Get the free Death Claim Form - Sample - Rev 10-08

Get, Create, Make and Sign death claim form

How to edit death claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out death claim form

How to fill out death claim form

Who needs death claim form?

A Comprehensive Guide to the Death Claim Form

Understanding the death claim form

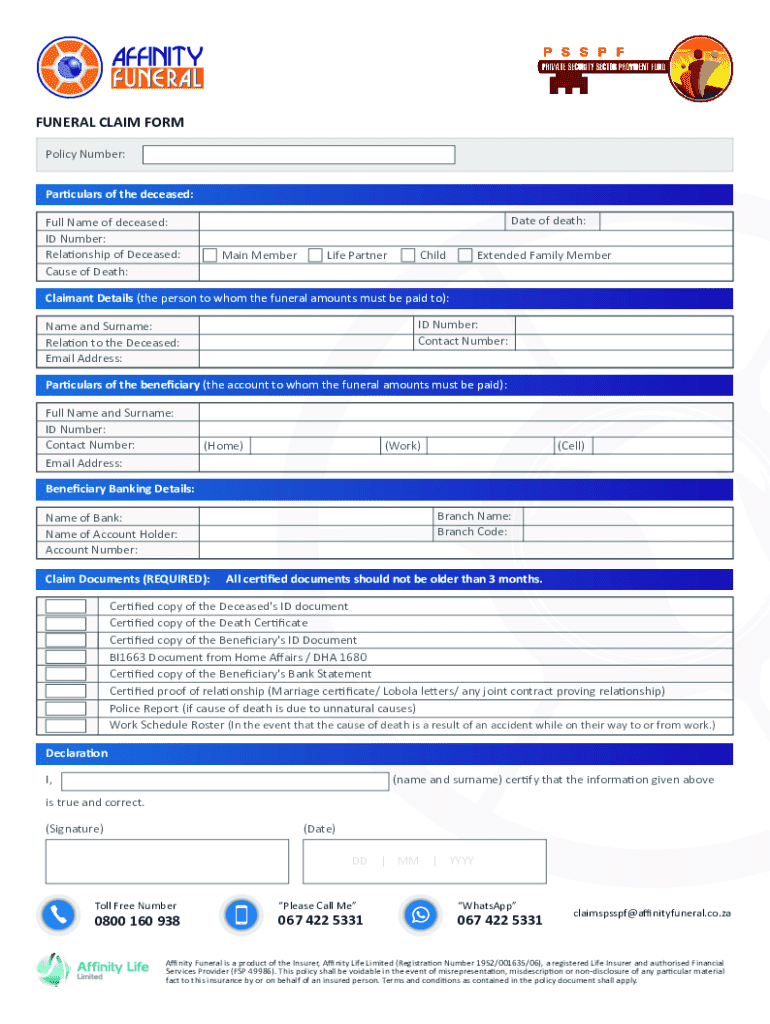

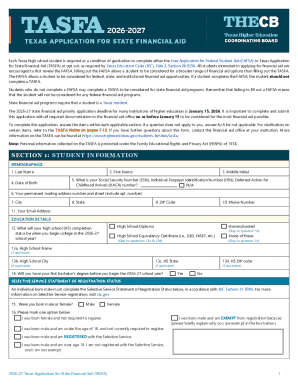

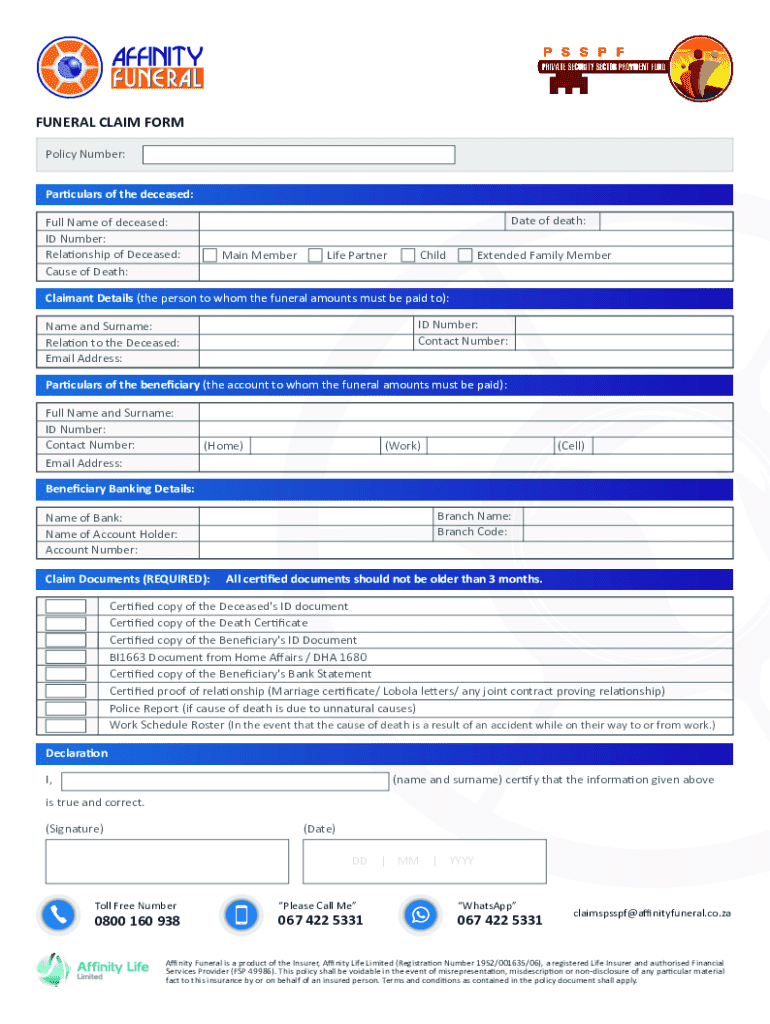

A death claim form is a critical document that beneficiaries submit to an insurance company to initiate a claim following the death of an insured individual. This form triggers the claims process, allowing beneficiaries to receive financial support as stipulated in the insurance policy. Understanding the nuances of this form is essential for successful claims management.

