Get the free w4 form 2022: fillable & printalbe blank pdf ... - cocodoc

Get, Create, Make and Sign w4 form 2022 amp

Editing w4 form 2022 amp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w4 form 2022 amp

How to fill out w4 form 2022 amp

Who needs w4 form 2022 amp?

Understanding the W-4 Form 2022: Your Comprehensive Guide

Understanding the W-4 form: A comprehensive overview

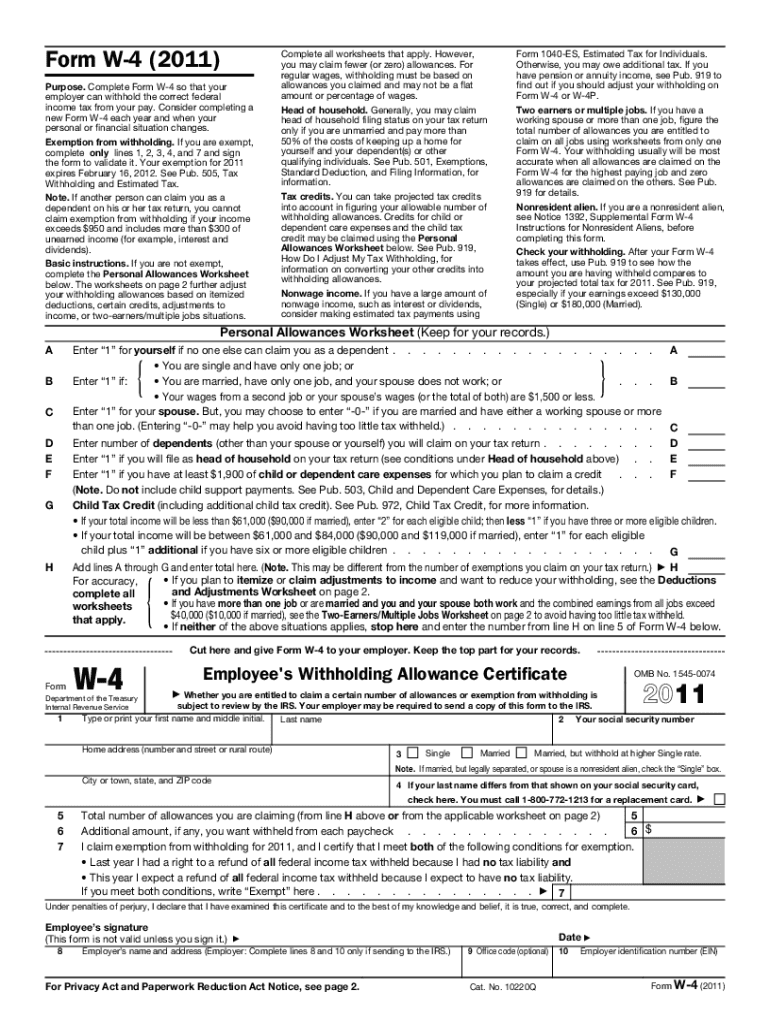

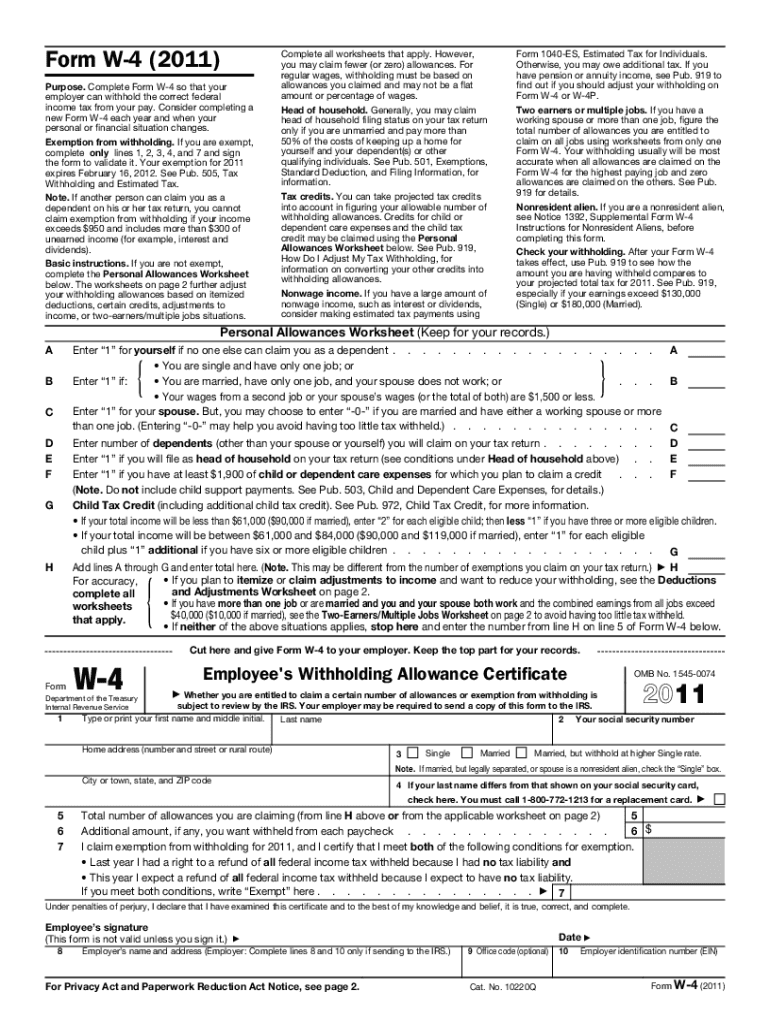

The W-4 form, officially known as the Employee's Withholding Certificate, is a crucial document provided by the IRS that allows employees to communicate their tax withholding preferences to their employers. It plays a significant role in ensuring that the right amount of federal income tax is withheld from your paycheck. By accurately completing this form, you can influence your tax refund or liability when filing your annual tax return.

In 2022, significant changes were introduced to the W-4 form, reflecting ongoing efforts by the IRS to adapt to changing tax laws and provide clearer guidance for taxpayers. These adjustments aim to simplify the withholding process while ensuring that individuals accurately report their financial situations.

Step-by-step guide to filling out the W-4 form

Completing the W-4 form can feel overwhelming, but breaking it down into sections simplifies the process significantly. Below, we’ll guide you through each section in detail.

Section 1: Personal information

Start by entering your name, address, and Social Security number. This information is vital as it identifies you for tax purposes and ensures the IRS can match your records correctly.

Section 2: Filing status

You must select your filing status: single, married filing jointly, married filing separately, or head of household. This choice significantly impacts your tax rate and withholding calculations.

Section 3: Dependents

In this section, you can claim dependents, which can exempt you from higher withholding rates. Make sure to consult IRS guidelines to determine the eligibility of your dependents.

Section 4: Other adjustments

This section allows you to account for other income, such as interest or dividends, which could affect your tax liability, along with expected deductions. Be sure to provide accurate figures to avoid discrepancies down the line.

Section 5: Signature and date

Finally, remember to sign and date the form. This step is crucial, as the W-4 is an official IRS document, and your signature confirms the information you've provided is accurate.

Exploring the components of the W-4 form

The W-4 form consists of several key sections that provide your employer with the necessary information for accurate tax withholding. Understanding each component can aid in efficient completion.

Understanding federal tax withholding

Federal tax withholding is the process where employers deduct a portion of an employee's salary to pay their income taxes directly to the IRS. This withholding is based on the information provided in your W-4 form and is designed to help taxpayers avoid owing a significant tax bill when filing their returns.

