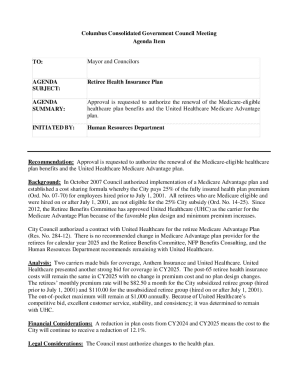

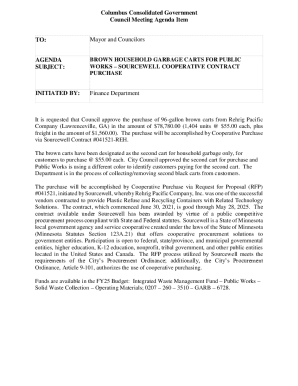

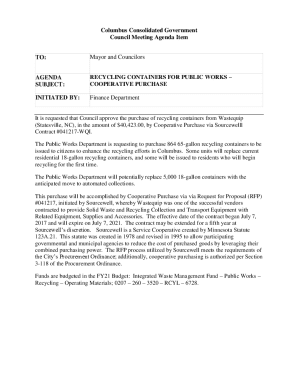

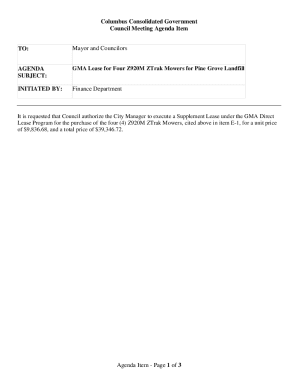

Get the free Instructions for Form PT-100 Petroleum Business Tax Return ...

Get, Create, Make and Sign instructions for form pt-100

Editing instructions for form pt-100 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form pt-100

How to fill out instructions for form pt-100

Who needs instructions for form pt-100?

