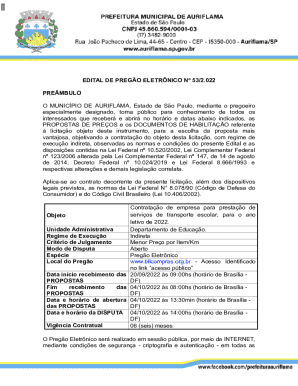

Get the free CAPITAL ACCESS PROGRAM LOAN ENROLLMENT ...

Get, Create, Make and Sign capital access program loan

Editing capital access program loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out capital access program loan

How to fill out capital access program loan

Who needs capital access program loan?

A Comprehensive Guide to the Capital Access Program Loan Form

Understanding the capital access program

The Capital Access Program (CAP) is designed to stimulate economic growth by enhancing access to credit for businesses and individuals who may otherwise struggle to obtain financing. This program aims to bridge the financing gap by providing loan guarantees, reducing the risk for lenders and making it easier for borrowers to secure funds. The initiative recognizes that access to capital is fundamental for sustainable business operations, expansion, and overall economic development.

Capital access is crucial, particularly for small businesses that often lack the credit history or financial security expected by traditional lenders. By facilitating loans through the Capital Access Program, participants can invest in infrastructure, hire employees, and ultimately contribute to a thriving economy, underscoring the program’s significance in stimulating growth and fostering entrepreneurial spirit.

Benefits of the capital access program

The Capital Access Program offers numerous benefits that make it an attractive option for potential borrowers. Key advantages include financial support tailored to the unique needs of each business and various accessibility options, enabling more entities to participate in the program. Participants often find favorable loan terms, such as lower interest rates and extended repayment periods compared to conventional loans.

These benefits collectively create a supportive framework for entrepreneurs and small businesses, empowering them to manage cash flow more effectively, invest in growth opportunities, and increase their chances of long-term success. For many, the Capital Access Program serves as a lifeline, ensuring they have the necessary resources to thrive.

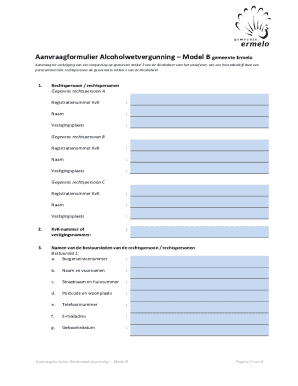

Eligibility requirements

To apply for funding under the Capital Access Program, individuals and businesses must meet specific eligibility requirements. Typically, applicants include small businesses, startups, and in some instances, individual entrepreneurs. Eligibility criteria generally encompass factors such as business size, financial needs, and the nature of the corresponding business operation, such as being a sole proprietorship, partnership, limited liability company, or corporation.

Furthermore, specific demographic characteristics might be prioritized, including minority-owned and women-owned businesses, as the program aims to foster diversity and inclusion in the marketplace. This targeted approach not only helps bridge gaps in capital but also enhances local economies.

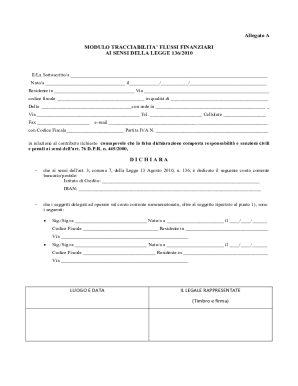

Required documentation

When applying for the Capital Access Program loan, careful preparation of documentation is essential. Required documents usually include detailed financial records such as recent tax returns, profit and loss statements, and balance sheets, which help demonstrate financial stability and projections for the business. Additionally, applicants may need to provide a comprehensive business plan outlining their operational strategies and financial forecasts.

Providing transparent and organized documentation aids in the application process and strengthens the case for funding, showcasing the viability and potential growth of the applicant’s business.

