Get the free Secretary of State: Business Services Forms - forms in

Get, Create, Make and Sign secretary of state business

How to edit secretary of state business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out secretary of state business

How to fill out secretary of state business

Who needs secretary of state business?

Secretary of State Business Form - How-to Guide

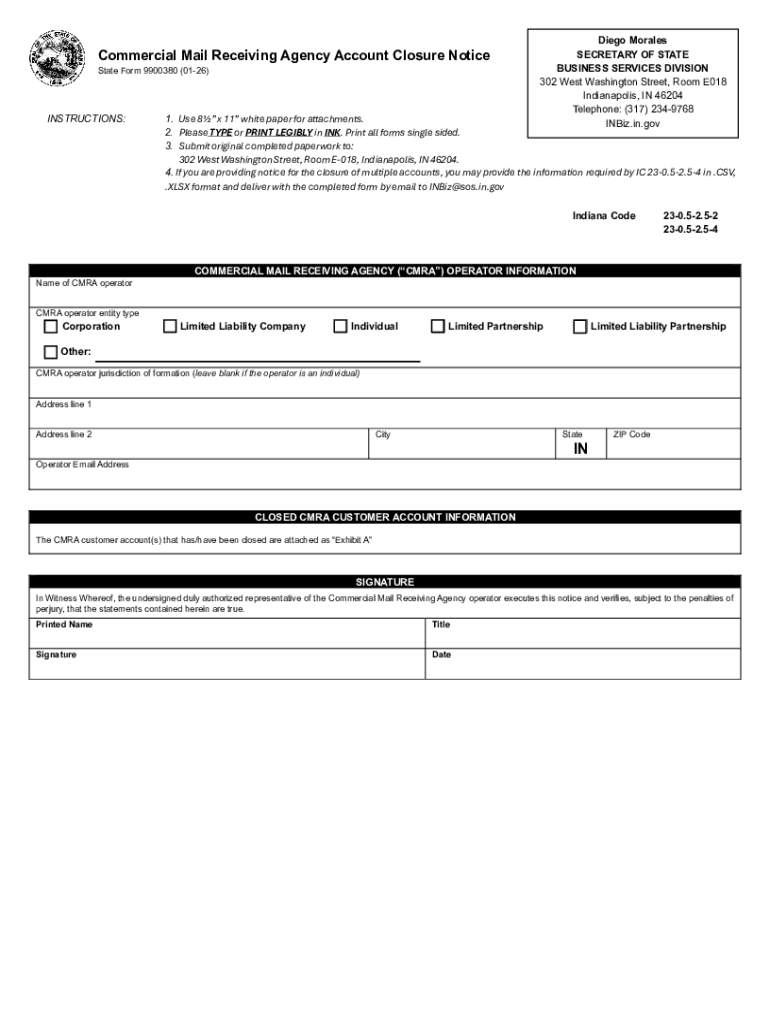

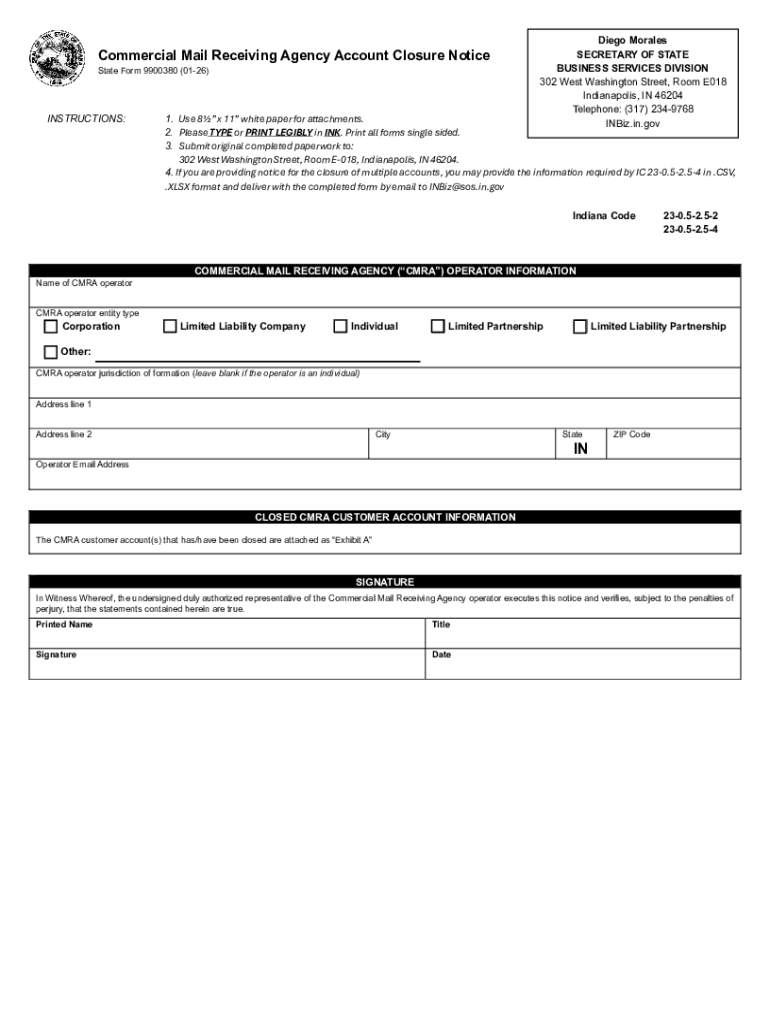

Understanding the Secretary of State Business Form

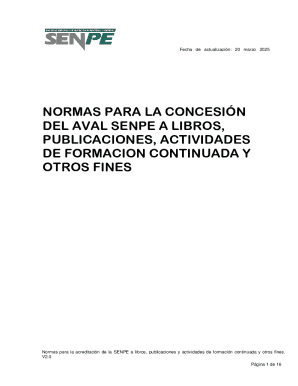

A Secretary of State Business Form serves as a vital document required for the official formation or registration of business entities such as corporations, limited liability companies (LLCs), and partnerships. This form is fundamental in making your business recognized at the state level, providing legal protection and access to various business resources. Filing these forms grants your business credibility while ensuring compliance with state regulations.

Each state may have different requirements and forms, but generally, the importance of filing with the Secretary of State cannot be overstated. It lays the groundwork for your business operations and opens doors to various other business filings and opportunities, such as name reservations and obtaining orders for certificates of status. Understanding these forms is essential to ensure a smooth and legal initiation of your business.

Necessary preparatory steps before filing

