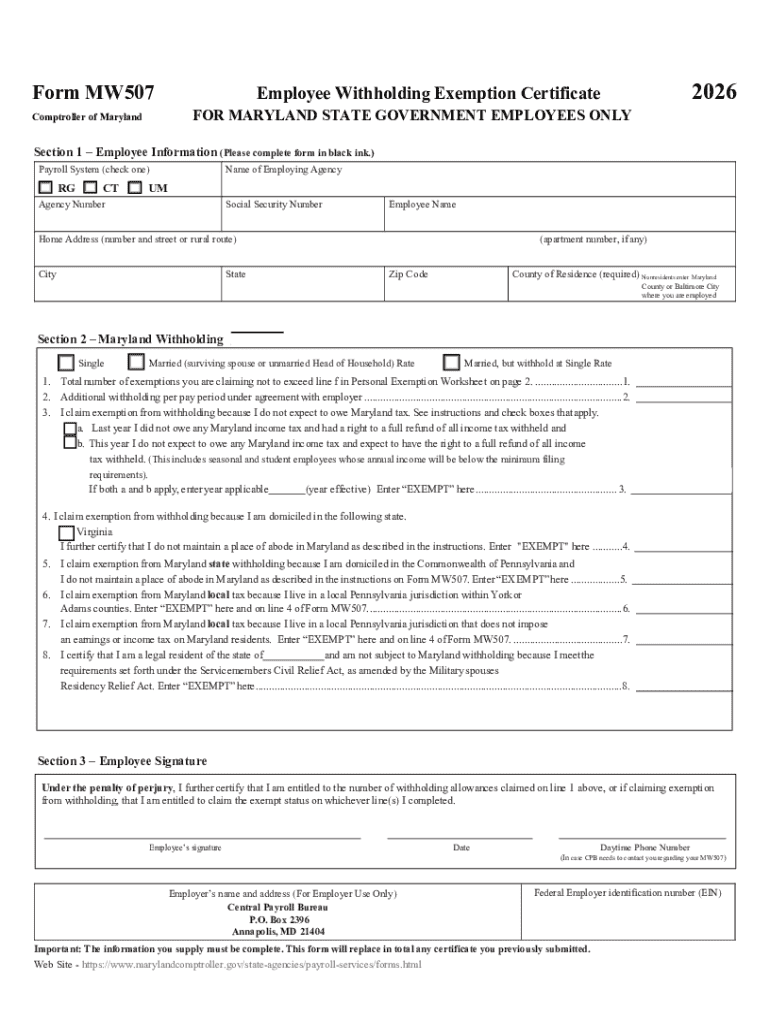

Get the free Maryland Form MW 507, Employee's Maryland Withholding ... - roads maryland

Get, Create, Make and Sign maryland form mw 507

Editing maryland form mw 507 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland form mw 507

How to fill out maryland form mw 507

Who needs maryland form mw 507?