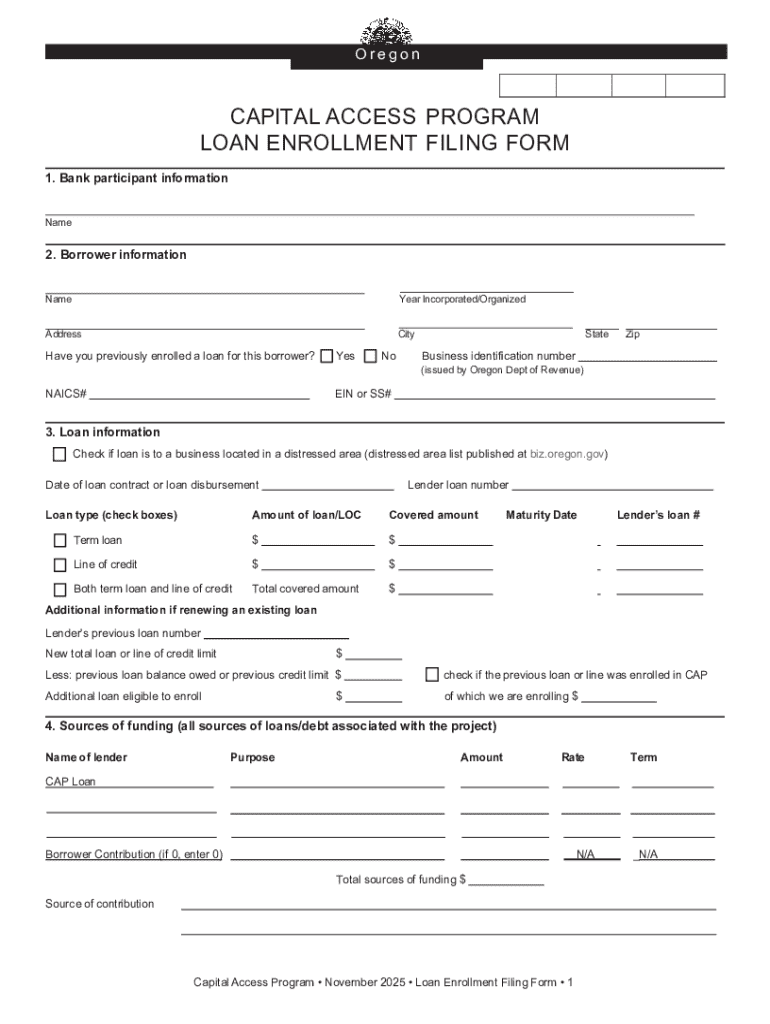

Detailed insights into the loan form

The Capital Access Program loan form is specifically structured to gather key information from applicants efficiently. Its components include sections designed to capture personal information, business details, the loan amount sought, and the intended use of the funds. Each section is crucial for assessing the suitability of the applicant for the program.

Understanding the terminology used in the loan form is equally important, as it ensures that applicants interpret the requirements accurately and provide the necessary details that will help in the review process.

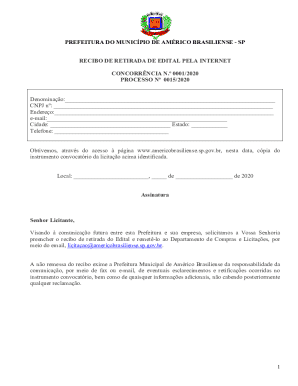

Step-by-step instructions for completing the loan form

Completing the loan form can seem daunting, but following structured steps can simplify the process significantly. Here's how to navigate each section:

Interactive tools for form assistance

pdfFiller provides various interactive tools designed to assist users in completing the Capital Access Program loan form seamlessly. Online form fillers are available to guide applicants in accurately filling out their forms without the hassle of printing and scanning.

Additionally, collaborative features allow teams to work together on form completion in real time. This functionality results in enhanced efficiency, as team members can review and edit documents simultaneously while managing potential discrepancies quickly.

Common mistakes to avoid

Throughout the application process for the Capital Access Program, several common pitfalls can hinder successful submission. One of the most frequent issues is submitting incomplete applications. Missing information can significantly delay processing and create unnecessary frustration. It is crucial to double-check each section to ensure all required entries are complete.

Another critical mistake is misunderstanding the eligibility criteria. Applicants often overlook important aspects, such as specific documentation or the requisite business type, which can ultimately lead to denial. A thorough review of the eligibility requirements can aid in ensuring alignment with the program’s standards.

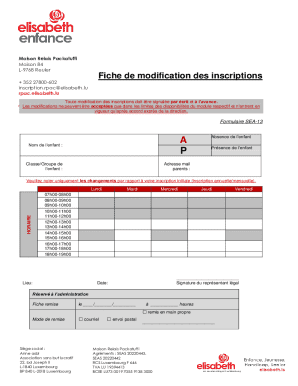

Post-submission processes

Once the Capital Access Program loan form is submitted, applicants enter the review stage. The review process typically involves an assessment of the submitted information along with the required documentation. This timeframe for approvals can vary depending on various factors, including the volume of applications under review.

Following submission, individuals can take proactive steps to check the status of their application, which often involves reaching out to the program’s customer service or checking an online portal. Understanding the next actions if additional information is requested can also streamline the process and support timely completion.

Additional support resources

For those requiring assistance during the entire process, pdfFiller’s customer support is readily available. Users can access contact information and various support options for troubleshooting any concerns they may encounter while utilizing the platform.

Moreover, community forums and online resources offer shared experiences and insights from other users, providing valuable tips and suggestions that can help navigate the nuances of the Capital Access Program.

Page navigation and user support

pdfFiller enhances user experience through effective main navigation links that provide quick access to other important forms and templates, helping users manage their documentation seamlessly. Additionally, breadcrumb navigation allows users to trace their steps back easily while ensuring they maintain context within the website.

Accessibility options

Recognizing the diverse needs of users, pdfFiller also offers translation services for non-English speakers, which facilitates wider access to the Capital Access Program loan form. Ensuring that language barriers do not impede accessibility signifies a commitment to equity in capital access.

Footer menu

The footer menu on pdfFiller provides links to additional services and product features, guiding users toward more advanced capabilities available on the platform. This structure not only enhances navigation efficiency but also allows users to explore solutions that further optimize their document management needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify capital access program loan without leaving Google Drive?

How do I make changes in capital access program loan?

Can I create an electronic signature for signing my capital access program loan in Gmail?

What is capital access program loan?

Who is required to file capital access program loan?

How to fill out capital access program loan?

What is the purpose of capital access program loan?

What information must be reported on capital access program loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.