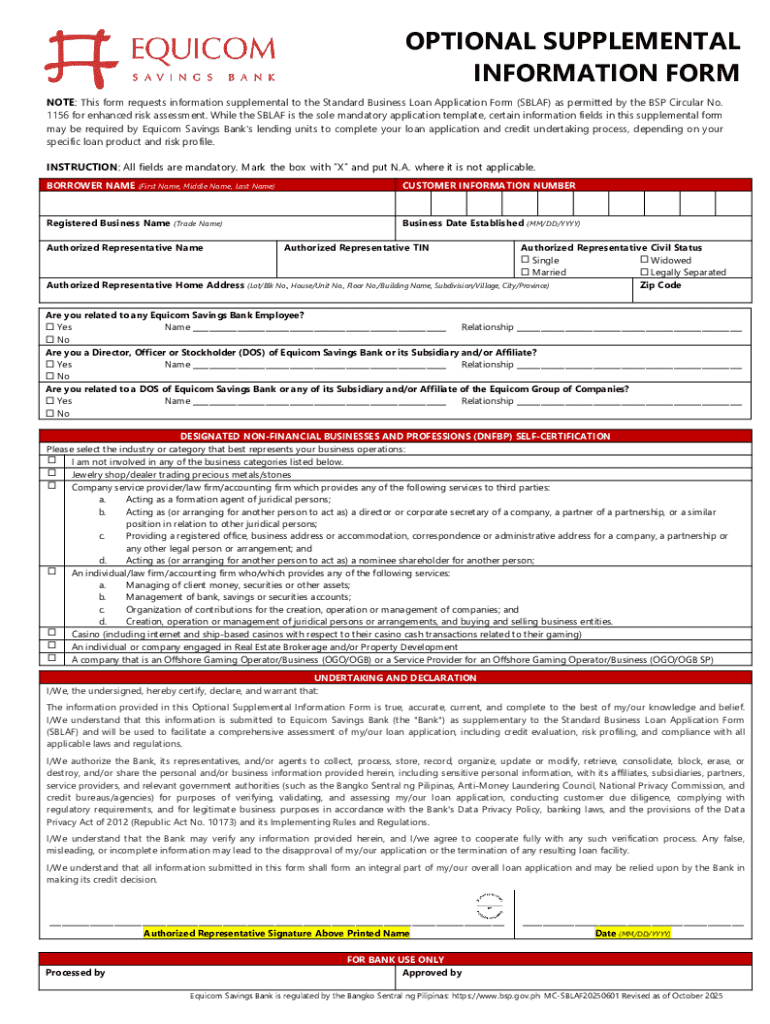

Get the free The Standard Business Loan Application Form (SBLAF) ...

Get, Create, Make and Sign the standard business loan

Editing the standard business loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out the standard business loan

How to fill out the standard business loan

Who needs the standard business loan?

The standard business loan form: How-to guide long-read

Overview of business loans

A business loan serves as a crucial financial tool enabling enterprises to manage cash flow, purchase equipment, or even expand operations. By definition, a business loan is a sum of money borrowed to fund various business activities, typically repaid with interest over time. Types of business loans widely vary, including term loans, lines of credit, and SBA loans, each designed to satisfy diverse funding needs. These loans can address immediate requirements, such as inventory acquisition or operational expenses, while also providing long-term financing for strategic purposes.

Common uses for business loans encompass a broad spectrum of requirements. For instance, a bakery may seek funding to purchase a new oven, while a tech startup might invest in software development. The flexibility of business loans allows entrepreneurs to cater to immediate demands and plan for future endeavors. With proper utilization, a business loan can enhance a company's growth trajectory and profitability.

Understanding loan terms

Navigating the world of business loans requires familiarity with some key terminologies. Principal refers to the initial loan amount, while interest rates are the costs incurred for borrowing that principal, often expressed as an annual percentage. Additionally, organizations will need to understand the duration of the loan, commonly referred to as the term, which can range from a few months to several years. Knowledge of these terms is essential in assessing how much you’ll ultimately owe over the life of the loan.

