Get the free TAP FAQPayments - Utah State Tax Commission

Get, Create, Make and Sign tap faqpayments - utah

Editing tap faqpayments - utah online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tap faqpayments - utah

How to fill out tap faqpayments - utah

Who needs tap faqpayments - utah?

Guide to TAP FAQPayments - Utah Form

Understanding the TAP Payments System

The Taxpayer Access Point (TAP) is an innovative online system established by the Utah State Tax Commission that enables taxpayers to manage their tax interactions seamlessly. The TAP provides access to various tax-related services, including the ability to file returns and make payments conveniently. By adopting TAP, taxpayers can streamline their tax processes, reducing the time spent on paperwork and direct interactions with tax offices.

One of the major benefits of using TAP for payments is the ability to manage accounts and payments from anywhere with an internet connection. This flexibility is essential for individuals and businesses that require quick access to their financial responsibilities. Additionally, TAP offers real-time updates, allowing users to stay informed about the status of their payments, which enhances overall tax management efficiency.

Getting started with TAP payments

To utilize TAP for payments, certain eligibility requirements must be met. Primarily, any individual or business that has tax obligations within the state of Utah can access TAP. This includes residents, businesses, and other entities required to pay state taxes. It is essential to have relevant personal or business information, such as Social Security Numbers (SSN) or Employer Identification Numbers (EIN), ready to set up an account.

Creating a TAP account is a straightforward process. To begin, visit the TAP homepage and select the option to create an account. The system will prompt you to enter your identifying information, including your SSN or EIN, your email address, and a secure password. Following the initial setup, it is critical to enable two-factor authentication to enhance the security of your account. Make sure to use strong passwords and update them regularly to protect your sensitive financial information.

Making payments in TAP

If you prefer not to create a TAP account, you can still make payments as a guest. TAP provides several methods for submitting payments, including using a debit card, credit card, or electronic check. For guest payments, navigate to the payment section of the TAP website, where you will be prompted to enter relevant details such as your tax ID and payment amount. The system will guide you through the required fields step-by-step, simplifying the payment experience while ensuring accuracy.

