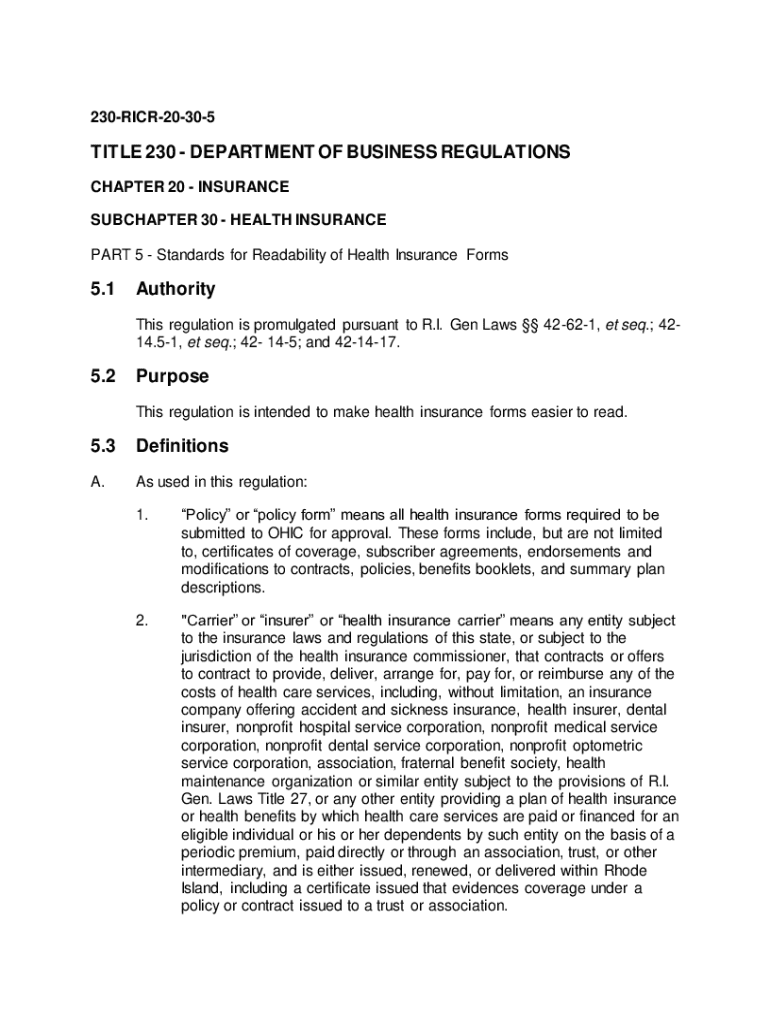

Get the free Part 5 - Standards for Readability of Health Insurance Forms ...

Get, Create, Make and Sign part 5 - standards

How to edit part 5 - standards online

Uncompromising security for your PDF editing and eSignature needs

How to fill out part 5 - standards

How to fill out part 5 - standards

Who needs part 5 - standards?

Part 5 - Standards Form: A Comprehensive Guide

Understanding part 5 of the standards form

Part 5 of the standards form plays a crucial role in the overall structure of financial documentation. Its primary purpose is to provide detailed insights into a spouse's employment, assets, and income, which are vital for legal and financial assessments. Accurate reporting in this section not only aids in compliance but also has significant implications for management and allocation of shared resources, especially in matters like divorce or estate planning.

Understanding the nuances of this section can help individuals ensure accurate representation of their financial situation. This is important not just for personal records but also for any legal implications that may arise. A well-completed part 5 demonstrates transparency and can facilitate smoother processes when evaluating marital assets or income considerations.

Key terminology

Familiarity with key terms is essential when filling out part 5 of the standards form. For instance, 'assets' refers to any resources owned, including property, bank accounts, and investments that have tangible dollar value. 'Income' encompasses all revenue streams, such as salary, bonuses, or other forms of compensation. Lastly, understanding 'spouse’s employment' details the type of work or business a spouse is currently engaged in.

Detailed breakdown of part 5 sections

Part 5 is segmented into three critical areas: spouse’s employment, spouse’s assets, and spouse’s income. Each section requires specific details that contribute to the broader financial picture.