The importance of filing a death claim cannot be overstated. Without timely completion and submission of the death claim form, beneficiaries may face significant delays in accessing funds that are necessary for covering final expenses, such as funeral costs, outstanding debts, or any planned financial support for dependents.

Essential components of the death claim form

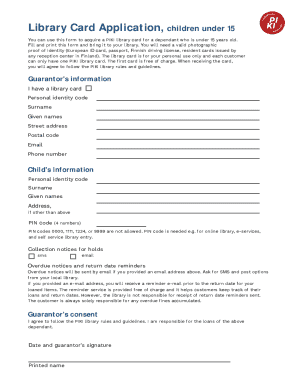

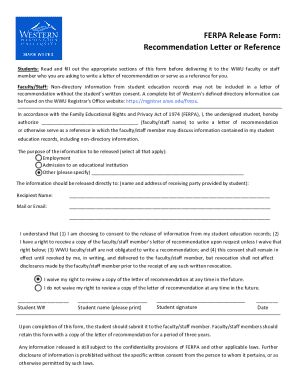

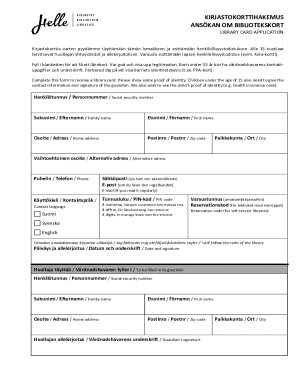

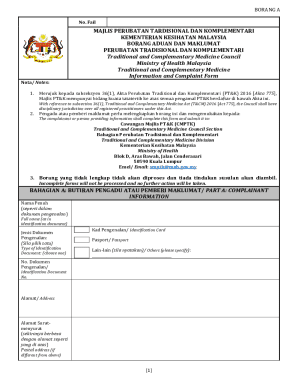

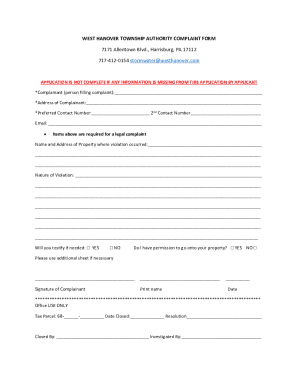

Filling out a death claim form requires specific key details. The form generally necessitates the claimant’s details, which include full name, contact information, and relationship to the deceased. The deceased's information section must capture their full name, date of birth, and date of death to establish accurate records.