Comprehensive Guide to Maryland Form MW 507 Form

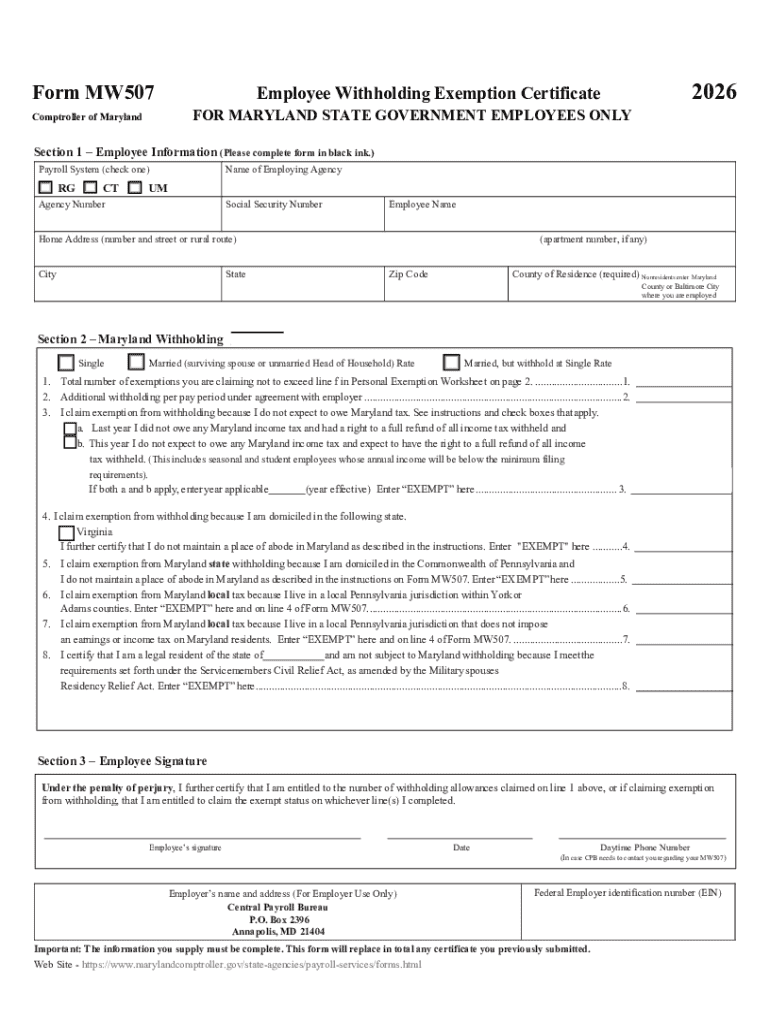

Understanding the Maryland Form MW 507

Maryland Form MW 507 is a key document in the Maryland tax system that enables employers to accurately withhold state income taxes from employees’ paychecks. The form helps both employees and employers ensure that the correct amount of withholding occurs, aligning with Maryland's tax regulations. It specifies the number of exemptions an employee claims, allowing employers to calculate withholding amounts correctly.

For employees, the accuracy of the MW 507 form influences take-home pay and tax obligations at the end of the fiscal year. For employers, it’s essential for compliance with state laws and for minimizing the risk of penalties that could arise from improper withholding.

Who needs to complete Maryland Form MW 507?

Workers in Maryland, especially those earning wages or salaries, are generally required to complete the MW 507 form. This includes full-time employees, part-time workers, and seasonal employees. Individuals eligible to claim exemptions, such as those who had no tax liability in the previous year and anticipate none in the current year, may also consider filing this form.

Employers must request this form from new employees and may ask current employees to update it under certain circumstances, such as following a significant change in income or personal situation. Students and part-time workers who might be part of the workforce temporarily should also be mindful of completing the MW 507, especially if they fall into the exemption category.

Completing the Maryland Form MW 507

Filling out the Maryland Form MW 507 may seem daunting, but breaking it down into sections can simplify the process. Begin with the first section that captures your personal information. Here’s a detailed approach:

Common mistakes include leaving fields incomplete or misclassifying your exemption status, which can lead to incorrect withholding and possible liabilities come tax season.

Editing and managing your form

In today's digital age, managing forms like the Maryland Form MW 507 has become remarkably streamlined with platforms like pdfFiller. You can easily edit, sign, and store your form online, ensuring you have access to your documents from anywhere. Using tools like pdfFiller allows for quick edits and adjustments as needed.

Using a digital signature also expedites the process of submitting the form. Implementing a system for storing your forms securely can save time and alleviate stress during peak filing periods. Organizing documents by year and type is a best practice that enhances efficiency when retrieval becomes necessary.

Submitting the Maryland Form MW 507

Once you’ve completed your Maryland Form MW 507, it’s crucial to know how to submit it correctly. Employees should return the form directly to their employer, who will then use it to adjust withholdings going forward. Employers are responsible for keeping these records for their employees.

Key deadlines are also important to keep in mind. Employers must ensure that the appropriate filing schedules align with state withholding laws, which can change annually. Keeping track of deadlines ensures compliance and minimizes the risk of penalties.

Updates and changes to the form

Tax forms are subject to changes that reflect adjustments in both local and federal laws. Staying informed about amendments to the Maryland Form MW 507 and related state withholding regulations is vital to ensuring compliance. Regular updates can affect the exemptions you may claim or the withholding rates applied by employers.

Resources like the Maryland state tax website can provide updates on any recent changes or anticipated alterations to tax policies that may affect your filings. Subscribing to newsletters or alerts from the Maryland Comptroller's office can keep you informed as well.

Common FAQs about Maryland Form MW 507

Given the complexities associated with tax-related documents, questions often arise regarding the Maryland Form MW 507. Here are answers to some common inquiries:

Additional tools and resources

Navigating tax forms like the Maryland Form MW 507 can be simplified using interactive tools available through pdfFiller. These tools allow for easy completion, submission, and management of various documents, reducing anxiety around tax season.

Helpful links, including the Maryland state tax website, provide extensive resources and guidance on tax regulations. It’s also beneficial to keep contact information for the Maryland Comptroller’s office on hand for any direct inquiries.

User experiences and testimonials

Many users have shared positive experiences with managing their Maryland Form MW 507 using digital solutions. One user noted how easy it was to correct errors in their form using pdfFiller’s editing capabilities, leading to peace of mind during filing.

Another advantage highlighted is the ability to collaborate with employers seamlessly, ensuring all documentation is in order without the hassle of physical forms. Such experiences emphasize the efficiency that comes with using comprehensive document solutions like those offered by pdfFiller.

Conclusion: Empowering your tax filing experience

The Maryland Form MW 507 is an essential part of ensuring proper tax withholding for employees. Digital platforms like pdfFiller empower users to manage this process with ease, from completing the form to securely storing it for future references.

Utilizing tools designed for seamless document management allows individuals and teams to focus on compliance, ensuring a smooth tax filing experience and maintaining financial health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send maryland form mw 507 for eSignature?

Can I edit maryland form mw 507 on an Android device?

How do I fill out maryland form mw 507 on an Android device?

What is maryland form mw 507?

Who is required to file maryland form mw 507?

How to fill out maryland form mw 507?

What is the purpose of maryland form mw 507?

What information must be reported on maryland form mw 507?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.