Get the free Simple Wage Claim Process With Our Sample Letter

Get, Create, Make and Sign simple wage claim process

How to edit simple wage claim process online

Uncompromising security for your PDF editing and eSignature needs

How to fill out simple wage claim process

How to fill out simple wage claim process

Who needs simple wage claim process?

Simple Wage Claim Process Form: A Comprehensive Guide

Understanding wage claims

A wage claim is a formal complaint filed by an employee against an employer for unpaid wages, misclassification of salary, or incorrect calculations of overtime. Understanding the essence of wage claims is crucial for any employee facing wage discrepancies.

Common reasons for filing a wage claim include unpaid overtime, a lack of payment for hours worked, or receiving less than the agreed compensation. Statistically, these issues affect not only hourly workers but salaried employees as well, causing financial strain and legal disputes.

Timely filing of a wage claim is paramount. There are often strict deadlines governed by state law or employer agreements, and failing to act quickly could result in losing the right to recover lost wages. For example, in Colorado, employees typically have two years to file a claim regarding unpaid wages.

Getting started with the simple wage claim process

The wage claim process begins with understanding your rights and responsibilities. Employees seeking to recover unpaid wages should first familiarize themselves with the specific wage complaint process applicable in their state. An essential starting point is to ascertain whether the employer has violated employment laws regarding wages.

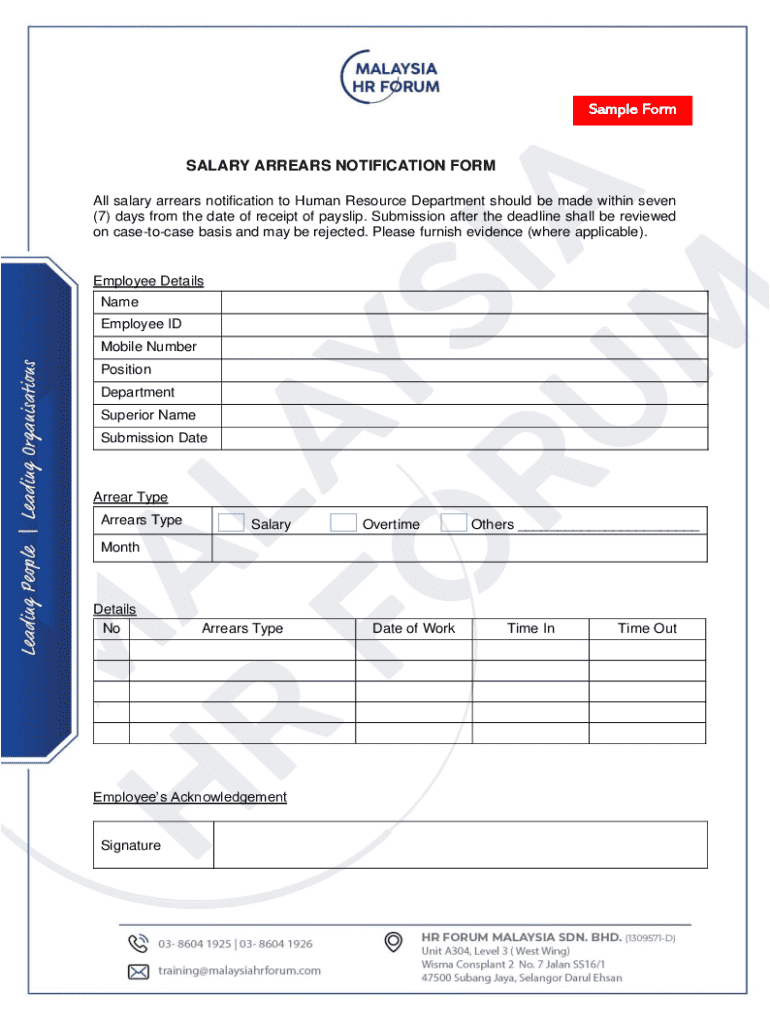

Anyone can file a wage claim, including current and former employees. It is also important to recognize that independent contractors may have different rights. Key information needed before starting the claim process includes employment details, wage records, the nature of the complaint, and relevant documentation to support the claim.

