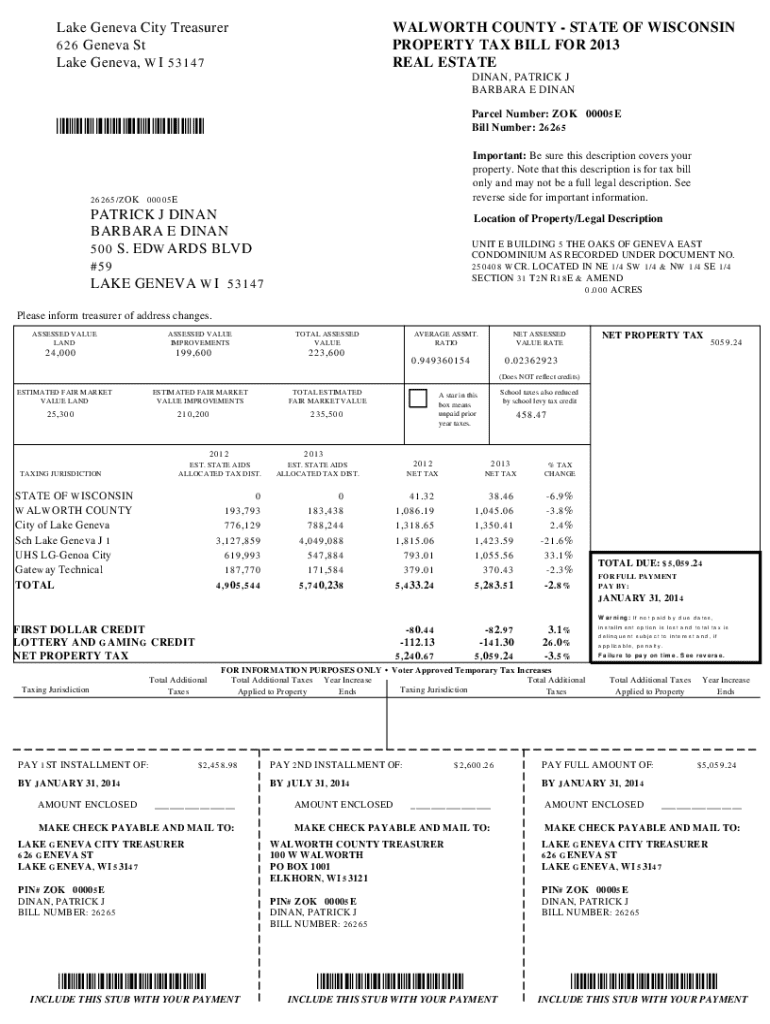

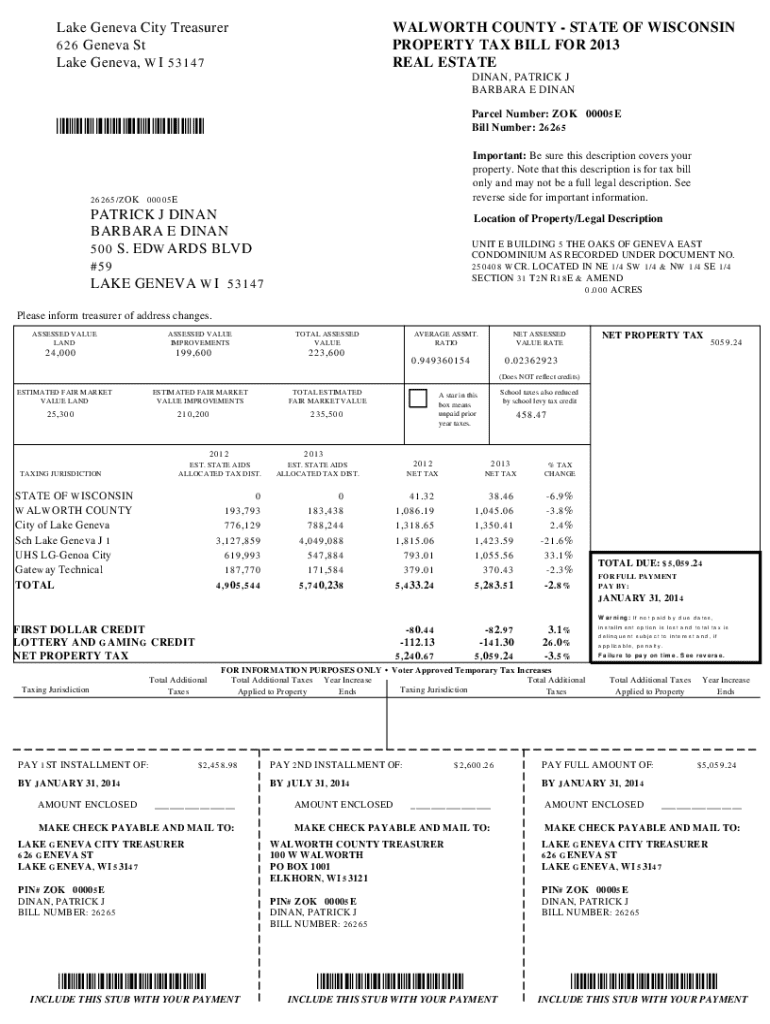

Get the free 2013 Tax Bill, City of Lake Geneva, Parcel ZOK 00005E

Get, Create, Make and Sign 2013 tax bill city

Editing 2013 tax bill city online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2013 tax bill city

How to fill out 2013 tax bill city

Who needs 2013 tax bill city?

Comprehensive Guide to the 2013 Tax Bill City Form

Overview of the 2013 Tax Bill City Form

The 2013 Tax Bill City Form is a crucial document for individuals and businesses required to report their tax obligations to local city authorities. This form serves multiple purposes, including calculating income taxes, reporting deductions, and ensuring compliance with local tax regulations. For taxpayers, understanding this form is essential to avoid penalties and maximize potential refunds.

Accurate tax reporting is fundamental for both individuals and businesses. Failing to provide correct information can lead to fines, audits, and even legal issues. Therefore, knowing the specifics of the 2013 Tax Bill is vital. Key changes in 2013 included adjustments in income tax rates and new credits that taxpayers could leverage to reduce their overall tax liabilities.

Eligibility requirements

The 2013 Tax Bill City Form must be utilized by residents of the city, as well as any business entities operating within city limits. If you earned income in a city where you reside or where your business is situated, you likely need to fill out this form. Special cases might include temporary residents or those working out of state; understanding these nuances is critical for compliance.