Your W-4 impacts your withholding amounts significantly. The more dependents you claim or other deductions you report, the less tax is withheld from each paycheck. Conversely, if you have additional income not subject to withholding, like interest or self-employment earnings, you may want to adjust your W-4 to ensure enough is withheld overall.

It's important to regularly assess your W-4 as salary changes or life events can affect your tax liability. Regularly reviewing your withholding can help minimize surprises: either a tax bill or an exorbitant refund.

Adjusting your W-4 for life changes

Life changes such as marriage, new jobs, or the birth of a child often warrant an update to your W-4 form. These events can significantly impact your tax situation, and timely adjustments can help you avoid owing taxes or receiving a smaller refund than expected.

For example, after getting married, you might want to change from single to married status to lower your withholding amount. Likewise, having a child allows you to claim additional dependents, which again lowers your taxable income and potentially increases your refund.

Common questions about the W-4 form

Navigating tax forms can lead to many questions. Here are some common inquiries regarding the W-4 form.

Tax planning and your financial strategy

The W-4 form is not just a tool for tax withholding; it's an integral part of your overall financial strategy. By managing your withholding appropriately, you can align your financial goals with effective tax planning.

Consider consulting a financial advisor to tailor your W-4 to your unique situation. This planning can aid in minimizing tax liabilities over the long term, positioning you to maximize savings and investments instead of losing money to unforeseen tax debts.

Navigating challenges and avoiding mistakes

Filling out the W-4 form may seem simple, but many make common errors that can lead to serious issues down the road. Recognizing these pitfalls early can save you from significant headaches come tax time.

Among the typical mistakes are miscalculating the number of dependents, failing to update life changes, and not providing a signature. It's critical to review your form carefully before submission.

Utilizing pdfFiller for W-4 form management

Managing the W-4 form doesn’t have to be a hassle, especially with tools like pdfFiller. This platform enables seamless document management, making it easier to fill out, sign, and edit your W-4 form digitally, ensuring you can access it anywhere.

With pdfFiller's interactive tools, you can make necessary adjustments, share your form with employers or advisors, and store it securely in the cloud. This eliminates the stress of physical paperwork and provides peace of mind in tracking your tax status, important as income taxes can significantly impact your finances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in w4 form 2022 amp without leaving Chrome?

Can I create an electronic signature for the w4 form 2022 amp in Chrome?

Can I edit w4 form 2022 amp on an iOS device?

What is w4 form 2022 amp?

Who is required to file w4 form 2022 amp?

How to fill out w4 form 2022 amp?

What is the purpose of w4 form 2022 amp?

What information must be reported on w4 form 2022 amp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.