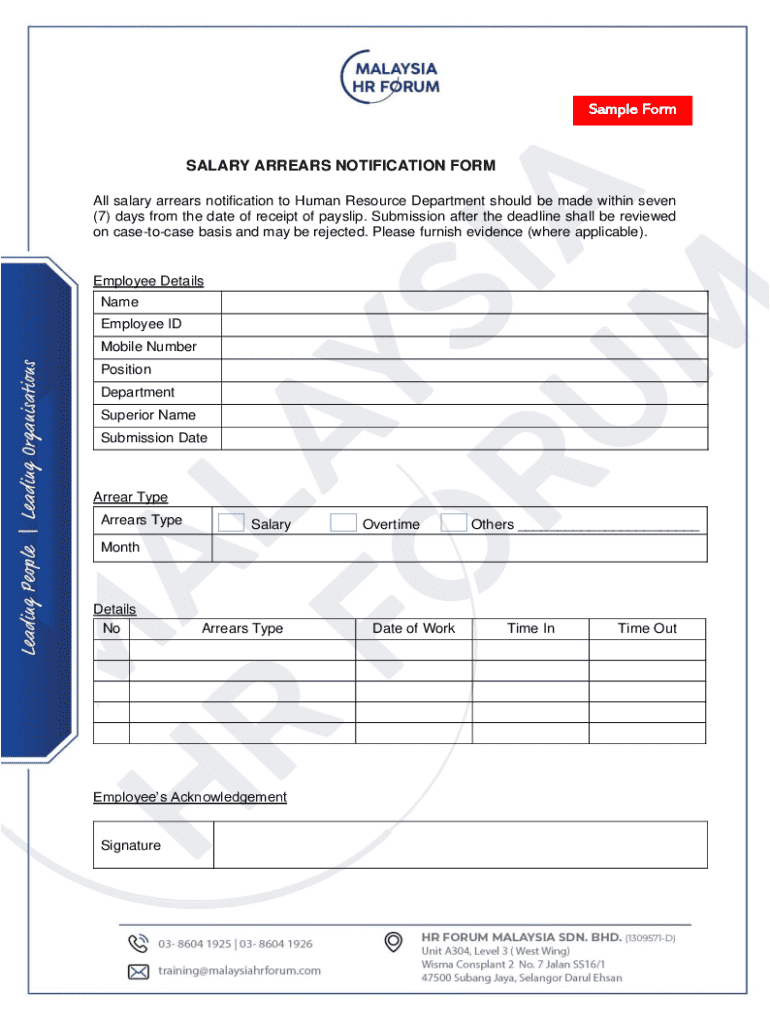

Step-by-step guide to filling out the simple wage claim process form

Step 1: Downloading the form

To initiate your claim, the first step is to download the simple wage claim process form. This form is typically available on state labor department websites or legal assistance websites, such as pdfFiller. Ensure compatibility with your device—most forms are accessible on smartphones, tablets, and computers.

Step 2: Completing the form

The claim form will require specific details. Here's a detailed breakdown of each section:

To ensure accuracy, consider double-checking your entries. Missing or incorrect information can delay processing.

Step 3: Reviewing the completed form

Before submission, review the completed form thoroughly. Check for typos, missing signatures, or incomplete sections. Common mistakes often include incorrect dates or details about the employment timeline. Ensure that you have included all relevant information to avoid complications later.

Step 4: Signing the form

Once your form is complete, the next step is to sign it. Options for electronic signing are available, providing a convenient way to validate your claim. Ensure that you understand the legal implications of your signature, as eSigning is recognized in most jurisdictions, including Colorado.

Submitting your wage claim

Once your form is complete and signed, it’s time to submit your claim. Various methods of submission are typically available:

Ensure that you attach all required supporting documents, such as pay stubs, employment contracts, or any relevant communications with your employer. Keeping copies of your submission is crucial for your records and can be helpful if issues arise during processing.

After submission: What to expect

After submitting your wage claim, the review process begins. Typically, claims are reviewed by a designated division of labor or workforce department which will investigate the details of your complaint.

Expect a timeline for processing your claim; this can vary depending on the volume of claims and specific state requirements. Possible outcomes might include an investigation report, notice of complaint to your employer, or a determination regarding the wage complaint. Depending on the findings, you may need to follow up with further documentation or clarification.

Frequently asked questions (faqs)

Several common questions about the wage claim process arise, including:

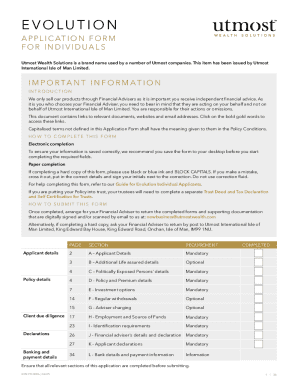

Utilizing pdfFiller for your wage claim process

pdfFiller offers a streamlined approach to managing your wage claim process. The platform provides editable forms and allows users to fill out their wage claim process form directly online. With cloud-based access, your documents are secure and available from anywhere.

Additionally, utilizing pdfFiller aids in future document needs, making it a versatile choice for ongoing administrative tasks.

Tips for a successful wage claim journey

Navigating the wage claim process can be intricate. Here are some essential tips to keep in mind for a successful experience:

Understanding your rights as an employee

As an employee, it’s vital to understand your rights regarding wage claims. Federal and state laws protect employees from wage theft and enforce standards for payment. Knowing these rights is the first step in effectively advocating for fair compensation.

Resources such as labor department websites, legal aid clinics, and employee rights organizations can provide further assistance and guidance. Remember, staying informed is a key aspect of protecting your rights in any wage dispute.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get simple wage claim process?

How do I complete simple wage claim process online?

Can I create an eSignature for the simple wage claim process in Gmail?

What is simple wage claim process?

Who is required to file simple wage claim process?

How to fill out simple wage claim process?

What is the purpose of simple wage claim process?

What information must be reported on simple wage claim process?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.