Get the free massachusetts department of - revenue

Get, Create, Make and Sign massachusetts department of

How to edit massachusetts department of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out massachusetts department of

How to fill out massachusetts department of

Who needs massachusetts department of?

Navigating the Massachusetts Department of Form: A Comprehensive Guide

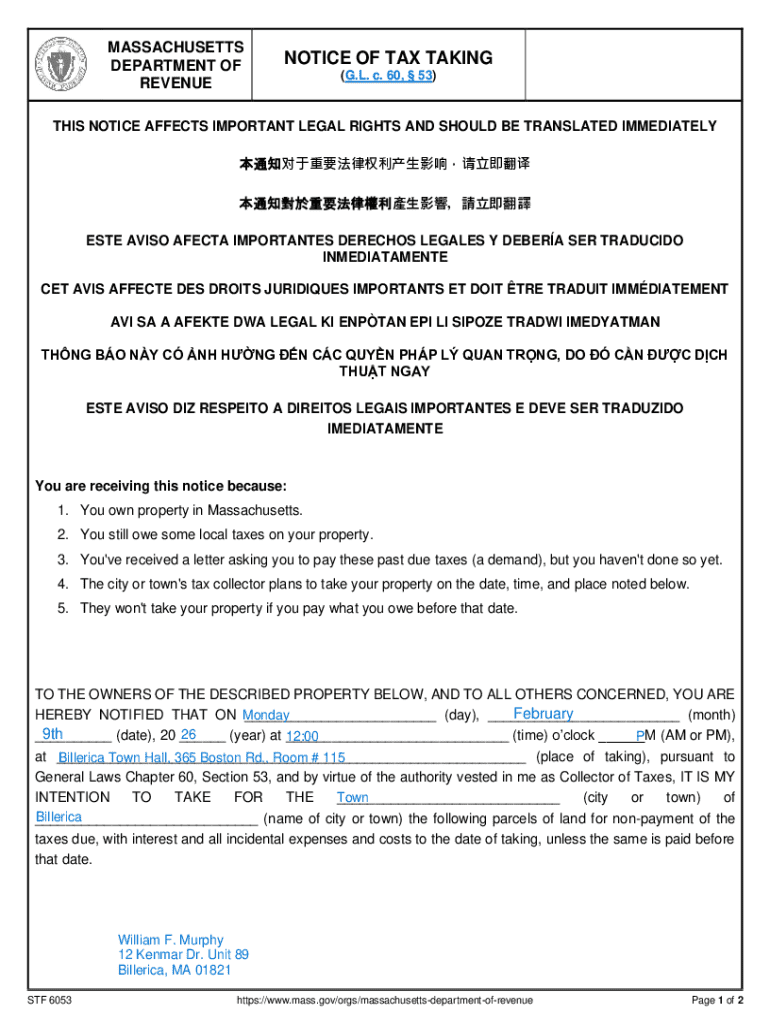

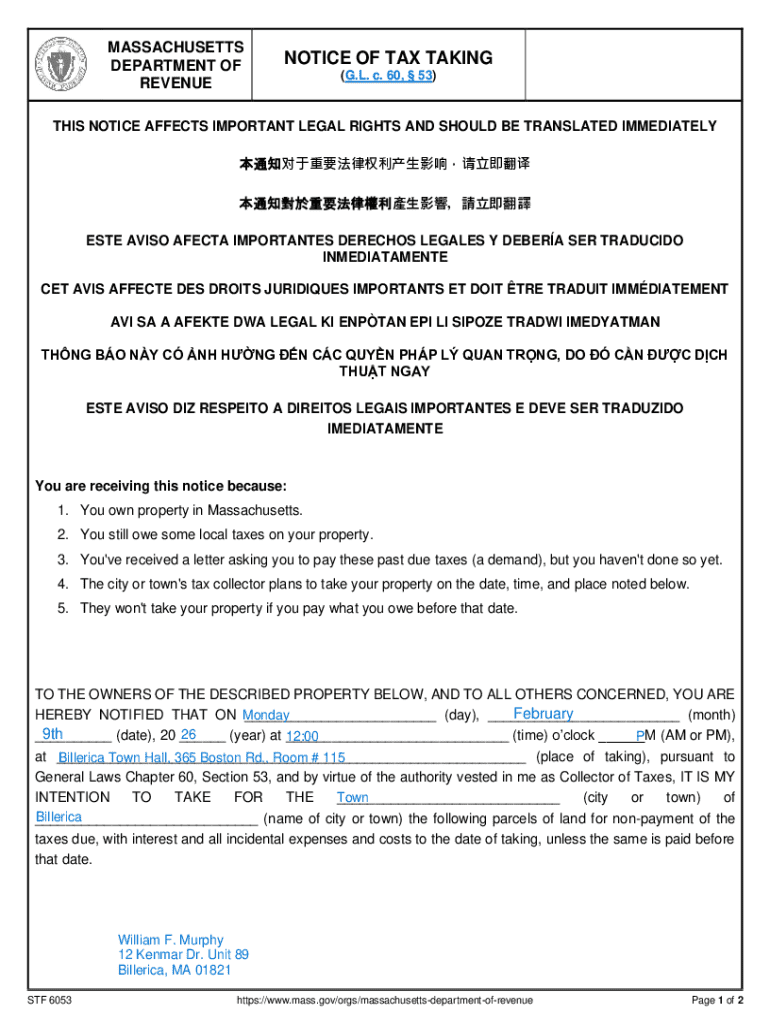

Overview of Massachusetts Department Forms

The Massachusetts Department of Form provides essential documentation necessary for the administration of state laws and regulations. These forms serve the purpose of standardizing how the public interacts with various government agencies, ensuring consistency and compliance. Using the official forms of the Massachusetts Department is crucial for individuals and businesses alike, as they help streamline processes ranging from tax returns to business licenses. This comprehensive repository includes various types of forms tailored for different needs, which simplifies the bureaucratic experience for residents.

