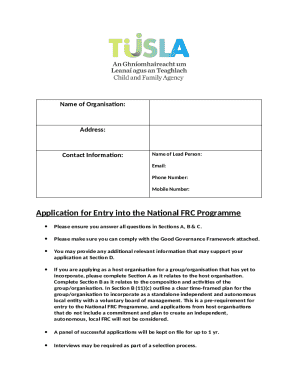

Get the free Final Agreement DraftPDFInterestTaxes

Get, Create, Make and Sign final agreement draftpdfinteresttaxes

How to edit final agreement draftpdfinteresttaxes online

Uncompromising security for your PDF editing and eSignature needs

How to fill out final agreement draftpdfinteresttaxes

How to fill out final agreement draftpdfinteresttaxes

Who needs final agreement draftpdfinteresttaxes?

Final Agreement Draft PDF Interest Taxes Form: A Comprehensive Guide

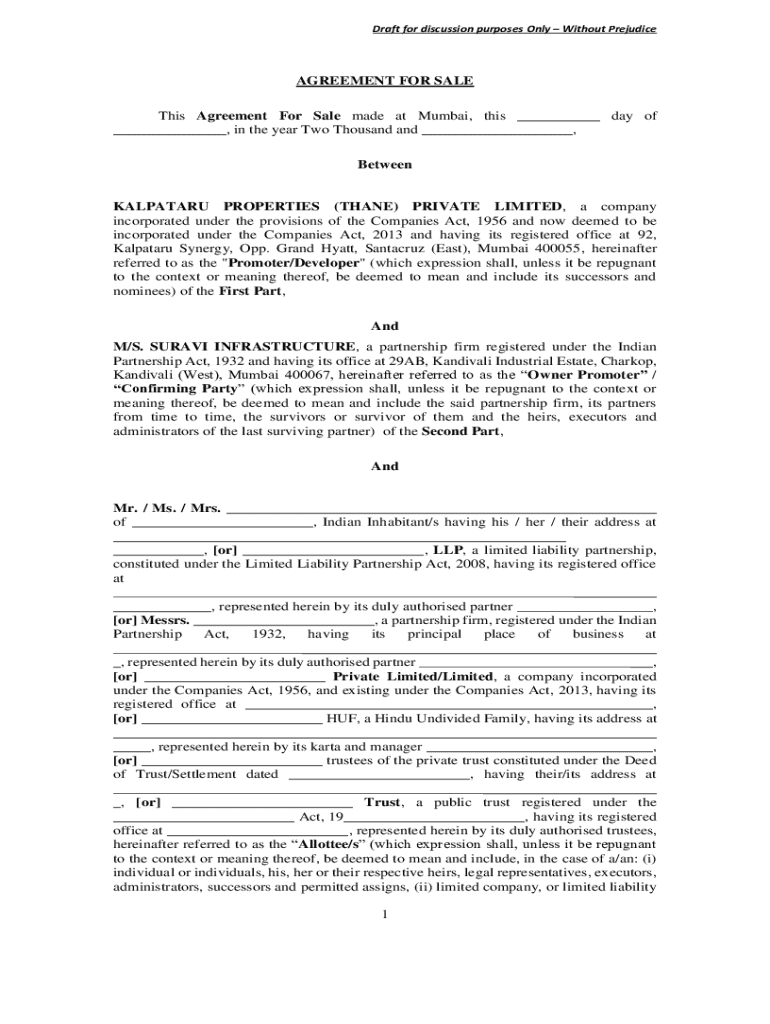

Understanding the final agreement draft pdf interest taxes form

The final agreement draft PDF interest taxes form serves a crucial role in formalizing agreements between parties while also ensuring compliance with tax regulations. A final agreement draft is a comprehensive document that outlines the terms and conditions agreed upon by the involved parties, which may include businesses, organizations, or individuals. The inclusion of interest taxes indicates a financial consideration that is essential in negotiations, especially in options involving loans, investments, or other monetary transactions.

Understanding this form is vital for anyone engaging in financial transactions where interest taxes are applicable. Accurate completion of this form ensures that all parties have a clear understanding of their obligations and rights, safeguarding against future disputes and potential legal issues.

Key components of the final agreement draft pdf interest taxes form

The final agreement draft PDF interest taxes form consists of several critical sections, each designed to facilitate accurate and thorough documentation. These sections typically include personal information requirements, which encapsulate the identities of the parties involved, as well as specific fields pertaining to interest taxes, detailing calculations, rates, and amounts owed.