Instructions for Form PT-100 Form: A Comprehensive Guide

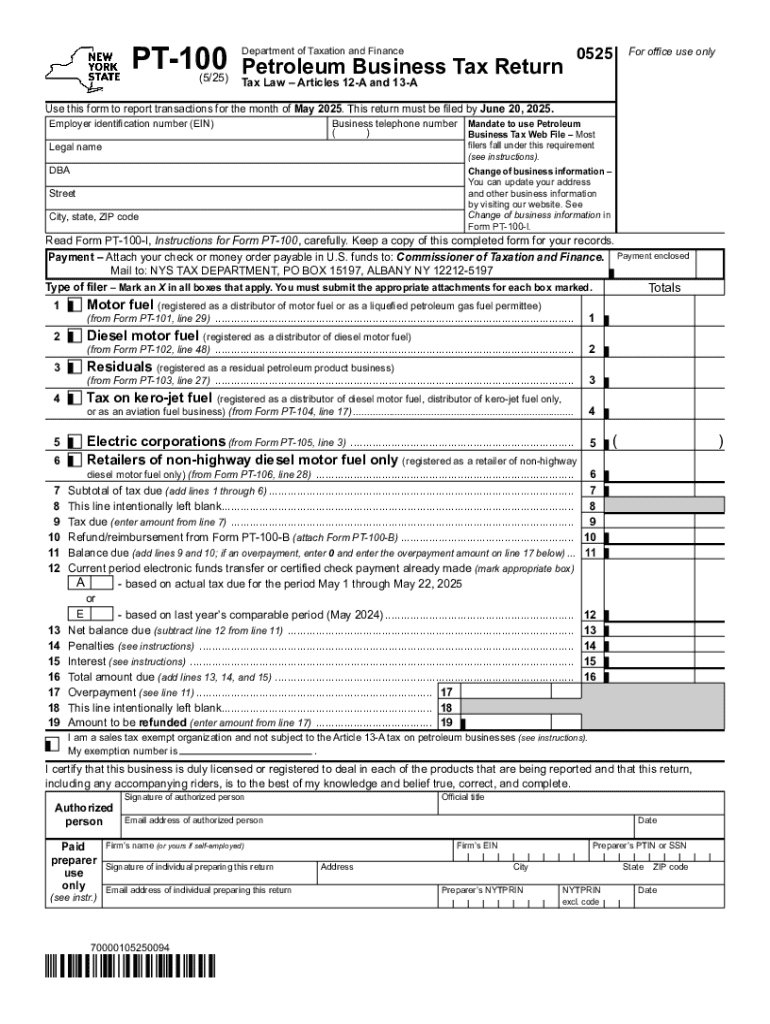

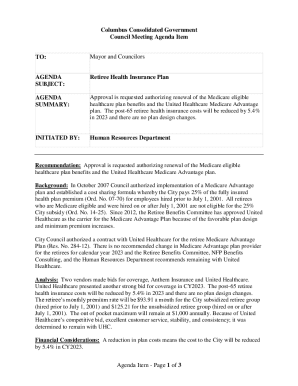

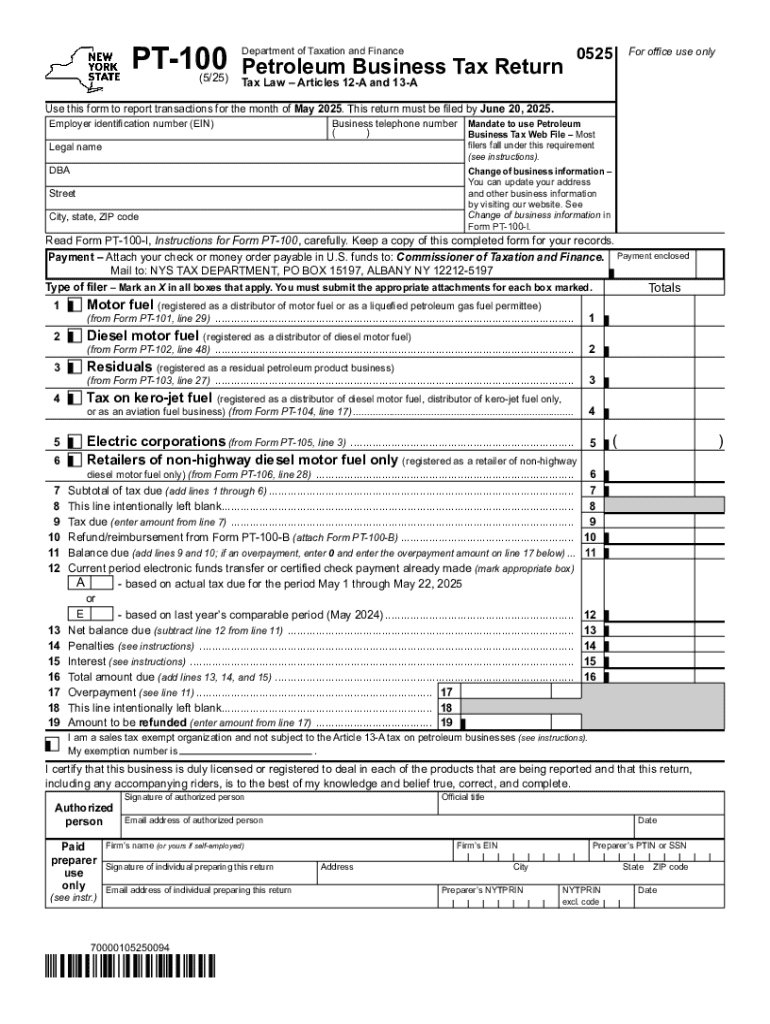

Understanding Form PT-100

Form PT-100 is an essential document utilized for specific tax reporting purposes, particularly in relation to property taxation. This form is pivotal for ensuring compliance with local jurisdictional requirements, hence its proper completion is crucial for avoiding potential penalties and fines. Understanding the nuances of Form PT-100 will equip you with the information needed to navigate completion and submission effectively.

Who needs to use Form PT-100?

Form PT-100 is designed primarily for use by individuals and businesses that hold property subject to taxation. This form helps ensure that all property owners report their holdings accurately, thereby allowing tax authorities to assess property values correctly. Key eligibility criteria include property ownership status and the specific requirements of the jurisdiction where the property is located.

Preparing to fill out the form

Before commencing with Form PT-100, it is vital to gather all necessary documentation and information. This preparatory step reduces the likelihood of errors which could lead to delayed processing or incorrect tax assessments. Required information may include property deeds, previous tax returns, and current property valuations.

