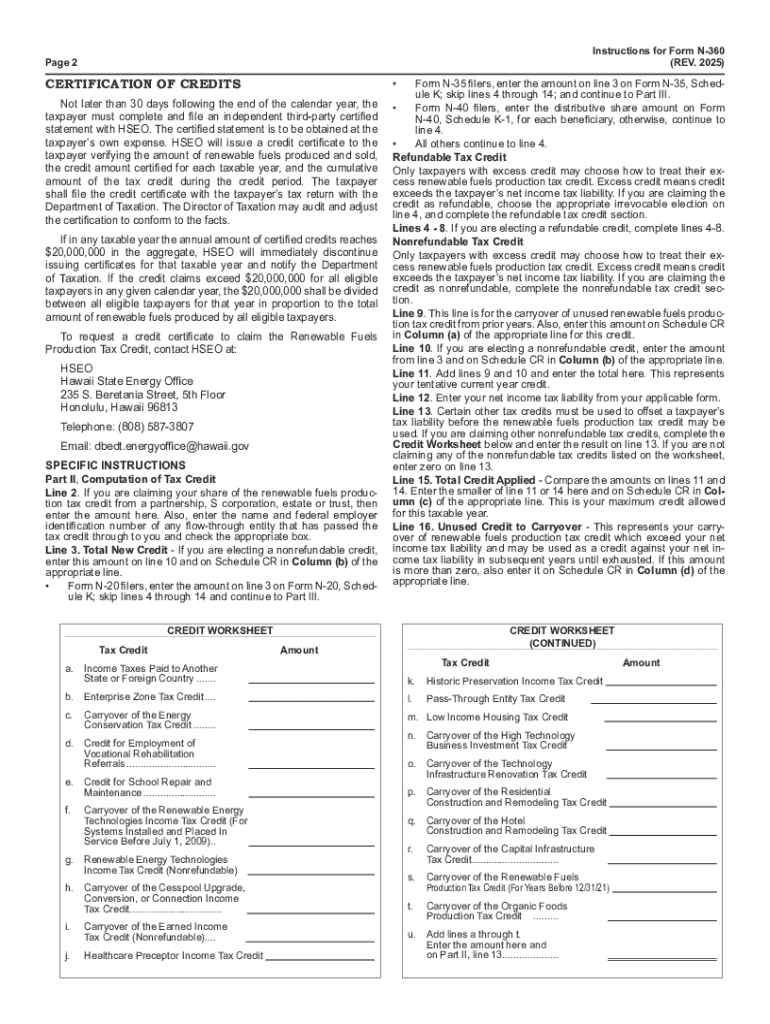

Form N-360 is an essential document for individuals and businesses claiming the Renewable Fuels Production Tax Credit (RFPTC). This form aids in reporting the production of renewable fuels, allowing eligible producers to leverage tax credits aimed at promoting sustainable energy production. The introduction of the RFPTC underscores the government’s commitment to encouraging renewable energy sources, and Form N-360 is the key instrument in substantiating the eligibility for these credits.

For tax years after December 31, 2021, Form N-360 plays an even more pivotal role as it serves as the formal declaration for claiming the tax credit. For those producing biofuels and other renewable energy sources, filling this form accurately can significantly affect tax liability, potentially yielding substantial financial benefits. The RFPTC can reduce federal income taxes owed, which is a critical advantage for renewable energy businesses.

Who should use Form N-360?

Form N-360 is designated for eligible individuals and teams engaged in the production of renewable fuels. To qualify for the RFPTC, applicants generally need to be producers of biodiesel, renewable diesel, or other biofuels produced from eligible feedstocks. It is crucial to confirm that the fuel produced meets the recognized standards set forth by the IRS to ensure compliance.

Typically, both individuals and businesses such as agricultural producers, cooperatives, and renewable energy firms should consider using Form N-360 if they aim to benefit from the tax credit. Common scenarios for submission include those producing biofuels for commercial sale or facilities that convert waste into fuel.

Interactive tools for preparing Form N-360

For streamlining the process of completing Form N-360, pdfFiller offers interactive tools that simplify form-filling and enhance user experience. These tools allow you to fill out, edit, and manage your Form N-360 conveniently from any device with internet access. Easy access to interactive features ensures you can submit your application without unnecessary obstacles.