Additionally, signature requirements are essential for legal acknowledgment, validating the document and making it binding. Each section must be completed with precision to ensure compliance with legislative requirements.

Moreover, familiarizing yourself with commonly used terms will enhance clarity and understanding while filling out the form. A glossary of relevant terms can serve as a valuable resource for anyone unsure about specific jargon.

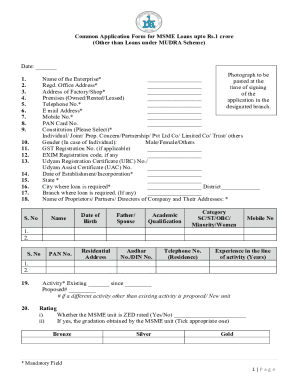

How to access the form

Accessing the final agreement draft PDF interest taxes form is straightforward. Users can easily download the form from pdfFiller, a renowned document management platform. This platform provides user-friendly access to various forms, including customizable templates.

Moreover, the form is compatible with various devices, including desktops, tablets, and smartphones, ensuring that users can fill it out anytime, anywhere.

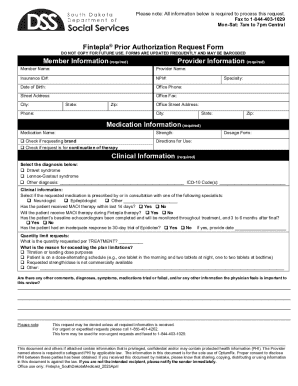

Step-by-step guide to filling out the form

Filling out the final agreement draft PDF interest taxes form can be a meticulous process, but breaking it down into manageable steps significantly eases the task. Begin by preparing your information; gather necessary documents such as previous agreements, financial statements, and tax records, which will provide essential data for the form.

Next, enter your personal information accurately. Ensuring the correct spelling of names and addresses is essential. Step two involves detailing the interest tax information, where users must input interest rates, amounts, and any relevant timelines for payments. Finally, it is crucial to review and verify every entry to avoid costly mistakes.

Utilizing the editing features on pdfFiller simplifies error correction and facilitates the use of auto-fill options for incorporating previously saved data. This efficiency streamlines the form-filling process.

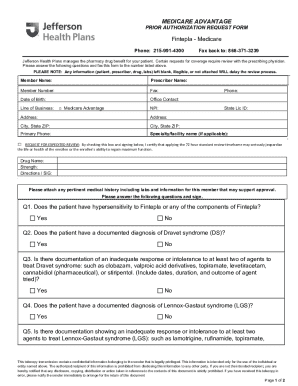

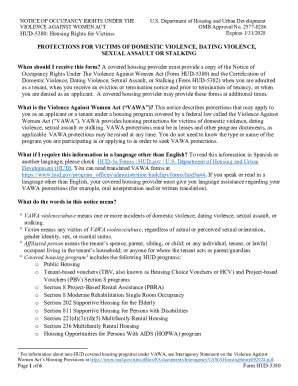

Best practices for drafting and submitting your agreement

When drafting and submitting the final agreement draft PDF interest taxes form, adhering to best practices is essential. To ensure clear and accurate filings, avoid common mistakes, such as oversight in data entry or misunderstanding legal terms. An effective approach is to double-check every entry against your source documents to confirm correctness.

Additionally, timing your submission is critical. Familiarizing yourself with key deadlines can prevent minor lapses that result in significant issues later on. Late filings can lead to penalties or complications with your agreement, diminishing its effectiveness.

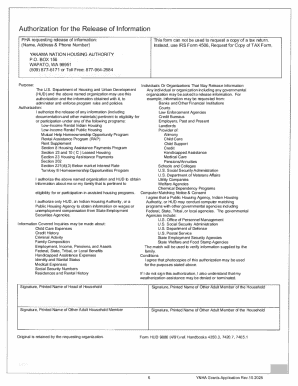

Collaboration and esigning

Sharing your final agreement draft PDF interest taxes form can be efficiently managed through pdfFiller. Collaboration tools on the platform allow users to invite others to view or edit the document easily, streamlining the negotiation or review process significantly.

The eSignature process, which is legally binding and widely accepted, simplifies the signing of agreements without the need for physical presence. With step-by-step instructions provided by pdfFiller, users can easily navigate through the eSigning process, ensuring that their agreements are executed promptly and securely.