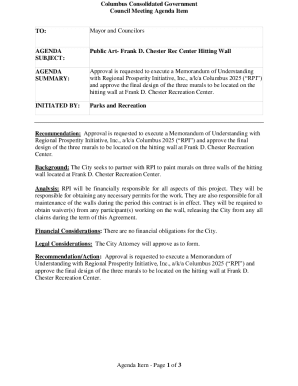

Accessing Form PT-100

Form PT-100 can be accessed easily through various means. It is available for download on official tax websites or may be obtained directly from local tax offices. Additionally, pdfFiller offers a simple solution for accessing and editing this form online, allowing users to fill it out seamlessly.

Detailed instructions for completing each section

Completing Form PT-100 involves accuracy and attention to detail. Each section requires specific information, and common errors can be avoided with careful preparation.

Section A: Personal Information

In this section, you will provide identifying details, including your name, address, and taxpayer identification number. Common mistakes include typos in the name or address, which could lead to confusion in processing.

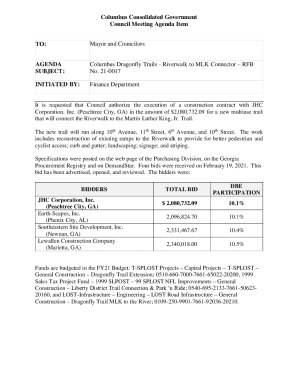

Section B: Property Information

You must detail the properties you own, including addresses and property types. Accuracy here is critical as it impacts tax calculations.

Section : Tax Details

This section requires the calculation of your tax obligations based on the property values declared. Ensure to consult current tax rates and refer to any recent tax assessments.

Section : Certification

Finally, signatures must be affixed to certify the accuracy of the information provided. It’s essential to read the certification statement carefully before signing.

Tips for common challenges

Common challenges, such as miscalculations in tax obligations or failure to include all necessary property details, can derail the submission process. Using tax software for calculations or engaging a professional tax advisor can help in mitigating these risks.

Using pdfFiller for Form PT-100

pdfFiller is a transformative platform that simplifies the process of editing PDFs, including Form PT-100. This service allows users to fill out forms digitally from anywhere, making it particularly advantageous for those managing multiple properties or for teams.

Editing the form online

Using pdfFiller, users can edit Form PT-100 by uploading the document and utilizing user-friendly tools to fill in required sections. This online approach eliminates the challenges associated with traditional paper forms, allowing for instant corrections.

eSigning the document

Electronic signatures are legally recognized and can be added easily using pdfFiller. This feature streamlines the completion process, ensuring that users can submit forms promptly.

Collaborating with others

pdfFiller also facilitates collaboration among team members. Users can invite others to review or edit the Form PT-100, enhancing accuracy through collective input.

Submitting Form PT-100

Prior to submission, it is crucial to conduct a thorough review of the completed Form PT-100. Make use of pdfFiller’s extensive validation tools to ensure all information is correct and complete before sending the document in.

Submission methods

There are several options for submitting your filled Form PT-100. This can include online submission through designated portals, mailing it to the tax office, or delivering it in person. Be aware of submission deadlines to avoid any penalties.

Managing and storing your form after submission

Once you have submitted Form PT-100, keeping a copy for your records is advisable. This practice ensures you have documentation in the event of future inquiries or audits.

Tracking submission status

Tracking the status of your submitted Form PT-100 can provide peace of mind. Utilize available online resources to check on the status and maintain records of communications with the tax authority.

Frequently asked questions (FAQs)

As users prepare to submit Form PT-100, they often have many questions. Common inquiries may include details about the information required, how to handle discrepancies, or what to do if additional documentation is requested. Engaging with online FAQs or consulting with a tax professional can provide needed clarifications.

Support for complex situations

For more complex scenarios that extend beyond the basics of Form PT-100, it may be beneficial to consult resources like tax advisors or certified public accountants who can assist with specific issues.

Next steps after filing

After submitting Form PT-100, understanding potential outcomes will help users prepare accordingly. Expect communication from tax authorities regarding the accepted form or any further actions required.

Preparing for future filings

To improve the process for future Form PT-100 submissions, consider maintaining accurate records throughout the year. Utilizing pdfFiller’s tools can ease the burden of document management significantly, providing a seamless experience for filing taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find instructions for form pt-100?

How do I complete instructions for form pt-100 online?

How do I edit instructions for form pt-100 straight from my smartphone?

What is instructions for form pt-100?

Who is required to file instructions for form pt-100?

How to fill out instructions for form pt-100?

What is the purpose of instructions for form pt-100?

What information must be reported on instructions for form pt-100?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.