Get the free 2025 Income Tax Forms - Nebraska Department of Revenue

Get, Create, Make and Sign 2025 income tax forms

Editing 2025 income tax forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 income tax forms

How to fill out 2025 income tax forms

Who needs 2025 income tax forms?

2025 Income Tax Forms: Your Essential Guide to Filing

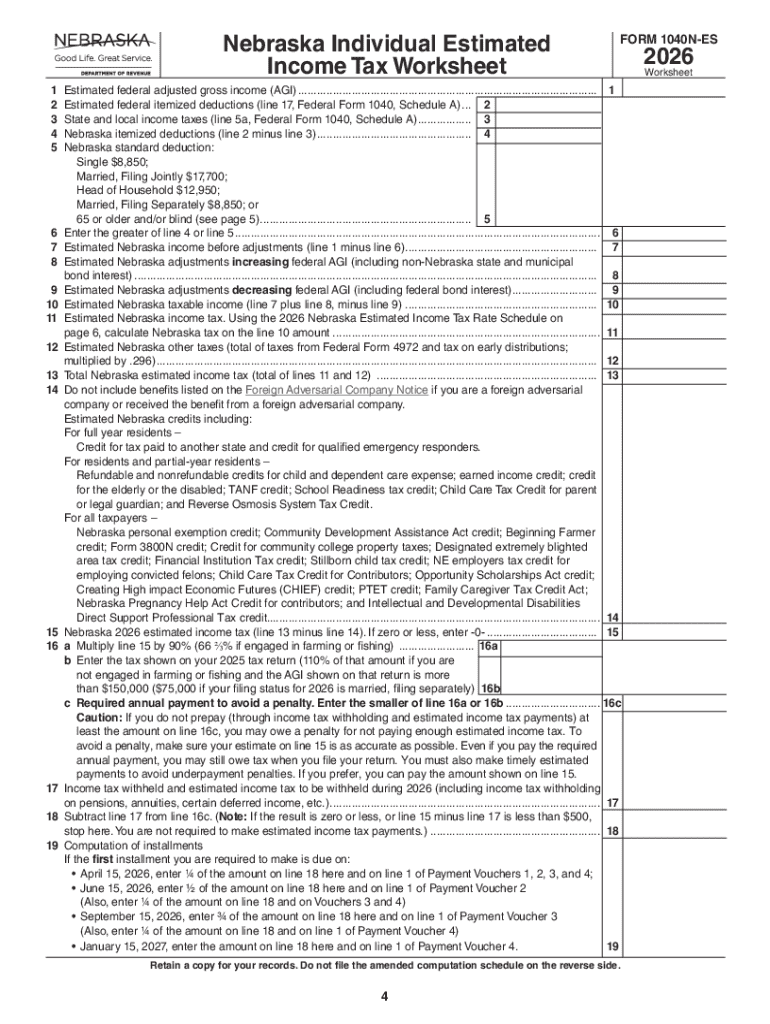

Overview of 2025 income tax forms

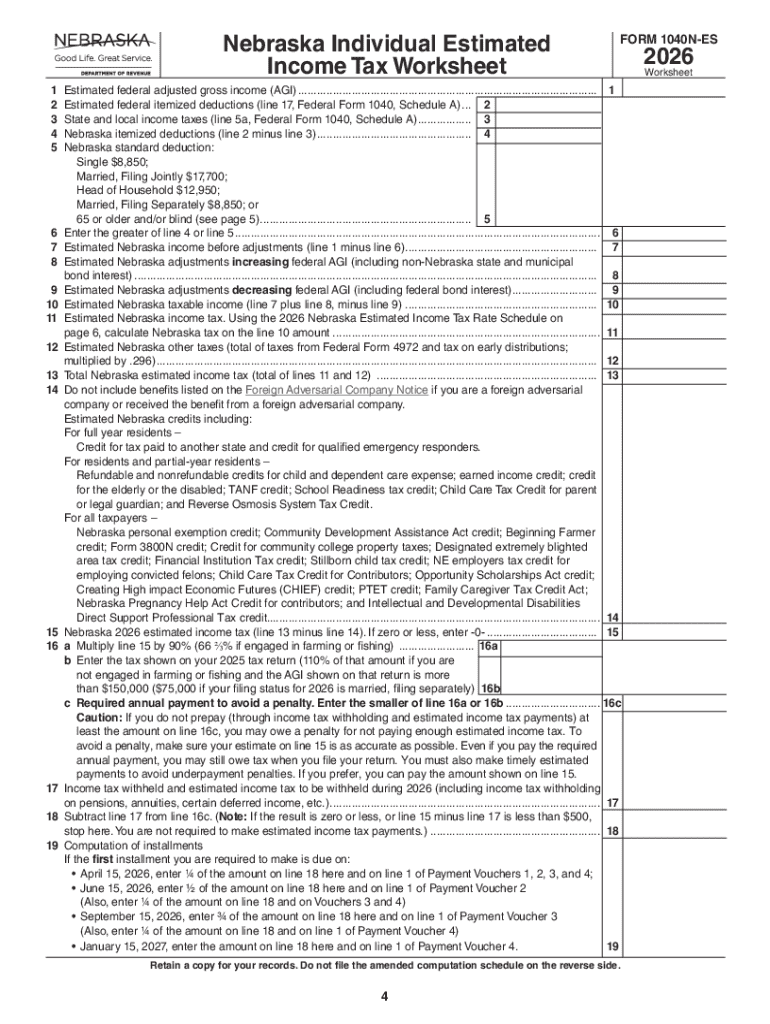

The purpose of the 2025 income tax forms is to provide a standardized method for individuals and businesses to report their income, expenses, and taxes owed to the government. Accurate and timely filing is vital to avoid penalties and to ensure compliance with tax laws. For 2025, key changes include adjustments to tax brackets, new credits and deductions, and modifications concerning eligible dependents.

Types of 2025 income tax forms

Understanding which forms you need is a crucial step in the filing process. The primary categories include:

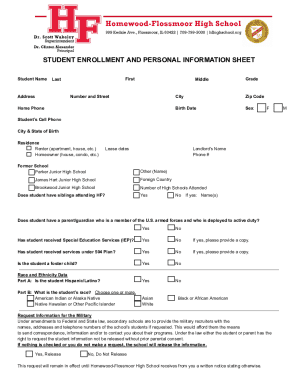

Understanding the structure of 2025 tax forms

Each income tax form has a specific structure, generally divided into key sections. These include personal information, income reporting sections, and deductions and credits this year. For example, the personal information section requires basic data like your name, Social Security Number, and address, while the income reporting sections vary greatly based on your forms.

It's also important to note that differences exist between federal and state forms, particularly regarding specific rates that apply in various states. For local nuances, it can be beneficial to consult your state's tax department or access their online services account to get detailed guidance.

Step-by-step guide to filling out your 2025 income tax form

Filing your tax return need not be an overwhelming task when you have a systematic approach. Here is a step-by-step guide:

Common mistakes include incorrect Social Security numbers, miscalculating deductions, and simple typos in amounts, which can greatly affect your return.

Tools and resources for 2025 income tax preparation

Utilizing online tools can simplify the tax preparation process significantly. pdfFiller offers interactive tools that enhance your experience, which include:

Furthermore, accessing eFiling options can be a game-changer. eFiling tends to be simpler, faster, and comes with the benefit of automatically calculating your refund.

