Get the free AZ Form 5000A 2020-2026 - Fill out Tax Template Online

Get, Create, Make and Sign az form 5000a 2020-2026

Editing az form 5000a 2020-2026 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out az form 5000a 2020-2026

How to fill out az form 5000a 2020-2026

Who needs az form 5000a 2020-2026?

Your Comprehensive Guide to AZ Form 5000A 2

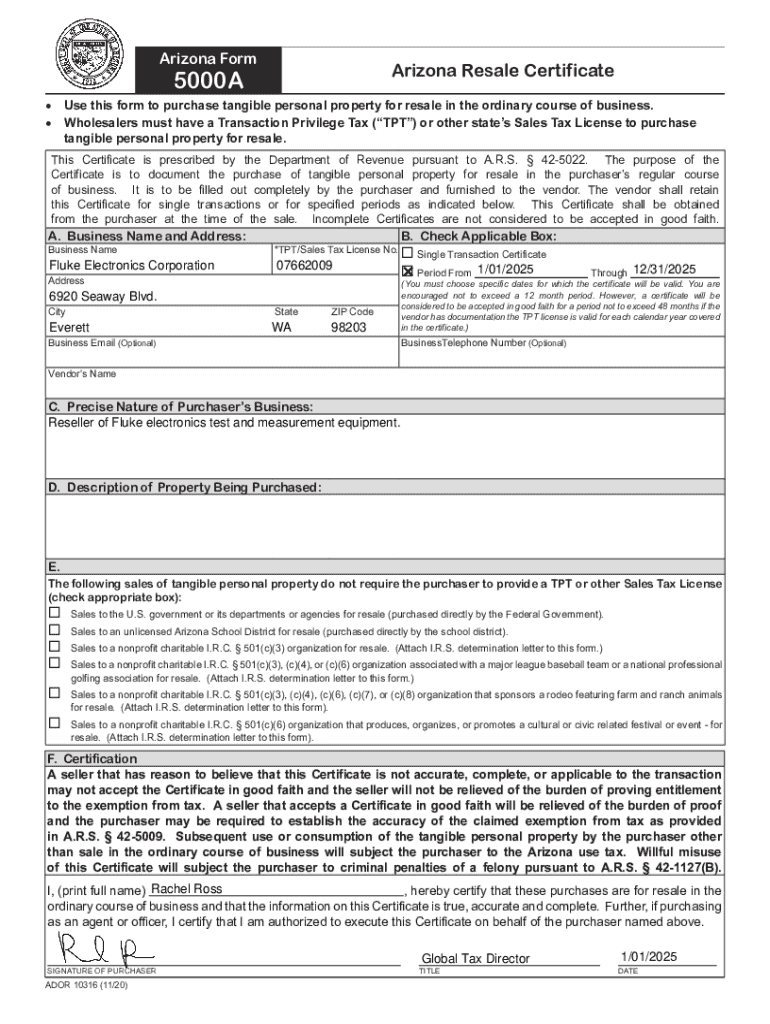

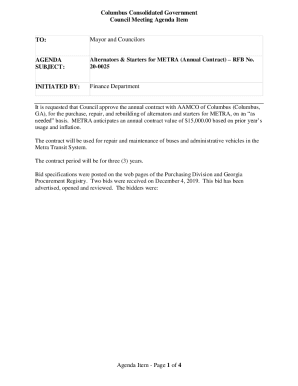

Overview of AZ Form 5000A

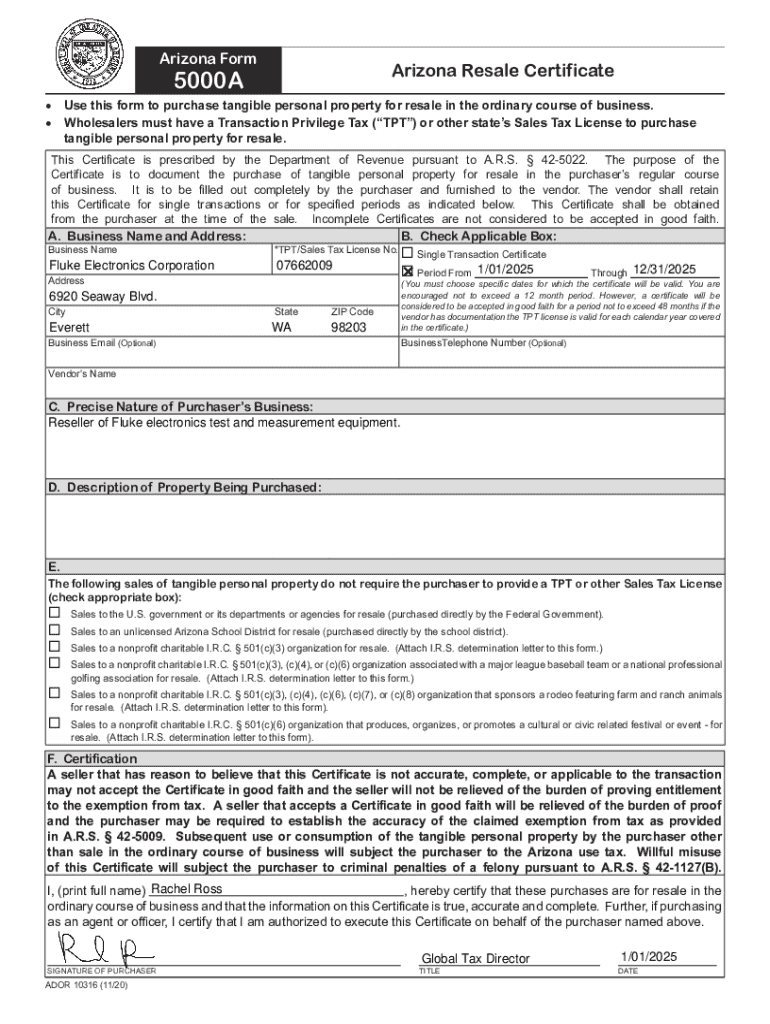

AZ Form 5000A is an essential document required for individuals engaging in specific Arizona tax-related processes. This form serves various purposes, primarily aimed at gathering vital information about residents' income and tax obligations. With the updates for the years 2, it simplifies the process for both individuals and tax professionals. The significance of the 2022 version lies in the updates that reflect current tax regulations and streamline the submission process.

