Get the free employee compensation insurance policy proposal form

Get, Create, Make and Sign employee compensation insurance policy

How to edit employee compensation insurance policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee compensation insurance policy

How to fill out employee compensation insurance policy

Who needs employee compensation insurance policy?

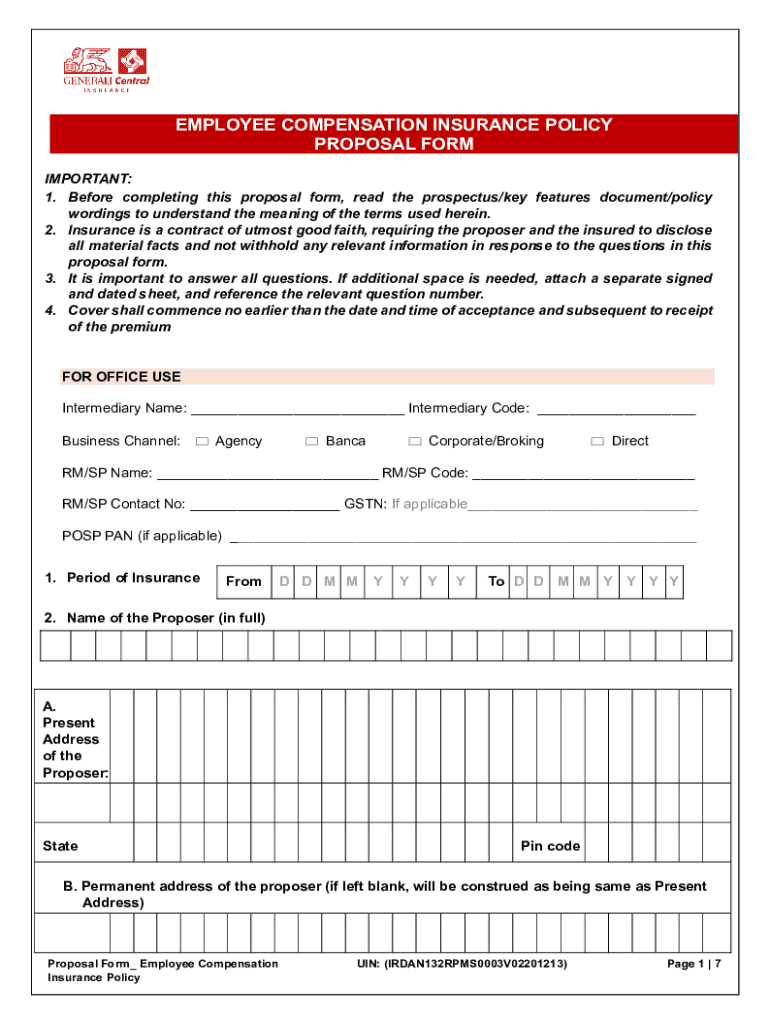

Comprehensive Guide to Employee Compensation Insurance Policy Form

Understanding employee compensation insurance

Employee compensation insurance is crucial for safeguarding both employers and employees in the event of workplace injuries or illnesses. This type of insurance provides medical benefits and wage replacement to employees who are injured on the job, ensuring they receive the necessary care without financial strain. It not only protects employees but also shields employers from potential lawsuits related to workplace injuries.

In many jurisdictions across the United States, employers are legally required to carry this insurance to comply with state laws. The failure to do so can result in severe penalties, including fines or restrictions on business operations. It's essential for employers to be aware of the specific laws governing employee compensation insurance in their state, as requirements can vary significantly.

The role of insurance policy forms

The employee compensation insurance policy form serves as a foundational document that defines the terms of coverage for both employees and employers. Its main purpose is to outline the specifics of the insurance agreement, providing clarity on what is covered and the responsibilities of each party. By filling out this form accurately, employers can ensure they are compliant with legal requirements and adequately protecting their workforce.

Additionally, these forms are commonly used during audits and compliance checks by regulatory bodies to verify that businesses have the necessary insurance in place. A well-completed policy form can also expedite the claims process in the event of an injury, ensuring that employees receive timely compensation and care.

Filling out the employee compensation insurance policy form

Completing the employee compensation insurance policy form requires careful attention to detail to avoid errors that could delay coverage or claims. Here’s a step-by-step guide to ensure you fill it out correctly:

Editing and customizing your policy form

With pdfFiller, users gain access to editing tools that make it easy to customize the employee compensation insurance policy form. Features include the ability to add annotations, comments, or specific instructions for different stakeholders involved in the process. This is especially helpful for collaborative work environments.

Collaborative editing allows multiple users to make changes in real-time, ensuring that every team member can contribute without the hassle of managing multiple document versions. This feature saves time and aligns the team effectively, particularly when dealing with large corporations or teams spread across various locations.

Signing the employee compensation insurance policy form

The validity of employee compensation insurance policy forms greatly depends on proper signing. eSigning, or electronic signing, enhances the security of the process while providing convenience. By using eSignatures, businesses can ensure that all parties involved in signing the form have unequivocally consented to the contents and conditions outlined in the document.

Utilizing pdfFiller for eSigning not only enables a quick signing process but also allows employers to collect signatures from multiple parties efficiently. This can significantly expedite the preparation of documents and ensure timely compliance with regulations.

Managing your employee compensation insurance policy

Once the employee compensation insurance policy form has been filled out and signed, the next step involves effective management of the policy documents. Utilizing cloud storage solutions offers significant advantages, allowing for easy access, secure storage, and quick retrieval of important documents whenever needed.

Maintaining accurate records by regularly tracking changes and updates is vital. This includes knowing when policy renewals are due, any adjustments in employee numbers, or changes in business operations that may affect coverage. Keeping your documents current not only ensures compliance but also provides peace of mind that your business is adequately protected.

Common questions about employee compensation insurance

Navigating employee compensation insurance can raise many questions for employers. One critical concern is what to do if a submitted policy form is denied. Commonly, this may occur due to incomplete information or discrepancies. In such cases, it's advisable to reach out directly to the insurance provider for clarification and guidance on how to rectify issues.

Understanding the nuances of policy limits and exclusions is equally important. Employers should familiarize themselves with what circumstances are not covered by their policy to prevent unwelcome surprises when claims are made. Resources such as insurance advisors or online forums can provide valuable information and support.

Additional tips for employers

Adopting best practices for maintaining compliance with employee compensation insurance is crucial for all employers. Regular audits of your coverage can help identify any gaps or areas where increased coverage might be necessary. Additionally, employee training on their rights and the compensation processes ensures that everyone is aware of how benefits work and how to report injuries.

Understanding the claims process is equally important for employers. By clearly outlining the steps involved, from initial reporting to claim submission, employers can minimize delays and complications that may arise during claims processing. Being proactive about these issues helps create a safer and more informed workplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in employee compensation insurance policy without leaving Chrome?

Can I create an electronic signature for signing my employee compensation insurance policy in Gmail?

How do I complete employee compensation insurance policy on an Android device?

What is employee compensation insurance policy?

Who is required to file employee compensation insurance policy?

How to fill out employee compensation insurance policy?

What is the purpose of employee compensation insurance policy?

What information must be reported on employee compensation insurance policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.