Get the free Financial Aid Information for Students Experiencing ... - financialaid illinoisstate

Get, Create, Make and Sign financial aid information for

How to edit financial aid information for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial aid information for

How to fill out financial aid information for

Who needs financial aid information for?

Financial Aid Information for Form: A How-to Guide

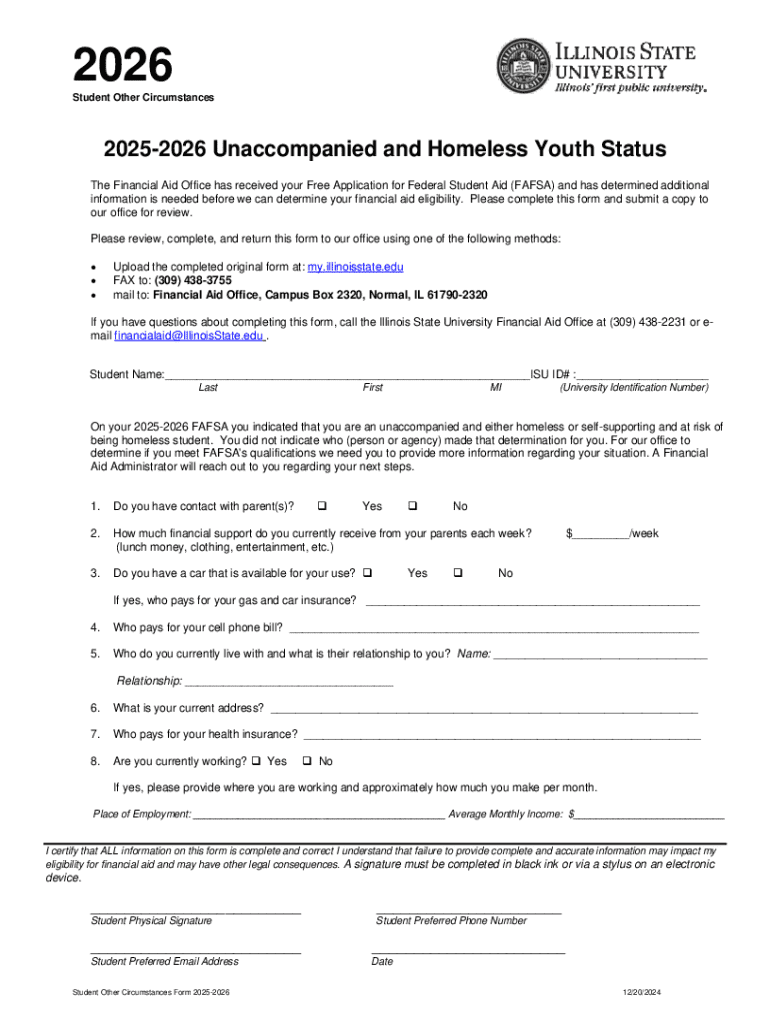

Understanding financial aid information

Financial aid is crucial for many students seeking to further their education. It encompasses various forms of monetary support that help cover tuition costs, fees, and other educational expenses. Without financial aid, attending college can be prohibitively expensive, leading many to abandon their academic ambitions. Understanding the intricacies of financial aid is thus paramount for students and families.

Key terms in financial aid include grants, scholarships, loans, and work-study programs. Grants and scholarships are forms of gift aid that do not require repayment, while loans need to be paid back with interest. Work-study provides a way for students to earn money through part-time jobs while enrolled in school. Each term carries specific implications for how aid is structured and received.

Types of financial aid available

When it comes to financial aid, there are several types available that cater to a variety of needs. Federal financial aid is the backbone for many students and includes grants, loans, and work-study programs. The Pell Grant, for example, is a well-known federal grant aimed at low-income undergraduates, providing crucial funds for those who qualify.

Beyond federal aid, each state offers its own financial aid programs, which can include merit-based scholarships and need-based grants. Additionally, many colleges and universities provide institutional aid, which can help fill gaps not covered by federal aid. Lastly, private scholarships and grants from organizations, businesses, and foundations can further support students in their pursuit of education.