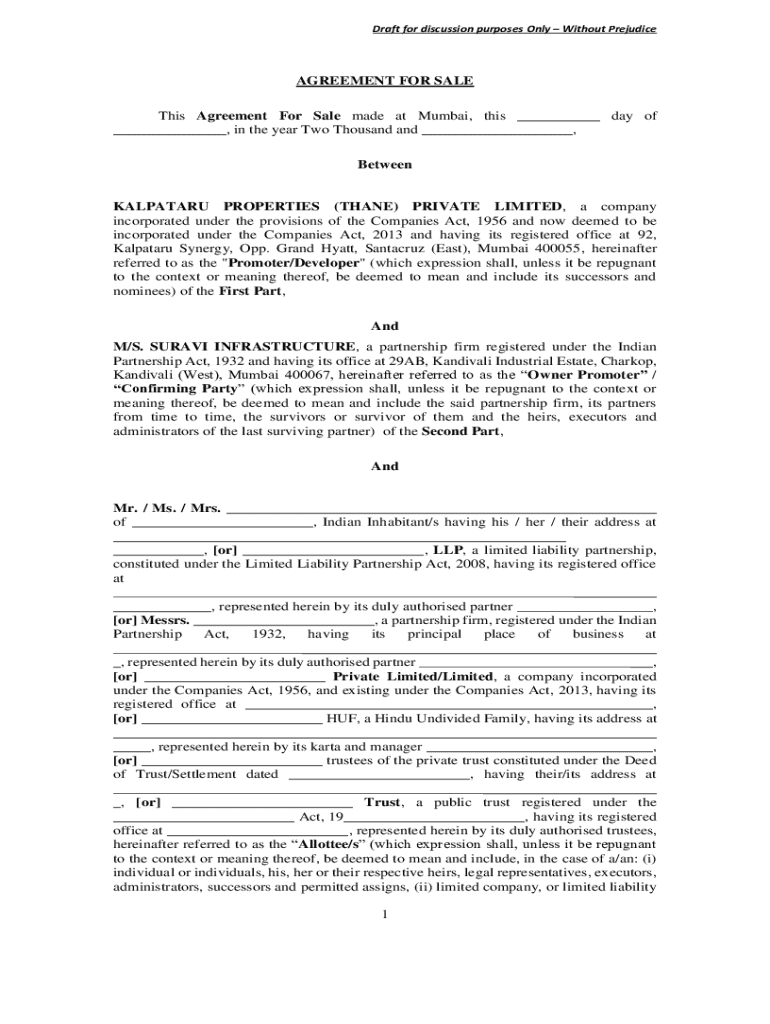

Managing your documents post-submission

After submission, tracking the status of your final agreement is essential. With tools provided by pdfFiller, users can monitor the progress of their documents, ensuring that they are processed and any necessary follow-ups are made. This level of oversight is valuable in maintaining momentum for agreements.

In addition to tracking, proper storage and organization of documents are equally important. Keeping digital copies secure and easily accessible is crucial for effective document management. Utilizing cloud storage features on pdfFiller allows for quick retrieval and sharing anytime, supporting both personal and business documentation needs.

Frequently asked questions about the final agreement draft pdf interest taxes form

Users often have common queries regarding the final agreement draft PDF interest taxes form. Addressing these concerns proactively can alleviate confusion and ensure smoother transactions. Questions may include inquiries about the consequences of errors, the validity of eSignatures, or the timeline for submitting documents.

Additionally, pdfFiller provides support options for users needing further clarification or assistance, enhancing the overall user experience. Quick access to customer service avenues can empower users to handle their document-related needs efficiently.

Conclusion: The benefits of using pdfFiller for your document needs

Using pdfFiller for handling your final agreement draft PDF interest taxes form and other document needs presents numerous advantages. The robust features of pdfFiller allow users to edit PDFs seamlessly, eSign easily, and collaborate effectively within teams. A cloud-based platform ensures access from anywhere, streamlining overall document management.

Leveraging pdfFiller’s interactive tools not only simplifies document creation but enhances user confidence in managing agreements and meeting regulatory requirements. By embracing cloud solutions, individuals and teams can improve their document handling processes, resulting in more efficient workflows and stronger compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit final agreement draftpdfinteresttaxes in Chrome?

Can I edit final agreement draftpdfinteresttaxes on an iOS device?

Can I edit final agreement draftpdfinteresttaxes on an Android device?

What is final agreement draftpdfinteresttaxes?

Who is required to file final agreement draftpdfinteresttaxes?

How to fill out final agreement draftpdfinteresttaxes?

What is the purpose of final agreement draftpdfinteresttaxes?

What information must be reported on final agreement draftpdfinteresttaxes?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.