To utilize pdfFiller’s interactive tools, first visit the pdfFiller website and navigate to the section dedicated to Form N-360. From here, users can begin filling out the form directly online. pdfFiller's interface guides you step-by-step, ensuring you understand what information is needed for each section. Additionally, you can save your progress, input digital signatures, and export your finished form in PDF format.

Step-by-step guide to completing Form N-360

Section 1: Applicant Information

Begin by entering your personal or business details in Section 1 of Form N-360. This section requires information such as your name, business name (if applicable), tax identification number, and contact information. Providing accurate and up-to-date details is crucial, as errors can lead to delays or rejections in your application.

Section 2: Fuel production details

Section 2 necessitates a detailed description of the fuels produced, including the type of fuel, production quantities, and dates of production. It's essential to carefully document these details, as they are directly linked to the credits you intend to claim. Keep in mind that only qualified fuels will qualify for the RFPTC.

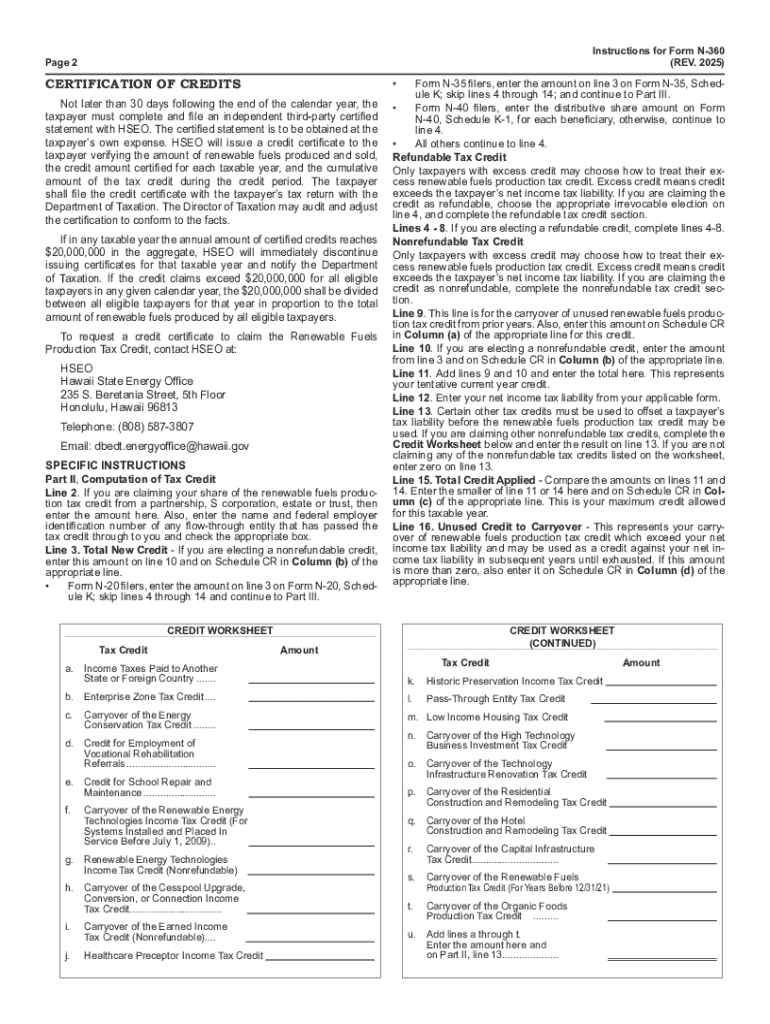

Section 3: Tax credit calculation

Calculating your tax credit in Section 3 can be one of the most intricate parts of filling out Form N-360. You will need to enter the total quantity of eligible fuel produced and apply the appropriate rates specified by the IRS. For clarity, use the examples provided in the IRS instructions to guide your calculation. It's advisable to double-check your figures to avoid mistakes.

Section 4: Certification statement

The final section of Form N-360 is the certification statement. This is where you affirm that all the information you've provided is accurate and complete to the best of your knowledge. This statement must be signed by an authorized representative if the applicant is a business. It's vital to ensure this section is completed accurately to maintain the integrity of your submission.