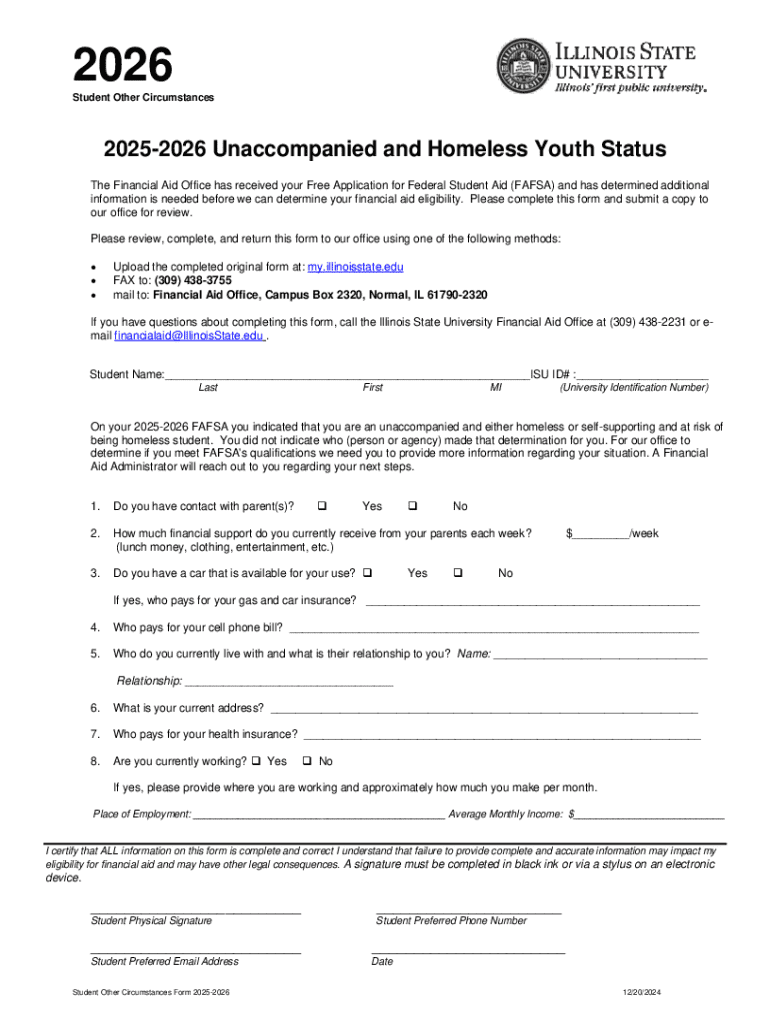

Key forms and documents required

To apply for financial aid, certain documents are essential, ensuring accurate assessment of your financial situation. First and foremost, every applicant will need a Social Security number, tax returns, and W-2 forms that verify income. Additionally, bank statements show any remaining financial assets, which play a critical role in determining aid eligibility.

The primary form used to apply for federal aid is the FAFSA (Free Application for Federal Student Aid). Another key document is the CSS Profile, used by some colleges for additional financial consideration. Institutional financial aid forms may also be required by specific colleges, making it crucial for applicants to stay organized and keep records up to date.

Step-by-step guide to filling out financial aid forms

Getting started with financial aid forms can be daunting, but breaking it down into manageable steps can ease the process. Before applying, it’s crucial to gather necessary information, such as tax details and Social Security numbers. Creating an FAFSA ID is an essential pre-application step that will facilitate submitting your form.

The FAFSA comprises several sections, starting with personal information such as name and address. Following that, applicants enter financial data, which includes income, assets, and other relevant financial details. Once this section is completed, students must select their schools; selecting the right institution is important as it dictates where financial aid notifications will be sent. Finally, ensure you sign your application electronically before submission.

Utilizing financial aid calculators

Financial aid calculators are invaluable tools in planning for college expenses. These online calculators help students estimate the amount of financial aid they may receive based on household financial information. The Expected Family Contribution (EFC) calculator estimates how much a family is expected to contribute toward a child’s education. Meanwhile, the Net Price Calculator provides a more tailored view by showing potential out-of-pocket costs after grants and scholarships.

