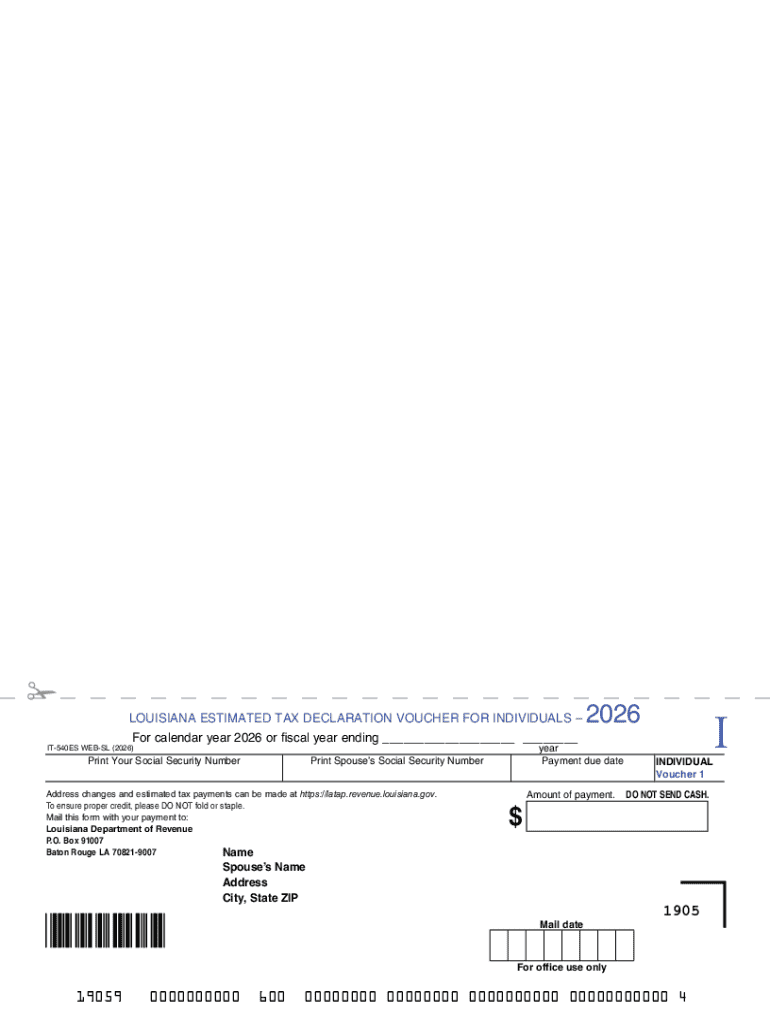

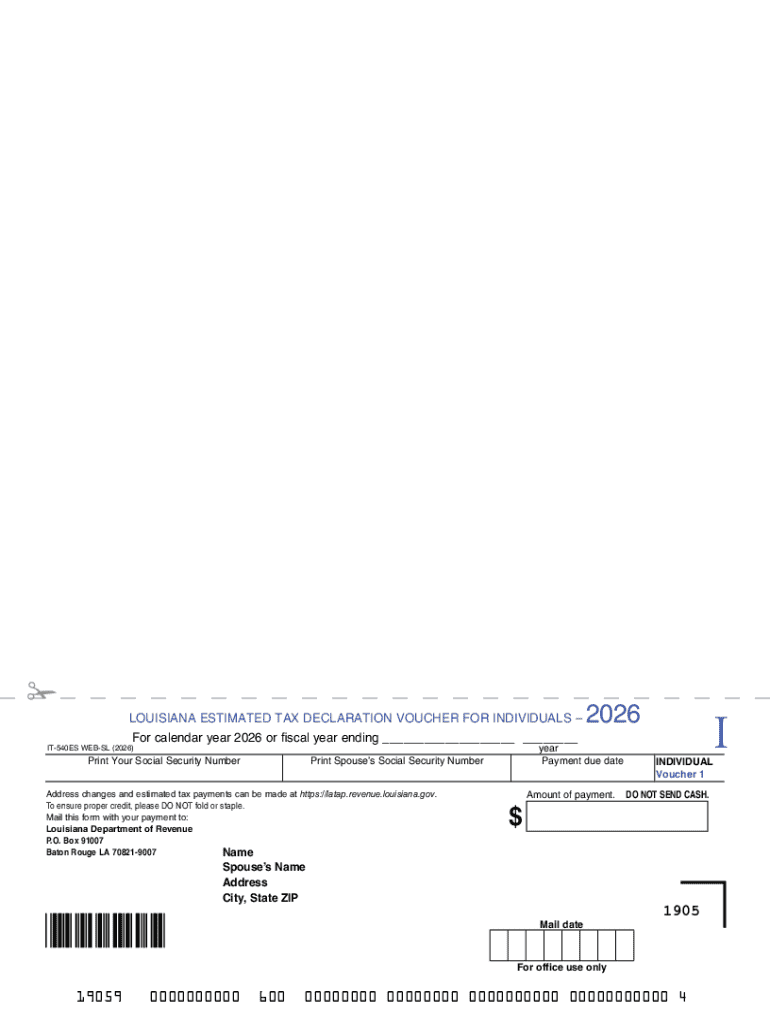

Get the free Online rev state la LOUISIANA ESTIMATED TAX ...

Get, Create, Make and Sign online rev state la

Editing online rev state la online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online rev state la

How to fill out online rev state la

Who needs online rev state la?