Certain exceptions apply. For example, individuals with only a small amount of incidental income may not need to file. Moreover, students or military personnel may have unique circumstances influencing their need to submit this form. To accurately complete the form, gather all necessary documentation such as W-2 forms, 1099s, and other relevant income statements.

Step-by-step instructions for completing the 2013 tax bill city form

Completing the 2013 Tax Bill City Form is straightforward if you follow a structured approach. Begin by gathering all necessary documentation, including W-2 forms, receipts, and other records of income and deductions. Understanding the form's layout will make it easier to fill out correctly.

Preparing to fill out the form

Prepare your tax documents meticulously. Ensure you have every financial document ready, from employment income to deductions for mortgage interest or education. Familiarize yourself with the form's structure to anticipate what information you'll need. This preparation helps prevent errors and speeds up the process.

Detailed walkthrough of form sections

Start by filling out your personal information, such as name, address, and Social Security number. Accurately report your income by categorizing it into appropriate sections, including wages, business income, and dividends. Next, enter any eligible deductions and credits to optimize your tax liability.

Lastly, do not forget to complete the signature and date sections. This final step is critical, as an unsigned form may be considered invalid or delayed in processing.

Common mistakes to avoid

Tax forms can be complex, and common errors can cause significant issues. One of the most prevalent mistakes is missing deadlines, which could result in penalties. Ensuring that you understand the deadlines for submitting the 2013 Tax Bill City Form is essential for compliance.

