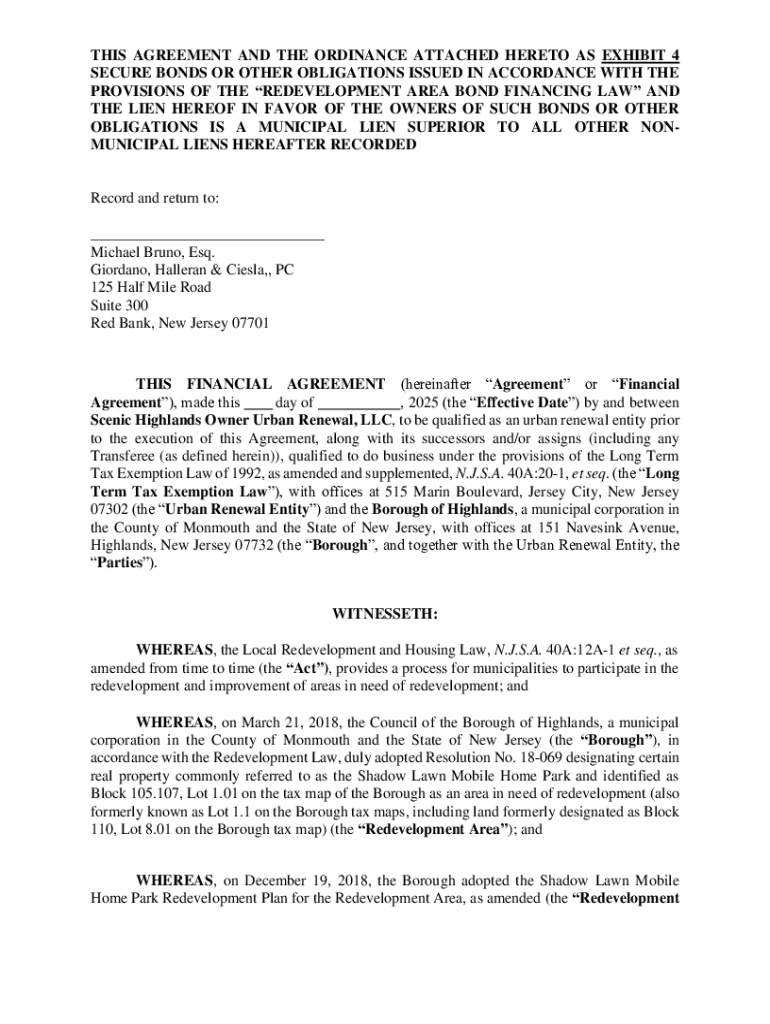

Get the free this financial agreement and the ordinance attached hereto ...

Get, Create, Make and Sign this financial agreement and

How to edit this financial agreement and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out this financial agreement and

How to fill out this financial agreement and

Who needs this financial agreement and?