Secured loans require borrowers to offer collateral, creating a safety net for lenders, while unsecured loans do not. This distinction often affects interest rates, with secured loans generally offering lower rates due to reduced risk. Businesses should also be aware of potential fees and penalties associated with their loans. These factors can substantially impact repayment, making it vital to comprehend the complete financial obligation before signing any agreement.

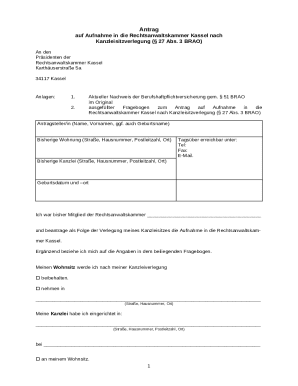

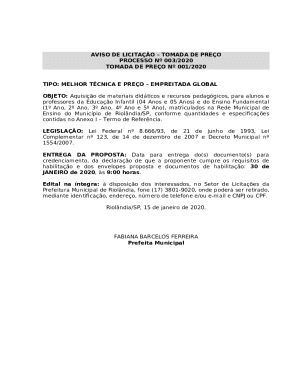

How to access the standard business loan form

To begin the loan application process, access the standard business loan form tailored to your needs. Different financial institutions issue various loan types, each requiring specific documentation. However, most conventional lenders and government organizations utilize a universal loan form or a similar structure. Accessing these forms is easy; they are often available on lender websites, or you can use online platforms like pdfFiller for a more streamlined experience.

For those who prefer an integrated document creation system, registering for pdfFiller provides access to the standard business loan form among numerous others. Follow these simple step-by-step instructions: start by visiting the pdfFiller homepage, click on 'Get Started,' then create an account with an email address and desired password. Upon verification, you can access a comprehensive library of forms tailored to your specific needs.

