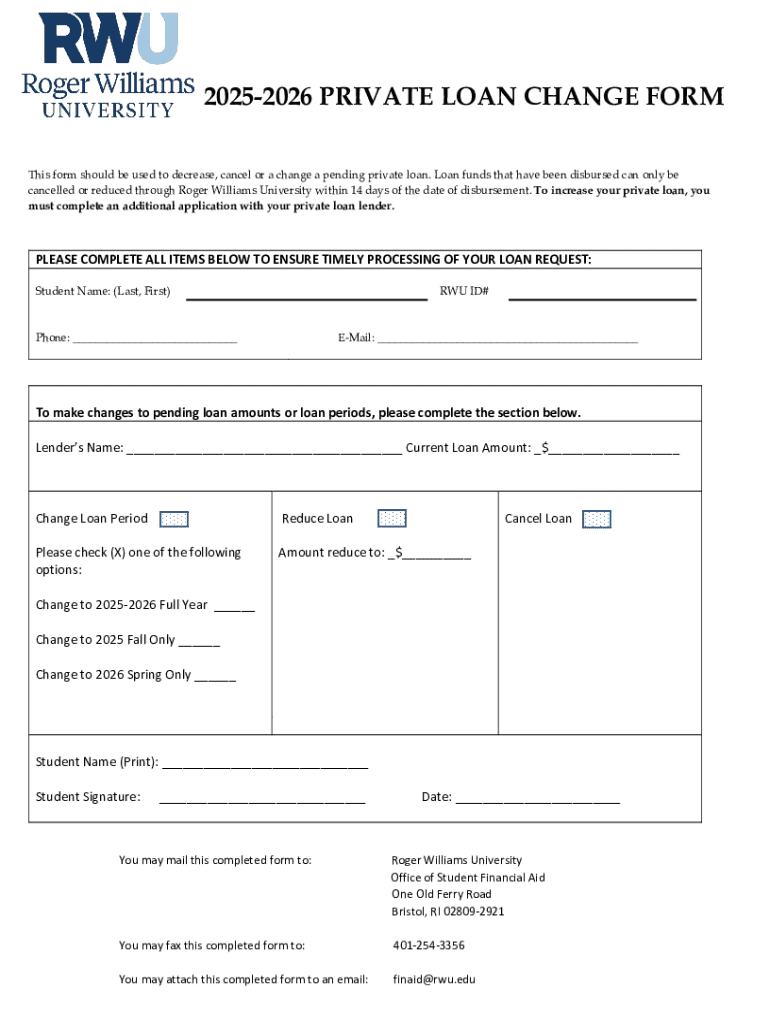

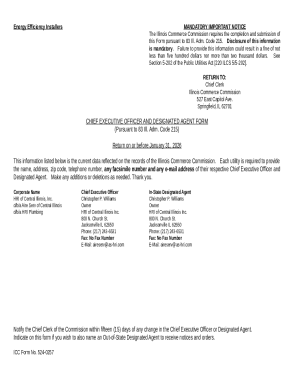

Get the free 2025-2026 Private Loan Change Request Form ALTCHG

Get, Create, Make and Sign 2025-2026 private loan change

Editing 2025-2026 private loan change online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 private loan change

How to fill out 2025-2026 private loan change

Who needs 2025-2026 private loan change?