This financial agreement and form: A comprehensive guide

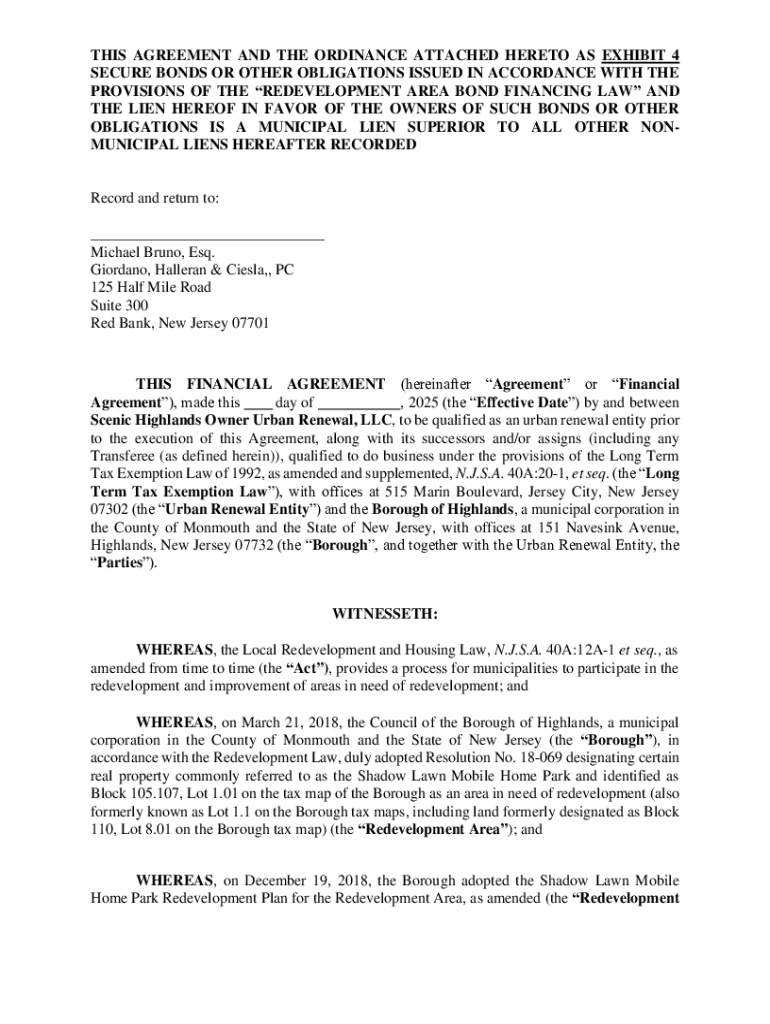

Overview of financial agreements

Financial agreements are formalized contracts outlining the terms of a loan, lease, or other financial transaction between two parties. This financial agreement and form serves as a crucial document that ensures clarity and protection for both the borrower and lender. Formalizing a financial agreement can minimize disputes and misunderstandings, fostering a trusting relationship between the involved parties.

The importance of implementing these agreements cannot be overstated. They set the framework for understanding obligations, payment schedules, and any penalties for breach of contract. A typical financial agreement can include personal loans, business loans, promissory notes, and lease agreements, catering to various financial needs and scenarios encountered by individuals and businesses alike.

Common uses for financial agreements include securing a mortgage for buying a home, entering into a lease for renting a property, or obtaining a business loan for expansion. Each of these instances emphasizes the necessity of having a clear, written financial agreement to avoid future disputes and provide legal recourse if needed.

Key components of the financial agreement

Every financial agreement comprises several essential components that dictate the terms and conditions agreed upon by the parties involved. Understanding these components is crucial to ensure that the agreement meets the needs of both the borrower and the lender and to prevent any potential misunderstandings.

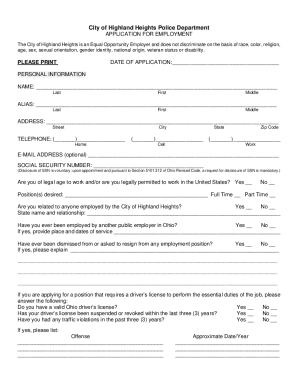

A. Parties Involved: The agreement should clearly identify the borrower and the lender, either individuals or entities. Necessary information like legal identification, contact details, and any relevant background should be included to solidify accountability.

B. Terms of Agreement: This lays out the duration of the agreement and the specific conditions under which modifications can occur, such as changes in payment plan or interest rates.

C. Loan Amount: Clearly determining the loan amount is vital, including how it will be disbursed and the schedule for repayments.

D. Repayment Structure: Defining the methods of repayment—whether in a lump sum or through installments—is essential. It’s equally important to include potential grace periods and any fees associated with late payments.

E. Interest Rate: The agreement should specify if the interest rate is fixed or variable, as well as how to calculate the total interest to be paid over the loan's lifetime.

Security and collateral

Security in a financial agreement serves as a safeguard for the lender—typically in the form of collateral that assures repayment of the loan. Understanding the types of collateral and their implications can enhance the security of a financial transaction.

Types of collateral can range from real estate to personal property. For instance, a lender may require the borrower to pledge a car or home as collateral, ensuring that they have a means of recovering their funds in the event of a default.

Evaluating risks associated with collateral is essential for both parties. Lenders should assess the value and marketability of the collateral, while borrowers need to understand the implications of losing their pledged assets in case of default.

Default and its consequences

Default occurs when either party fails to meet the obligations outlined in the financial agreement. Understanding the specifics of default and its implications is crucial for both the borrower and the lender.

The consequences of default can be severe and may include legal action, damage to credit ratings, or loss of collateral. Thus, ensuring that both parties are clear on what constitutes default and how to address it helps maintain accountability.

Remedies for default include negotiating with the lender for more time or restructuring payments. However, if negotiations fail, the lender may pursue legal action to reclaim the owed amount or enforce the terms of the agreement.

Governing law

The jurisdiction in which a financial agreement is executed governs the terms and conditions of that agreement. Each state may have specific laws affecting financial contracts.

Understanding state law variations is important for individuals drafting a financial agreement, as they may affect interest rates, default implications, and legal recourse.

Navigating these legal frameworks requires awareness of specific local regulations and potential modifications in the agreement based on the state’s legal context.

Dispute resolution mechanisms

Including a dispute resolution clause in a financial agreement protects both parties from the lengthy and costly legal battles that might arise from misunderstandings. It's critical to clearly outline this mechanism within the agreement.

Various options for dispute resolution exist, including mediation, arbitration, and litigation. Each method has its pros and cons, and selecting the appropriate one depends on the specific circumstances surrounding the financial agreement.

Choosing the right method depends on various factors, including the complexity of the case and the relationship between the parties. Clear communication regarding these processes in the initial agreement can save time and resources in the long run.