By using these calculators, families can devise effective financial strategies to ensure they are prepared for college expenditures. Before applying, testing out various scenarios can reveal potential aid eligibility and important funding sources.

Frequently asked questions about financial aid

After submitting your financial aid forms, it's common to have questions about what happens next. The processing time can vary significantly, and students should keep an eye on their email for notifications. If additional information is required, institutions may reach out directly; maintaining contact with the financial aid office is beneficial for clarification.

Another frequent concern is the possibility of appealing for more financial aid. If a family's financial situation changes or if additional expenses arise, it's crucial to communicate this with the financial aid office. Understanding the differences between grants and loans can also clear up confusion. It’s vital to read the financial aid award letter carefully, as it outlines not just what you'll receive, but the terms attached to each type of aid.

Interactive tools for managing financial aid

Managing financial aid documents efficiently is crucial, and tools like pdfFiller streamline this process. With pdfFiller, users can edit PDFs seamlessly, making any necessary changes to financial documents without hassle. Furthermore, the platform’s eSignature functionality allows for quick and efficient signing of forms, eliminating the need for printing and scanning.

Collaboration tools on pdfFiller also empower students and their advisors to work together on financial aid documents. Feedback can be given in real-time, allowing for shared understanding and quicker responses to any issues that arise. By utilizing these features, students can manage financial aid with confidence.

Navigating deadlines and timeframes

Understanding financial aid deadlines is paramount for successful application. The key deadline for submitting the FAFSA typically falls on June 30, but many states have their own deadlines that can be as early as February. Late submissions can result in lost opportunities for grants and institutional aid, which often operate on a first-come, first-served basis.

Students must also be aware of renewal applications, as financial aid may need to be reapplied for each academic year. Regularly checking deadlines keeps students informed of crucial timelines, ensuring that they do not miss important funding opportunities.

Staying informed about financial aid

Financial aid policies and legislation can frequently change. Keeping abreast of these changes is crucial for students and families seeking assistance. Regularly check websites for updates, subscribe to newsletters, or follow social media accounts dedicated to educational financing. Maintaining contact with financial aid offices at prospective institutions is also an effective way to stay informed.

Additionally, various resources provide ongoing financial education, including community programs, school workshops, and online courses. Connecting with financial aid professionals at your school or local institutions can provide personalized insights and best practices for managing financial support.

Personalization and customization of financial aid apps

The financial aid process can often be overwhelming; however, tailoring your approach can lead to more effective results. Utilizing tools like pdfFiller allows students to create customized documents tailored to their specific needs and apply them across their financial aid journey. By creating templates for personal finance records or common forms, students can streamline the application process.

pdfFiller's cloud-based platform offers the convenience of access-from-anywhere solutions, enabling students and families to manage their documents regardless of where they are. This flexibility ensures all stakeholders involved in the financial aid process can participate actively.

Case studies and real-life experiences

Real-life stories often illustrate the power of financial aid in reshaping futures. Many students successfully navigate financial aid by learning from others. For instance, a student from a low-income background managed to secure a full Pell Grant and additional state aid, allowing them to attend their dream university without financial burden.

Conversely, other students encountered challenges, such as incomplete applications leading to missed aid opportunities. These cases emphasize the importance of thoroughness in filling out forms and meeting deadlines. Learning from the experiences of those who have gone before can empower new applicants in their financial aid journeys.

Final considerations

Timing is crucial when applying for financial aid. Being proactive, staying organized, and monitoring all important deadlines can significantly enhance a student's chances of receiving aid. Regularly updating documents and following the application process with diligence ensures no opportunities are missed.

Lastly, never hesitate to seek assistance when needed. Navigating the financial aid landscape can be complex, but support is available through schools, community programs, and online resources. Engaging with these resources can prove invaluable in making informed decisions throughout the financial aid process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial aid information for to be eSigned by others?

How do I execute financial aid information for online?

Can I create an eSignature for the financial aid information for in Gmail?

What is financial aid information for?

Who is required to file financial aid information for?

How to fill out financial aid information for?

What is the purpose of financial aid information for?

What information must be reported on financial aid information for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.