Get the free 2025-2026 Tax Forms for Federal and State Taxes - TurboTax

Get, Create, Make and Sign 2025-2026 tax forms for

Editing 2025-2026 tax forms for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 tax forms for

How to fill out 2025-2026 tax forms for

Who needs 2025-2026 tax forms for?

Comprehensive Guide to 2 Tax Forms

Overview of 2 tax forms

Tax forms for the 2 tax year are crucial documents that individuals and businesses must correctly fill out to report their income, deductions, and tax liabilities. These forms not only ensure compliance with federal and state tax laws but also impact your potential refund amount. Understanding the evolution of these forms, especially when compared to the previous tax year, can help taxpayers navigate changes that could affect their filings.

In the 2 tax forms, several amendments and updates have been introduced, reflecting the latest tax regulations enforced by the Department of the Treasury. For instance, changes in standard deductions and tax brackets designed to adjust for inflation may influence how much taxpayers owe or receive as refunds. Keeping forms accurate and up-to-date is vital for maximizing potential refunds and minimizing erroneous tax liabilities.

Navigating the 2 tax forms

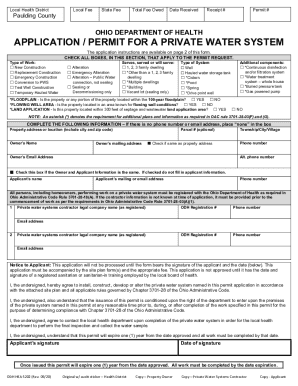

Taxpayers encounter various forms, which can be broadly categorized into three main types: Income Tax Forms, Business Tax Forms, and State-Specific Forms. Each category addresses unique situations and needs. Familiarizing yourself with the key forms within these categories enhances efficiency during the filing process.

Key Income Tax Forms include Form 1040 for individual tax returns, Form W-2 for wage and salary earners, and Form 1099 for reporting other types of income. These forms are integral in detailing all income sources received throughout the year. On the business side, freelancers and small business owners must use various schedules and forms, including Schedule C, to accurately report their business income and expenses.

Furthermore, states may have specific requirements that diverge from federal guidelines, necessitating the use of State-Specific Forms. Each state employs its form and instructions, so taxpayers should consult with their respective state's revenue department to ensure compliance.

Accessing and downloading tax forms

Accessing tax forms has never been easier. You can efficiently download the necessary documentation from platforms like pdfFiller. To ensure you find the correct form quickly, follow these steps:

For alternative resources, the IRS website offers downloadable forms, instructions, and additional guidelines. Similarly, state tax websites also provide localized forms and instructions relevant to your state's processing.

Detailed insights on popular tax forms

Examining specific forms in-depth provides clarity on what is required for accurate filings. Form 1040 is often the centerpiece for individual taxpayers, consisting of sections related to personal information, income reporting, and withholding details. It also includes spaces for additional income and tax credits, directly impacting your final tax return.

Form W-2 is significant for employers, providing necessary details about employees' earnings over the year. Employers must furnish these forms by January 31st each year to ensure employees can accurately file their tax returns. On the other hand, Form 1099, which comes in various versions like 1099-MISC and 1099-NEC, is used to report non-employee income, dividends, and distributions. Understanding the differences in these forms helps taxpayers report various income sources accurately, ensuring they avoid penalties or audits.

Interactive tools for form management

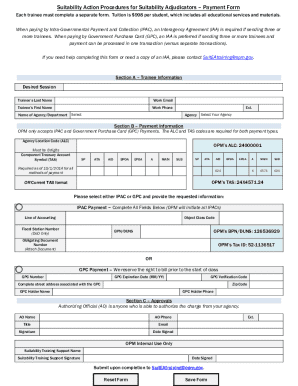

pdfFiller provides several interactive features geared toward enhancing user experience when managing tax forms. A notable tool is the form-filling feature, which allows users to enter data seamlessly online without printing paper forms, thereby reducing clutter and enhancing efficiency.

Additionally, pdfFiller includes eSigning capabilities that allow users to sign forms digitally. This streamlined process for signing not only saves time but also enhances document security. For teams or those working with tax professionals, collaboration features facilitate sharing forms, annotating, and ensuring all necessary information is included before submission.

Essential steps for filling out tax forms accurately

Accuracy when filling out tax forms is vital. Follow these essential steps to ensure precision:

Common pitfalls when completing tax forms

Taxpayers frequently make common errors that can complicate the filing process. These include math errors, failure to sign forms, and submitting incomplete information. Understanding these pitfalls is essential to prevent issues that could delay your refund status or trigger audits.

Best practices to avoid these common mistakes include using tax preparation software like pdfFiller for calculations, ensuring you review prior year returns for consistency, and having a peer or tax professional review your forms prior to submission. Addressing these potential problems proactively can save you time and stress when tax season arrives.

Important dates for the 2 tax year

Awareness of key deadlines is essential in the 2 tax year. The primary deadline for individual tax returns is April 15, 2026. However, if you need more time, you can apply for an extension, giving you until October 15, 2026, to file, although payments must still be made by the original due date to avoid penalties.

Businesses should also be aware of estimated tax payment dates, generally due on a quarterly basis. Specific dates may vary based on your business structure and state requirements, so always check your state tax department's guidelines to ensure compliance.

Getting help with your tax forms

When the tax filing process becomes overwhelming, seeking assistance can be beneficial. Resources are available for taxpayers looking for guidance. Depending on your needs, you can find a qualified tax professional or advisor through local recommendations or online directories.

Online resources, including forums and FAQs on pdfFiller and IRS websites, offer ample information to answer common queries regarding filling out tax forms. If you have specific questions related to your documents, pdfFiller’s customer support is an excellent resource for real-time assistance with form-related queries, enhancing your overall experience.

Conclusion: Empower yourself with document management

pdfFiller offers a comprehensive solution to enhance your experience with 2 tax forms and facilitates efficient document management strategies. By using features such as e-signatures, collaborative sharing, and interactive forms, you can effectively manage your tax documentation with minimal stress.

Leveraging these tools today not only streamlines the current filing process but also sets you up for success in future tax years. Preparing your forms early can greatly reduce last-minute stress, allowing you to ensure that all information is accurate and submitted on time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2025-2026 tax forms for?

How do I make edits in 2025-2026 tax forms for without leaving Chrome?

Can I edit 2025-2026 tax forms for on an Android device?

What is 2025-2026 tax forms for?

Who is required to file 2025-2026 tax forms for?

How to fill out 2025-2026 tax forms for?

What is the purpose of 2025-2026 tax forms for?

What information must be reported on 2025-2026 tax forms for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.