Get the free FAFSA Corrections, Unusual and Special Financial ...

Get, Create, Make and Sign fafsa corrections unusual and

How to edit fafsa corrections unusual and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fafsa corrections unusual and

How to fill out fafsa corrections unusual and

Who needs fafsa corrections unusual and?

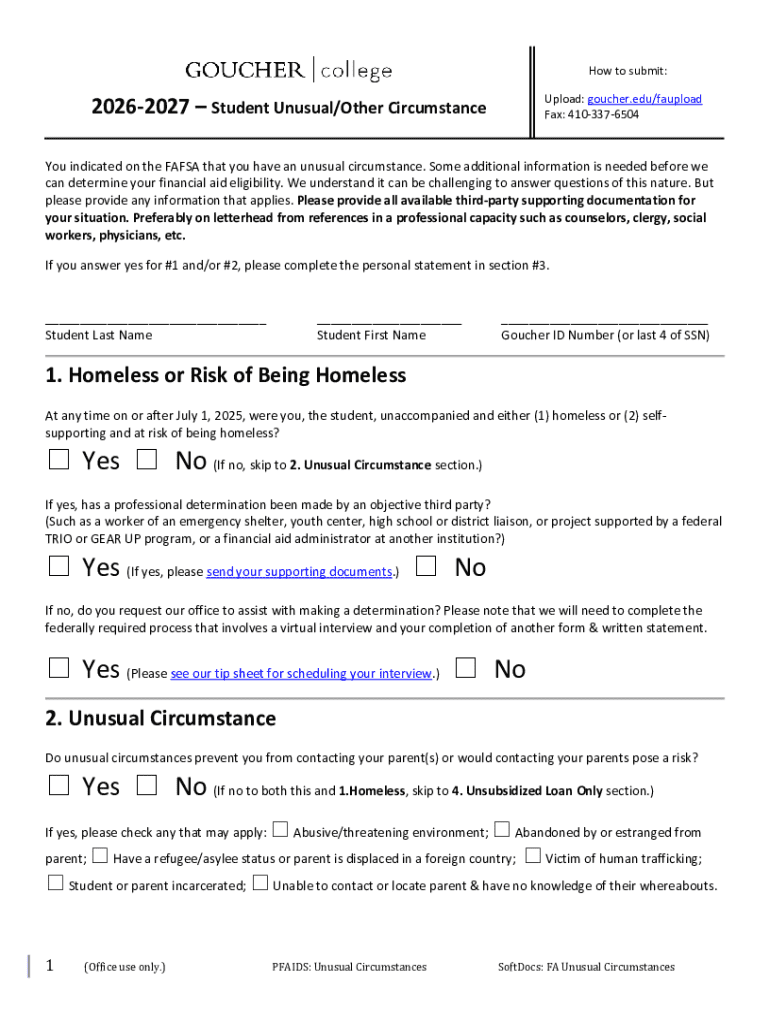

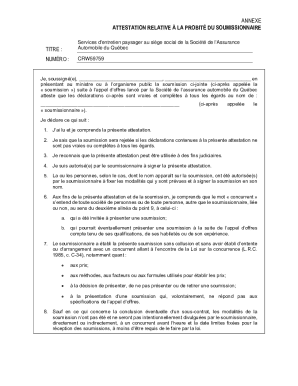

FAFSA corrections: Unusual situations and form guidance

Understanding FAFSA corrections

FAFSA corrections refer to modifications made to the Free Application for Federal Student Aid (FAFSA) after its initial submission. This process is crucial because accurate information directly impacts a student's eligibility for federal funds and financial aid packages. Making timely corrections ensures that students receive the financial support they need for their education.

Common reasons for making corrections include clerical errors, changes in income, or updates to family circumstances. These changes may arise due to unexpected situations, making it essential to understand how to navigate these adjustments effectively. Ensuring that FAFSA reflects the most accurate and current information can significantly influence financial decisions for many families.