Individuals looking to file their Arizona state taxes need to utilize AZ Form 5000A. This includes employees, business owners, and anyone who has received income that falls under the jurisdiction of state taxes. By understanding this form thoroughly, taxpayers can ensure compliance and potentially maximize their deductions and credits.

Key features of AZ Form 5000A

The AZ Form 5000A features multiple changes in its 2022 version that enhance usability. Key updates often pertain to information organization, including new options for income reporting and more accessible deduction sections. An overview of the significant changes includes a better layout for data entry and new fields that reflect the latest tax laws. This format ensures that users can easily navigate through the form and accurately report their information.

The form is divided into several critical sections, each designed to elicit specific information necessary for accurate tax assessment. The detailed sections include:

Step-by-step instructions for completing AZ Form 5000A

To properly complete AZ Form 5000A, follow these detailed steps:

Common pitfalls include forgetting to include all income sources or not carefully checking figures. Ensuring accuracy during this process will prevent future issues with tax liability.

Editing and managing your AZ Form 5000A

Using pdfFiller allows users to easily edit the AZ Form 5000A. With its intuitive interface, you can make changes to the form directly in your browser without needing additional software. The platform also includes several interactive tools that enhance collaboration among team members when completing the form.

Additionally, pdfFiller provides options for saving multiple versions of your document, ensuring that all changes can be tracked and managed seamlessly. Users can also integrate comments and suggestions when sharing with team members to compile comprehensive details before submission.

Signing AZ Form 5000A

In the digital age, the ability to eSign documents is essential. Electronic signatures are legally binding in most jurisdictions, including Arizona, allowing taxpayers to finalize their AZ Form 5000A efficiently.

To eSign your document via pdfFiller, follow these steps: Select the eSignature option, create a signature using your mouse or upload an image of your handwritten signature, and place it on the designated signing line. Ensure that your signature is correctly positioned before saving the final version.

It's crucial to understand the legal implications of using eSignatures, as electronic-documented consent can expedite business and tax filing processes while adhering to regulatory standards.

Submitting AZ Form 5000A

Once your AZ Form 5000A is filled out and signed, it’s time to submit it. The submission guidelines vary based on individual circumstances, but forms can typically be submitted electronically through state tax systems or by mailing them to the appropriate Arizona Department of Revenue office. The specific address can depend on the type of submission you are making.

Understanding submission deadlines is critical to avoid penalties. Mark your calendar with specific due dates relevant to your tax situation, and don’t hesitate to check the Arizona Department of Revenue website for the most up-to-date information. Additionally, tracking your submission status can be done through the state’s online portals, providing peace of mind that your form has been officially processed.

Frequently asked questions (FAQs) about AZ Form 5000A

Many taxpayers often have queries regarding AZ Form 5000A. Common concerns include clarifications on eligibility to fill out the form and confusion regarding certain sections. Here are a few typical questions that users may encounter:

Troubleshooting common issues

While using AZ Form 5000A, you may encounter various challenges. Common issues include form submission errors due to missing required fields. If you face problems while filling out the form, double-check to ensure all fields are complete and accurate.

When using pdfFiller, technical issues may arise, such as problems when attempting to edit or save the document. The pdfFiller support team is readily available to guide users through any hurdles, offering assistance via help articles or direct contact through their platform.

Enhancing your document workflow with pdfFiller

pdfFiller provides an array of additional features for efficient document management beyond just filling out AZ Form 5000A. Users can access a vast library of templates to streamline their form-filling process, providing a head start on document creation.

The cloud storage solutions offered ensure that all documents are easily accessible from anywhere, facilitating collaboration. By opting into this platform, teams can work together on forms, enhancing efficiency and reducing redundancy in the workplace.

The value of a cloud-based platform

Choosing a cloud-based platform like pdfFiller for managing your AZ Form 5000A provides numerous benefits. Not only does it enhance productivity, but it also reduces costs associated with paper and printing. Statistics indicate that businesses using cloud solutions can save up to 30% annually on document management.

Testimonials from current users reflect improved efficiency in document management workflows, as the features provided help minimize errors and streamline the preparation process, leading to faster turnaround times for necessary filings.

Conclusion

Accurate completion of AZ Form 5000A is vital for meeting tax obligations in Arizona. Utilizing the comprehensive features provided by pdfFiller can significantly ease the process of document creation, editing, signing, and management. By embracing this digital approach, users can ensure they navigate their responsibilities efficiently, avoiding common pitfalls and maximizing their tax benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify az form 5000a 2020-2026 without leaving Google Drive?

How do I edit az form 5000a 2020-2026 straight from my smartphone?

How do I edit az form 5000a 2020-2026 on an Android device?

What is az form 5000a 2020-2026?

Who is required to file az form 5000a 2020-2026?

How to fill out az form 5000a 2020-2026?

What is the purpose of az form 5000a 2020-2026?

What information must be reported on az form 5000a 2020-2026?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.