Get the free Mortgage Core Fund Statement of Additional Information

Get, Create, Make and Sign mortgage core fund statement

How to edit mortgage core fund statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage core fund statement

How to fill out mortgage core fund statement

Who needs mortgage core fund statement?

Mortgage Core Fund Statement Form: A Comprehensive How-To Guide

Understanding the mortgage core fund statement form

The mortgage core fund statement form is a crucial document in the realm of mortgage financing. It acts as an official record that provides a detailed summary of your mortgage-related financial activities. This form is particularly important for both borrowers and lenders as it consolidates vital information regarding the mortgage agreement, payment history, and property details. In an era where transparency and organization in financial matters are paramount, understanding this form can significantly enhance your financial literacy and decision-making.

Key concepts related to mortgage financing include loan terms, interest rates, and payment schedules. Each of these components plays a significant role in how a mortgage is structured and how it ultimately affects an individual's financial planning. Therefore, the mortgage core fund statement form becomes an essential tool not only for maintaining accurate records but also for assessing one's financial performance regarding the property investment.

Key features of the mortgage core fund statement form

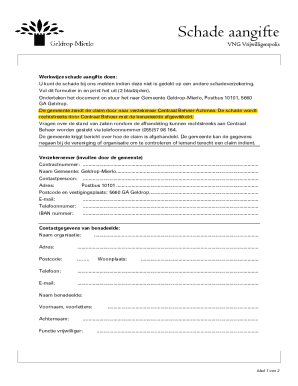

A well-structured mortgage core fund statement form typically consists of several standard sections and fields. Each of these sections is designed to capture essential information that contributes to a comprehensive understanding of the mortgage arrangement. The first section covers personal information, requiring details about the borrower, such as name, address, and contact information. This data is vital for identification and communication purposes.

Next, the loan details section provides an overview of the mortgage itself, including the loan amount, interest rate, and the specified term length. It is crucial for users to accurately represent these figures, as they will affect financial projections and repayment strategies. Additionally, a payment history section outlines past payment behavior, which is vital for assessing overall financial health and planning future payments. Lastly, the property information section provides a description of the collateral securing the loan, ensuring that all parties involved have full awareness of the asset in question.

Step-by-step instructions for filling out the form

Before tackling the mortgage core fund statement form, proper preparation is essential. Start by gathering all necessary documentation, including previous mortgage statements, tax records, and identification. Understanding the precise terms and definitions used in the form will also empower you to fill it out accurately. Misinterpretations can lead to costly mistakes, so please invest time in familiarizing yourself with key terminology.

Once you are prepared, follow these detailed instructions for completing the form: In the personal information section, clearly state your full name and current address. Next, for loan details, enter the total amount borrowed, along with the interest rate and monthly payment amount. Then, delve into the payment history section. List your payment dates, amounts paid, and any missed payments to give a complete picture of your payment behavior. Lastly, provide property details, including the address, type of property, and any other relevant identifiers.

Some common mistakes include neglecting to update the contact information or misrecording payment amounts. These inaccuracies can lead to confusion and potential discrepancies in your financial records.

Editing and customizing your mortgage core fund statement

After filling out the mortgage core fund statement form, editing is often necessary. pdfFiller provides robust tools specifically designed for editing PDFs. Start by adding annotations and comments on any sections that require clarification. This is particularly useful for collaborative efforts or areas needing additional context. Additionally, if you need to modify existing information, pdfFiller makes it easy and straightforward. Customization ensures that your document accurately reflects your current financial situation.

Once you have made the required edits, it’s essential to save your document properly to keep records organized. pdfFiller allows you to save the customized document in various formats, providing you with flexibility based on your needs. Furthermore, the platform offers sharing options, allowing you to effortlessly send the document to lenders, partners, or any parties involved in your mortgage.

Collaborating on your mortgage core fund statement

Collaboration is a vital aspect of managing the mortgage core fund statement effectively. pdfFiller allows you to invite team members to input and review the document as needed. This feature is especially beneficial when multiple stakeholders are involved, ensuring that everyone’s perspective is considered before finalizing the statement. Utilize pdfFiller’s collaboration features to enable simultaneous edits and comments, streamlining the communication process and enhancing productivity.

