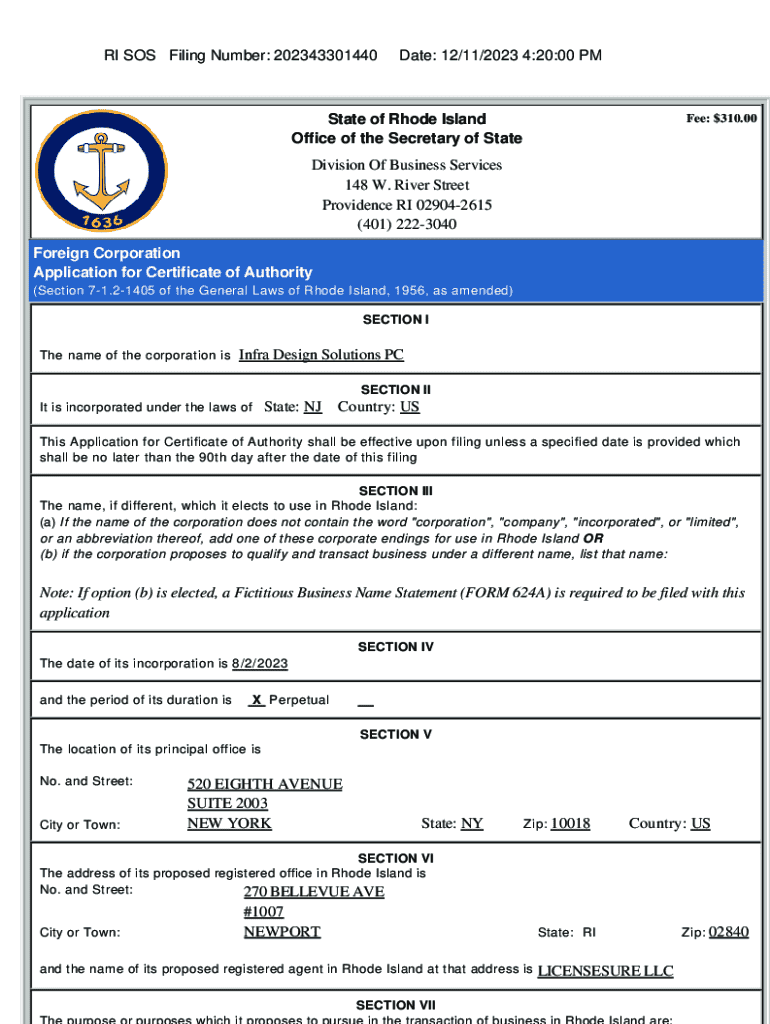

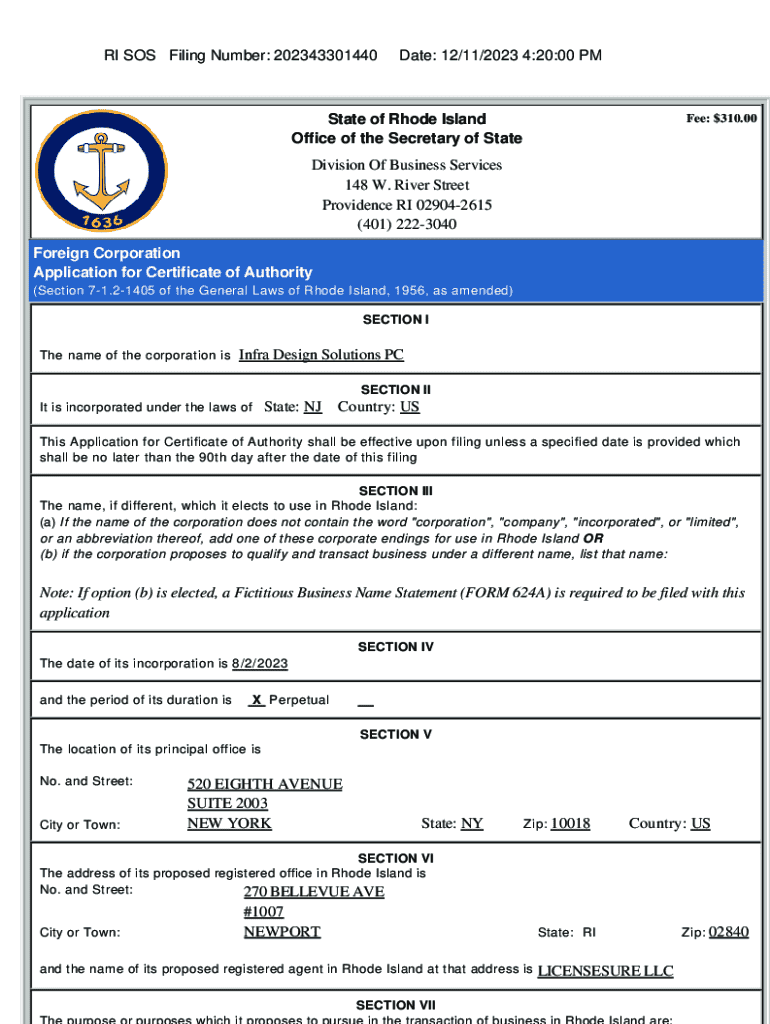

Get the free RI SOS Filing Number: 202343301440

Get, Create, Make and Sign ri sos filing number

How to edit ri sos filing number online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ri sos filing number

How to fill out ri sos filing number

Who needs ri sos filing number?

Understanding the RI SOS Filing Number Form: A Comprehensive Guide

Understanding the RI SOS filing number form

The RI SOS Filing Number Form is a crucial document for businesses registered in Rhode Island. This form is primarily used to report essential information regarding the status and operations of an entity to the Rhode Island Secretary of State. By filing this form, businesses ensure compliance with state regulations, allowing for smoother operations and legal standing.

Every entity is assigned a unique filing number, which serves as a key identifier. This number is vital not only for identification purposes but also for maintaining good business practices within the state's corporate database. Proper filing not only signals legitimacy but also reflects the overall health and transparency of a business entity.

Who needs to complete the RI SOS filing number form?

Various types of entities in Rhode Island are required to complete the RI SOS Filing Number Form. Understanding which entities fall under this requirement ensures compliance with state laws and helps avoid potential penalties.

Key reasons for filing annually include maintaining compliance, avoiding fines, and ensuring the entity’s information is readily available to the public for transparency.

Prerequisites for filing the RI SOS filing number form

Before you start filling out the RI SOS Filing Number Form, it’s important to gather all necessary information. This preparation will help prevent delays and errors during submission.

It's also essential to confirm your eligibility for filing based on the entity's current status within the state to avoid complications.