Before you proceed with your Secretary of State Business Form, it is crucial to identify the right business structure that suits your needs. Each entity type—be it an LLC, partnership, or corporation—comes with its own regulatory obligations and tax implications. Determining the right type early on helps in avoiding complications later in the filing process.

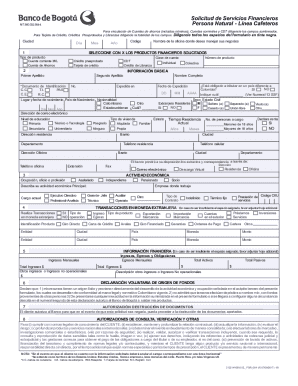

Alongside identifying your business structure, you'll want to gather all necessary information and documents. This typically includes personal identification, the desired business name, and specifics about your registered agent, who will handle legal correspondence on behalf of your business. Ensuring that you've collected complete and accurate documentation will simplify the process, minimize errors, and expedite the approval of your business entity filings.

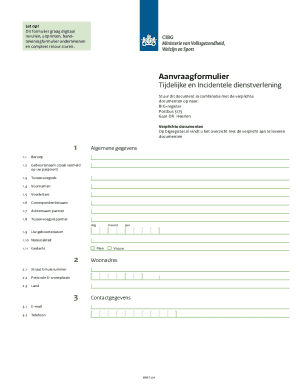

How to access your Secretary of State business form

Accessing your Secretary of State Business Form begins with navigating to the website specific to your state’s Secretary of State office. Each state has a distinct webpage dedicated to business filings where you can find links to the various forms required for registration. Use your favorite search engine to obtain the direct link to your state’s resources.

Once on the appropriate webpage, locating the right form can be done by searching in the business filings section. It's common to see categories organized by business structure. After identifying your desired form, downloading and printing it can usually be done in PDF format. Ensure you have the latest version to avoid any issues with incomplete or outdated forms.