2 Private Loan Change Form: A Comprehensive Guide

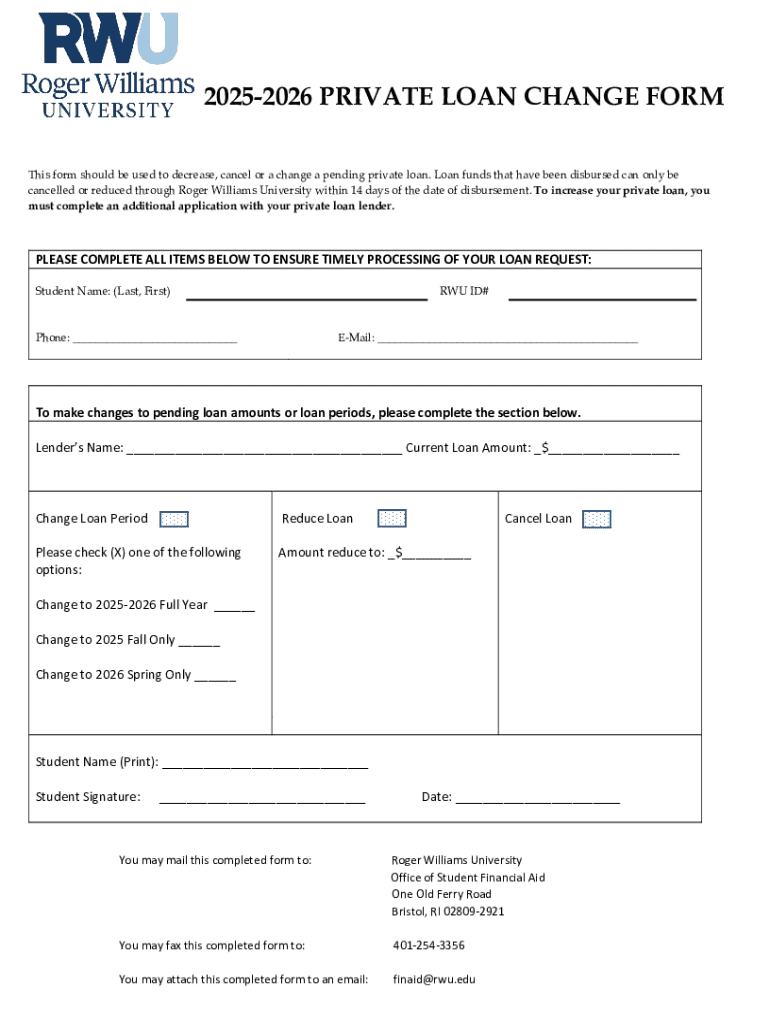

Understanding the 2 private loan change form

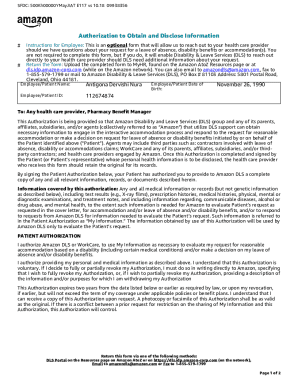

The 2 private loan change form is a critical document for managing your private student loans effectively. It serves as a formal request to modify existing loan information, whether you're adjusting your loan amount, repayment terms, or borrower details. Keeping your loan information up-to-date is crucial not only for compliance but also for ensuring that you are making the most of your financial resources as an educational borrower.

Changes in the academic year can affect your financial planning significantly. For instance, if educational institution tuition fees increase or your financial situation changes, updating your loan details accordingly can provide greater flexibility in managing your repayments and overall debt.

Who needs to use the private loan change form?

The 2 private loan change form is not just for students. Various stakeholders can benefit from its use. first and foremost, student borrowers who find their financial situation has altered—be it through changes in income, academic status, or personal circumstances—should consider utilizing this form to ensure their loan terms align with their current situation.

Parents and guardians also play a crucial role, particularly in supporting students financially. If a change occurs in the family's financial circumstances, it is vital that they also assess how this may impact their student’s loans. Additionally, educational institutions can act as facilitators, guiding students and families on how to fill out and submit the form to adapt their financial agreements effectively.

Types of changes addressed by the form

The 2 private loan change form encompasses various types of changes that borrowers might need to make. This includes modification of borrower information, such as updating contact details or name changes. Additionally, if a student requires a higher loan amount due to increased tuition or educational costs, this form allows for that adjustment.

Repayment terms may also need to be altered based on financial capabilities. Borrowers might look to extend repayment periods or switch to income-driven repayment plans that better accommodate their current financial situation. Lastly, for those who initially had a co-signer but wish to remove them, or who need to add a new co-signer, this change can be processed through the same form.

Step-by-step instructions for completing the form

Completing the 2 private loan change form is straightforward when you follow these detailed instructions, ensuring smooth processing of your request.

