Get the free Aof number hdfc: Fill out & sign online

Get, Create, Make and Sign aof number hdfc fill

How to edit aof number hdfc fill online

Uncompromising security for your PDF editing and eSignature needs

How to fill out aof number hdfc fill

How to fill out aof number hdfc fill

Who needs aof number hdfc fill?

AOF Number HDFC Fill Form - How to Guide

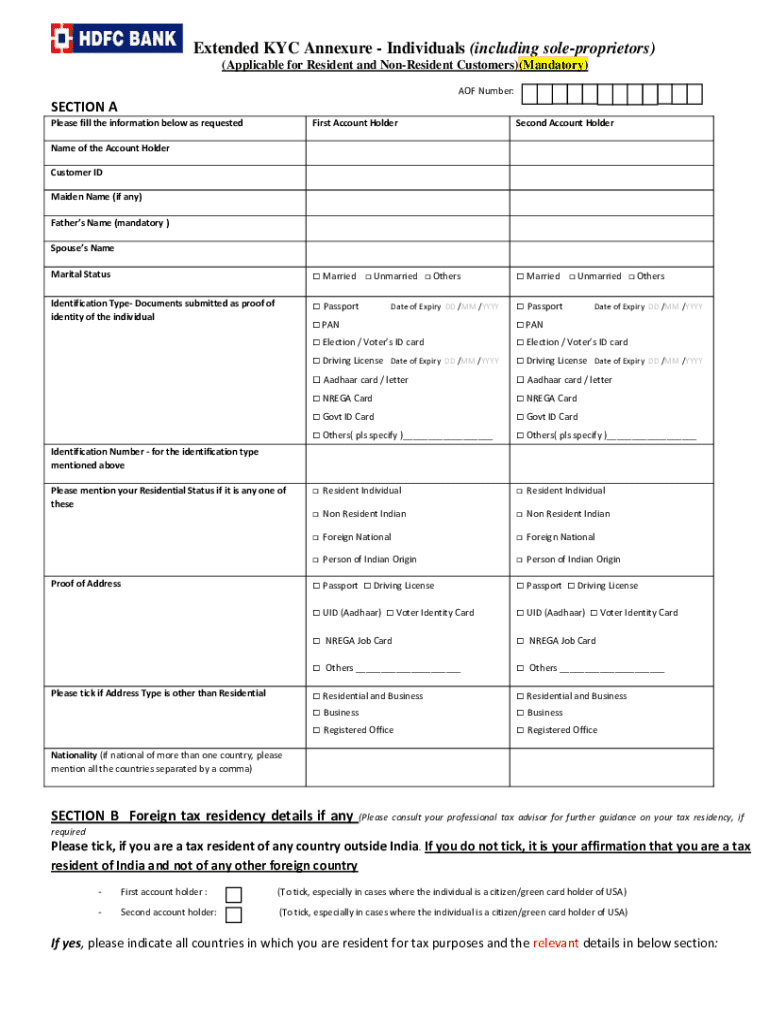

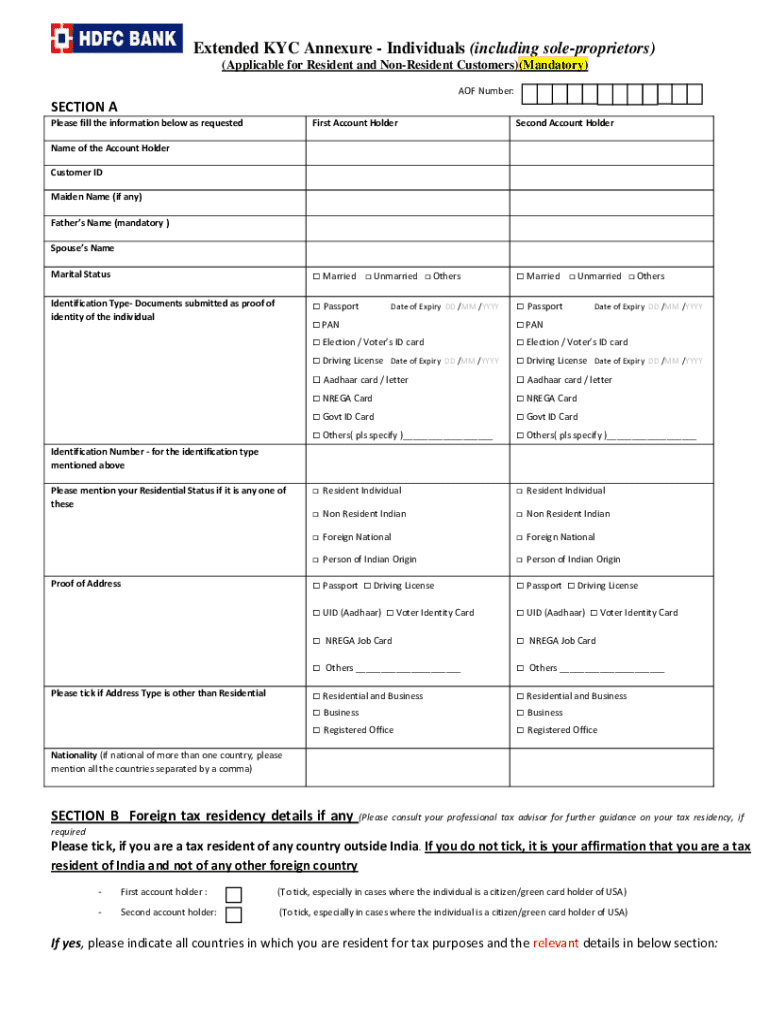

Understanding the AOF number

The AOF number, or Account Opening Form number, is a unique identifier assigned by HDFC Bank for each new account application. It serves as a tracking mechanism for the bank and customers alike, ensuring that every application is managed efficiently from submission to activation.