Spouse’s employment

This section requires thorough information regarding the spouse’s current employment status. Users need to describe if the spouse is employed full-time, part-time, or is self-employed. Each type of employment may influence calculations related to income and asset value. For a comprehensive overview, individuals shall indicate the employer's name, job title, date of employment, and the nature of their work. It's necessary to report accurately since errors in this area can lead to misunderstandings during any financial negotiations.

Spouse’s assets

In this section, different types of assets must be reported, including real estate, cash in bank accounts, stocks, and any investments. Users need to value these assets accurately. Valuation methods vary — real estate may require market analysis while stocks might require current market rates. It’s critical to list both the description of each asset and the dollar value associated with it, as even small inaccuracies can substantially impact financial assessments.

Spouse’s income

The income section captures various income sources, including salary, bonuses, and stock options. Each source should be reported with particular attention to detail. Additionally, it’s essential to provide information regarding retirement accounts and any implications for reporting them. Users should ensure the income amount is stated clearly, as any discrepancies can lead to challenges in validating the financial situation during pertinent discussions.

Filling out part 5: step-by-step instructions

Completing part 5 of the standards form requires preparation and an organized approach. Before diving in, gather the necessary documentation, such as pay stubs, tax returns, and any other pertinent financial records. Having these documents on hand will streamline the process and ensure that all information is accurately reported.

Preparing to complete the form

Establishing an organized workspace is crucial when completing part 5. Select a quiet area where focus is possible and ensure all required documentation is laid out for easy access. This preparation phase can facilitate a clearer thought process when entering details into the form.

Step-by-step entry process

Common pitfalls to avoid

Several common pitfalls can lead to complications when completing part 5. One significant issue is missing vital information, which can ultimately result in form rejection. Users should double-check for completeness before submission. Additionally, misestimating asset values can skew financial calculations, so accuracy is paramount.

Reviewing and editing the completed part 5

Once part 5 is completed, reviewing the document is vital for ensuring thoroughness. Check each section for accuracy, and verify that all information aligns with legal requirements. A meticulous review process helps reveal any potential errors that could impact the overall validity of the financial data reported.

Importance of thorough review

A thorough review not only emphasizes accuracy but also compliance with pertinent regulations. Address any areas where information is vague or lacking. This attention to detail will foster confidence in the submitted data.

Utilizing pdfFiller tools

pdfFiller offers robust tools for easy editing and collaborative reviewing of documents. Utilize features such as eSignature options for quick submission, allowing all parties involved to electronically sign with ease. The collaborative aspect facilitates discussions and streamlines the review process, making potential edits clear and straightforward.

Special considerations

Life circumstances can change; therefore, it’s crucial to know when and how to report changes in financial status through an updated part 5. Whether it’s a new job, significant changes in asset value, or shifts in income, timely updates are essential to maintain accurate records.

Reporting changes in financial status

Drafting updates should follow the same careful process as the initial fill-out. Changes should be recorded succinctly but comprehensively to avoid any questions or issues during legal evaluations. Staying proactive in this area safeguards against unwanted complications.

Confidentiality and privacy concerns

Reporting financial data comes with a responsibility to uphold confidentiality. Understand the sensitivity of the information within part 5 and employ best practices for safeguarding personal data. This will not only protect privacy but also ensure compliance with applicable data protection laws.

Interactive tools and features offered by pdfFiller

pdfFiller provides users with interactive document templates, ensuring quick access to necessary formats. Users benefit from pre-formatted parts that significantly enhance efficiency during form completion. This feature streamlines the process, allowing users to focus on accuracy without having to worry about formatting.

Document templates for quick access

The advantages of using templates extend beyond efficiency; they offer a consistent starting point ensuring that critical sections are not overlooked. This allows individuals to fill out the part 5 standards form with confidence knowing they are working with a trusted foundation.

Real-time collaboration with team members

pdfFiller also facilitates real-time collaboration, allowing users to share documents securely and receive instant feedback from team members. This collaborative environment enhances the accuracy of the submitted information, as multiple perspectives can guide revisions and improvements.

Cloud-based management

The cloud-based nature of pdfFiller allows access to documents from any device, anywhere. This flexibility is particularly advantageous for individuals constantly on the go, ensuring that they can manage their forms as needed without restrictions.

Industry standards and compliance

Compliance with industry standards is paramount when filling out any part of the standards form. A clear awareness of the regulatory landscape provides peace of mind that the submitted data will meet necessary legal requirements. Understanding relevant laws and ethical guidelines ensures a smoother process when submitting financial documents.