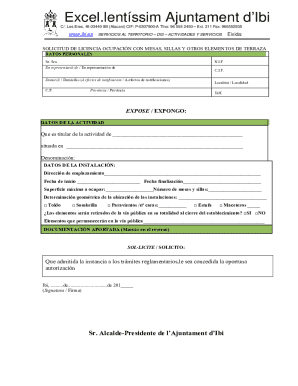

Filling out the Secretary of State business form

Filling out the Secretary of State Business Form may seem daunting at first, but by following a step-by-step approach, you can minimize mistakes. Start with your business name at the top, clearly indicating whether the name reflects the type of entity you are registering. Follow this with details about your registered agent, their address, and contact information. Keep your answers as straightforward and honest as possible.

It’s crucial to watch out for common errors that could delay approval, like typos in your business name or incorrect agent details. If you need to streamline the process, consider using services like pdfFiller, which allow for easy editing and collaboration. This tool can help you fill out the form electronically, ensuring legibility and preventing submission issues due to poor handwriting.

Submitting your Secretary of State business form

After filling out your Secretary of State Business Form, you need to decide how you will submit it. This typically presents several options: online submission, mail-in submission, or in-person filing. Online filing is often the most efficient method, as it allows for immediate processing; ensure that you follow the step-by-step instructions provided on your state's site.

If you choose to submit by mail, make sure to double-check the address and prepare your submission packet carefully to avoid any delays. Tracking your mail may also provide peace of mind. For those who prefer a face-to-face interaction, locate your local Secretary of State office and prepare for standard processing procedures.

Understanding fees associated with filing

It’s essential to be aware of the costs associated with submitting your Secretary of State Business Form. These fees vary by state and type of business entity, typically ranging from $50 to several hundred dollars. Checking your state’s specific fee schedule can help you plan your budget effectively.

Additionally, understand the payment methods accepted for both online and offline filings. Most states now offer online payments via credit or debit cards, while checks or money orders are usually required for mail-in filings. Be cautious of any additional charges that may apply for expedited services or supplementary filings, as these can add to your overall costs.

Post-filing considerations

Once your Secretary of State Business Form has been submitted, the next step is confirming that your filing was processed successfully. Most Secretary of State offices provide online tools for tracking the status of your application, allowing you to confirm whether your business has been officially registered.

Maintaining copies of all filed documents is crucial for your records. Using tools like pdfFiller, you can effectively manage and store your documents in the cloud, ensuring easy access whenever you need to reference or share information. Keeping thorough records also simplifies compliance requirements in the future.

Common FAQs about Secretary of State business forms

Many individuals have questions regarding their Secretary of State Business Form after submission. One common concern is what to do if errors are found post-submission. Most states allow you to amend your form; however, the process can vary, including the possible need for additional forms and fees.

Another frequently asked question pertains to how to keep your business information updated without going through a full re-filing process. Most Secretary of State offices have straightforward guidelines on how to amend existing information. Also, processing time can vary widely based on your state; check your local state’s processing averages to set your expectations.

Legal obligations after filing your form

After successfully filing your Secretary of State Business Form, businesses must navigate ongoing compliance requirements. This often includes the need for business licenses, additional permits, and annual reports, depending on the entity type and state regulations. Be proactive in understanding these obligations to avoid penalties.

If your business grows or your needs change, it’s advisable to consult with a legal professional to ensure that you remain compliant and that your legal documentation accurately reflects your business activities. Knowing when to seek legal assistance can greatly affect your operational integrity and success.

Leveraging technology for business documentation

In an age where efficiency is key, utilizing a cloud-based document solution, such as pdfFiller, can significantly enhance your business operations. This platform supports the seamless editing of PDFs, electronic signing capabilities, and real-time collaboration features, immensely beneficial for teams submitting Secretary of State Business Forms.

Embracing technology not only assists in managing documents but streamlines processes, reduces errors, and allows for better control of your important business filings. Features of pdfFiller can help you remain organized and compliant, offering a comprehensive system from which to operate your business.

Feedback and contact information

At pdfFiller, we believe in empowering users through user engagement and support. If you have questions or need assistance while filling out your Secretary of State Business Form, we encourage you to reach out. Our dedicated support team is here to provide guidance and ensure a smooth document management experience.

Feel free to explore the active support options available on our website, where users can access tutorials, FAQs, and direct contact information to get the assistance they may require while navigating through their document creation process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my secretary of state business directly from Gmail?

Can I create an eSignature for the secretary of state business in Gmail?

How do I fill out the secretary of state business form on my smartphone?

What is secretary of state business?

Who is required to file secretary of state business?

How to fill out secretary of state business?

What is the purpose of secretary of state business?

What information must be reported on secretary of state business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.