The primary purpose of the AOF number in banking is to streamline processes associated with account opening. It links all the documents and information submitted with that particular form to the applicant. Therefore, when you provide your AOF number, you help facilitate smoother communications and faster processing times.

Providing an accurate AOF number when filling out forms is crucial. An incorrect AOF number could delay the processing of your application or even result in rejection, as the bank relies on this number to retrieve and verify your submission.

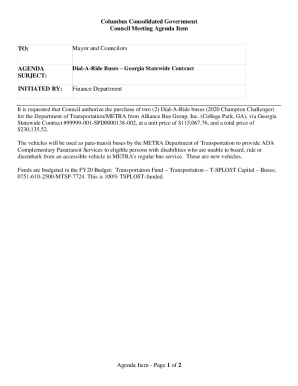

Overview of the HDFC Bank form filling process

When dealing with HDFC Bank, several forms require the inclusion of your AOF number. The most common forms are the Account Opening Form and various Loan Application Forms. Each of these forms is pivotal in executing different banking operations and necessitates accurate information.

Before you can submit your AOF, it's essential to prepare various documents proving your identity, residence, and income. The essential documents required for AOF submission typically include:

These documents not only help validate your identity but also ensure that your AOF is processed without hitches, making it imperative to keep them ready before filling out any forms.

How to fill out the HDFC AOF number form

Filling out an HDFC AOF number form correctly is essential for the timely processing of your application. Here’s a detailed step-by-step guide:

As you fill out the form, each section will require specific information:

While filling out the form, avoid common mistakes such as providing incorrect information or failing to sign where required. Double-checking entries can save time and frustrations later.

Editing and reviewing your form

Once the form is filled, it’s vital to review and edit any sections that may need correction. PDFfiller provides robust editing tools that allow users to make necessary adjustments easily.

You can edit text directly, add sections if needed, or even delete extraneous information. Each tool is accessible through the editing menu on PDFfiller.

Moreover, if you’re collaborating with others on the form, you can share it for review. PDFfiller allows real-time collaboration, making it easy for others to provide input and suggestions immediately.

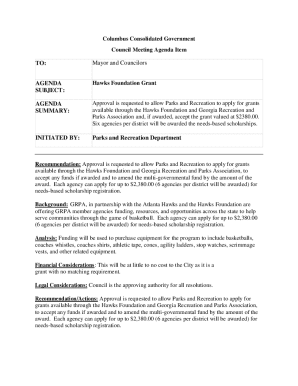

Signing and submitting the HDFC AOF form

One of the final steps in your application process is signing the document. PDFfiller offers a convenient eSignature feature, allowing you to sign your form electronically.

After signing the form, you have multiple submission options. You can submit it online through HDFC’s portal or print it out and mail it to the nearest HDFC branch. Each method has its benefits, depending on your preference and urgency.

Managing your AOF number and related documents

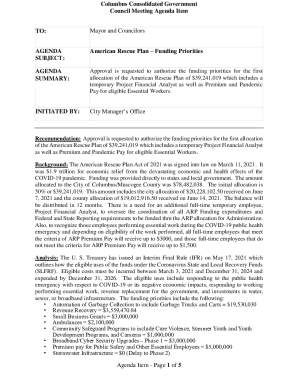

After submitting your AOF, it’s important to manage your documents effectively. Use PDFfiller to keep track of your AOF application and related documents. Storing these documents in a cloud-based platform allows for easy access and organization.

In addition, utilize PDFfiller’s features to categorize and label your forms for future reference. This proactive approach will simplify future submissions and amendments, saving you time and reducing stress.

Troubleshooting common issues

Encountering issues with your form submission isn’t uncommon. If you face problems, such as submission errors, take time to revisit the details you entered. Frequently, issues arise from minor errors like incorrect AOF numbers or missing documents.

For more complex inquiries, contact HDFC Bank’s customer service. They can provide specific guidance, ensuring that any hurdles are swiftly addressed. Additionally, PDFfiller has a robust customer support feature to assist with technical or procedural queries as well.

Best practices for future forms involving AOF number

Being proactive about document management in banking is essential. Stay updated on HDFC bank policies regarding AOF applications. Periodically check for any changes in requirements or documentation needed to ensure timely application processing.

Equally important is maintaining accurate personal records, as this reduces the potential for errors during future submissions. Efficiently managing your documents using PDFfiller can create a smoother experience in the long run, particularly for those dealing with multiple forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit aof number hdfc fill from Google Drive?

How do I execute aof number hdfc fill online?

How do I edit aof number hdfc fill on an Android device?

What is aof number hdfc fill?

Who is required to file aof number hdfc fill?

How to fill out aof number hdfc fill?

What is the purpose of aof number hdfc fill?

What information must be reported on aof number hdfc fill?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.