Get the free Are Medicare Premiums Tax-Deductible?

Get, Create, Make and Sign are medicare premiums tax-deductible

Editing are medicare premiums tax-deductible online

Uncompromising security for your PDF editing and eSignature needs

How to fill out are medicare premiums tax-deductible

How to fill out are medicare premiums tax-deductible

Who needs are medicare premiums tax-deductible?

Are Medicare premiums tax-deductible?

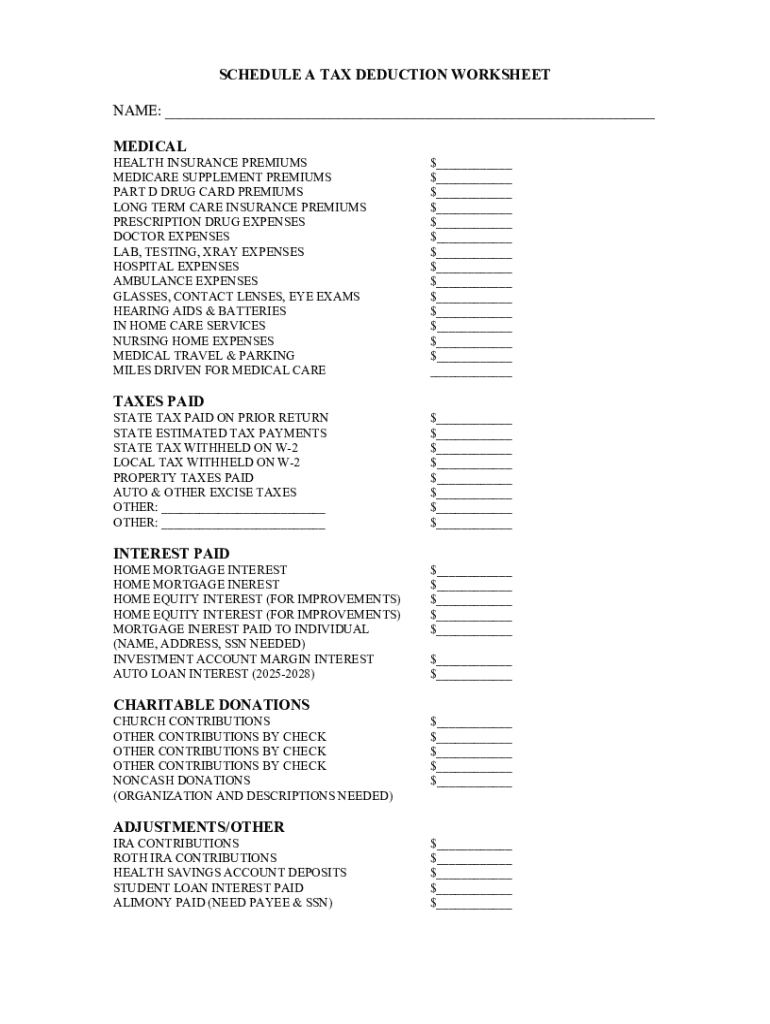

Understanding Medicare premiums

Medicare premiums are fees that beneficiaries pay to maintain their health coverage under the Medicare program. These premiums cover various health services and support, crucial for seniors and qualified individuals with disabilities. Understanding the specifics of these premiums is the first step to determining potential tax deductions.

Types of Medicare plans and associated costs

Medicare consists of several parts, each with distinct coverage options and premium costs. These components include:

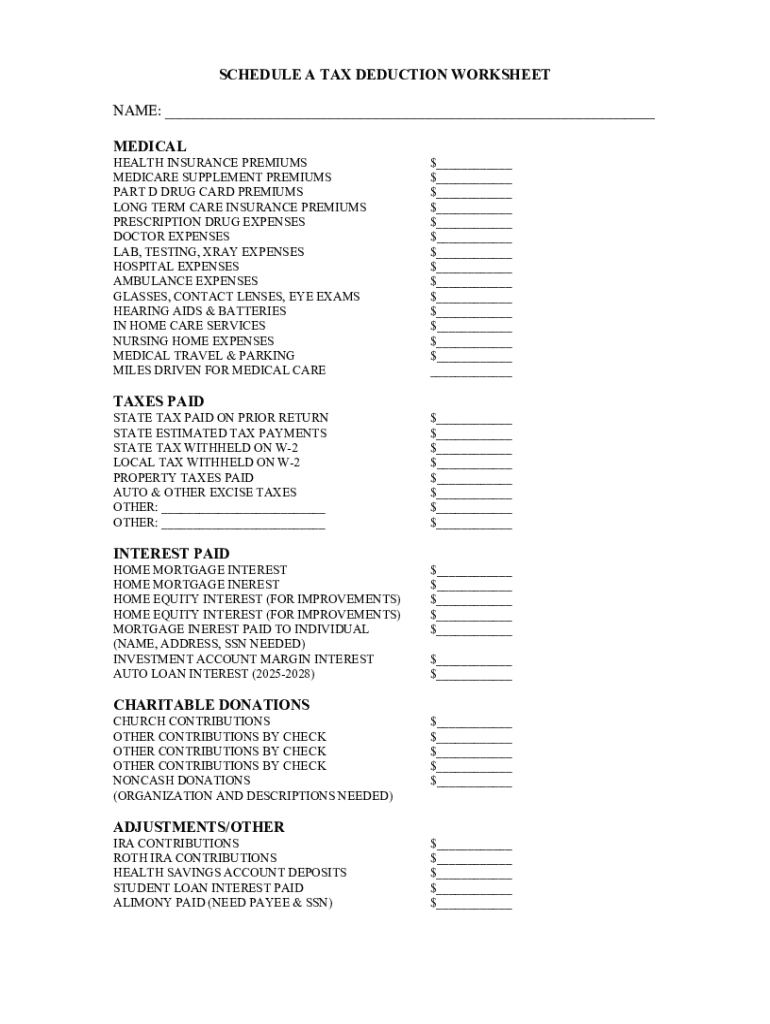

Tax deductions overview

A tax deduction is an expense that reduces your taxable income, ultimately lowering the amount of tax you owe to the IRS. Understanding the types of deductions available is vital for optimizing your tax return during tax season.

Types of tax deductions relevant to individuals

For individuals, there are two primary types of tax deductions:

Can you deduct Medicare premiums on your tax return?

Yes, in certain circumstances, Medicare premiums may be tax-deductible. Understanding the conditions and eligibility is critical in leveraging this deduction.

Eligibility criteria for deducting Medicare premiums

The ability to deduct premiums depends on several factors, including:

Documentation needed for deduction claim

To claim these deductions accurately, gather relevant documents such as Form 1095-A, which details health insurance coverage, as well as proof of premium payments made throughout the year.

Specific scenarios for deducting Medicare premiums

Different groups may see varying impacts of Medicare premium deductions based on individual circumstances.

Deduction for self-employed individuals

If you’re self-employed, you can deduct your Medicare premiums as an above-the-line deduction, which lowers your adjusted gross income (AGI). This can also positively affect your self-employment tax obligation, essentially allowing you to save on overall taxes.

Deduction for retirees and non-self-employed individuals

Retirees or those not self-employed need to manage their Medicare premiums through itemizing deductions. It’s essential to consider that total medical expenses, including premiums, must exceed 7.5% of your AGI to claim. This can require careful documentation and consideration of all eligible medical costs.

Special considerations for dependents

If you support an elderly parent or dependent, you might also claim their Medicare premiums as part of your medical expenses, provided you meet specific criteria set by the IRS. This can offer substantial tax relief to families taking care of elderly dependents.

Alternative strategies for managing Medicare premiums

Beyond traditional deductions, alternative strategies exist that may help in managing and minimizing Medicare costs effectively.

Using health savings accounts (HSAs)

If you have a Health Savings Account, funds can potentially be used for Medicare premiums. However, eligibility for HSAs generally requires lower health coverage, which may make this option less accessible post-retirement.

Premium tax credit for lower-income individuals

Individuals with lower incomes might qualify for premium tax credits intended to help cover costs. Understanding how these credits interact with Medicare premiums is crucial for effective financial planning.

Additional factors impacting your tax situation

Several additional elements play a crucial role in determining your overall tax landscape, particularly for Medicare-related expenses.

Changes in income and how it affects deductions

A significant change in income may have a direct effect on your ability to deduct some medical expenses, including Medicare premiums. Being proactive about these changes can significantly impact your tax liability.

State-specific variations in tax laws

State tax laws vary widely and can influence how Medicare premiums are treated on your state tax returns. Understanding local legislation can potentially yield additional benefits.

Considerations for couples filing together vs. separately

Whether you file jointly or separately also influences your tax situation and the scope of deductions. Couples should strategize carefully, especially if one partner has significantly higher medical expenses.

Common questions and misconceptions

Receiving accurate information about Medicare premium deductions is essential to avoid common pitfalls and misunderstandings.

Can you deduct Medicare Advantage Plan premiums?

Yes, premiums for Medicare Advantage Plans can generally be deducted if you itemize your medical expenses, as these premiums fall under reporting scenarios for medical costs.

Are there any hidden fees or costs?

It’s essential to recognize that some plans might involve additional costs, such as copayments and coinsurance, which are not deductible. Thorough research on any hidden fees associated with your Medicare choices is prudent.

How do other medical expenses factor into deductions?

All medical expenses exceeding 7.5% of your AGI may contribute to itemized deductions, so including your Medicare premiums in comprehensive calculations is critical for maximizing possible deductions.

Seeking professional help

Navigating tax deductions around Medicare premiums can be complex. Engaging with a tax professional can lend clarity and ensure compliance with the IRS regulations.

When to consult a tax professional

Consider consulting a tax professional in cases of unusual financial situations, particularly if you've experienced significant income changes or are unsure about eligibility and documentation needed for deductions.

Using online resources and tools for tax preparation

Utilizing resources such as those available at pdfFiller can enhance your understanding and improve your document management for tax filing, making the process more efficient.

pdfFiller's tools for document management in tax filing

pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform, ensuring you have the tools necessary for effective tax preparation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get are medicare premiums tax-deductible?

How do I make changes in are medicare premiums tax-deductible?

How do I fill out are medicare premiums tax-deductible using my mobile device?

What is are medicare premiums tax-deductible?

Who is required to file are medicare premiums tax-deductible?

How to fill out are medicare premiums tax-deductible?

What is the purpose of are medicare premiums tax-deductible?

What information must be reported on are medicare premiums tax-deductible?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.