Filing your Form N-360: Key considerations

Once you’ve completed Form N-360, filing it accurately is the next crucial step. You have the option of e-filing or mailing your application. E-filing is generally faster and allows for immediate confirmation of receipt, while mailing provides a physical record of submission.

For those who decide to file by mail, ensure you follow these steps: first, print your completed form. Then, include any required attachments, such as proof of fuel production, and send it to the appropriate IRS address based on your state. Always keep a copy for your records. Pay special attention to filing deadlines to avoid penalties and ensure timely processing.

Common challenges and solutions

While completing Form N-360, several common challenges can arise. Errors such as omitted information, incorrect calculations, and failure to meet eligibility requirements are among the most frequently encountered issues. To avoid these pitfalls, ensure you carefully review each section before submission.

Additionally, promote clarity by referring to the official IRS instructions for Form N-360 available on the IRS website or through pdfFiller. If you encounter specific issues, do not hesitate to reach out for support via dedicated hotlines or customer service options available through pdfFiller and the IRS.

Post-submission checklist

After submitting Form N-360, it's essential to carry out a post-submission checklist to ensure everything is correct. Verify that you have included all necessary documentation and confirmations of submission. This prevents issues that might arise from incomplete filings.

After submission, monitor the status of your application, especially if you filed by mail. Typically, the IRS processing times can vary, but reaching out to them for updates can keep you on track with your tax situation.

Best practices for managing documentation

Document management is a crucial part of the tax credit claiming process. Organizing your financial records, including receipts, production logs, and Form N-360 itself, will facilitate a smoother experience not only for current submissions but for future filings as well. Utilize pdfFiller's document management features to streamline this process.

Consider employing digital management solutions to keep your documents secure and easily accessible. Version control, secure sharing options, and easy retrieval of documents can alleviate the stress associated with tax season and audits.

Related tax forms and resources

When claimants consider filling out Form N-360, they may also need to review related tax forms for renewable energy credits. Utilizing other forms like Form 8862 (for those claiming certain credits after a disallowance) can be necessary to maximize available tax benefits.

Further, pdfFiller offers additional resources and templates that complement Form N-360, including guidelines for filling out other tax-related forms. This comprehensive ecosystem ensures that users can streamline their tax preparation across multiple forms seamlessly.

Success stories: Real-life applications of Form N-360

Many producers have successfully utilized Form N-360 to obtain the Renewable Fuels Production Tax Credit, thereby enhancing their financial stability. Whether a small-scale biodiesel producer or a large renewable energy firm, insights gleaned from their experiences offer valuable learning opportunities.

Testimonies from individuals have highlighted the ease of managing documents through pdfFiller, allowing them to focus on optimizing production rather than getting bogged down in paperwork. Such success stories underscore the synergy between proper documentation and financial gain.

Updates and changes to Form N-360

Form N-360 has undergone several amendments to address changes in the Renewable Fuels Production Tax Credit policies. Recent updates have clarified eligibility criteria and modified instructions to improve user experience. Staying informed about these changes is vital, as they directly impact the strategy behind claiming tax credits.

As new tax years approach, anticipate further modifications that may require revisiting the information provided on the form. Keeping abreast of these updates can ensure disadvantaged producers do not miss out on unclaimed benefits.

Interactive FAQ section

Engaging with frequently asked questions can bolster understanding of Form N-360 and its filing process. An interactive FAQ section can address common queries, ranging from 'What documents are needed for submission?' to 'How do I handle a denial of my tax credit application?' This access to clear information eases any concerns that potential claimants may have.

Furthermore, readers are encouraged to participate by submitting their questions for future FAQ updates. Intricately connecting readers with the form preparation process enhances learning and facilitates a community culture around sustainable fuel production.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get instructions for form n-360?

How do I edit instructions for form n-360 in Chrome?

How do I complete instructions for form n-360 on an iOS device?

What is instructions for form n-360?

Who is required to file instructions for form n-360?

How to fill out instructions for form n-360?

What is the purpose of instructions for form n-360?

What information must be reported on instructions for form n-360?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.