Key forms overview

Understanding the most common forms can mitigate errors and streamline transactions with the state. Two key categories are tax forms and employment forms, each serving critical compliance functions.

Tax forms

Commonly used tax forms include the MA-1040, which is the Massachusetts Personal Income Tax Return. It is essential for individuals to accurately report their income and claim applicable credits and deductions. The MA-1065 is another important form used for the Partnership Return of Income, necessary for partnerships to report their income on behalf of all partners.

Steps for submission

To submit any tax form, individuals should first ensure they have accurately filled out the form based on the guidelines provided by the Massachusetts Department. After completing the form, it can be submitted electronically or through traditional mail. Electronic submissions often provide quicker processing times.

Employment forms

Employment forms, such as the W-4, which is used to determine federal tax withholding, and the New Hire Reporting Form, which is required to report newly employed individuals to the state, are vital for both employees and employers. Accurate completion of these forms ensures compliance with state laws and smooth payroll processing.

Step-by-step guide to accessing forms

Accessing forms from the Massachusetts government website is straightforward, but knowing the path can save time. The official website is well-structured, allowing users to search for the necessary forms based on categories.

Navigating the Massachusetts government website

Users can simply head to the forms section of the Massachusetts state website, where there are direct links to frequently used forms. These forms are categorized, making navigation easier. For example, searching under 'tax' will display all relevant tax forms available.

Using pdfFiller for document management

pdfFiller enhances the process of managing forms significantly. Users can upload forms directly to the platform and edit them as needed. This functionality includes adding text, signatures, and utilizing collaboration tools, which are invaluable in a team environment.

Completing your form: tips and best practices

Filling out forms correctly is essential to avoid delays in processing. Understanding the specific requirements for each form is crucial. Carefully reading instructions and completing each section accurately will help sidestep common pitfalls that often lead to rejection.

Understanding form requirements

Some common mistakes include incomplete fields, miscalculations in tax forms, and failing to sign documents where necessary. Double-checking entries and ensuring compliance with state requirements is advisable.

Interactive tools for assistance

Leveraging pdfFiller’s help features can provide guidance throughout the form-filling process. The FAQs section is particularly beneficial for first-time users who may have uncertainties regarding procedures.

Securing document validity

Finally, to ensure that your forms hold up legally, eSignatures and secure authentication processes are both necessary. Document validity is crucial when submitting forms, especially those pertaining to financial reporting or legal obligations.

Specific use cases for Massachusetts forms

Understanding when and how to use the various Massachusetts Department forms is fundamental for compliance.

For individuals

Individuals often need to file their taxes for the current year, which mandates the usage of accurate tax forms. Furthermore, applying for various licenses like business permits requires completion of several official forms. Being informed about these is paramount for a smooth filing process.

For businesses

Businesses, on the other hand, might need to set up employee tax withholding through forms such as the W-4, ensuring compliance with state tax regulations. Furthermore, submitting forms that detail compliance with the state’s statutory requirements prevents potential fines.

Managing and storing completed forms

Once forms are completed, managing and storing them properly is essential. Digital storage solutions provide a convenient and secure method for keeping all documents in one place.

Cloud-based document storage

Utilizing cloud-based services like pdfFiller ensures easy access from anywhere, allowing users to retrieve documents quickly. The flexibility of online storage is particularly advantageous for individuals and teams who need to collaborate on documents.

Organizing forms for easy retrieval

Implementing a systematic approach to organizing completed forms will enhance retrieval. Common best practices include categorizing documents based on type (e.g., taxes, licenses, contracts) and regularly reviewing your stored files to ensure they are up-to-date.

Additional tools and resources

The complexity of regulations often requires additional resources. pdfFiller provides various features that assist in navigating legal requirements and regularly updating forms, ensuring compliance with Massachusetts laws.

Accessing legal advice through pdfFiller

Having access to legal advice is invaluable, especially when dealing with document completion that involves significant contractual obligations. pdfFiller offers tools that allow users to consult with legal professionals when necessary.

Future forms and updates

Staying informed about changes in Massachusetts regulations is vital for individuals and businesses alike. Regular updates to forms reflect any changes in state legislature, and utilizing services like pdfFiller keeps users aware and compliant.

FAQs about Massachusetts forms

Navigating Massachusetts forms can seem daunting. Understanding common queries can significantly improve user confidence.

Providing quick tips for first-time users helps ensure they are better prepared. Familiarizing oneself with the platform and available resources will mitigate errors and ensure compliance with state regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute massachusetts department of online?

Can I create an electronic signature for signing my massachusetts department of in Gmail?

Can I edit massachusetts department of on an Android device?

What is Massachusetts department of?

Who is required to file Massachusetts department of?

How to fill out Massachusetts department of?

What is the purpose of Massachusetts department of?

What information must be reported on Massachusetts department of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.