Get the free 2026 KENTUCKY WITHHOLDING TAX FORMULA

Get, Create, Make and Sign 2026 kentucky withholding tax

Editing 2026 kentucky withholding tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 kentucky withholding tax

How to fill out 2026 kentucky withholding tax

Who needs 2026 kentucky withholding tax?

2026 Kentucky Withholding Tax Form - How-to Guide

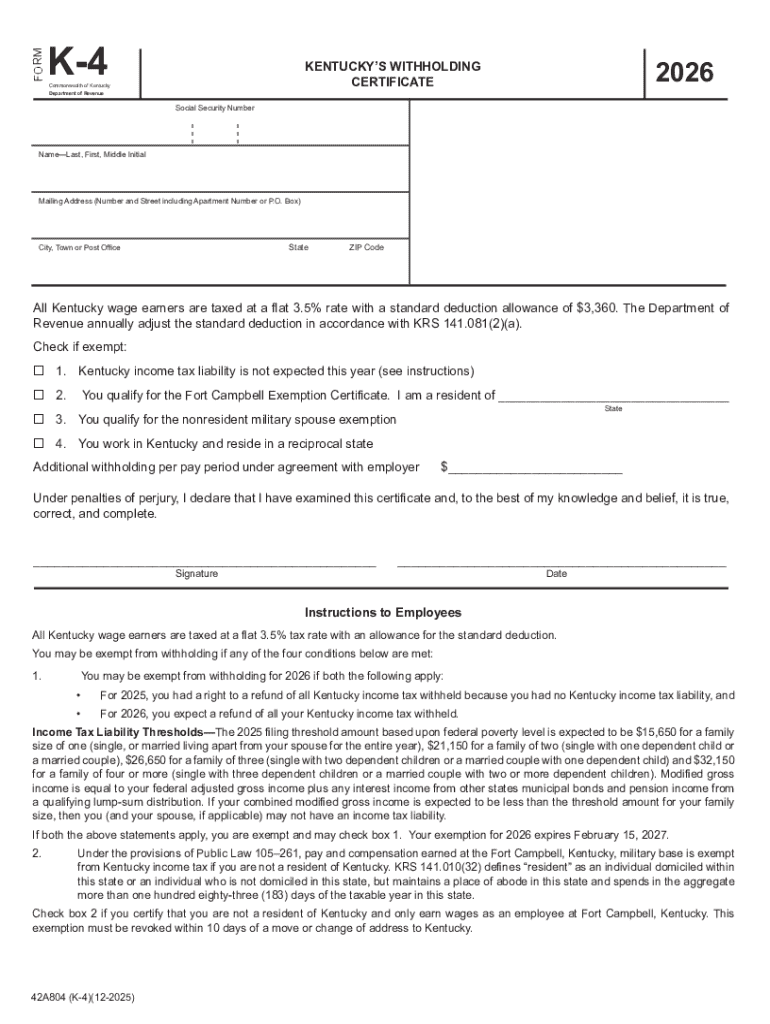

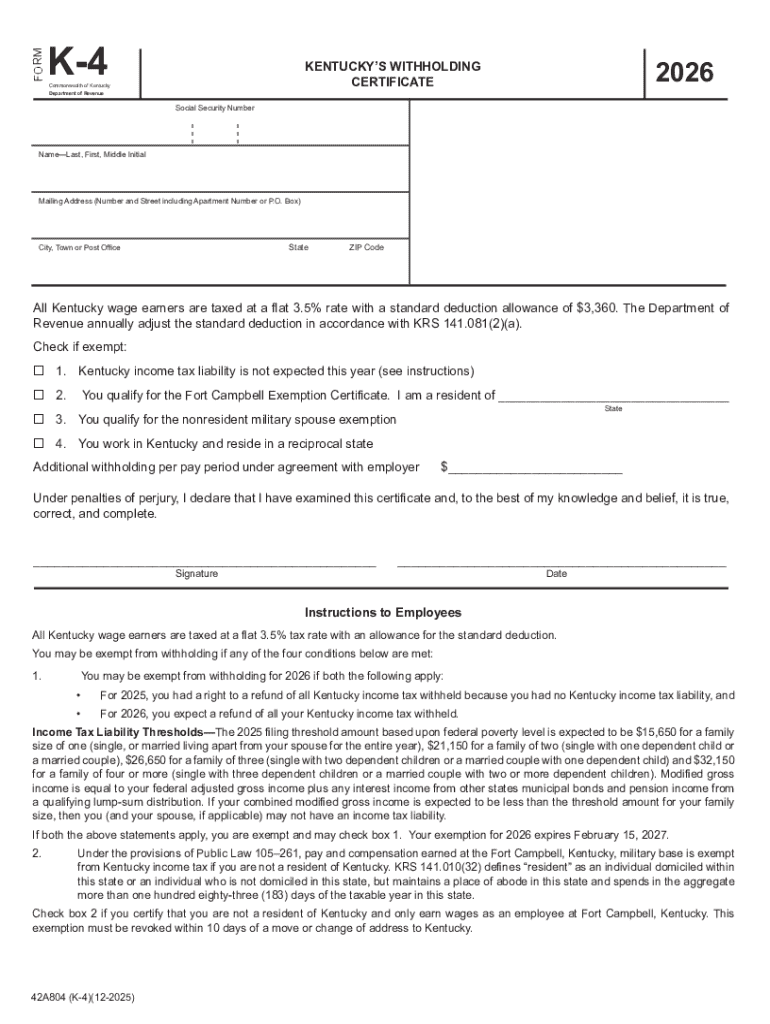

Understanding the Kentucky withholding tax landscape

Withholding tax is a critical component of income tax collection for both federal and state governments. In Kentucky, employers are responsible for appropriately withholding state income taxes from their employees' paychecks. This responsibility ensures that workers contribute to state revenue, which in turn supports public services. Understanding the nuances of Kentucky's withholding tax law is essential for employers and employees alike to ensure compliance and prevent liabilities.