Managing your completed tax forms

Completing your tax forms is just one part of the process; managing your records afterward is crucial. Keeping your tax records organized and accessible safeguards against future inquiries from tax departments. Consider these suggestions:

If collaborating as a team, pdfFiller offers features that allow secure sharing of files, enabling team members to contribute effectively and track changes in real-time.

Getting help with 2025 income tax forms

If you encounter challenges or have specific questions, there are several resources available for you. A frequently asked questions (FAQ) section might resolve common confusions. For more complex situations involving unique tax circumstances, contacting a tax professional can be invaluable.

Additionally, utilizing pdfFiller's customer support services offers immediate assistance and can help alleviate stress during taxing times.

Multilingual assistance for 2025 tax forms

Language accessibility in tax filing is increasingly important. pdfFiller understands this necessity and offers support for various languages to cater to a diverse user base.

Utilizing these multilingual resources ensures that non-English speakers can navigate their tax forms without barriers. This not only enhances understanding but also compliance with deadlines and requirements set forth by tax departments.

Additional considerations for filing 2025 income tax forms

As you prepare your 2025 income tax forms, keep in mind recent changes in tax regulations. New credits and deductions unique to 2025 may play a significant role in your filing. Be aware of any adjustments in filing deadlines or procedures introduced by the IRS this year.

Furthermore, state-specific filing requirements can impact your tax planning, so check with your state's tax department for specific communications, notices, and bills that may apply directly to you or your situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 income tax forms for eSignature?

How can I edit 2025 income tax forms on a smartphone?

How do I complete 2025 income tax forms on an iOS device?

What is 2025 income tax forms?

Who is required to file 2025 income tax forms?

How to fill out 2025 income tax forms?

What is the purpose of 2025 income tax forms?

What information must be reported on 2025 income tax forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.