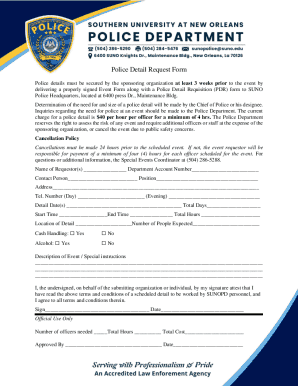

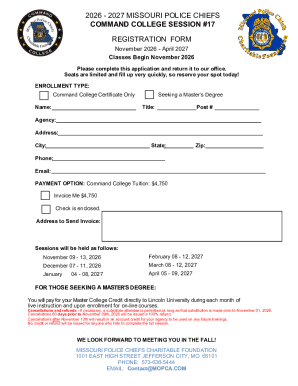

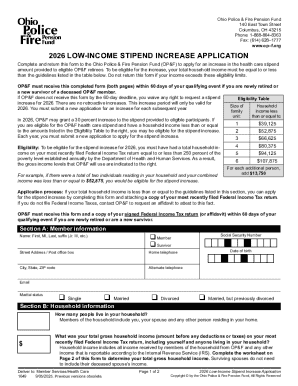

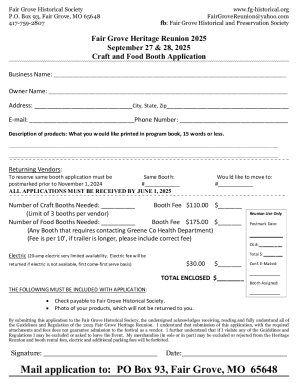

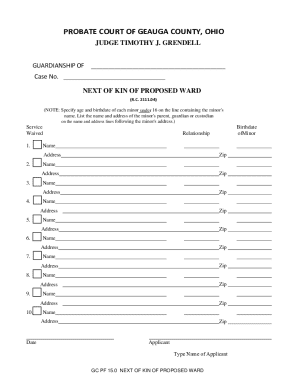

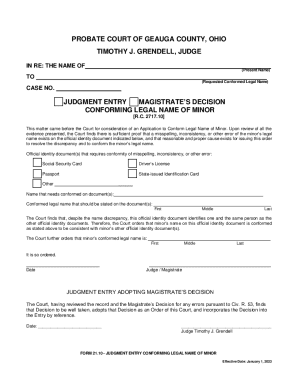

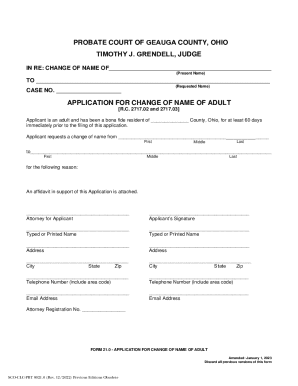

Filling out the financial agreement form

Completing a financial agreement form accurately is vital to ensure it holds legal weight and serves its intended purpose. Understanding the structure of the form facilitates a smoother completion process.

Step-by-step instructions for filling out the form include verifying information accuracy, providing complete details of both parties, loan amount, payment terms, and ensuring all participants sign where necessary. Witness requirements may vary; thus, it's prudent to familiarize yourself with local regulations.

Common pitfalls to avoid include leaving out essential details, providing incorrect information, or neglecting to have all parties sign. These errors can lead to disputes and potentially invalidate the agreement, undermining its effectiveness.

Editing and customizing your financial agreement

Personalizing a financial agreement can enhance its relevance to specific situations and can prove crucial for both parties' needs. Customization allows you to tailor the terms to match individual circumstances or preferences, making the agreement more effective.

Utilizing tools like pdfFiller aids in editing financial agreements easily. Features allow for adding, removing, or modifying clauses, including payment terms, obligations, and interests.

Ensuring that any modifications are mutually agreed upon and documented properly to avoid confusion in the future reinforces a sustainable financial arrangement.

Managing and storing your financial agreement

Effective document management strategies are essential for preserving the integrity of financial agreements. Best practices include digital storage solutions that ensure your documents are easily accessible and secure.

Organizing your agreement is key—utilizing a cloud-based platform like pdfFiller allows for collaboration among teams. This feature enables sharing documents with stakeholders and collecting signatures efficiently, ensuring everyone has access to the most up-to-date version.

Securing your agreement through encryption or password protection adds an extra layer of safety, safeguarding sensitive information from unauthorized access.

Reviewing and updating your financial agreement

Regularly reviewing and updating your financial agreement is crucial for ongoing relevance and compliance with current financial goals or changes in circumstances. Timing is essential; ideally, reviews should occur annually or whenever a significant financial change arises.

To update an agreement, follow specific steps: first, determine which aspects need revision, then communicate these changes with all parties involved, and finally, execute a new agreement reflecting these changes.

Keeping track of amendments ensures clarity and compliance with the latest terms agreed upon, solidifying trust among the parties involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send this financial agreement and to be eSigned by others?

How do I make changes in this financial agreement and?

How do I edit this financial agreement and on an iOS device?

What is this financial agreement?

Who is required to file this financial agreement?

How to fill out this financial agreement?

What is the purpose of this financial agreement?

What information must be reported on this financial agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.