Another frequent mistake is misreporting income. It's important to accurately reflect all sources of income, as incorrect reporting can lead to audits and fines. Additionally, errors in claiming deductions can lead to a smaller refund or potential liability. Finally, failing to sign the form may render it invalid, so never overlook the importance of authentication.

Editing and managing your 2013 tax bill city form

Editing your 2013 Tax Bill City Form is made easy with pdfFiller's intuitive features. You can easily modify text, add comments, or correct errors directly within the document. This ability to edit ensures that all information is accurate before final submission.

After completing the form, securely save and store it. Utilize cloud storage solutions to maintain easy access and protect sensitive information. It's important to have a backup in case you need to refer to it in the future or in case of an audit.

Collaborating with others on your 2013 tax bill city form

Collaboration is key when managing your 2013 Tax Bill City Form, especially for business entities. With pdfFiller, you can invite team members for review and input, facilitating efficient teamwork. This collaborative approach ensures that multiple perspectives contribute to the accuracy of the form.

Furthermore, pdfFiller's version control features allow you to track changes made by collaborators, making it simple to see edits and suggestions over time. Sharing the form via secure links is not only safe but also user-friendly, ensuring all relevant parties can access the document with ease.

eSigning the 2013 tax bill city form

In today’s digital age, eSigning your 2013 Tax Bill City Form has grown in importance. An electronic signature is often legally recognized, facilitating quicker submission and enhancing efficiency. With pdfFiller, you have a streamlined process for eSigning your document effortlessly.

Step-by-step, you can use pdfFiller's eSigning features to place your signature directly onto the form. Additionally, the security measures implemented by pdfFiller ensure that your signed documents are protected from unauthorized changes, providing peace of mind.

Additional forms related to the 2013 tax bill

Often, completing the 2013 Tax Bill City Form may require additional documents. Understanding what supplementary forms you might need is critical for successful tax filing. These can include forms for reporting specific deductions, adjusting withholdings, or declaring special credits.

Access additional forms through pdfFiller, which organizes and provides links to necessary supplementary documents. It’s essential to file these forms in parallel to avoid delays in processing your 2013 Tax Bill City Form.

Resources for further assistance

When navigating the complexities of the 2013 Tax Bill City Form, resources for assistance are invaluable. Reach out to your city tax division for guidance on specific questions or issues you encounter. They can provide up-to-date information and clarification on local tax policies.

Additionally, online tax filing tools provide resources and FAQs that can address common queries. Familiarizing yourself with these resources will empower you to resolve any issues that arise during the tax filing process.

Navigating the local tax landscape

Understanding the local tax landscape is key for individuals and businesses alike when completing the 2013 Tax Bill City Form. Various business taxes and licenses may impact your filing, and staying abreast of changes in local tax policies is essential for compliance and optimal reporting.

Awareness of tax law changes can also benefit strategic planning for individuals and businesses. Engaging with local tax experts or reading up on city tax-related topics helps ensure you're well-informed of new incentives, deductions, or credits that may arise.

Language support and accessibility options

The 2013 Tax Bill City Form maintains inclusivity through language support and accessibility features. It is designed to be accessible for non-English speakers, allowing them to engage with local tax processes comfortably.

If specific language translations are required, inquire with your local tax authority about available resources. Moreover, pdfFiller offers accessibility features that ensure those with disabilities can easily complete the form and engage with vital tax information.

Social media connections for ongoing support

Leverage social media for resources and updates related to your 2013 Tax Bill City Form. Engaging with tax experts and communities on platforms like Facebook, Twitter, and LinkedIn can provide valuable insight and support throughout the filing period.

Follow your local tax authority on social media to receive real-time updates, announcements, and informational resources that may impact your tax filing experience. Interacting with expert-led online communities could also yield helpful tips and shared experiences from peers going through the tax process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2013 tax bill city to be eSigned by others?

How do I execute 2013 tax bill city online?

How do I edit 2013 tax bill city in Chrome?

What is 2013 tax bill city?

Who is required to file 2013 tax bill city?

How to fill out 2013 tax bill city?

What is the purpose of 2013 tax bill city?

What information must be reported on 2013 tax bill city?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.