Your Comprehensive Guide to the Online Rev State LA Form

Understanding the Online Rev State LA Form

The Online Rev State LA Form is an essential document for individuals and businesses navigating their tax responsibilities in Louisiana. This digital form streamlines the process of filing necessary tax information, covering income and deductions, thus simplifying what can often be a tedious task. Tailored for both individual taxpayers and corporate entities, the form serves as a central hub for reporting income and calculating taxes owed or refundable. It meets Louisiana state requirements, ensuring compliance and facilitating the timely filing of income taxes.

The importance of the Online Rev State LA Form cannot be overstated. It helps taxpayers avoid penalties associated with late filings or inaccurate reporting. Moreover, using this form responsibly can lead to potential tax savings through deductions and credits.

Who needs to use the Online Rev State LA Form?

This form is essential for a diverse audience. Individuals, families, and teams tasked with tax preparation benefit from utilizing the Online Rev State LA Form, especially during income tax season. Anyone filing taxes in Louisiana is likely required to use this form, particularly if they have income to report or wish to claim deductions and credits.

Common situations necessitating the completion of this form include receiving income from multiple sources, engaging in freelance work, or managing rental properties. Additionally, teams involved in collective tax responsibilities must also be well-versed in using this form to ensure compliance.

Accessing the Online Rev State LA Form

To access the Online Rev State LA Form efficiently, visit authorized online platforms dedicated to Louisiana tax resources, with pdfFiller being the premier choice. The website provides a user-friendly interface that makes form retrieval straightforward. Users can also navigate directly to pdfFiller’s dedicated landing page, ensuring access to the most current version of the form.

Ensure your system meets basic requirements for optimal functionality while filling out the form. Recommended browsers include Google Chrome, Firefox, and Safari, offering the best compatibility with interactive features. Reliable internet access is crucial to prevent interruptions during the filing process, ensuring an efficient user experience.

Step-by-step guide to filling out the Online Rev State LA Form

Preparing to fill out the Online Rev State LA Form requires organized efforts. Gather all necessary documents beforehand, such as W-2 forms, 1099 statements, and records of deductible expenses. Understanding terminology will also facilitate a smoother completion process, as terms like 'tax credits' and 'deductions' directly affect your tax responsibilities.

When filling out the form, pay close attention to each section:

Commonly highlighted mistakes include incorrect Social Security numbers, overlooking to sign the form, or leaving out crucial information. To avoid these errors, double-check each entry and make sure documentation is complete. Take your time during this critical process to ensure accuracy.

Editing and customizing the Online Rev State LA Form

Once the Online Rev State LA Form is filled out, pdfFiller offers invaluable features for editing. Users can modify text easily, ensuring the information presented is correct and reflects any updates. Signature integration allows for a seamless completion process, where e-signatures can be applied without printing the document.

Collaborating effectively on the form is equally crucial, especially for teams dealing with shared responsibilities. pdfFiller enables easy sharing among team members, allowing them to edit or comment on sections without alterations to the main version. This collaborative approach helps refine the final submission and gather input from various stakeholders.

Submitting the Online Rev State LA Form

After successfully filling out the Online Rev State LA Form, users are presented with several submission options. The easiest route involves online submission via pdfFiller, ensuring all data is securely sent to the Louisiana Department of Revenue. Alternatively, users can opt for traditional methods, such as mailing a hard copy or faxing it, though these options may delay processing.

Tracking your submission is equally vital. Confirm the successful submission through confirmation emails or receipts generated by pdfFiller. Understanding the response timeline from state authorities can also ease the uncertainty surrounding your tax filings, as review periods can vary based on submission volume.

Managing and storing the Online Rev State LA Form

After submission, securely saving your completed Online Rev State LA Form must remain a priority. Utilizing cloud storage options available within pdfFiller provides a convenient way to keep your documents accessible yet safe. Establishing a systematic approach to document management can help in easily retrieving forms for future reference, particularly as tax regulations evolve.

Retrieving and reusing forms in future tax seasons will save time and effort. Users can access their previously completed forms within pdfFiller’s platform, simplifying the process of updating information as required for future submissions, including any estimated payments or extension requests.

FAQ section

Many users have questions regarding the Online Rev State LA Form. Some of the most common inquiries revolve around submission deadlines, the necessity of using this form, and guidance on filing extensions. Being clear about the requirements helps mitigate confusion and ensures compliance with Louisiana’s tax laws.

If you have questions about specifics, contacting the Louisiana Department of Revenue directly can provide clarity on processes and upcoming deadlines. Resources from pdfFiller also offer up-to-date information that can assist users with their filing journey.

Additional tips for a smooth filing experience

Staying updated on taxation regulations in Louisiana is crucial for every taxpayer. Regularly checking resources from the Louisiana Department of Revenue allows individuals to understand new changes in regulations, including tax credits and payment options. This proactive approach can yield optimizations in tax outcomes, enabling taxpayers to take full advantage of eligible deductions.

Moreover, utilizing support resources can relieve stress during the filing process. pdfFiller’s customer service is a valuable asset, offering assistance with any technical difficulties encountered while filling out the Online Rev State LA Form. Accessing guidance from state tax offices or consulting with tax professionals can also provide critical insights into unique financial circumstances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send online rev state la for eSignature?

How do I complete online rev state la online?

How can I fill out online rev state la on an iOS device?

What is online rev state la?

Who is required to file online rev state la?

How to fill out online rev state la?

What is the purpose of online rev state la?

What information must be reported on online rev state la?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.