Get the free Why does the FA take forever to process fafsa special ...

Get, Create, Make and Sign why does form fa

How to edit why does form fa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out why does form fa

How to fill out why does form fa

Who needs why does form fa?

Why Does Form FA Form: A Comprehensive Guide

Understanding Form FA: An overview

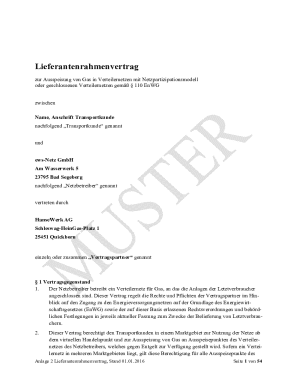

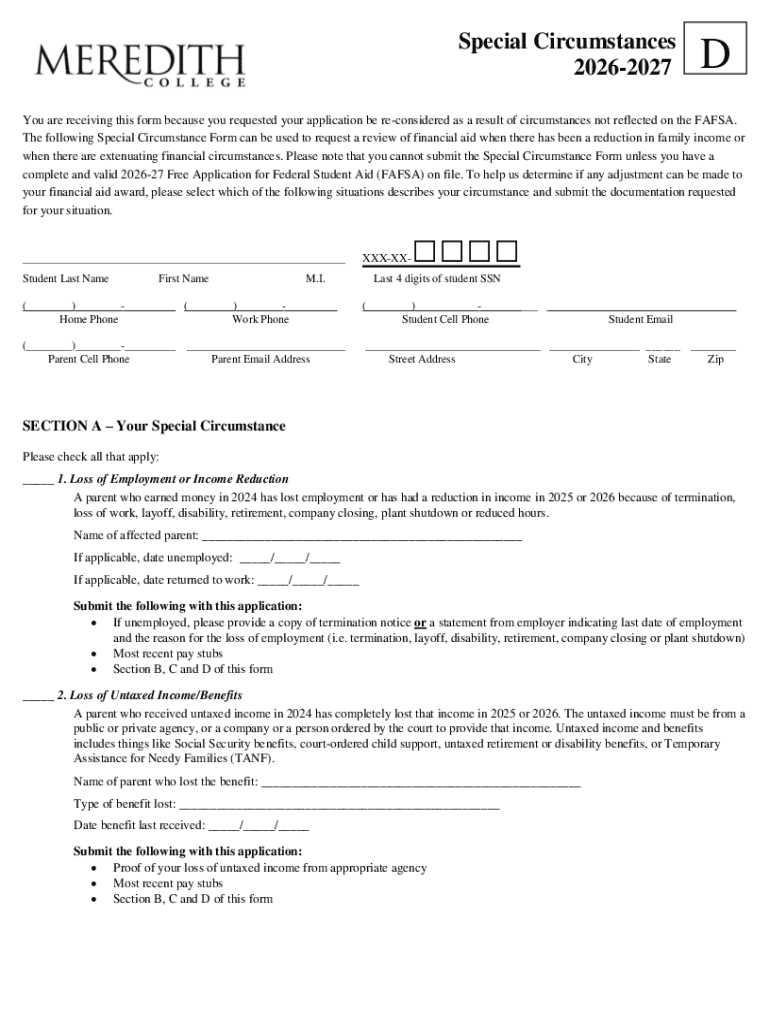

Form FA, or the 'Financial Disclosure Form', is a critical document used primarily in tax compliance and various other financial contexts. Its main purpose is to ensure that individuals and entities report their financial status accurately, allowing for a transparent assessment of their fiscal responsibilities. For countries with intricate tax policies, such as the United States and others with diverse immigration frameworks, submitting Form FA is essential for adherence to regulations.

Despite its importance, misconceptions about Form FA abound. Some may believe that it’s only necessary for high-net-worth individuals or businesses; however, anyone who has financial dealings that could affect their tax obligations might need to fill out this document. Ultimately, understanding Form FA can demystify many processes related to financial reporting and compliance.

Key reasons to use Form FA

Submitting Form FA isn't just about following the rules; it's fundamental to several aspects of financial clarity and legality. Here are some key reasons for its necessity:

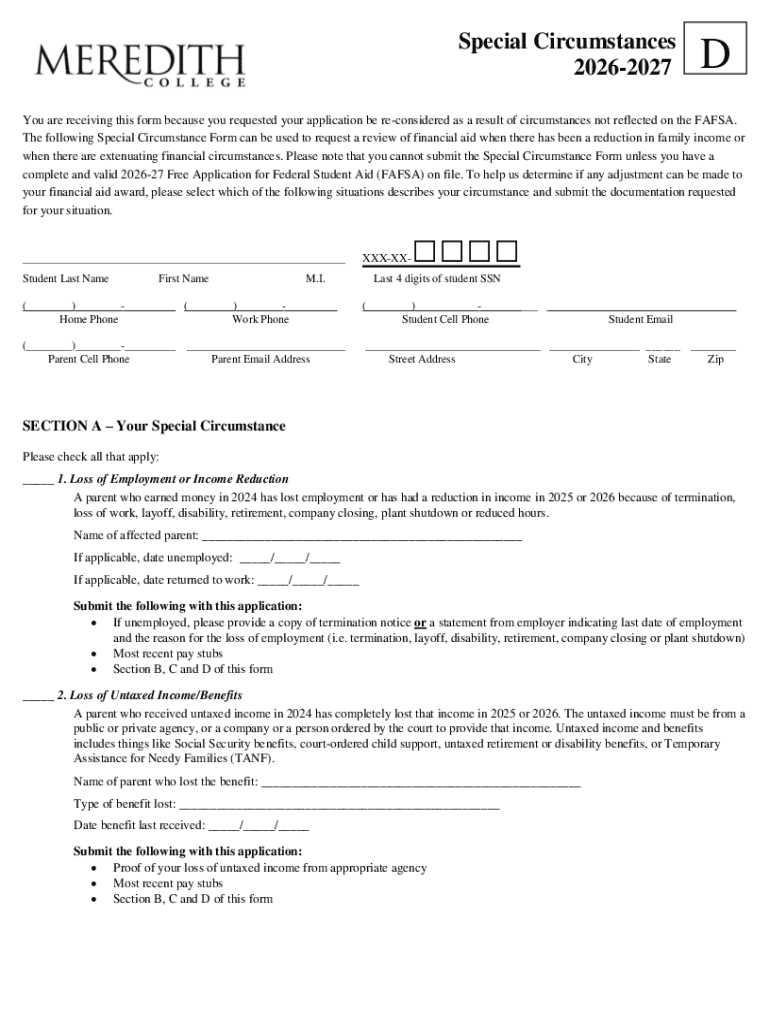

The specifics of Form FA

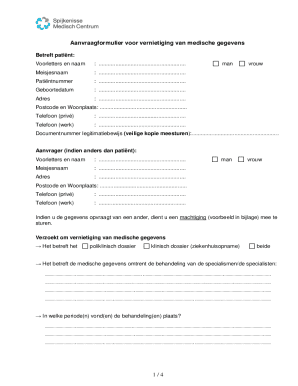

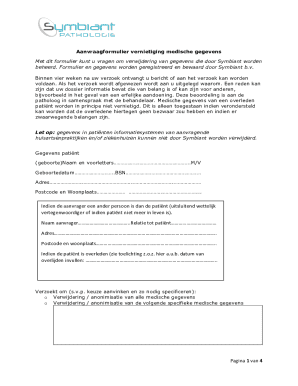

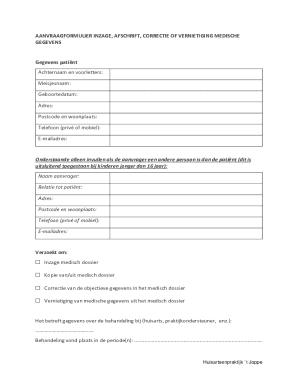

Understanding the specifics of Form FA is crucial for effective completion. The form includes various sections dedicated to different financial aspects, including income, assets, liabilities, and expenditures. Each section serves a different purpose, ensuring that every financial activity is accounted for.

Common pitfalls in filling out Form FA include errors such as missing signatures, incorrect figures, and failure to provide adequate supporting documentation. It is essential to carefully review the form and understand what information is required for each section to avoid delays and complications in processing.

Step-by-step instructions to fill out Form FA

Step 1: Gather required information

Before filling out Form FA, gather all necessary documents. This list typically includes:

Step 2: Fill out the form

When filling out Form FA, proceed section by section. Ensure that all required fields are completed accurately. If you need help understanding specific terms or sections, consult with a financial advisor.

Step 3: Review and verify

Once completed, take the time to review the entire form thoroughly. Use the following checklist to ensure accuracy before submission:

Interactive tools for Form FA management

Using pdfFiller can significantly simplify the process of managing Form FA. The platform offers an array of interactive tools that streamline the form-filling process. For instance, users can easily edit PDF files with user-friendly features, making corrections seamless and efficient. Additionally, pdfFiller allows teams to collaborate on Form FA, ensuring multiple team members can work together on the same document in real time.

Moreover, with e-signing capabilities, users can sign documents electronically, reducing the time spent on physical paperwork. This not only speeds up the process but also adds a layer of convenience and security.

Common questions regarding Form FA

One of the best ways to address user concerns about Form FA is to compile frequently asked questions. Here are some common inquiries:

Troubleshooting issues with Form FA

Encountering issues while filling out Form FA? Here are common problems and their resolutions:

For additional support, reach out to your local immigration or tax authority for guidance on complicated cases.

Enhancing user experience with pdfFiller

Managing Form FA with pdfFiller provides various benefits that improve the user experience. The platform is designed with the user in mind, offering intuitive navigation and a seamless document management system that allows users to keep everything organized in one place. Testimonials from users highlight how pdfFiller has simplified their form management processes, emphasizing the speed and efficiency with which they can edit, sign, and submit forms.

Case studies demonstrate the value pdfFiller brings to individuals and teams. Users report time savings of up to 50% when using the platform for their document creation and management tasks. This not only enhances productivity but also fills participants with greater confidence when dealing with essential documentation like Form FA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete why does form fa online?

Can I create an eSignature for the why does form fa in Gmail?

How do I edit why does form fa on an iOS device?

What is why does form fa?

Who is required to file why does form fa?

How to fill out why does form fa?

What is the purpose of why does form fa?

What information must be reported on why does form fa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.