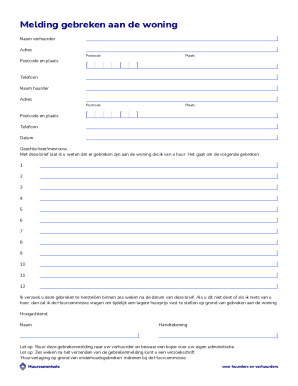

Get the free 2024 Form CBT-100U. 2024 Form CBT-100U

Get, Create, Make and Sign 2024 form cbt-100u 2024

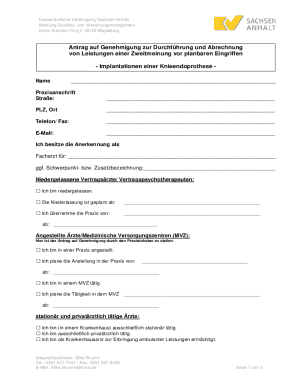

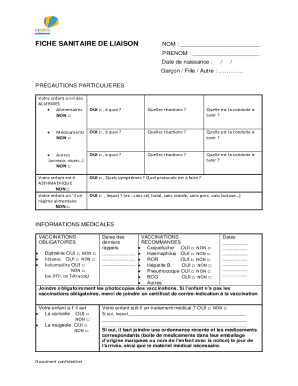

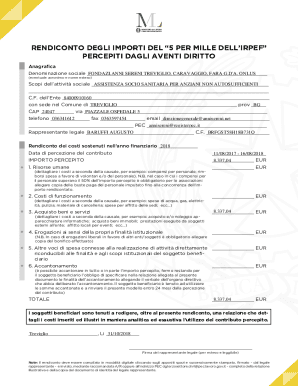

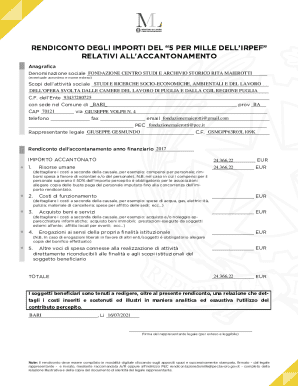

How to edit 2024 form cbt-100u 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 form cbt-100u 2024

How to fill out 2024 form cbt-100u 2024

Who needs 2024 form cbt-100u 2024?

2024 Form CBT-100U: A Comprehensive Filing Guide

Understanding the 2024 Form CBT-100U

The 2024 Form CBT-100U is a critical document for corporations operating in New Jersey. It serves as the Corporation Business Tax Return, enabling businesses to report their taxable income and calculate the tax owed. Beyond mere compliance, this form plays a vital role in the financial health of businesses, providing insights into profits and guiding future fiscal strategies.

Who needs to file the CBT-100U?

The eligibility to file the 2024 Form CBT-100U extends to all corporations, including C corporations and certain S corporations, that conduct business or earn income in New Jersey. If your corporation has gross receipts exceeding $100,000 or fully owns a subsidiary, you are mandated to file this form. Additionally, any business that operates multiple locations or has nexus with New Jersey is subject to these requirements.

Key features of the 2024 CBT-100U

One significant feature of the 2024 Form CBT-100U is its updates compared to the previous year's version. The New Jersey Division of Taxation has introduced new reporting requirements, especially in areas affecting corporate tax credits and deductions. These enhancements ensure that the form aligns with the evolving tax landscape and provides greater transparency to the tax authorities.

Among the crucial changes are adjustments to section headings and additional directives that clarify reporting obligations, making it easier for businesses to navigate the complexities involved. Understanding these revisions can prevent costly errors during the filing process.

Crucial deadlines and filing dates

The deadlines for submitting the 2024 Form CBT-100U are critically important for tax compliance. The general due date typically aligns with the 15th day of the fourth month following the end of the corporation's tax year. For most corporations following a calendar year, this means that the form is due on April 15, 2024. It's essential to mark your calendar and ensure all necessary documentation is prepared in advance.

Failure to meet these deadlines can result in late fees and interest payments, which can accumulate quickly. Therefore, businesses should strive to submit their forms ahead of time, allowing for corrections if needed.

Detailed walkthrough of filling out the 2024 CBT-100U

Filling out the 2024 Form CBT-100U can be straightforward if approached methodically. The form consists of several sections, each designed to capture specific information critical to the tax calculation. Starting with the Personal Information section, ensure that all identifying details—such as the name of the corporation, Federal Employer Identification Number (FEIN), and address—are accurate to avoid processing delays.

The subsequent section, Income Reporting, requires a comprehensive disclosure of the corporation's earnings. It encompasses various sources of income, including sales revenues and investment income. Identifying these figures correctly is essential to calculating applicable taxes promptly.

Lastly, in the Deductions and Credits segment, businesses should closely analyze their expenses to maximize deductions allowable under law. Mistakes here may lead to an inflated tax liability or missed opportunities for tax relief.

Common mistakes to avoid

Filing errors can have serious implications, including fines and audits. One common mistake is miscalculating taxable income due to overlooked sources of revenue or improperly documented deductions. Businesses should undertake a rigorous review of all figures reported on the form.

