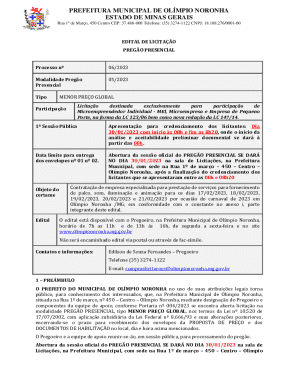

Get the free IRS Form SS-4: EIN NumberPDF

Get, Create, Make and Sign irs form ss-4 ein

How to edit irs form ss-4 ein online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form ss-4 ein

How to fill out irs form ss-4 ein

Who needs irs form ss-4 ein?

Your Complete Guide to IRS Form SS-4 EIN Form

Understanding the SS-4 form: What you need to know

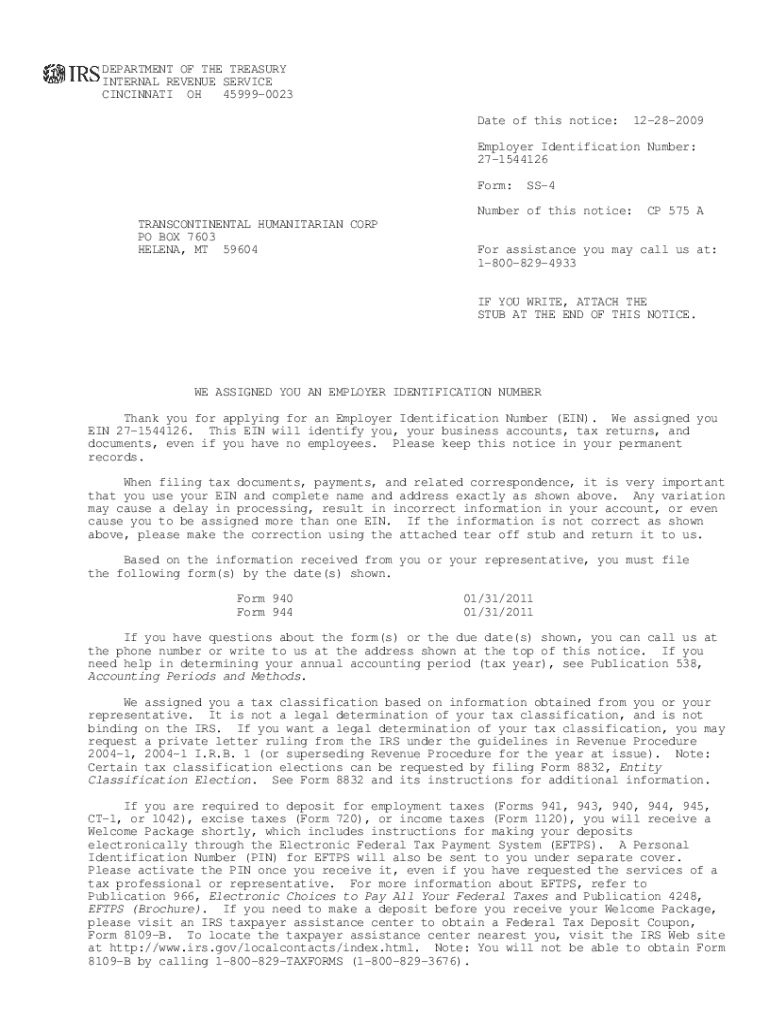

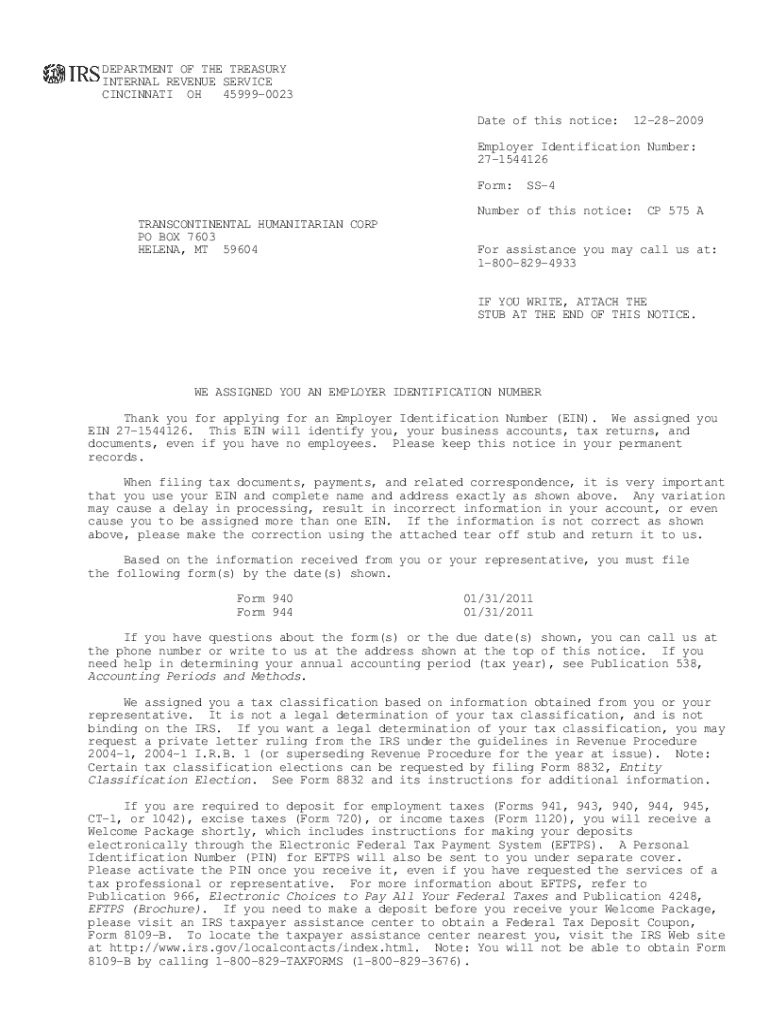

The IRS Form SS-4 is essential for businesses and individuals seeking an Employer Identification Number (EIN). This nine-digit number is assigned by the Internal Revenue Service (IRS) and is crucial for various tax-related activities. Utilizing the SS-4 form correctly ensures that your EIN request is processed smoothly.