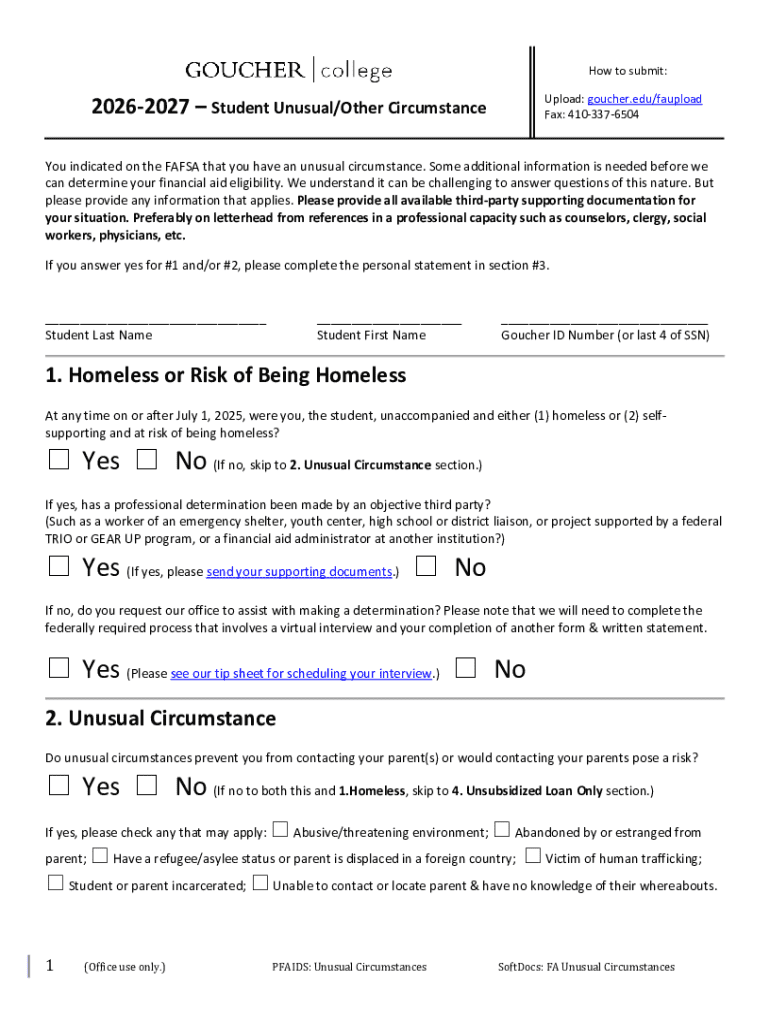

Identifying unusual corrections

An unusual correction generally refers to situations that deviate from the standard updates usually expected during the FAFSA correction process. Such scenarios can sometimes present challenges in understanding the necessary steps to take. For instance, circumstances involving dependency overrides or corrections related to identity theft are considered unusual due to their complex nature.

Special cases that require particular attention encompass diverse circumstances. Some examples include adjustments needed due to dependency overrides, a situation where a student may not meet the standard requirements of parental support, or when there's an occurrence of identity theft resulting in fraudulent FAFSA submissions. Understanding these unusual situations can help guide students and parents effectively through the correction process.

Step-by-step guide to making FAFSA corrections

Making FAFSA corrections can seem overwhelming, but following a structured approach can simplify the process. The first step involves gathering all necessary documentation. This ensures you have accurate data to support your corrections. Required documents may include tax returns, W-2 forms, and any relevant documentation related to recent changes in employment or family makeup.

Next, accessing the FAFSA form is crucial. Log into the FAFSA portal using your FSA ID, which is necessary for both students and parents. Once logged in, locate your original submission to initiate correction changes. Carefully review the sections needing updates, and be sure to follow specific instructions for any unusual corrections. This may require providing additional documentation or supporting letters, particularly in cases involving dependency overrides or identity theft.

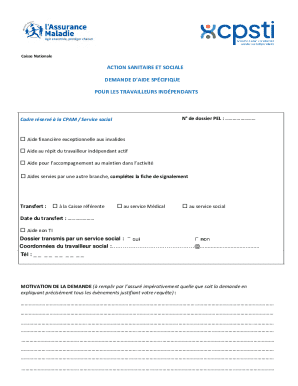

Special circumstances requiring advanced solutions

In some cases, students may need to seek professional judgment due to unusual financial circumstances. This refers to a process by which financial aid administrators at educational institutions possess the flexibility to override standard financial aid eligibility criteria based on unique circumstances that affect a student's financial status.

To request a professional judgment review, students typically must demonstrate special circumstances, such as recent job loss or unexpected medical expenses that have substantially altered their financial situation from what the FAFSA reflects. Documentation supporting these claims will be essential, and students should be prepared to provide detailed evidence to their financial aid office.

Handling discrepancies and verification issues

When discrepancies arise, it is critical to identify conflicting information within the FAFSA itself. Common misunderstandings often stem from incorrect figures related to income or asset values. If you notice such discrepancies, take action immediately by revisiting the specific sections and ensuring that the information aligns with official tax documents.

Verification issues can also present challenges. If the Department of Education flags your application for verification, you'll need to respond promptly to verification notices. This typically involves submitting required documents such as tax transcripts or proof of income. Resolving these issues in a timely manner is crucial as it can impact processing times and eligibility for financial aid.

Resources and support

Utilizing interactive tools can significantly simplify the process of managing FAFSA corrections. One useful resource is pdfFiller, which offers document management capabilities, allowing users to fill out, edit, and e-sign forms quickly and securely from any device. Using such tools can lead to greater accuracy as you navigate through the correction process.

Additionally, accessing help from your financial aid office can make a significant difference. Financial aid professionals can provide guidance on the specifics of your situation and assist you in understanding the correction process better. Regular follow-ups on any submitted corrections can ensure that your application is continuously reviewed and processed in a timely manner.

Best practices for managing your FAFSA information

To ensure that your FAFSA information remains accurate and up to date, regular updates are essential. It is advisable to review your FAFSA annually or after any significant life event. Keeping a close eye on personal information and family circumstances can help preempt any errors that might arise, reducing the stress associated with last-minute corrections.

Moreover, meticulous record-keeping of all changes made to your FAFSA can ensure consistency and reliability. Understanding the impact of corrections on your financial aid is crucial, as adjustments to income or family size can alter your eligibility for grants, loans, or other types of aid. Being proactive is essential in navigating these facets of financial aid.

Conclusion

Accurate FAFSA submissions are essential for securing the necessary funds for educational pursuits. Understanding the intricacies of FAFSA corrections, especially in unusual situations, prepares students and their families to tackle challenges proactively. Seeking guidance from resources such as pdfFiller can provide additional support in managing these forms effectively.

Encouragement exists to reach out for help when needed. Navigating the financial aid landscape can be daunting, but with the right tools and resources, ensuring the success of your educational financing is achievable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fafsa corrections unusual and in Gmail?

How can I modify fafsa corrections unusual and without leaving Google Drive?

How do I fill out fafsa corrections unusual and on an Android device?

What is fafsa corrections unusual and?

Who is required to file fafsa corrections unusual and?

How to fill out fafsa corrections unusual and?

What is the purpose of fafsa corrections unusual and?

What information must be reported on fafsa corrections unusual and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.