Any employer engaging individuals for work in Kentucky is required to withhold state taxes. This applies not only to full-time employees but also to part-time, seasonal, and certified contractors. Familiarity with these obligations is crucial as it helps to avoid costly errors during tax seasons.

Key changes for the 2026 tax year

The 2026 tax year brings forth several significant changes to the Kentucky withholding tax form that employers should be aware of. One key update is the revision of withholding rates based on legislative changes that could affect the amount employers are required to withhold from employee wages. These changes can reflect shifts in the economy and state budget, and it's vital to stay informed about how they impact your tax responsibilities.

Comparing the 2026 Kentucky withholding tax form to previous years, there are adjustments aimed at simplifying the filing process, including clarifications in line instructions and modifications to the information required for nonresident employees, a common area of confusion. Employers are encouraged to review the differences from the 2025 withholding statement reporting to ensure compliance.

Employer responsibilities

Under Kentucky Revised Statute Chapter 141, employers have distinct obligations regarding payroll withholding. This statute outlines the requirement for employers to collect and remit state taxes, specifically ensuring that the correct amount is withheld from each employee’s paycheck based on their income level and tax status. It's important for employers to stay updated on this legislation to maintain compliance.

Classifying employees accurately is equally important. Employers need to distinguish between residents and nonresidents, as well as identify who qualifies for exemptions. Misclassification can lead to issues during audits or when discrepancies arise in tax filings, which is why it’s crucial to refer to the state's guidelines and definitions when determining an employee's status.

The 2026 Kentucky withholding tax form explained

The 2026 Kentucky withholding tax form presents a clear structure aimed at ensuring ease of use for employers. Each line of the form has been designed with specific instructions to guide users through the process. It's crucial to understand that this form is not just a bureaucratic obligation but a critical tool for accurate taxpayer reporting and compliance.

When filling out the form, attention to detail is paramount. Mistakes on the form can result in financial penalties and interest charges. Common pitfalls include miscalculating withholdings or failing to include necessary statement information required for nonresident employees. To avoid these issues, review each line carefully and consider consulting a tax professional if necessary.

Filing the 2026 Kentucky withholding tax form

Filing the 2026 Kentucky withholding tax form can be done electronically or via traditional paper methods. Each option has its own set of advantages; electronic filing tends to be faster, often providing immediate confirmation of receipt, while paper filing offers a tangible record. Employers must ensure that they adhere to the deadlines specific to the 2026 tax year, as late submissions can incur penalties.

Moreover, engaging with pdfFiller's document solutions simplifies the entire filing process. Users can upload, edit, and sign the form quickly and securely, making it less daunting for employers managing multiple employee records.

Tools and resources for easy management

pdfFiller offers a user-friendly platform for managing tax documents, including the 2026 Kentucky withholding tax form. Accessing and utilizing the tax form template is straightforward. The platform supports varied functionalities, enabling users to edit, sign, and collaborate on essential tax documents effortlessly. This can be particularly useful for teams needing to coordinate on filings without the hassle of email exchanges.

For instance, pdfFiller's cloud-based solutions accommodate users who require access to documents from anywhere. This portability can be invaluable for employers on the go or for those who work remotely, ensuring that important filing deadlines are met regardless of location.

Common FAQs regarding Kentucky withholding tax

Many users have pressing questions when it comes to filing the 2026 Kentucky withholding tax form. Some common inquiries include what to do if a mistake is made on the form, how to verify the status of a submission, and what penalties might be incurred for noncompliance. Addressing these issues proactively can save employers significant headaches down the road.

Managing multiple employee tax situations

For businesses with diverse employee compositions, managing withholding can be particularly intricate. Employers need to develop strategies for handling various classifications, such as part-time, full-time, seasonal, and nonresident employees. Each category has different withholding requirements, and mismanagement can lead to tax compliance issues.

Understanding the implications of employee tax status is critical for accurately estimating the correct withholding amounts. Employers should regularly refresh their knowledge on state regulations concerning these classifications to stay aligned with compliance obligations and avoid common pitfalls associated with misclassification.

Staying up to date with withholding tax regulations

Keeping abreast of developments in Kentucky's withholding tax regulations is a crucial task for any employer. Establishing best practices for ongoing education can spare employers from costly mistakes as tax laws evolve. Subscribe to updates from the Kentucky Department of Revenue and participate in relevant workshops or webinars to stay informed.

Additionally, consider engaging with platforms like pdfFiller, which can assist in managing all tax forms and indexes of pertinent changes in regulations, ensuring that all documents are compliant with the latest information available.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2026 kentucky withholding tax in Chrome?

Can I create an electronic signature for signing my 2026 kentucky withholding tax in Gmail?

Can I edit 2026 kentucky withholding tax on an Android device?

What is 2026 kentucky withholding tax?

Who is required to file 2026 kentucky withholding tax?

How to fill out 2026 kentucky withholding tax?

What is the purpose of 2026 kentucky withholding tax?

What information must be reported on 2026 kentucky withholding tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.