**Step 1:** Downloading the 2 Private Loan Change Form. You can easily find this form on educational and lending institution websites, or directly from pdfFiller.

**Step 2:** Filling Out Personal Information. This includes your name, address, and loan account number. Be meticulous; incorrect personal details can lead to delays.

**Step 3:** Specifying the Nature of the Change. Here you’ll need to check boxes or fill in specific areas indicating what changes are being requested.

**Step 4:** Providing Supporting Documentation. Depending on your changes, documentation may be required such as proof of income or identification. Ensure all necessary documents are included to avoid processing delays.

Tips for filling out and submitting the form

Filling out the 2 private loan change form accurately is vital to avoid unnecessary delays in processing. Here are some best practices to consider:

Double-checking all information before submission is crucial. Common mistakes often arise from incorrect personal details or missing signatures. To mitigate this, make use of checklists for required fields.

Finally, submitting your form via a reliable platform like pdfFiller can also ensure your document is sent securely and trackable, further reducing chances of errors.

eSigning the private loan change form

With the rise of digital documentation, eSigning the 2 private loan change form is increasingly essential. Electronic signatures streamline the process, ensuring that submissions are both secure and timely.

Using pdfFiller, the eSigning process is simple. Navigate to the signature section of the form, select to add a signature, and follow the prompts to create and place your signature electronically.

Ensuring signature legitimacy is paramount. Be sure to use secure networks when signing and send completed forms through trusted channels to maintain record integrity.

Managing your document post-submission

After submitting your 2 private loan change form, it’s essential to know how to manage the document and track its status. Keeping an eye on your submission can provide peace of mind during processing.

You can check the status of your submitted form through pdfFiller’s user interface, which offers tracking options. If you find that changes are necessary post-submission, pdfFiller also provides options for editing submitted forms easily.

Efficient document storage and organization is crucial. Create a dedicated folder for your loan documents within pdfFiller’s cloud-based platform; this allows easy access and organization of multiple forms.

Interactive tools available on pdfFiller

pdfFiller isn’t just about filling out forms; it offers many interactive tools that can enhance the user experience. For instance, the powerful PDF editing features provide users with the capability to make adjustments to their forms without needing a secondary editing program.

Collaborative tools also ensure that teams can work together efficiently. If multiple parties are involved in the loan change process, sharing documents in real-time can speed up the negotiation and review process.

Additionally, using a cloud-based platform means your documents are securely stored and accessible from anywhere, an invaluable resource for those who travel or need flexibility.

FAQs about the 2 private loan change form

As you navigate through the process of utilizing the 2 private loan change form, you may have questions. Below are some frequently asked questions that might provide clarity:

What to do if your form is declined? If your form is declined, reach out to your lender immediately to understand the reasons and gather insights into corrective actions you can take.

How long does it take to process changes? Processing times can vary, but typically, you can expect a turnaround of 1-3 weeks. However, this can depend on the lender’s internal processes.

For more assistance, lenders usually provide contact information on their websites. It’s wise to reach out directly to them for specific and personalized guidance.

Additional insights into private loan management

Understanding your rights as a borrower is fundamental to effective private loan management. Familiarize yourself with your repayment options and what your lender can and cannot do. Knowledge empowers borrowers and aids in better financial decision-making.

Managing private loans also requires diligence in tracking your repayment schedule—set reminders for payments to avoid late fees. Moreover, communicate regularly with lenders should circumstances change; they may offer flexible repayment options that suit new situations.

Lastly, engaging with resources on financial aid can provide additional insights. Many educational institutions offer financial literacy programs to better prepare students for managing their loans efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2025-2026 private loan change?

Can I create an eSignature for the 2025-2026 private loan change in Gmail?

How do I complete 2025-2026 private loan change on an iOS device?

What is 2025-2026 private loan change?

Who is required to file 2025-2026 private loan change?

How to fill out 2025-2026 private loan change?

What is the purpose of 2025-2026 private loan change?

What information must be reported on 2025-2026 private loan change?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.