Moreover, failing to sign and date the form before submission can lead to delays or rejections. It is equally crucial to ensure that the correct version of the form is being used, as outdated forms can carry unintended consequences.

Interactive tools for managing the CBT-100U

With the ongoing digital transformation, utilizing platforms like pdfFiller can significantly ease the process of filling out the 2024 Form CBT-100U. pdfFiller enables users to edit PDFs easily, include eSignatures, and collaborate with team members for comprehensive document management.

Using pdfFiller's features, users can complete their forms efficiently by filling in the necessary details directly in the document. It also offers robust tools for managing workflows, ensuring that all members involved in finalizing the return can access and make updates in real-time.

Submitting the 2024 CBT-100U

The method you choose to submit the 2024 Form CBT-100U can impact the timeliness of your filing. For electronic submissions, businesses should utilize the New Jersey Division of Taxation's online portal, which simplifies the process and allows for instant confirmation. It is essential to gather all necessary documentation in advance to ensure a smooth submission.

If opting for paper submission, ensure that the form is postmarked by the deadline. Incorporating a tracking method such as certified mail can provide further peace of mind regarding delivery.

Tracking and confirmation of submission

After submitting the 2024 Form CBT-100U, it's crucial to confirm that your submission has been received and processed. For electronic submissions, users can check their submission status through the same online portal where they filed. Keeping a copy of the submission confirmation is highly advisable, as it serves as proof of compliance should questions arise later.

For paper submissions, retaining a copy of the form and the certified mail receipt is an effective way to document your compliance. If more than six weeks pass without confirmation, reaching out to the New Jersey Division of Taxation for follow-up is prudent.

Managing your documents post-submission

After filing the 2024 Form CBT-100U, organizing documents is key to maintaining good standing with tax authorities. Using pdfFiller, corporations can store their forms securely, allowing for easy access when future requirements arise. Best practice inclines towards keeping copies of all filed documents for at least three years, as this is generally the period during which the IRS can initiate an audit.

In instances where amendments are necessary, pdfFiller provides tools that simplify the process of making corrections. This flexibility can be crucial if any inaccuracies are discovered after submission, ensuring that businesses can remain compliant and transparent.

Handling amendments and corrections

If discrepancies arise post-filing, handling amendments to Form CBT-100U promptly is essential. Guidelines indicate that a corporation should file an amended return when an error is identified. This not only helps to correct reported income or deductions but also mitigates potential penalties.

pdfFiller streamlines this process, allowing users to access the original form easily, make necessary changes, and re-submit without the hassle of redrafting everything. Ensuring that amendments are noted explicitly will also simplify any follow-up inquiries from tax authorities.

Frequently asked questions about the 2024 Form CBT-100U

Many businesses have common questions regarding their obligations related to the 2024 Form CBT-100U. One frequent concern is whether all sources of income must be reported, even those that might seem minor. The answer is yes, as this helps to establish a fuller financial picture and avoid potential audits.

Other inquiries often focus on what to do in the event of an audit. Maintaining diligent records and being prepared to demonstrate compliance through accurate reporting can ease the process significantly.

Expert tips for a smooth filing experience

Seeking advice from tax professionals can significantly smooth out the filing process. Their expertise in the intricacies of tax law ensures that businesses take full advantage of available deductions and credits, while also adhering to compliance requirements. Additionally, using technology like pdfFiller maximizes efficiency and accuracy during the filing process.

Make sure to plan your filing well in advance of deadlines, gather all necessary documents early, and utilize available resources to address any questions that may arise.

Additional tools and resources

pdfFiller is committed to providing comprehensive resources to aid users in navigating their filing. From templates to guides on tax credits and deductions, the platform is equipped to support users at every step of the filing process. Utilizing these resources can enhance understanding and application, ensuring smooth compliance.

Stay informed about potential changes in tax laws that could impact future filings. Regularly reviewing the New Jersey Division of Taxation’s announcements will help businesses remain proactive and prepared.

Case studies: Successful submissions of the 2024 CBT-100U

Real-life examples often provide the best insights into the filing process. Take, for instance, a small technology firm that diligently utilized pdfFiller to prepare and submit their 2024 Form CBT-100U. They meticulously documented their income across various sources, ensuring their filings accurately reflected their financial situation. When audited, they confidently presented their organized documentation, which ultimately led to a seamless review process.

On the other hand, there are stories of corporations that neglected timely submissions and faced significant financial repercussions. These examples underline the importance of adhering to requirements and utilizing available tools for proper documentation and submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2024 form cbt-100u 2024 in Chrome?

How do I fill out the 2024 form cbt-100u 2024 form on my smartphone?

How do I fill out 2024 form cbt-100u 2024 on an Android device?

What is 2024 form cbt-100u 2024?

Who is required to file 2024 form cbt-100u 2024?

How to fill out 2024 form cbt-100u 2024?

What is the purpose of 2024 form cbt-100u 2024?

What information must be reported on 2024 form cbt-100u 2024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.