Get the free S.45 - Small Business Tax Fairness and Compliance ...

Get, Create, Make and Sign s45 - small business

How to edit s45 - small business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out s45 - small business

How to fill out s45 - small business

Who needs s45 - small business?

s45 - Small Business Form: A Comprehensive Guide

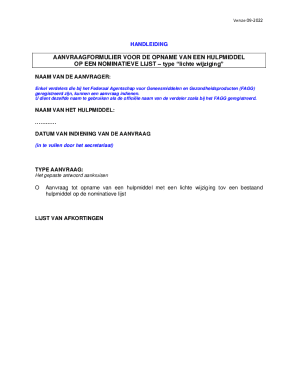

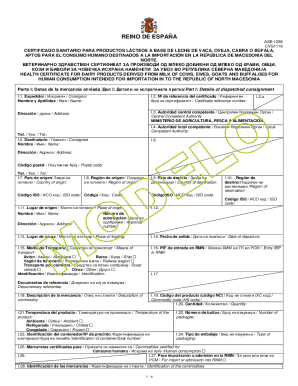

Understanding the s45 Small Business Form

The s45 Small Business Form is a pivotal document designed specifically for small businesses navigating various regulatory requirements. It serves as a formal notice to the appropriate authorities regarding important business details, allowing governments and agencies to maintain accurate records and facilitate streamlined processes. The importance of this form cannot be overstated, as it often plays a critical role in securing funding, compliance with local laws, and ensuring eligibility for various programs and tax benefits.

Eligibility criteria for completing the s45 form typically includes any small business owner or representative handling official documentation intended for government offices. Common scenarios necessitating the use of this form encompass business registrations, updates on business status, or notifications regarding changes, such as ownership alterations or operational focus.

Navigating the s45 Small Business Form

When navigating the s45 Small Business Form, it’s essential to understand its various sections. The form typically starts with header information, which includes the business’s name, address, and contact details. Following that, you'll need to provide small business identification data, which may include business registration numbers and tax IDs, ensuring a comprehensive identity profile. Finally, the financial and operational details section will request information such as revenue estimates, number of employees, and the business's operational focus.

To fill out the s45 form accurately, here are some tips to avoid common pitfalls: Double-check all fields for clarity and completeness to avoid delays in processing. Ensure alignment with existing business registrations or previous filings. Regularly referring to relevant regulatory updates can help maintain compliance with evolving standards.

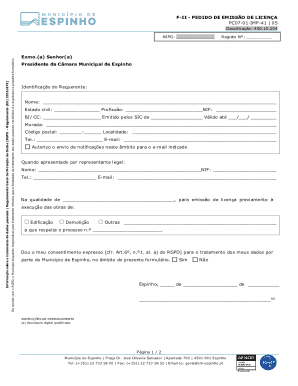

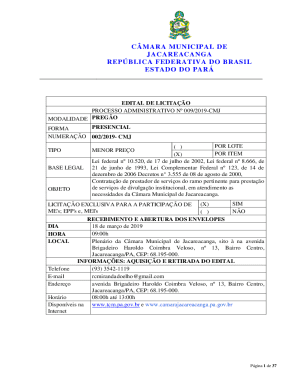

Filling out the s45 Small Business Form effectively

Completing the s45 Small Business Form requires careful preparation and organization. The first step involves gathering the necessary documents and information, including licenses, tax records, and identification numbers. This preparatory phase ensures a smoother filling process. When initiating the filling process, careful attention to each section is vital.

Detailed instructions for each section include collecting required information from businesses like ownership details and operational data. Optional fields can often enhance the value of your submission; however, it’s advisable to assess whether adding additional information serves a clear purpose. Striking a balance between comprehensive data and essential requirements is key.

Editing and customizing the s45 Small Business Form

Editing the s45 Small Business Form can greatly enhance your document’s effectiveness. Using pdfFiller, you can seamlessly upload the form and leverage robust features for document editing. The platform supports digital editing, allowing changes to be made quickly and efficiently, which can save time and reduce friction in the submission process.

Additionally, customizing the form for specific business needs is straightforward. Adding logos and branding elements helps personalize your submission and presents a more professional appearance. Moreover, incorporating additional sections or notes relevant to your business can provide context that may assist the reviewing authority.

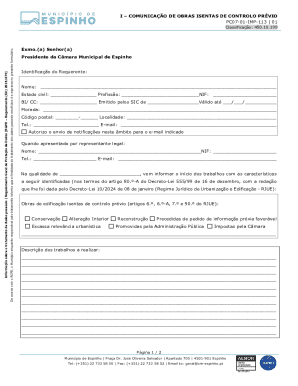

eSigning the s45 Small Business Form

Signatures hold substantial importance for the legal validity of the s45 Small Business Form. Electronic signatures ensure that the document is both binding and compliant with legal standards. pdfFiller makes the eSigning process intuitive, starting with setting up an account for eSignature. Business owners can invite additional signers if collaborative input is needed.

Once the eSignature feature is activated, navigating to the signing area of the document is seamless. After reviewing the entire form carefully, the signing process can be completed with just a few clicks.

Collaboration and document management

Sharing the completed s45 form with stakeholders is a vital step in maintaining transparency and achieving collective approval. With pdfFiller, users can securely share the document via direct links or email, ensuring that only the intended recipients have access to sensitive information. This is particularly relevant in scenarios involving multiple decision-makers or external parties.

Moreover, managing forms in the cloud alleviates concerns about document loss. It allows for organized storage, easy access, and the ability to set permissions based on user roles. This feature ensures that only authorized personnel can view or edit specific documents, enhancing overall operational security.

Frequently asked questions about the s45 Small Business Form

Common inquiries surrounding the s45 Small Business Form include dealing with potential errors or inaccuracies. If errors occur after submission, the first step is to determine if corrections can be filed officially or if a new form is required. Often, maintaining open communication with the responsible authority is beneficial in resolving any discrepancies.

Tracking the status of submitted forms can often be accomplished through online systems maintained by the submitting authority. Knowing where your document currently stands is critical for managing timelines effectively. For additional support and resources about the s45 form, pdfFiller offers extensive guidance and tutorials that can help streamline the completion process.

Best practices for small businesses utilizing the s45 form

To ensure ongoing accuracy and compliance, regular updates to business information are essential. Small business owners should set a schedule for reviewing submitted forms, particularly when there are significant operational changes or after annual reviews. Keeping updated records not only facilitates transparency but also aligns with regulatory obligations.

Integrating electronic forms into routine operations provides numerous advantages. Utilizing pdfFiller for documentation beyond just the s45 Small Business Form fosters organizational efficiency. Transitioning to digital forms encourages a more agile response to operational demands and compliance requests, ultimately benefiting the overall business model.

Real-life examples and case studies

Success stories abound among businesses that have effectively utilized the s45 form. One notable case includes a local tech startup that streamlined its funding application process by ensuring timely submissions of the s45, resulting in accelerated approval and funding access. Emphasizing efficiency in documentation can yield significantly more favorable outcomes.

Another example could be a small retail business that enhanced its compliance track record by consistently updating its s45 form, ensuring alignment with business growth and regulatory requirements. The lessons learned from these businesses illustrate that proactive management of documentation fosters smoother operations and positive relationships with regulatory authorities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute s45 - small business online?

How do I make edits in s45 - small business without leaving Chrome?

How do I edit s45 - small business on an iOS device?

What is s45 - small business?

Who is required to file s45 - small business?

How to fill out s45 - small business?

What is the purpose of s45 - small business?

What information must be reported on s45 - small business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.