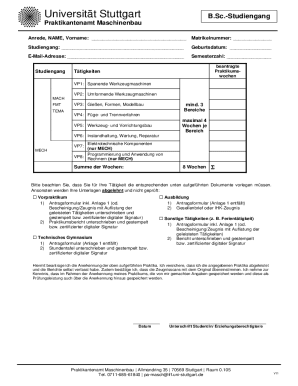

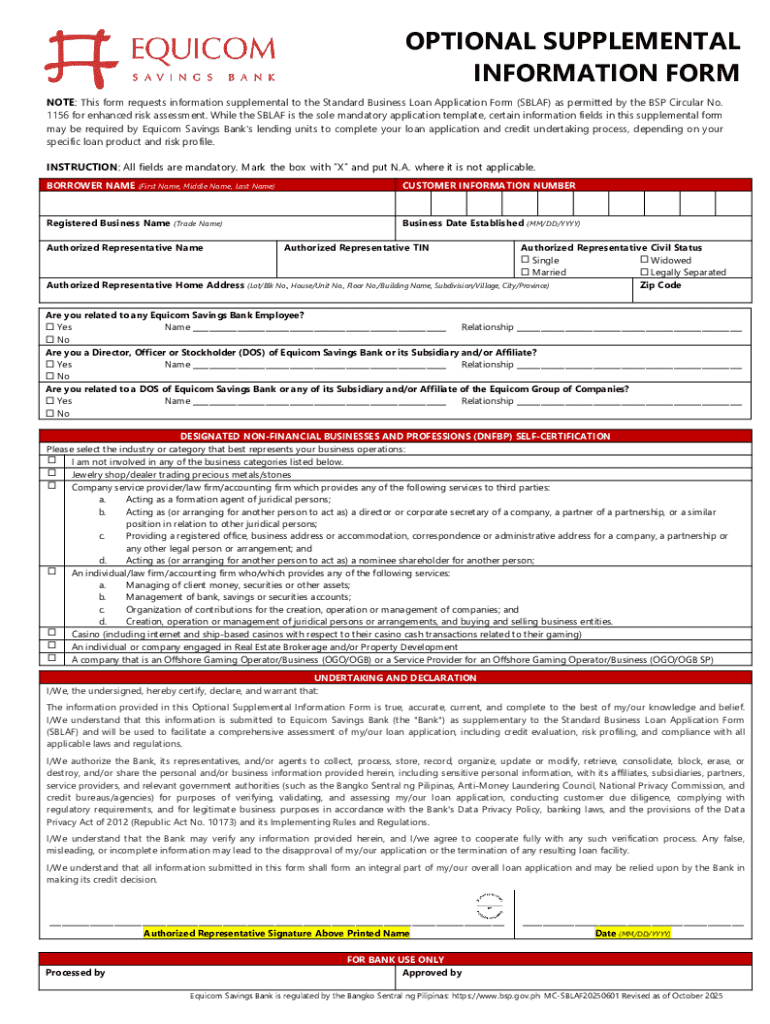

Filling out the form

Completing the standard business loan form necessitates accurate data entry to prevent delays or rejections. Essential fields typically include personal information such as name, address, and socioeconomic stats, alongside critical business details like business name, type, and annual revenue. Equally important are the loan specifics, including the amount requested and the intended purpose of the loan.

Take precaution during the data entry process. Common mistakes include typos in business names or incorrect financial figures that could raise red flags during the application review. To enhance accuracy, double-check the information against your business records before submission. Utilizing tools within pdfFiller can facilitate easy editing, while prompt completion enhances your chances of receiving funding swiftly.

Editing and adding information

Utilizing pdfFiller offers functionality that simplifies the process of editing and adding information to your standard business loan form. Within the platform, users can seamlessly modify sections for clarity or provide additional data essential for loan approval. Numerous templates are available, promoting a consistent approach to documentation across multiple applications. This can save time while ensuring essential details are captured.

Moreover, practicing good document management is key. Implement version control by saving each iteration of your form separately, allowing easy retrieval if revisions are needed later. When proper versioning is implemented, it reduces confusion and helps maintain focus on the most current data while enabling reference to past submissions when necessary.

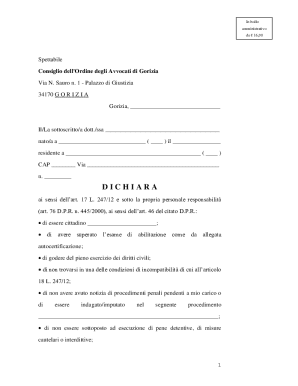

eSigning the business loan form

The growing trend of eSigning offers a convenient method to sign the standard business loan form electronically. This practice is legally recognized across various jurisdictions, provided the eSignature adheres to the requisite legal standards. Users can complete the signing process through pdfFiller without the hassle of printing or scanning documents, ensuring a quick turnaround.

Before eSigning, ensure all information is accurate, and the form is complete. Once satisfied, navigate to the eSignature option on pdfFiller, where security measures protect your electronic signature against potential fraud. After signing, confirm your identity, finalize the submission, and keep a copy for your records while your application is under review.

Managing your loan application

After submitting your standard business loan form, proactive management of your loan application can significantly impact the outcome. Follow-up procedures with lenders are highly recommended; reaching out to verify that your application is being processed shows engagement and seriousness. Tracking your application's progress can also provide insight into potential issues or necessary corrections.

In the event of troubleshooting, frequent applicants might face common issues such as delayed responses or additional information requests. Understanding FAQs related to these scenarios can provide quick resolutions. Moreover, customer support services on platforms like pdfFiller are invaluable for timely assistance, especially in ensuring you understand the nuances of loan applications and how to rectify potential issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit the standard business loan from Google Drive?

Can I create an electronic signature for the the standard business loan in Chrome?

How can I edit the standard business loan on a smartphone?

What is the standard business loan?

Who is required to file the standard business loan?

How to fill out the standard business loan?

What is the purpose of the standard business loan?

What information must be reported on the standard business loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.