Maintaining version control is another critical component of collaboration. As changes are made, ensure that all versions are documented and accessible. This helps prevent any confusion regarding which version of the statement is current, thereby solidifying accountability among team members. Establishing clear communication channels about changes made to the document can significantly enhance overall efficiency in managing your mortgage documentation.

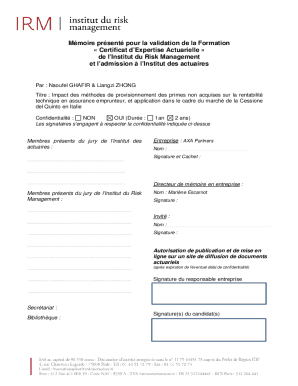

Signing the mortgage core fund statement

Electronic signing has revolutionized the way we handle important documents, including the mortgage core fund statement form. Through pdfFiller, the process of eSigning becomes seamless and efficient. Begin by reviewing the document to ensure all changes and details are correct before adding your signature. The platform walks you through the step-by-step process of eSigning, ensuring you understand each step. This provides greater accessibility, as users can sign the document from anywhere, eliminating delays related to physical signatures.

When utilizing eSignatures, it’s essential to understand the legal considerations surrounding them. Generally accepted in jurisdictions around the world, electronic signatures offer the same legal validity as traditional signatures. Ensure you are aware of any specific regulations in your locality, as some areas may have unique requirements regarding electronic documents and signatures.

Managing your mortgage core fund statement

Proper management of your mortgage core fund statement is vital for long-term financial success. Best practices for document storage and organization include keeping both digital and physical copies in secure locations. Cloud-based features offered by pdfFiller ensure accessibility and security, allowing you to access your documents from anywhere while maintaining confidentiality. Regularly reviewing and updating your statement is equally important, particularly after major financial events such as refinancing or changes in property circumstances.

Keeping your statement updated encompasses knowing when to act. For instance, whenever interest rates fluctuate or after settling a payment discrepancy, you should update your mortgage core fund statement to reflect these changes. This practice ensures that you have the most accurate picture of your financial situation, enabling better decision-making regarding your mortgage management strategy.

Understanding common uses and applications of the mortgage core fund statement

The mortgage core fund statement form serves various applications in personal finance management. By maintaining an accurate record of your mortgage arrangement, you can assess your financial health and make informed decisions regarding future investments. For lenders and financial institutions, this document provides critical insights into a client's mortgage behavior, impacting lending decisions and risk assessment.

Furthermore, the mortgage core fund statement is instrumental in shaping your overall mortgage management strategy. It enables you to track your progress in paying down the mortgage, calculate potential savings from refinancing, and analyze the impact of market conditions on your investment. Regularly utilizing this tool will empower you to navigate the complexities of mortgage management with greater confidence.

Frequently asked questions (FAQs)

When filling out the mortgage core fund statement form, issues may arise. For instance, if you make a mistake while completing the form, it’s crucial to address it promptly. Typically, you can draw attention to any errors by making annotations and corrections through pdfFiller tools. If a major correction is needed, you may request an official amendment under the guidelines provided by your lender.

After completing the form, the next steps include ensuring it is signed and shared with relevant parties. If you have questions about the form's applicability to different types of mortgages, consulting your financial advisor or checking with your lender can provide the clarifications needed to ensure compliance and understanding.

User testimonials and success stories

Real-life experiences shed light on the importance of maintaining accurate mortgage documentation. Users have shared success stories demonstrating how meticulous record-keeping through the mortgage core fund statement form has significantly improved their financial monitoring and management. One user reported that regularly updating their statement helped them identify a discrepancy in payment records, enabling them to rectify the issue swiftly and prevent potential penalties.

Additionally, many individuals have found that utilizing pdfFiller has simplified their mortgage management processes. The platform’s intuitive features for editing and collaboration ensured that users could navigate their mortgage documentation without hassle, thus freeing them to focus on other investment opportunities and financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my mortgage core fund statement in Gmail?

How do I edit mortgage core fund statement on an Android device?

How do I fill out mortgage core fund statement on an Android device?

What is mortgage core fund statement?

Who is required to file mortgage core fund statement?

How to fill out mortgage core fund statement?

What is the purpose of mortgage core fund statement?

What information must be reported on mortgage core fund statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.