Get the free Reporting a Death Claim Form

Get, Create, Make and Sign reporting a death claim

How to edit reporting a death claim online

Uncompromising security for your PDF editing and eSignature needs

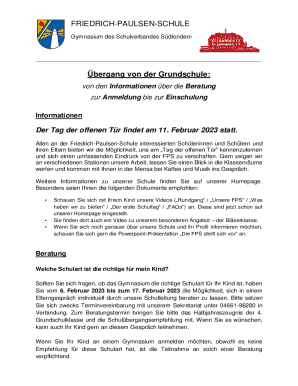

How to fill out reporting a death claim

How to fill out reporting a death claim

Who needs reporting a death claim?

Reporting a Death Claim Form: A Comprehensive How-to Guide

Understanding death claims

A death claim refers to the process of filing a request for benefits after the death of an insured individual. This could involve collecting funds from life insurance policies, employer benefits, and even funeral expenses. Understanding the nuances of death claims is crucial, as the process can be emotionally demanding for the survivors, but knowing what to expect can alleviate some stress.

There are several types of death claims, each serving different scenarios. The most common include life insurance claims, where the beneficiaries receive a payout upon the policyholder's death, employee benefits claims, which offer financial support through workplace-provided benefits, and funeral expense claims that cover costs associated with burial and memorial services.

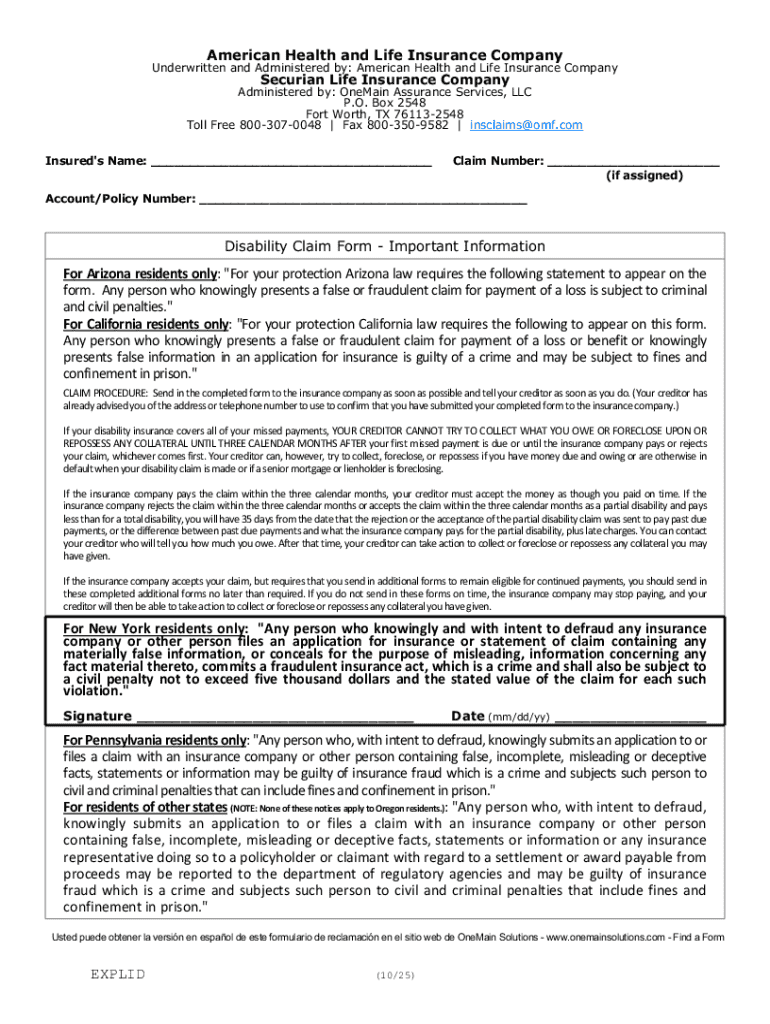

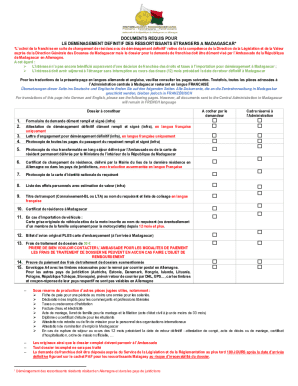

Key components of a death claim form

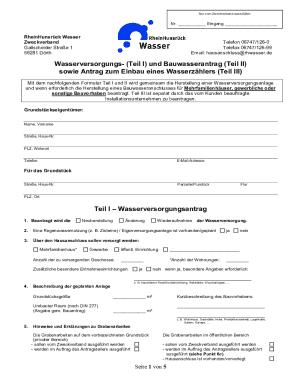

When reporting a death claim, it’s essential to complete the death claim form with accurate information. The key components include details about the deceased, such as their full name, date of birth, and policy number. The claimant, or the person filing the claim, must provide their relationship to the deceased along with their contact information.

Additionally, documentation such as the dead certificate, any relevant medical records, and proof of identity for the claimant will typically be required.

Step-by-step guide to reporting a death claim

The process of reporting a death claim can be streamlined by following a few important steps. First, gather all the required documentation as noted. Second, fill out the death claim form with precise information to avoid delays. Third, submit the claim either online or via traditional mail, and finally, follow up after submission to check your claim's status.