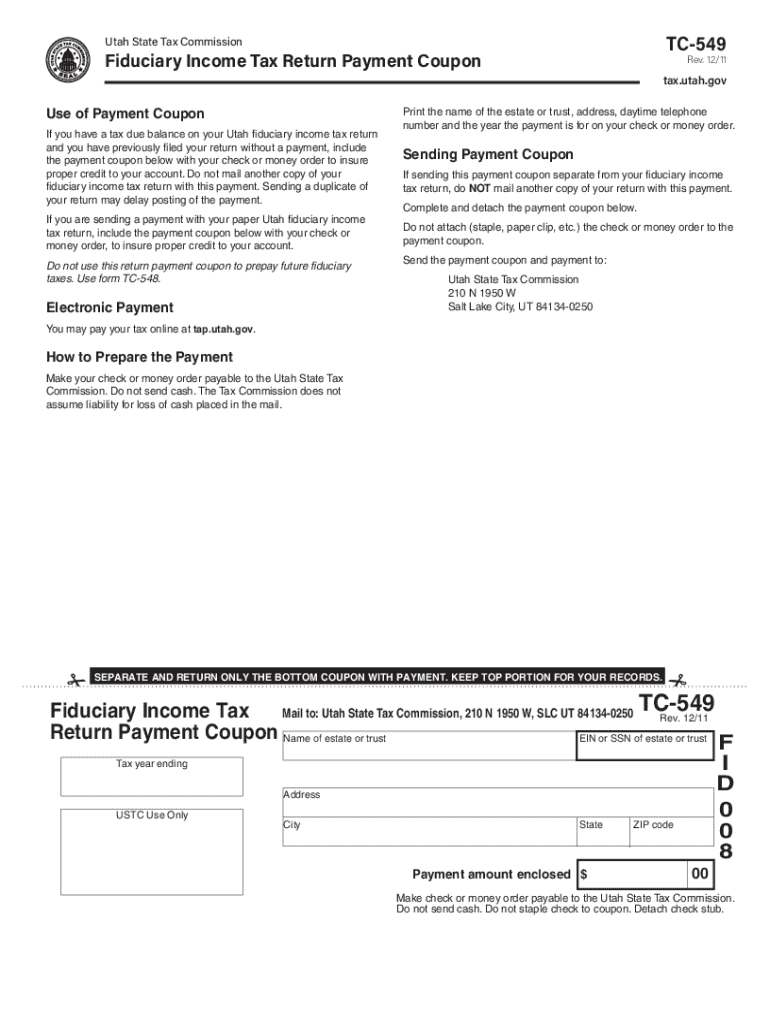

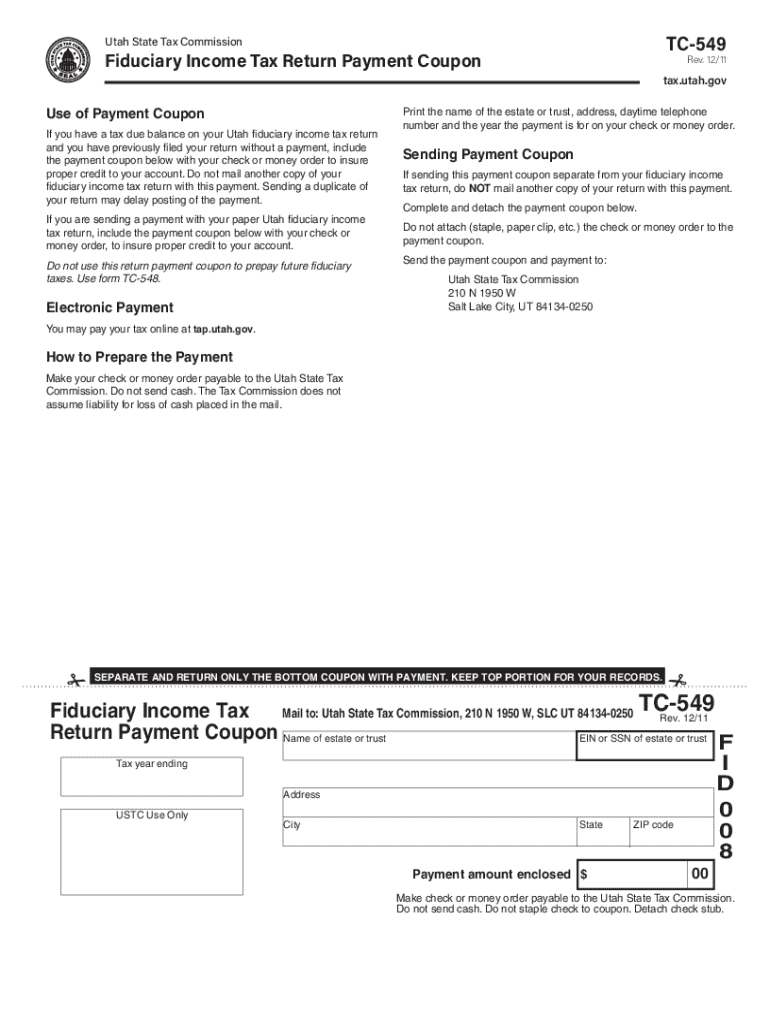

Additionally, taxpayers can utilize payment coupons that include a coupon code to secure proper credit for their payments. A payment coupon generally comes attached to a tax bill or can be printed from the TAP site. To use a coupon code, first enter the code in the designated field during the payment process. Ensure the coupon code is accurate, as any mistakes can lead to payment processing errors.

Accurate banking information is crucial when making electronic payments. To locate your bank routing and account numbers, check the bottom of your checks or login to your bank's online platform. Typically, the routing number is the first set of digits printed on the left, while your account number follows. This information is vital for ACH (Automated Clearing House) debit transactions. Double-checking this information before finalizing your payment can prevent unnecessary complications.

Managing your TAP payments

Once a payment is submitted in the TAP system, users will receive a confirmation screen showing the transaction details. It’s essential to keep this information for your records. If you need to check the status of your payment, simply log in to your TAP account and navigate to the 'Payment History' section. This will allow you to view all past payments and their statuses quickly, ensuring you stay updated on your financial obligations.

In certain circumstances, a taxpayer may need to cancel a payment made through ACH debit. If you find yourself in such a situation, it would be advisable to act fast. Contact the relevant financial institution immediately and inform them of your intention to cancel the payment. It's crucial to follow their specific procedures — this often includes verifying your identity and providing transaction identifiers.

Troubleshooting common payment issues

Errors can occasionally occur during payment submissions, such as incorrect account numbers or insufficient funds. If you encounter an error while submitting your payment, carefully review the entered data for correctness. Commonly, small mistakes such as transposed digits can lead to issues. If the problem persists, reach out to TAP’s customer support for assistance. They provide guidance and resources to help taxpayers resolve any submission issues.

What if you don't receive a payment confirmation after submission? This can be frustrating, but rest assured there are steps to resolve this. Check your email (including your spam/junk folder) for a confirmation email from TAP. If an email is not found, head back to your TAP account to verify transaction details, such as whether the payment processed successfully or failed. Should you still find inconsistencies, don’t hesitate to contact TAP support for detailed assistance.

Frequently asked questions about TAP payments

When it comes to TAP payments, many users have similar queries. One common question is about receiving updates on payment status. You can subscribe to notification emails through your TAP account settings, allowing you to stay informed of any changes related to your payment. Additionally, users often wonder if they can change their payment method post-submission; generally, once a payment is submitted, it cannot be modified. Hence, always double-check your information before finalizing any payments.

Individuals also voice concerns when payments are declined. Common reasons for declines include insufficient funds or incorrect banking details. Make sure to verify your financial information and ensure that your account has adequate funds available. If necessary, reattempt the payment after resolving any issues.

Leveraging pdfFiller for seamless document management

Utilizing pdfFiller can significantly enhance the management of payment-related documents associated with TAP. The platform provides powerful tools for editing and customizing payment forms, ensuring they meet your requirements. Whether you need to change some details on the TAP forms or want to add specific notes or letters, pdfFiller makes the process straightforward. Simply upload the required PDF document to the platform and begin editing it using the intuitive interface.

In addition to document editing, pdfFiller offers secure eSigning capabilities, allowing users to sign payment documents electronically from any location. This feature is crucial for those working collaboratively with team members or advisors. Use pdfFiller to invite collaborators to review and sign documents securely so that all parties can keep track of changes efficiently and confidently manage their financial interactions concerning tax payments.

Conclusion

Using TAP for payments simplifies the tax management process for users in Utah. With features designed to improve efficiency, transparency, and convenience, TAP powers a stress-free experience for its users. Coupling TAP with the capabilities of pdfFiller transforms document management practices, enabling seamless editing, signing, and sharing. Empower yourself with the tools available to manage your tax payments effectively while ensuring safety and security in handling sensitive information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tap faqpayments - utah from Google Drive?

How do I edit tap faqpayments - utah straight from my smartphone?

How do I fill out tap faqpayments - utah on an Android device?

What is tap faqpayments - utah?

Who is required to file tap faqpayments - utah?

How to fill out tap faqpayments - utah?

What is the purpose of tap faqpayments - utah?

What information must be reported on tap faqpayments - utah?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.