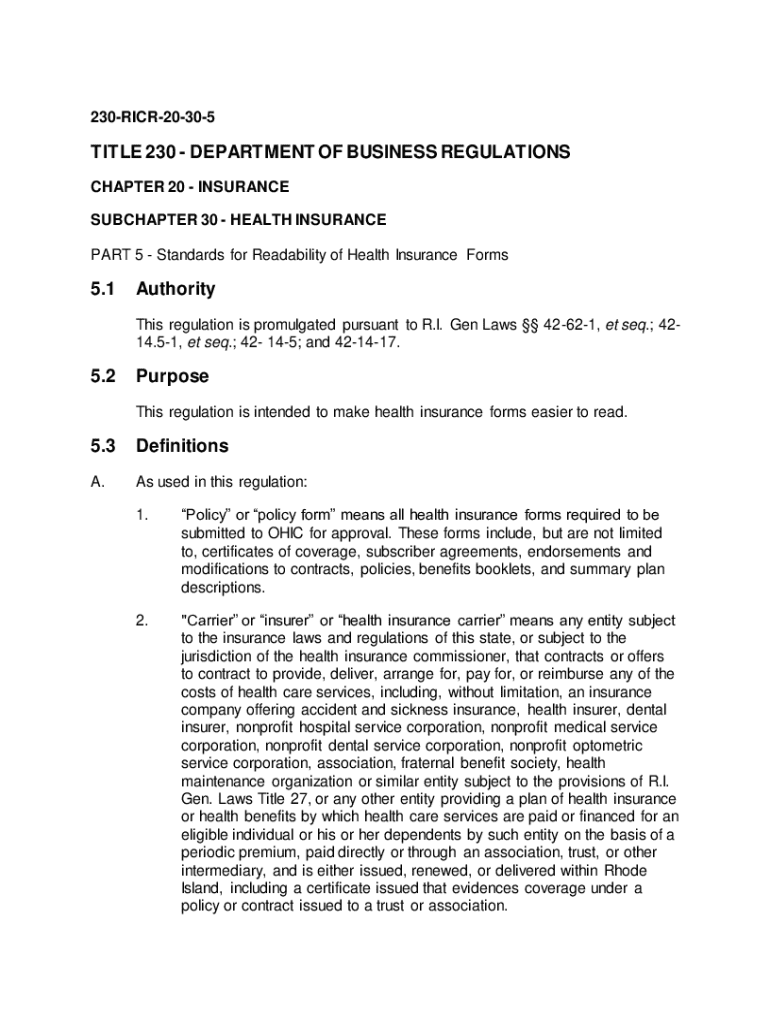

Overview of the regulatory landscape

The specifics may vary depending on jurisdiction; however, key laws govern financial reporting standards that apply universally. Staying abreast of these regulations will help avoid potential legal challenges and penalties.

Adhering to best practices

Best practices in filling out part 5 of the standards form include maintaining accuracy and timeliness in submissions. Submit documents promptly and keep copies for personal records, as these actions help maintain transparency in all financial dealings.

FAQs related to part 5 of the standards form

Users may have questions while completing part 5, and understanding common queries can prevent delays and confusion. Addressing potential scenarios can provide clarity.

Closing note

Utilizing pdfFiller's advanced suite for document management ensures that users can approach the completion of forms like part 5 of the standards form with confidence. Its array of features, including editing and eSigning capabilities, makes it an indispensable tool for individuals and teams navigating financial documentation effectively. Leveraging pdfFiller positions users for success in accurately completing critical financial forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete part 5 - standards online?

How do I make changes in part 5 - standards?

How do I edit part 5 - standards straight from my smartphone?

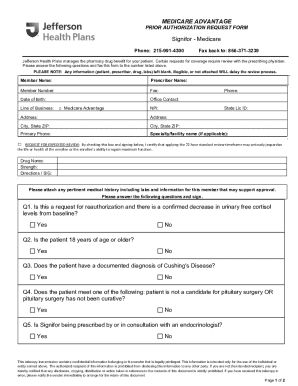

What is part 5 - standards?

Who is required to file part 5 - standards?

How to fill out part 5 - standards?

What is the purpose of part 5 - standards?

What information must be reported on part 5 - standards?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.