Understanding the lifeline: Checking the status of a death claim

Checking the status of your death claim is essential to ensure it is being processed. Most insurance companies provide online tools to track the status of claims. Alternatively, contacting customer service for updates can provide peace of mind and clarify any doubts.

If your claim is denied, understand the reasons behind the decision. Common reasons include discrepancies in the information provided or missing documentation. It’s advisable to keep a detailed record of all correspondence and appeal the decision promptly if needed.

Specific considerations for different situations

Different situations may require unique approaches when reporting a death claim. For instance, if you are filing as an employee or family member, specific forms may differ based on your relationship to the deceased. It’s also worth noting how to handle multiple policies or beneficiaries. Each beneficiary must be acknowledged according to their respective claims, which can complicate the process slightly.

Navigating common challenges

The path to processing a death claim can be fraught with challenges, such as delays or discrepancies in claim information. Addressing these issues involves maintaining clear and open communication with the insurer. Familiarize yourself with common complications in the process to anticipate potential issues.

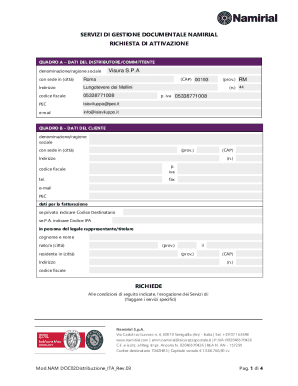

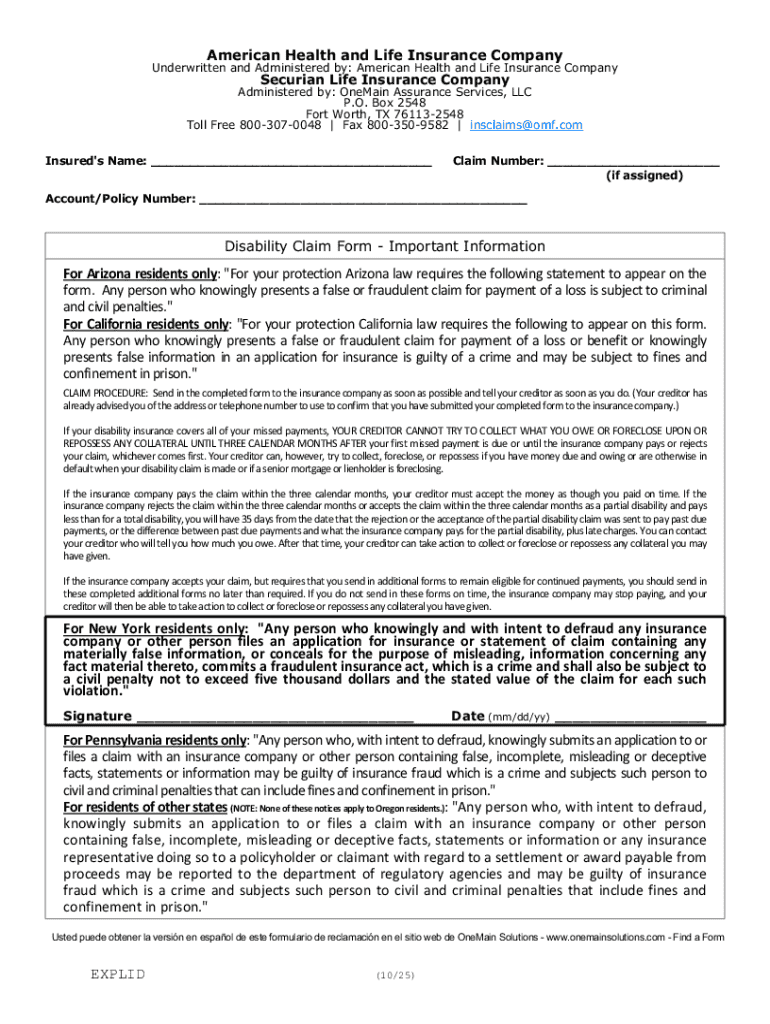

Utilizing pdfFiller for enhanced document management

Utilizing pdfFiller can streamline the process of reporting a death claim form. This powerful tool allows users to edit PDFs, eSign, and collaborate, making it easier can manage necessary documents efficiently. The platform supports real-time collaboration, which is crucial when several beneficiaries are involved.

Conclusion: Empowering you through the claims process

The journey of reporting a death claim form can seem overwhelming, but this guide serves to simplify the process. With proper preparation and a clear understanding of each step, you’ll navigate the complexities of filing a death claim with confidence. Utilize the resources available through pdfFiller to aid you in this critical time.

Remember, taking proactive steps early in the process can ensure a smoother experience. Keep all necessary documents organized and maintain communication with your insurer for updates. Empowering yourself through knowledge will ease the burden during this challenging period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete reporting a death claim online?

How do I edit reporting a death claim online?

Can I edit reporting a death claim on an Android device?

What is reporting a death claim?

Who is required to file reporting a death claim?

How to fill out reporting a death claim?

What is the purpose of reporting a death claim?

What information must be reported on reporting a death claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.