Additionally, the policy number and insurance company details are crucial. This information ensures that the claim is processed under the correct policy. Insurance companies may ask for supporting documents such as the death certificate, the original policy document, and identification for the claimant to verify their claims.

Step-by-step guide to completing the death claim form

To navigate the death claim process smoothly, follow this structured approach. Step One involves gathering all necessary information and documents. It’s crucial to create a checklist to avoid any omissions during the submission process.

Step Two is filling out the death claim form. Carefully follow the instructions, making sure to fill in each section accurately. Failure to do so could lead to processing delays. Common pitfalls include overlooking required signatures or entering incorrect information.

Lastly, in Step Three, review the completed form meticulously. Double-check for accuracy and completeness. If any errors are discovered after submission, contact the insurance company immediately to rectify issues.

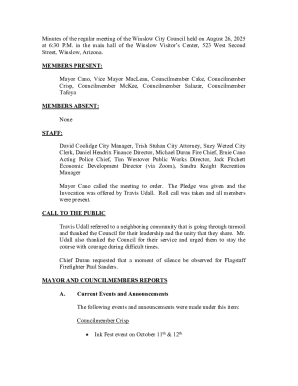

Submitting the death claim form

Submitting your death claim form can be done through various methods. Online submission options, such as pdfFiller, allow for quick uploads and processing. If you prefer in-person submission, locate your insurance company's local office and take the completed form with all supporting documents.

Common submission procedures generally include ensuring that all required supporting documents accompany your claim form. These may include the death certificate and your identification. Opt for certified mail for tracking paper submissions to maintain a record of your claim.

Managing the status of your claim

Once your death claim form has been submitted, it’s essential to know how to check the status of your claim. Many insurance companies provide online portals or customer service numbers for tracking your claim’s progress, offering peace of mind during this challenging time.

Typically, you can expect to hear back from the insurance company regarding the status of your claim within a few weeks. It's also crucial to be aware of any communications they may send requesting additional information, which can slow down the process if not promptly addressed.

Potential challenges when filing a death claim

Surprisingly, claim denial is a common challenge faced by many individuals filing a death claim form. The reasons for claim denials can include incomplete forms, missing documents, or specific policy exclusions that the insured may not have known about. Understanding these common pitfalls before submitting your claim can save you time and effort.

If your claim is denied, it's important not to lose hope. There are established procedures to appeal a denial. Begin by reviewing the denial letter for specific reasons provided by the insurance company and ensure to address each point raised in your appeal.

Benefits of using pdfFiller for your death claim process

When navigating the death claim process, pdfFiller proves beneficial for document management. This platform’s cloud-based convenience allows users to access forms from anywhere, ensuring that all necessary documents are available at their fingertips. Its interactive features facilitate easy editing and signing, creating a user-friendly environment.

Moreover, numerous user testimonials highlight real cases where individuals successfully submitted claims using pdfFiller. The platform aids in gathering all required documents and managing submissions without the hassle often associated with traditional methods.

Additional support and resources

For any assistance needed during the death claim process, reaching out to customer support is vital. pdfFiller offers robust support options, including live chat and email assistance to respond to inquiries regarding your death claim submission.

In addition, a comprehensive FAQ section addresses common queries, offering guidance on everything from filling out forms to troubleshooting submission issues effectively.

Related document services offered by pdfFiller

pdfFiller goes beyond just the death claim form by offering a variety of other insurance claim forms as well. Whether it’s life, health, or property insurance, the platform provides tools that simplify the process of document creation, editing, and signing.

The benefits of managing documents in the cloud are plentiful. Users no longer need to worry about storage, as everything is consolidated online, ensuring that all documents can be accessed easily when needed.

Footer navigation

For additional information regarding privacy policies, terms of service, or to navigate through the site map, pdfFiller makes these resources available for users seeking to understand their platform better.

Stay connected with pdfFiller through various social media platforms to receive updates, tips, and best practices for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send death claim form to be eSigned by others?

How can I get death claim form?

How do I edit death claim form on an iOS device?

What is death claim form?

Who is required to file death claim form?

How to fill out death claim form?

What is the purpose of death claim form?

What information must be reported on death claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.