Step-by-step guide to completing the RI SOS filing number form

Completing the RI SOS Filing Number Form is straightforward if you follow these steps methodically.

Filing fees and payment options

Filing the RI SOS Filing Number Form often incurs a fee, which varies depending on the type of entity and method of submission. Understanding these costs is essential for budgeting your compliance efforts.

The general overview of filing fees is as follows:

Accepted payment methods include credit cards for electronic submissions or check/money order for paper submissions.

Tracking your filing status

Once you've submitted your RI SOS Filing Number Form, it’s important to track and confirm its status. This helps avoid any unintended consequences due to incomplete filings.

Managing your filing number and related documents

After filing, managing your RI SOS Filing Number becomes important for future compliance. Keeping this identifier secure ensures you won’t face issues down the line.

Frequently asked questions about the RI SOS filing number form

Business owners often have questions about the RI SOS Filing Number Form. Here are some common inquiries and their answers.

Tools and resources for efficient filing

Leveraging the right tools can streamline the process of filling out the RI SOS Filing Number Form, ensuring efficiency and accuracy.

Additional tips for successful filing

To ensure a smooth filing process for the RI SOS Filing Number Form, here are some best practices to follow.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ri sos filing number to be eSigned by others?

How do I make edits in ri sos filing number without leaving Chrome?

How can I fill out ri sos filing number on an iOS device?

What is ri sos filing number?

Who is required to file ri sos filing number?

How to fill out ri sos filing number?

What is the purpose of ri sos filing number?

What information must be reported on ri sos filing number?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.