Obtaining an EIN holds significant importance, as it identifies your business for tax purposes and helps you establish a banking relationship. Almost all businesses or organizations that have employees, operate as a corporation or partnership, or need to file certain tax returns must obtain an EIN.

A prevalent misconception is that only large businesses require an EIN. In reality, small businesses and freelancers also benefit from having an EIN, which can aid in building business credit and protecting personal information. Understanding the nuances of the IRS Form SS-4 and EINs can significantly influence your business’s financial health.

Step-by-step guide: How to fill out the IRS Form SS-4

Filling out the SS-4 form can seem daunting, but breaking down each section makes the process more manageable. The form is structured in several segments, each requiring specific information relevant to your business. Begin by providing basic information about your business, including the legal name and business address.

The second step involves selecting your entity type, which can range from an LLC to a corporation, depending on your business structure. Be sure to choose the correct designation to avoid complications. Following this, indicate the reason for applying. Common reasons include starting a new business or hiring employees.

Other crucial sections include identifying your responsible party, defining their role, and providing any specific requests, like the date your business was established. It is also advisable to keep in mind some common pitfalls when filling out the form, such as misplacing important details or choosing the wrong entity type.

How to submit your IRS Form SS-4

Once your SS-4 form is complete, the next step is to submit it to the IRS. You have three options for submission: online application, mailing the form, or faxing it in. Each method has its advantages, but submitting online is the fastest and most efficient.

When mailing the form, be sure to use the correct address based on your business location. There are specific addresses designated for various submission types. If you choose to fax, confirm that your fax machine adheres to the required specifications to avoid issues. Generally, you can expect to receive your EIN within a few days after submission.

After obtaining your EIN: A complete guide

Once you receive your EIN, it’s crucial to keep it secured. Document storage best practices are essential. This includes storing your EIN in a secure digital format and not sharing it unnecessarily to prevent identity theft. Your EIN is fundamental for various applications such as opening a business bank account or filing tax returns.

If there are any changes to your business structure, name, or location, updating your EIN is a straightforward process. Contact the IRS or use the appropriate form to inform them of any changes. In certain cases, you may need to reissue your EIN, such as when you change your business structure completely.

Troubleshooting common issues with the SS-4 form and EIN

While the IRS Form SS-4 process is generally smooth, issues can occasionally arise. If you find discrepancies in your EIN, it's important to contact the IRS immediately to correct them. If you haven't received your EIN within the anticipated time frame, contacting the IRS can provide clarification on your application status.

Furthermore, if you notice any errors on your application, the IRS allows you to amend your SS-4 application by following established procedures. Keeping abreast of changes with your EIN is vital for effective business management.

Additional insights: The importance of your EIN for business growth

Having an EIN is more than just a number; it enhances your business's credibility. Clients and vendors often feel more secure doing business with registered entities, knowing there is an identification number linked to the IRS. Furthermore, your EIN is crucial for tax reporting and banking; many banks require an EIN to open a business account.

Long-term, maintaining an EIN can significantly benefit your business expansion efforts. It allows you to acquire additional licenses, permits, and funding opportunities that require an EIN. This identification can facilitate growth both financially and in reputation.

Tools and resources for effective document management with pdfFiller

Using pdfFiller allows users to seamlessly manage their IRS Form SS-4 and any associated documents. From editing the SS-4 form post-completion to eSigning for final submission, pdfFiller simplifies document management. Users can collaborate easily, ensuring all team members are on the same page when applying for an EIN.

The benefits of utilizing pdfFiller also extend to organized document storage, which enhances efficiency during audits or tax time. Collaborative tools allow for multiple users to work on the same document, making the process more streamlined.

Stay informed: Sign up for newsletter updates

Maximizing the potential of the IRS Form SS-4 and EIN requires staying informed. Being aware of evolving IRS regulations and procedures ensures your application is always compliant. Subscribers to our newsletter receive tips, guides, and tutorials designed to enhance your document management skills.

By keeping up-to-date on changes and best practices, you'll ensure your business remains compliant and proactive in its growth strategy. Exclusive resources on document management and eSigning are also available.

FAQs: Your questions about IRS Form SS-4 and EINs answered

Navigating the world of EINs can provoke several questions, especially regarding the SS-4 form. Common inquiries often pertain to eligibility for obtaining an EIN, processing times for the application, and what to do in case of an error in the EIN issued. Directly addressing these concerns helps demystify the process.

Engaging with frequently asked questions presents an opportunity for additional insight into managing your EIN effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irs form ss-4 ein directly from Gmail?

Can I create an eSignature for the irs form ss-4 ein in Gmail?

How do I complete irs form ss-4 ein on an Android device?

What is irs form ss-4 ein?

Who is required to file irs form ss-4 ein?

How to fill out irs form ss-4 ein?

What is the purpose of irs form ss-4 ein?

What information must be reported on irs form ss-4 ein?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.