Get the free HSA Employer Application & Contribution Form

Get, Create, Make and Sign hsa employer application amp

Editing hsa employer application amp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hsa employer application amp

How to fill out hsa employer application amp

Who needs hsa employer application amp?

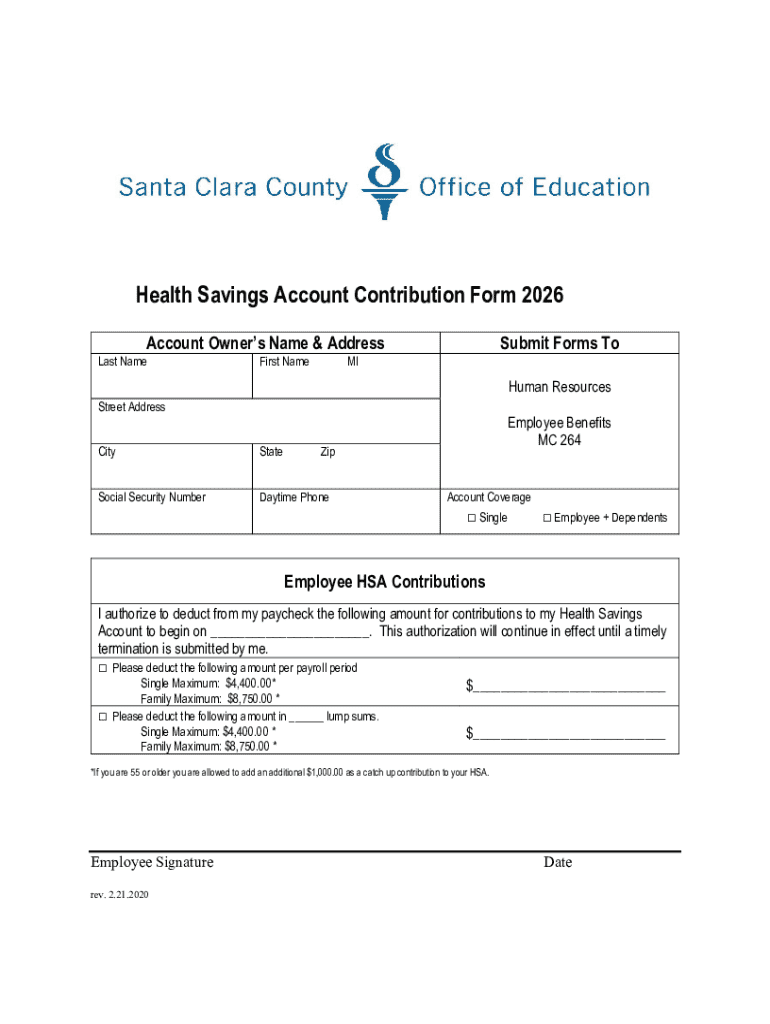

Understanding the HSA Employer Application AMP Form

Understanding HSA employer application AMP form

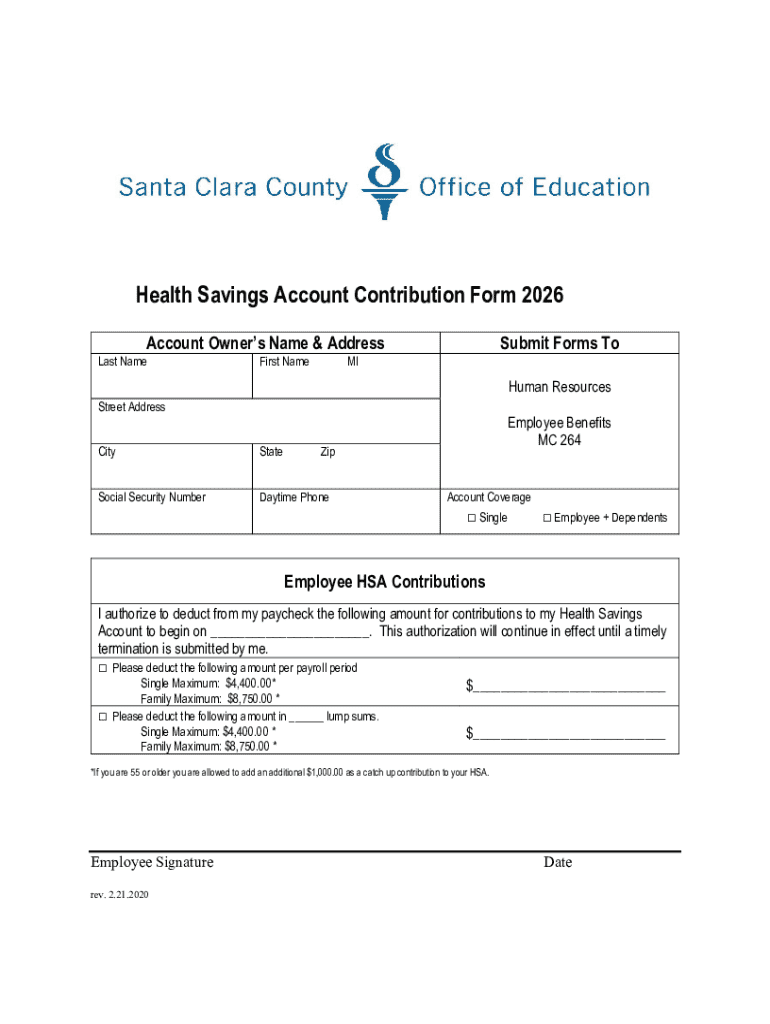

A Health Savings Account (HSA) serves as a tax-advantaged savings account that allows individuals to set aside funds for medical expenses. HSAs offer a unique financial opportunity, particularly for those enrolled in high-deductible health plans, enabling them to contribute pre-tax money for qualified healthcare costs. When it comes to HSAs, employers play a significant role in the administration and management of these accounts, ensuring that their employees can take full advantage of the associated benefits.

The HSA employer application AMP (Application Management Process) form is crucial for organizing employee accounts and documenting their contributions effectively. This form not only streamlines the setup process for new HSAs but also ensures compliance with IRS regulations, making it an essential tool for both employers and employees.

Components of an HSA employer application AMP form

The HSA employer application AMP form includes several critical pieces of information that facilitate the proper setup and management of health savings accounts. Primarily, the form requires specific information from employees, which can typically be categorized as follows:

Moreover, the form also requires information from the employer, which typically includes:

How to fill out the HSA employer application AMP form

Filling out the HSA employer application AMP form can seem daunting, but following a structured approach can simplify the process. Here’s a step-by-step guide to ensure every necessary detail is correctly filled out:

Interactive tools for HSA management

pdfFiller offers several interactive tools that can enhance the experience of managing the HSA forms. By utilizing this platform, employers can streamline the entire process from creation to submission. Notably, pdfFiller provides features such as:

Common mistakes to avoid when filling out the HSA employer application AMP form

While filling out the HSA employer application AMP form, several common pitfalls can lead to complications or delays. Here are key mistakes to be cautious of:

Understanding employer contributions to HSAs

Understanding the nuances of employer contributions to HSAs is essential for both employers and employees alike. Contributions can take various forms and have specific guidelines governing them. Here’s what you need to know:

Legal considerations for HSA employer contributions

Employers must also navigate various legal considerations when managing contributions to HSAs. Compliance with IRS regulations is paramount to avoid penalties and ensure the smooth operation of HSA programs. Key legal aspects include:

Frequently asked questions about HSA employer application AMP form

Encountering questions while managing HSAs is common for both employers and employees. Below are some frequently asked questions that provide clarity on important aspects of the HSA employer application AMP form.

Best practices for employers implementing HSA programs

To ensure a successful HSA rollout, employers should consider implementing best practices that engage and educate employees about their health savings accounts. These might include:

Conclusion

To recap, the HSA employer application AMP form is a foundational element in managing employee health savings accounts effectively. By fostering a clearer understanding of how to properly fill out this form, alongside utilizing tools like pdfFiller, employers can not only streamline the registration process but also enhance employee engagement with their benefits package. Leveraging these resources empowers employees to take full advantage of their HSAs, ultimately fostering better health and financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send hsa employer application amp for eSignature?

Can I create an eSignature for the hsa employer application amp in Gmail?

How can I fill out hsa employer application amp on an iOS device?

What is hsa employer application amp?

Who is required to file hsa employer application amp?

How to fill out hsa employer application amp?

What is the purpose of hsa employer application amp?

What information must be reported on hsa employer application amp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.